With India's largest electric two-wheeler business under its wings, Chennai-based TVS Motor Company has emerged as biggest gainer of the Indian two-wheeler market in the first half of 2025. It not only recorded strong volume growth of 11.95% but also captured the largest market share gain among all major manufacturers, and was the only one among India’s large, mass market brands to avoid a market share decline.

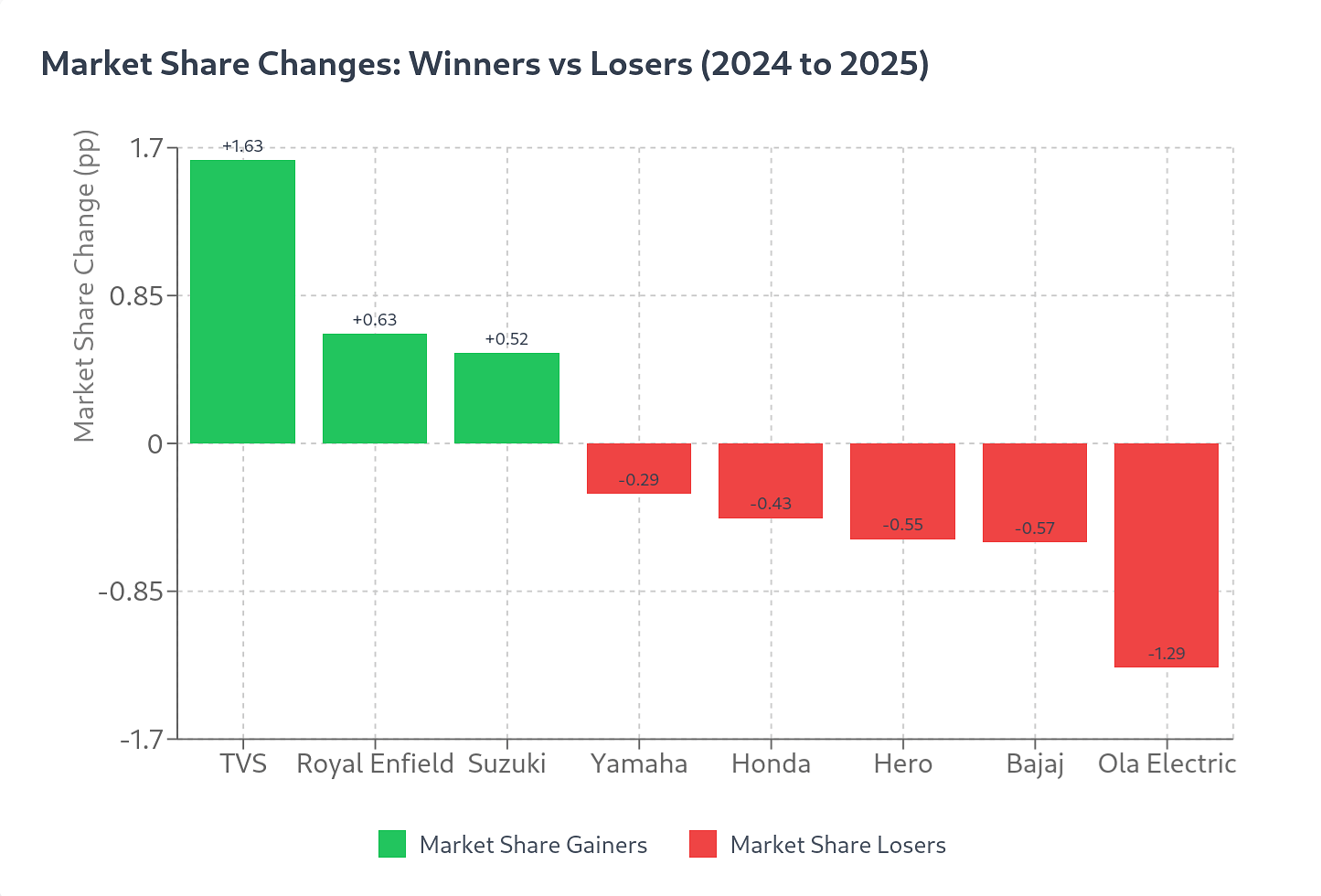

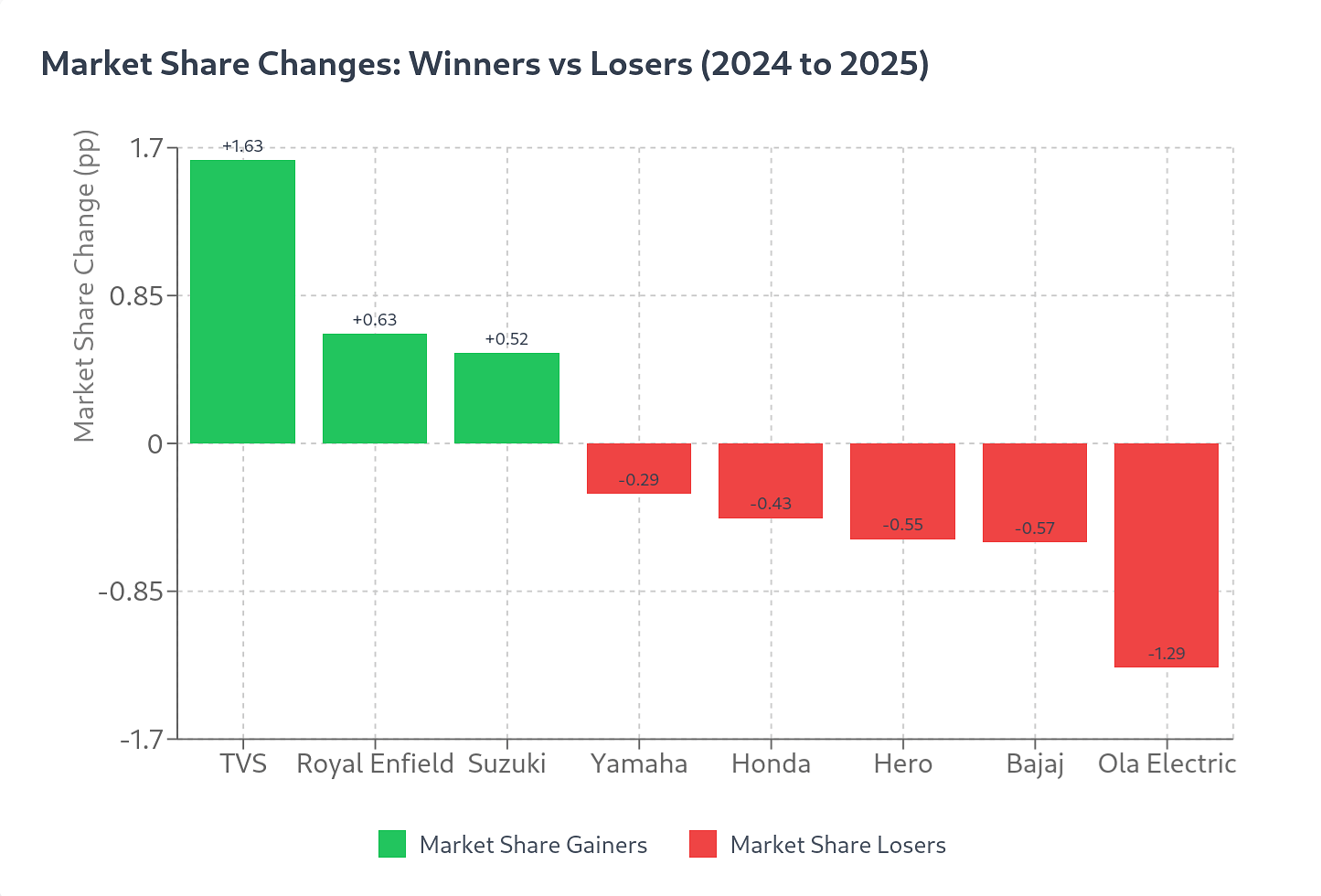

TVS expanded its market share from 17.08% in 2024 to 18.71% in 2025—a significant gain of 1.63 percentage points.

In contrast, the traditional market leaders experienced share erosion, including Hero MotoCorp, Honda Motorcycle, and Bajaj Auto.

Performance Overview

TVS achieved total sales of 17.2L units in H1 2025 compared to 15.3L units in the corresponding period of 2024, representing an increase of 1.8L units. The company's market share expansion demonstrates that this growth significantly exceeded overall market expansion, with TVS capturing share in a much larger volume base compared to smaller competitors with similar growth rates.

The quarterly breakdown reveals accelerating momentum: Q1 2025 showed steady progress with 8.19L units versus 7.57L units in Q1 2024, while Q2 2025 delivered stronger performance with 9.03L units compared to 7.81L units in Q2 2024.

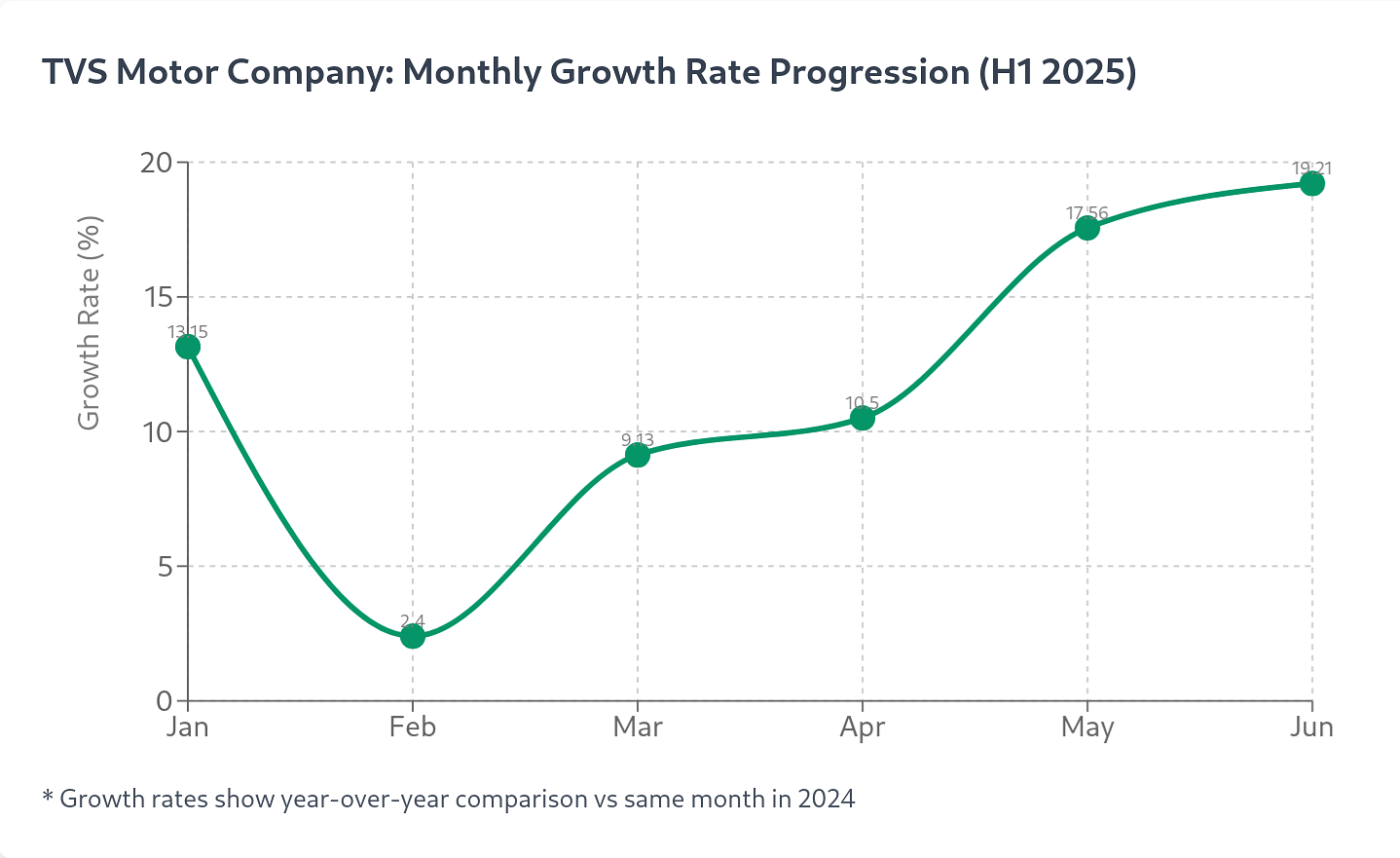

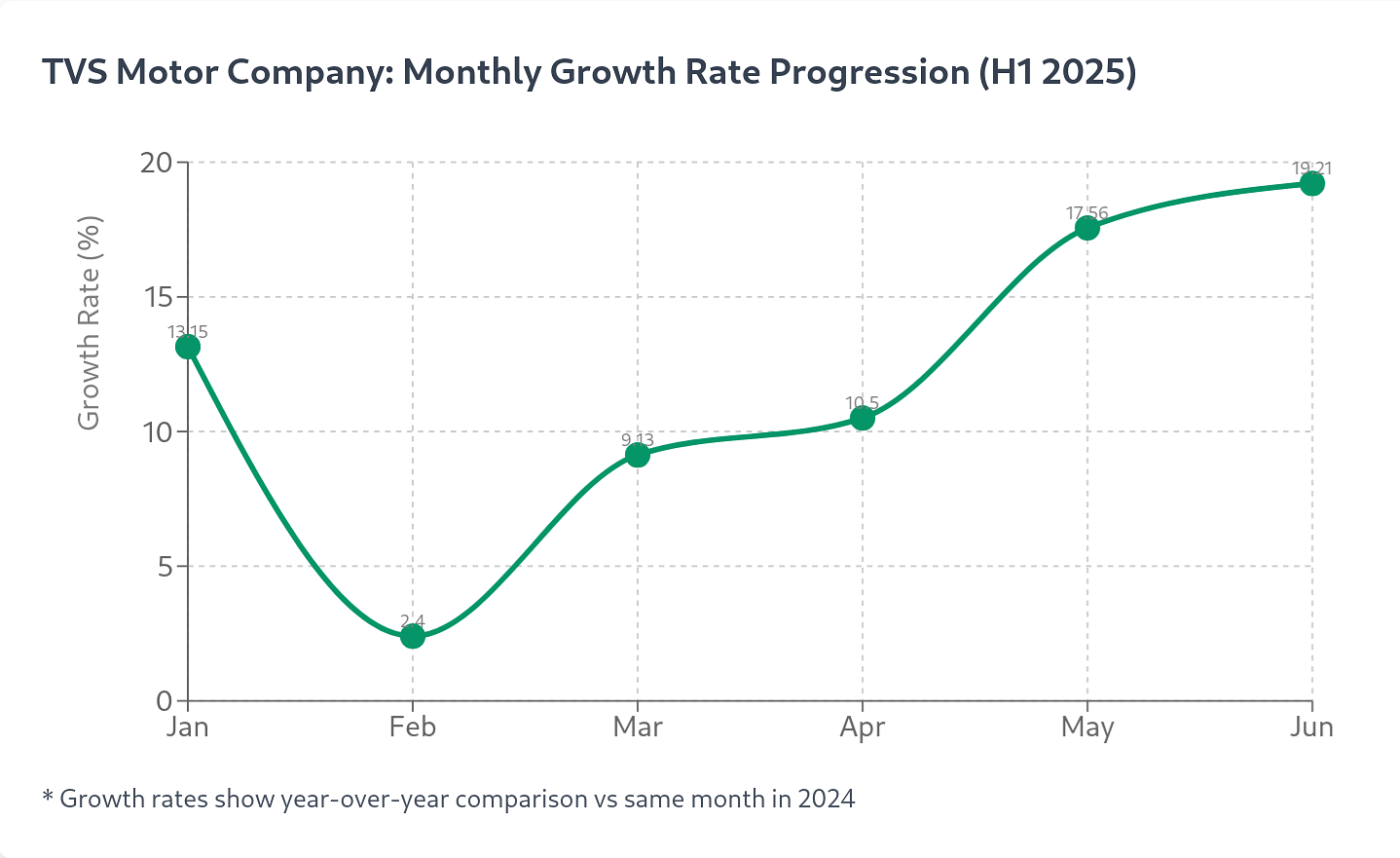

Monthly performance demonstrated progressive acceleration throughout H1 2025, ranging from 13.15% in January to 19.21% in June 2025.

The acceleration in growth rates during May and June 2025, culminating in 19.21% growth in June with 2.82L units sold versus 2.37L units in June 2024, demonstrates sustained momentum. This performance positioned TVS to capture market share from both struggling competitors and slower-growing market leaders while consistently outpacing industry benchmarks.

The acceleration in growth rates during May and June 2025, culminating in 19.21% growth in June with 2.82L units sold versus 2.37L units in June 2024, demonstrates sustained momentum. This performance positioned TVS to capture market share from both struggling competitors and slower-growing market leaders while consistently outpacing industry benchmarks.

In comparison, other established players lost market share during the first half of the year. Hero MotoCorp, despite maintaining its leadership position with 26.3L units, saw its market share erode from 29.23% to 28.68% (−0.55 percentage points), while Honda Motorcycle struggled with sluggish momentum, and saw its market share decline from 24.53% to 24.10% (−0.43 points).

Both companies' lackluster performance highlighted their inability to capitalize on market opportunities that TVS successfully leveraged, particularly in the electric vehicle segment where TVS demonstrated strong growth momentum. Against the nearly 12% volume growth seen by TVS, Hero saw a growth of only 0.25%, while Honda had to be content with 0.39% volume growth.

The other major player -- Bajaj Auto -- not only lost market share from 11.72% to 11.15% (−0.57 points), but was the only major player to see a sales decline during the period, according to Vahan numbers.  Because of this, TVS was able to widen its lead over Bajaj to nearly 7 lakh units during the first half, while expanding the market share gap to 7.56 percentage points.

Because of this, TVS was able to widen its lead over Bajaj to nearly 7 lakh units during the first half, while expanding the market share gap to 7.56 percentage points.

Even the premium brands, which have been doing well, showed mixed results during the first half of the year. Royal Enfield demonstrated strong performance, growing its market share from 4.36% to 4.99% (+0.63 pp), while Suzuki also gained share from 5.09% to 5.61% (+0.52 pp). India Yamaha Motor faced headwinds, with both volume declining 6.12% and market share dropping from 3.60% to 3.31% (−0.29 pp).

Electric Vehicle Leadership

TVS's electric vehicle business emerged as a significant growth driver during H1 2025, highlighting a key differentiator against traditional market leaders who lack meaningful electric portfolios. In May 2025, TVS achieved strong 50% growth in electric vehicle sales, increasing from 18,674 units in May 2024 to 27,976 units in May 2025, demonstrating the company's ability to capitalize on the electric transition.

While June 2025 EV sales moderated to 14,400 units compared to 15,859 units in June 2024 due to China magnet blockade, TVS's established position in this segment provides strategic advantages unavailable to competitors. The company noted that "retails of TVS iQube continue to be robust" despite short-term supply constraints, indicating sustained consumer demand.

This positions TVS uniquely among the top four manufacturers—Hero, Honda, TVS, and Bajaj—as the only player with an established electric vehicle business contributing meaningfully to its growth trajectory. Hero MotoCorp, Honda, and Bajaj Auto showed minimal electric vehicle momentum, limiting their ability to benefit from the electric transition that TVS has successfully leveraged.

It should be noted that the broader EV segment experienced volatility during the period, with Ola Electric suffering the steepest decline among all manufacturers. The former No.1 fell from 2.54% of the market to 1.25% (−1.29%). Ather Energy demonstrated resilience in the EV space, growing its market share from 0.58% to 0.89% (+0.31 pp), indicating selective success within the electric two-wheeler segment, though at significantly smaller volumes than TVS.

Market Outlook

TVS's market share expansion of 1.63 percentage points—the largest among all major manufacturers—positions the company as the primary beneficiary of market share redistribution in H1 2025. While Hero MotoCorp and Honda maintained their leadership positions with 28.68% and 24.10% respectively, their declining shares suggest market dynamics are shifting.

The company's ability to gain share while maintaining double-digit growth across diverse market segments demonstrates strategic effectiveness in a challenging environment. As the Indian two-wheeler market continues to evolve, TVS's performance metrics and market share gains suggest it is well-positioned to further consolidate its position as the third-largest manufacturer while continuing to narrow the gap with the top two players.

04 Jul 2025

04 Jul 2025

18171 Views

18171 Views

The acceleration in growth rates during May and June 2025, culminating in 19.21% growth in June with 2.82L units sold versus 2.37L units in June 2024, demonstrates sustained momentum. This performance positioned TVS to capture market share from both struggling competitors and slower-growing market leaders while consistently outpacing industry benchmarks.

The acceleration in growth rates during May and June 2025, culminating in 19.21% growth in June with 2.82L units sold versus 2.37L units in June 2024, demonstrates sustained momentum. This performance positioned TVS to capture market share from both struggling competitors and slower-growing market leaders while consistently outpacing industry benchmarks. Because of this, TVS was able to widen its lead over Bajaj to nearly 7 lakh units during the first half, while expanding the market share gap to 7.56 percentage points.

Because of this, TVS was able to widen its lead over Bajaj to nearly 7 lakh units during the first half, while expanding the market share gap to 7.56 percentage points.

Ajit Dalvi

Ajit Dalvi

Arunima Pal

Arunima Pal