Royal Enfield Emerges as India's Fastest Growing Legacy Motorcycle Brand

The Chennai-based manufacturer achieves remarkable 16.88% growth, outpacing established competitors in premium segment expansion.

Royal Enfield has emerged as India's fastest-growing traditional motorcycle brand among established players, recording exceptional sales growth of 16.88% in the first half of 2025, according to Vahan numbers. The motorcycle division of Eicher Motors sold 458,933 units during January-June 2025, compared to 392,659 units in the same period of 2024, significantly outperforming most legacy manufacturers in the highly competitive Indian two-wheeler market.

This stellar performance places Royal Enfield ahead of traditional industry giants in terms of growth velocity. While market leader Hero MotoCorp managed modest growth of just 0.25% with 2.63 million units, and Honda Motorcycle and Scooter India recorded marginal growth of 0.39% with 2.21 million units, Royal Enfield's double-digit expansion demonstrates the brand's exceptional momentum in the premium motorcycle segment.

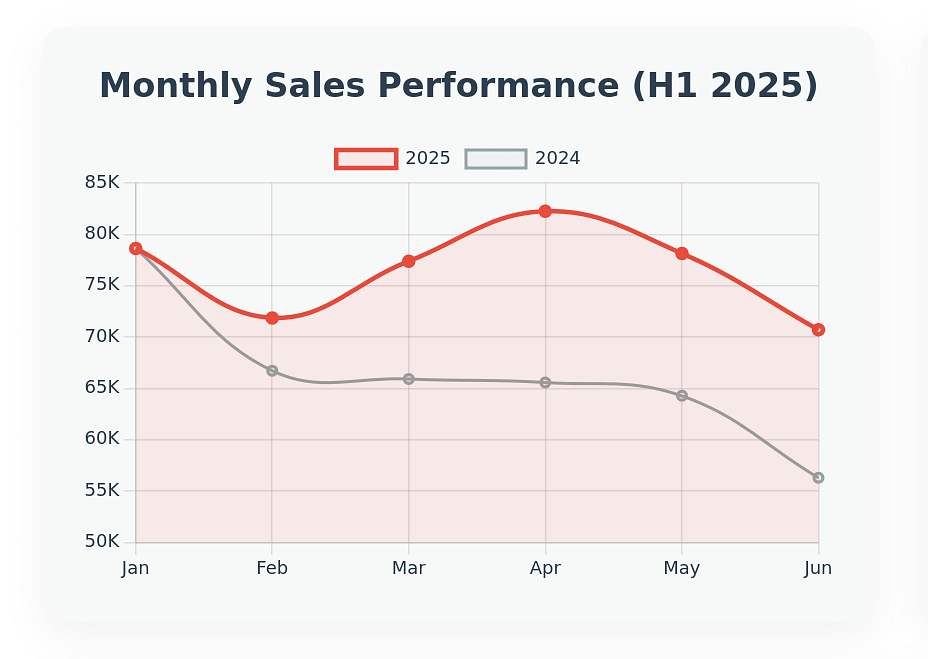

Consistent Month-on-Month Performance

Royal Enfield demonstrated remarkable consistency throughout the first half, with monthly sales beginning at 78,628 units in January and maintaining robust performance across all months. The company showed resilience during the traditionally slower February period (71,859 units) before recovering strongly in March (77,382 units). Sales peaked in April at 82,237 units, representing the strongest single-month performance in the period, before moderating to 78,130 units in May and 70,697 units in June.

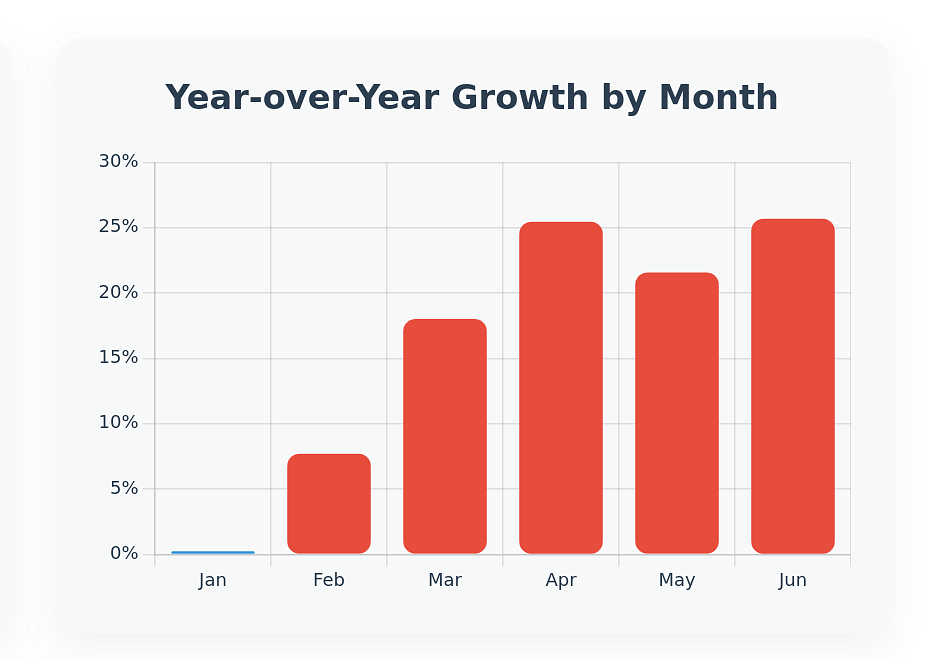

The most impressive aspect of Royal Enfield's performance was its year-over-year growth consistency. June recorded the highest growth rate at 25.69% compared to the previous year, while March showed 18.01% growth and May achieved 21.56% growth, indicating sustained consumer demand across diverse market conditions.

Market Share Gains and Competitive Positioning

Royal Enfield's growth trajectory has enabled it to strengthen its position in the crucial mid-tier motorcycle segment. With 4.99% market share in H1 2025 compared to 4.36% in H1 2024, the company has successfully expanded its footprint while maintaining premium positioning. This places Royal Enfield in an increasingly competitive position with Suzuki Motorcycle India, which recorded 516,164 units (5.61% market share) despite achieving lower growth of 12.63%.

The company's performance becomes even more remarkable when contrasted with mixed results across the broader industry. While Royal Enfield and TVS Motor Company (11.95% growth) posted strong double-digit growth, other established players showed varied results. Bajaj Auto, traditionally a strong performer, declined 2.85% to 1.02 million units, while India Yamaha Motor saw a 6.12% decline to 304,192 units.

Premium Segment Leadership

Royal Enfield's success reflects its dominant position in India's premium motorcycle segment, where it maintains over 80% market share in the 250cc+ category. Royal Enfield dominates India's retro and premium motorcycle market, holding over 80% share in the 250cc+ segment. The brand's iconic retro styling combined with modern engineering has solidified its leadership in the mid-size motorcycle category, particularly with flagship models like the Classic 350 and Hunter 350.

This dominance has not gone unnoticed by competitors. Over the past five years, major players including Honda (H'ness CB350), Jawa, Yezdi, and the Bajaj-Triumph partnership have launched retro-styled motorcycles specifically to challenge Royal Enfield's market leadership, intensifying competition but also validating the segment's growth potential.

Record-Breaking Annual Performance

Royal Enfield's H1 2025 performance contributes to what appears to be a record-breaking year for the company. Royal Enfield has achieved a major milestone by selling over 10 lakh motorcycles in a single financial year, for the first time in its history. The company recorded total sales of 10,09,900 units for the 2025 financial year, marking an 11% increase and demonstrating sustained growth momentum.

The brand's global ambitions are also bearing fruit, with export performance showing remarkable strength. The manufacturer also reported a 23% growth in exports, shipping 9,871 motorcycles overseas. This international expansion, supported by operations in over 60 countries and nearly 850 international stores, provides Royal Enfield with diversified revenue streams and reduced dependence on the domestic market.

India's Modern Classic

The Indian motorcycle market has witnessed significant transformation in recent years, with the premium and modern classic segments emerging as key growth drivers. The India Premium Motorcycles market was valued at USD 1.3 billion in 2024 and is projected to reach approximately USD 2.5 billion by 2030, expanding at a CAGR of 12.5% during the forecast period of 2025–2030.

This remarkable growth reflects changing consumer preferences and rising disposable incomes. As disposable incomes increase and the middle class expands, there is a growing segment of consumers who are willing to spend more on premium motorcycles that offer advanced features, superior performance, and a luxurious riding experience. India's population is predominantly young, with a large percentage of the population falling in the age group of 18-35 years. This young population has a strong affinity towards motorcycles as they are seen as a symbol of freedom and independence.

The modern classic segment, where Royal Enfield pioneered and continues to lead, represents a unique blend of heritage design and contemporary technology. This segment appeals to consumers seeking emotional connection and lifestyle expression rather than just utilitarian transportation. Superbikes in the premium bike segment account for over 20% of the market share in India, driven by increasing demand for high-performance motorcycles and the growing appeal of luxury brands.

India's economy is forecast to expand 6.6% in 2025, mainly driven by strong public investment and resilient private consumption. This economic stability, combined with manufacturers' focus on technology integration and feature enhancement, positions the premium and modern classic segments for sustained growth in India's dynamic motorcycle market.

RELATED ARTICLES

Hero, Honda, TVS, Bajaj and Royal Enfield Target India’s Nascent Electric Motorcycle Market

Even as scooters dominate the electric 2W market, legacy ICE motorcycle OEMs are already pushing the innovation and R&D ...

Which is Cheaper over 14 Years of Use: Maruti Suzuki e Vitara or Victoris?

Maruti Suzuki's first EV has arrived, promising low running costs and a clever Battery-as-a-Service plan. But how does t...

Bajaj Chetak Retail Sales Cross 600,000 Units, 227,000 In Last 10 Months

Since the launch of the zero-emission Chetak six years ago, Bajaj Auto has delivered 602,673 units to customers in India...

07 Jul 2025

07 Jul 2025

9840 Views

9840 Views

Ajit Dalvi

Ajit Dalvi

Arunima Pal

Arunima Pal