Tata Motors' EV Dominance Fast Disappearing as Full-Year EV Sales Drop Sharply

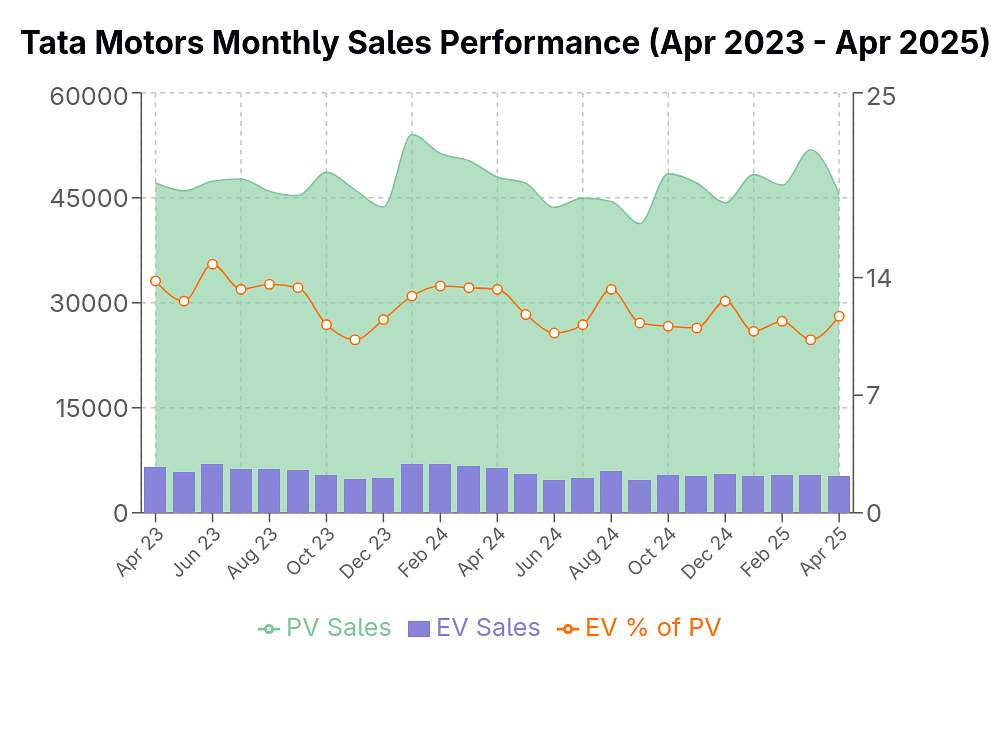

Tata Motors has seen its monthly EV sales drop to 5-5.5k range in 2025 from 6-6.5k range in FY24, even as competitors seem to have no trouble growing.

The Indian electric vehicle market is witnessing a dramatic shift in competitive dynamics. Tata Motors, once the unchallenged leader in India's nascent electric vehicle space, now faces an increasingly precarious position as its EV sales decline and its passenger vehicle growth stagnates. Simultaneously, JSW MG has emerged as a formidable challenger, demonstrating exceptional growth that positions it to potentially overtake Tata Motors in the electric vehicle segment within months rather than years.

Tata Motors: A Declining Trajectory

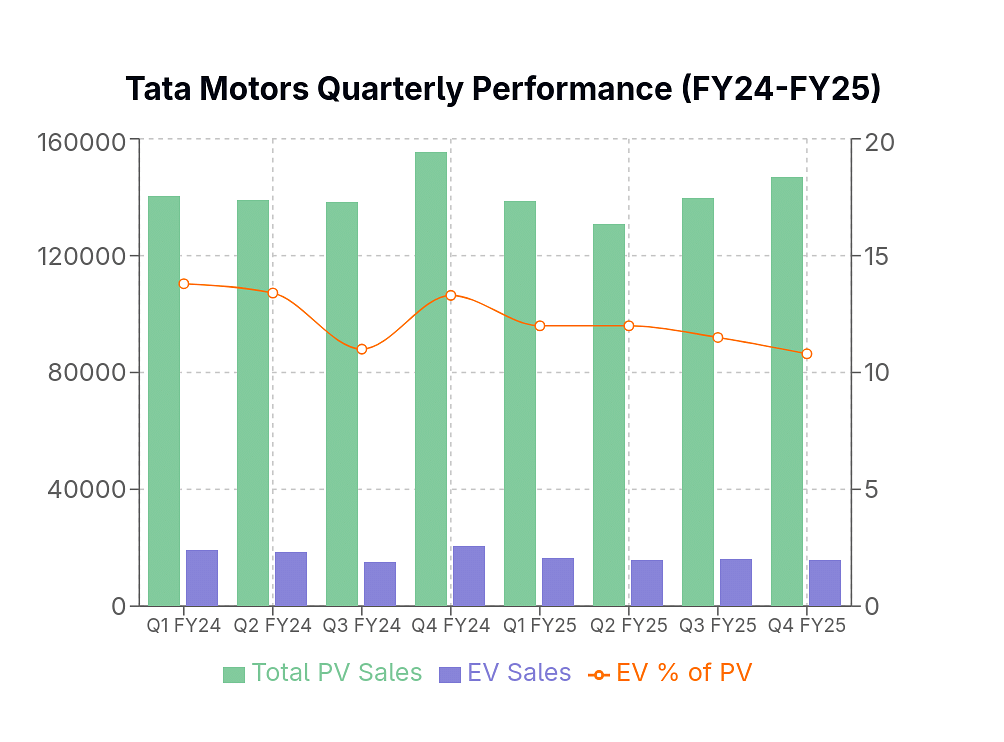

The data reveals a troubling trend for Tata Motors' EV division. The company experienced a substantial 13% year-on-year drop in EV sales, falling from 73,833 units in FY24 to 64,276 units in FY25. This decline is particularly concerning given that it occurred during a period of overall growth in India's EV market.

The company has faced consistent year-on-year monthly decreases in EV sales throughout most of FY25. June 2024 saw a particularly steep drop with 4,657 units sold, representing a 34% decline compared to June 2023's 7,025 units. Similar troubling patterns emerged in January 2025, with 5,240 units representing a 25% decrease from January 2024's 6,979 units. Even April 2025, with 5,318 units, showed a 16% reduction from April 2024's 6,364 units.

This pattern of decline extends to quarterly performance as well. Every quarter in FY25 showed diminished results compared to FY24, with the fourth quarter seeing a particularly significant 23% year-on-year decrease. The third quarter showed a slight 6% improvement over the previous year's comparable period, but this modest gain fails to reverse the overall downward trajectory and remains below the performance seen in earlier quarters of FY24.

The underperformance in the EV segment has contributed significantly to the broader stagnation in Tata Motors' passenger vehicle division. The entire PV division experienced a 3% contraction, with sales dropping from 573,495 units in FY24 to 556,263 units in FY25. This suggests that the challenges in the EV segment are substantial enough to drag down the performance of the entire passenger vehicle business.

Several factors appear to be contributing to Tata Motors' EV challenges. The expiration of the FAME II subsidy in March 2024, mentioned explicitly by the company last year, significantly impacted fleet segment sales. The company acknowledged this impact, noting: "The Electric Vehicle industry was affected by the broader industry trend and the impact of significant preponement fleet sales in Q4FY24, due to expiry of FAME II subsidy in March 2024."

Additionally, the reduction of state-level incentives has played a role. "Electric Vehicle sales in personal segment was affected by the lapse of registration and road tax waivers in key states," the company noted recently. These policy changes have created headwinds for Tata Motors' EV business.

Despite introducing new models like the Curvv.ev and higher-range Nexon.ev, these product refreshes haven't significantly reversed the sales decline. This suggests potential issues with market positioning, pricing, or competitive differentiation.

Perhaps the most important reason is one that the company itself has acknowledged, and even welcomed - the launch of several new models, particularly from the likes of Mahindra & Mahindra and JSW MG Motor.

JSW MG: A Remarkable Rise

A look at JSW MG Motor's numbers indicate that the electric PV market is still growing, even if Tata Motors is not able to capture the incremental volumes.

From August 2024 to March 2025, JSW MG transformed from a minor player to a major contender in the EV market. Their journey began with approximately 1,646 EV units in August 2024, representing 35% of their total sales. By October 2024, this figure had surged to approximately 4,932 EV units, constituting 70% of total sales. December 2024 saw continued strength with approximately 5,261 EV units, and by March 2025, the company was selling approximately 4,675 EV units, representing an impressive 85% of their total sales.

The introduction of the MG Windsor EV and the BaaS model has been transformative for JSW MG, becoming their "top-selling passenger EV" with monthly sales reaching 3,785 units in December 2024. This single model appears to have catalyzed the company's rapid growth in the EV segment.

Perhaps most tellingly, JSW MG has progressively increased the EV share of its total sales throughout this period. Starting at 35% in August 2024, this figure rose to 49% in September, hovered around 70-80% from October through February, and reached 85% by March 2025. This consistent increase in EV penetration within their own sales mix demonstrates a clear strategic emphasis on electric vehicles that contrasts with Tata Motors' more diversified approach.

A Market at the Inflection Point

When comparing the recent performance of these two manufacturers, we can see a clear convergence in their monthly EV sales volumes. Tata Motors has been averaging approximately 5,300 monthly EV units in early 2025, while JSW MG has been averaging between 4,500 and 5,000 monthly EV units during the same period. The gap between them has narrowed dramatically.

The growth trajectories of these companies tell even more contrasting stories. While Tata Motors struggled with a 13% year-on-year decline in FY25, JSW MG reported explosive growth, with a 251% year-on-year increase reported in January 2025. JSW MG claimed a 37% market share in the EV segment in January 2025, suggesting it may already be approaching or even exceeding Tata Motors' position in certain months.

The effectiveness of their respective product strategies also appears quite different. Tata Motors' multi-powertrain approach, which offers consumers various options including petrol, diesel, CNG, and electric versions of the same models, seems to be diluting its EV focus. Conversely, JSW MG's dedicated EV strategy, centered around the Windsor, has yielded immediate and substantial results.

Will JSW MG Triumph?

If current trends persist, several outcomes appear increasingly likely. JSW MG could overtake Tata Motors in the EV segment within the next 6-12 months, particularly if their respective growth trajectories remain consistent. This would represent a remarkable reversal in market leadership in a relatively short period.

Tata Motors may need to reconsider its product positioning and pricing strategy to regain momentum in the EV segment. The rapid adoption of the MG Windsor suggests evolving consumer preferences that Tata Motors hasn't fully addressed with its current offerings.

The contrasting fortunes of Tata Motors and JSW MG in the EV segment highlight how quickly competitive dynamics can shift in emerging markets. Tata Motors' early-mover advantage has eroded significantly in the face of aggressive competition and changing market conditions.

Meanwhile, JSW MG has demonstrated that well-positioned products can rapidly capture market share even from established players. Their focus on EVs as a core strategy rather than one option among many appears to be resonating strongly with consumers in the current market. The next 12 months will prove critical in determining whether Tata Motors can reverse its declining EV sales trend or if JSW MG will solidify its position as India's new EV market leader.

RELATED ARTICLES

Bajaj Auto Sells More Electric 3Ws Than Mahindra in January 2026, TVS in Third Place

With 8,510 units, Bajaj Auto, which entered the e-3W market in June 2023, has outsold market leader Mahindra Last Mile M...

Kia Seltos Sells 600,000 Units in India, Second-Gen Model off to a Good Start

Kia’s first made-in-India SUV, which shook up the midsize SUV segment after launch in August 2019, registers new sales m...

Tata Motors Well Set to Sell 600,000 Cars and SUVs, 100,000 EVs in FY2026

Bolstered by its highest monthly sales of 70,222 units in January, Tata Motors with 10-month dispatches of 502,866 passe...

01 May 2025

01 May 2025

10710 Views

10710 Views

Ajit Dalvi

Ajit Dalvi