India's Electric Car Market Sets New Record in June

Sales reached a record 13,178 units, up from 12,304 units in May and 12,233 in April, spurred by new models such as Creta EV and Mahindra Born Electrics.

With more and more brands entering the segment, India's electric passenger vehicle market achieved a new record in June, with total sales crossing the 13,000 mark for the first time.

At 13,178 units, overall electric PV sales were up nearly 80% compared to a year ago, pushing EV penetration in the car segment to an unprecedented 4.4%, according to the latest data from the Federation of Automobile Dealers Associations (FADA).

The strong June performance caps off an impressive first quarter of FY2026 (April-June 2025), with cumulative sales reaching 37,715 units across the three-month period. This represents a consistent upward trajectory, with monthly sales growing from 12,233 units in April to 12,304 units in May, before hitting the record 13,178 units in June.

From Monopoly to Three-Way Battle

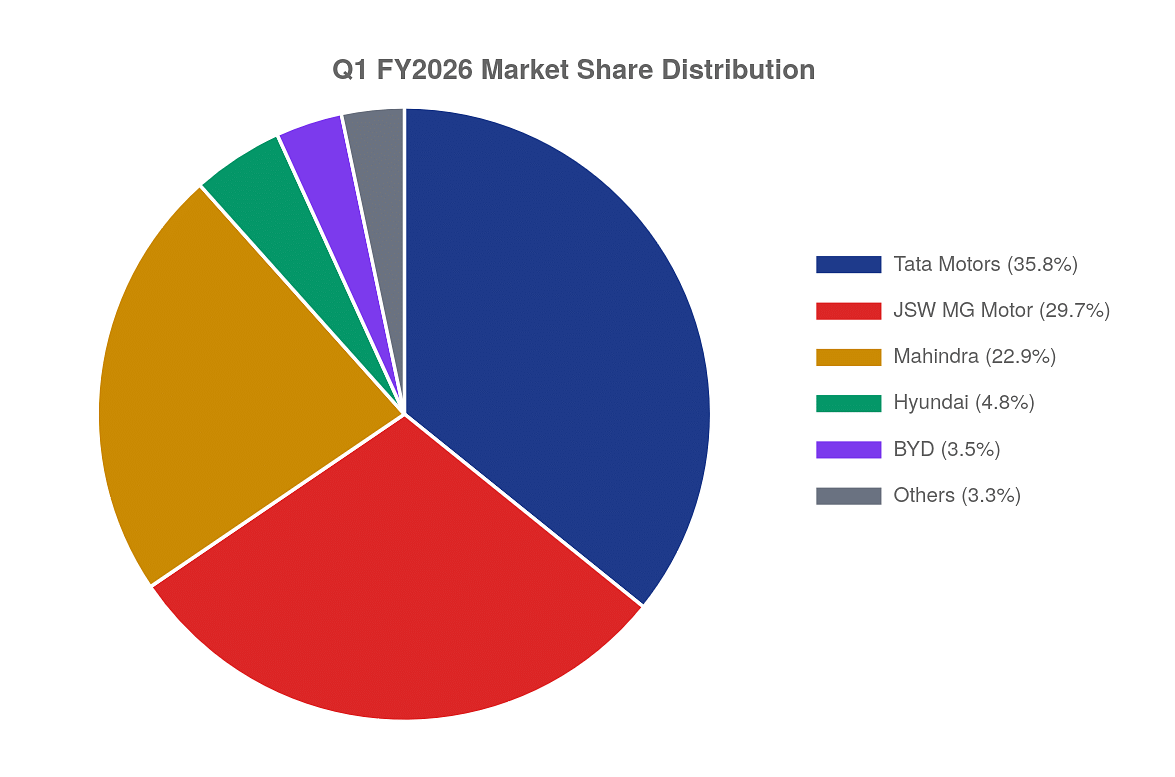

While Tata Motors maintains its market leadership position, the competitive landscape has undergone a dramatic transformation. The company's Q1 FY2026 sales of 13,495 units represent a 35.8% market share – a significant decline from its previous dominance of over 70%. Despite retaining the top spot with 4,708 units sold in June, Tata's modest 2.48% year-on-year growth pales in comparison to the overall market expansion.

JSW MG Motor India has emerged as a formidable challenger, securing the second position with 11,199 units sold in Q1 FY2026 (29.7% market share). The company's June sales of 3,972 units, backed by a stunning 168.38% year-on-year growth, have narrowed the gap with Tata to just 736 units.

Mahindra & Mahindra completes the new power triumvirate with 8,640 units sold in the quarter (22.9% market share). The automaker's meteoric 523.25% year-on-year growth in June, resulting in 3,029 units sold, underscores its rapid ascent in the electric vehicle segment.

Together, these three manufacturers now control 88.4% of India's electric passenger vehicle market, signaling a new era of concentrated competition.

Beyond the Big 3

The remaining market share is distributed among several players, with Hyundai Motor India (1,795 units in Q1), BYD India (1,316 units), and luxury brands BMW (514 units) and Mercedes-Benz (262 units) contributing to the market's diversity.

Notably, in the luxury segment, BMW has taken a decisive lead over Mercedes-Benz, with June sales of 214 units representing a remarkable 275.44% year-on-year growth. This performance gives BMW more than twice the monthly sales volume of its German rival.

Market Penetration Reaches New Heights

The electric vehicle segment's market share has shown consistent growth, climbing from 2.5% in June 2024 to 4.4% in June 2025. This nearly doubled market penetration reflects growing consumer acceptance and confidence in electric mobility solutions.

The month-on-month growth of 7.10% from May to June 2025 further indicates sustained momentum, suggesting that the market has moved beyond early adopters to capture mainstream consumer interest.

Looking Ahead

The broad-based growth across multiple manufacturers indicates a maturing market where increased model availability, improving charging infrastructure, and competitive pricing are driving adoption. While Tata Motors faces intensifying competition, the overall market expansion benefits all players, with the segment establishing itself as a crucial growth engine for India's automotive industry.

As the market evolves from a single-player dominance to a multi-brand competitive environment, consumers stand to benefit from increased choice, innovation, and potentially more competitive pricing. The second half of 2025 promises to be pivotal as manufacturers vie for position in this rapidly expanding segment.

With nearly 13,200 units sold in June alone, India's electric vehicle market has clearly shifted gears, accelerating toward a more sustainable automotive future.

RELATED ARTICLES

India-EU FTA: What We Know so Far

Two of the world’s top economies ink a mega trade deal that can supercharge growth in a multitude of sectors, including ...

BEV Sales in Europe Jump 30% to 1.88 Million in CY2025, Hybrids up 14%, Decline Continues for Petrol, Diesel

The EU’s top four battery electric car markets registered double-digit growth in a year which saw the BEV share rise to ...

Skoda Kylaq to Zip Past 50,000 Sales 13 Months After Launch

On January 27, Skoda Auto India rolled out the 50,000th Kylaq from its Chakan plant in Pune. With the game-changing comp...

08 Jul 2025

08 Jul 2025

3247 Views

3247 Views

Arunima Pal

Arunima Pal

Ajit Dalvi

Ajit Dalvi