A Tale of 3 Markets - How China, Europe, and the US Are Approaching Electrification

While China has decided to adopt a "leapfrog" strategy, America is going for a "wait-and-see" approach, with Europe in the middle with a "cautious transition".

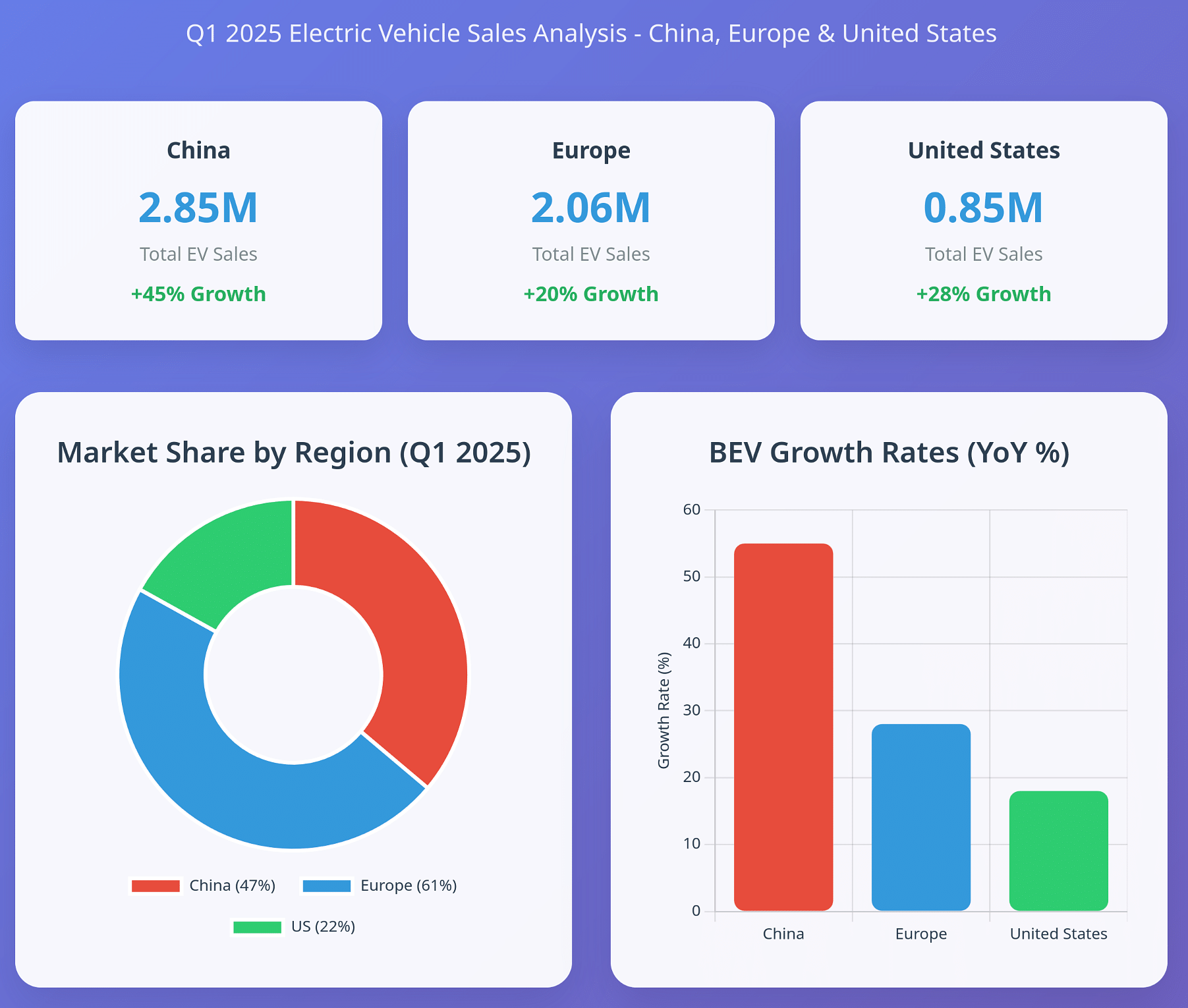

The first quarter of 2025 has underlined the critical difference in the way the three major auto markets in the world approach electrification. According to Strategy& and PwC Autofacts' latest Electric Vehicle Sales Review for Q1 2025, China, Europe, and the United States are pursuing dramatically different strategies in their transition to electric mobility—each reflecting distinct consumer preferences, policy environments, and market dynamics.

China: The Electric Juggernaut

China continues to demonstrate why it has become the undisputed global leader in electric vehicle adoption, with performance metrics that leave other markets in the dust. The Chinese market achieved a staggering 2.85 million total EV sales in Q1 2025, representing 47.1% of the country's total automotive sales—a remarkable 45.0% year-over-year increase that underscores the country's commitment to electrification.

What sets China apart is its wholehearted embrace of pure battery electric vehicles. The country sold 1.64 million BEVs in the first quarter alone, capturing 27.1% market share with an impressive 55.2% year-over-year growth. As the report notes, "BEV sales surged by 55% compared to the same period last year, setting a record for any first quarter."

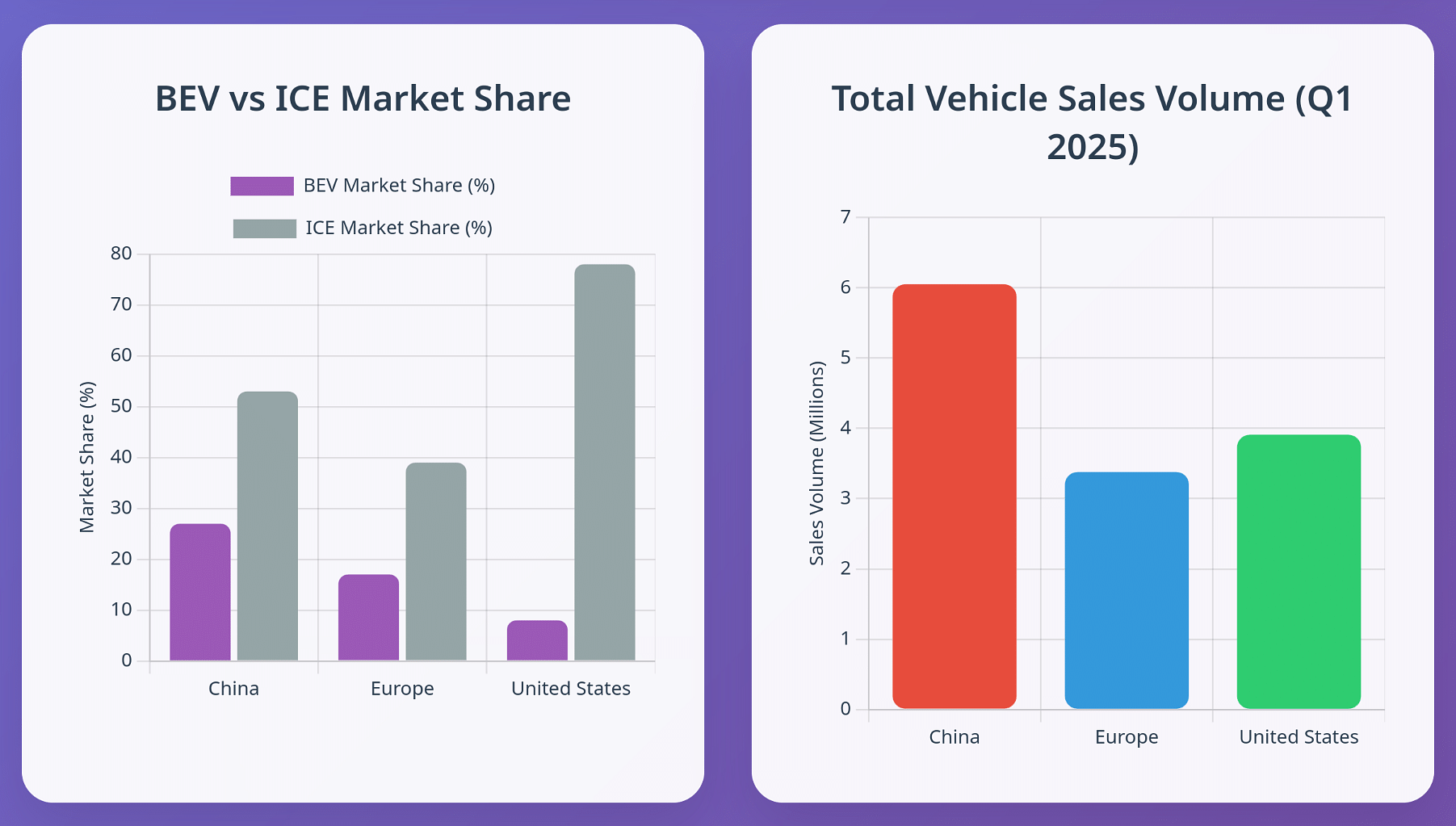

China's success extends beyond BEVs to plug-in hybrids, with 994,000 PHEV units sold (16.4% market share) and 36.9% growth. This dual-pronged electric approach—strong performance in both BEVs and PHEVs—indicates a market that has moved decisively beyond traditional internal combustion engines. The report attributes this growth to "a series of government measures, including the expansion of the trade-in scheme which offers financial incentives that encourage consumers to upgrade to newer vehicles."

Perhaps most telling, ICE vehicle sales in China declined 7% year-over-year, marking "the tenth successive quarter in which such a decline was registered."

Europe: The Hesitant Middle Path

Europe presents a more complex and arguably concerning picture for electric vehicle advocates. While the region maintains a respectable 60.8% total EV market share across EU27+UK+EFTA countries with 2.06 million total EV sales, the underlying trends reveal significant market uncertainty and consumer hesitation.

The most striking development is Europe's dramatic reversal in BEV performance. After "three consecutive quarters of year-on-year declines," Europe experienced what the report calls "a significant revival" with BEV sales increasing by 28% to reach 574,000 units. However, this growth came primarily from low base comparisons, particularly in Germany where growth was "partly attributed to a sudden fall in sales in the equivalent quarter last year in the wake of the sudden withdrawal of incentives."

The UK leads European BEV adoption with 21% market share, followed by France at 18% and Germany at 17%. Yet even with this revival, Europe's BEV market share of 17% pales in comparison to China's 27.1%.

More concerning is the collapse in PHEV adoption across Europe. PHEV sales grew only 6% year-over-year to 268,000 units, representing just 7.9% market share—a dramatic contrast to China's robust PHEV performance.

Where European consumers are showing genuine enthusiasm is in traditional hybrid vehicles, which surged 20% to reach 1.22 million units and 35.9% market share. This trend suggests European consumers want some electrification benefits but remain hesitant about full battery dependence, possibly reflecting concerns about charging infrastructure maturity or range anxiety.

As the report notes, "Total EV market share in these markets (BEV, PHEV and hybrid combined) now stands at more than 60%. To gauge the growth of the market, it is worth recalling that in the first quarter of 2020, total EV market share in these five markets was 17%, and BEV market share was just 4%."

United States: 'Wait & Watch'

The United States presents perhaps the most conservative approach to electrification among the three major markets, with distinct patterns that reflect both policy uncertainty and consumer preferences.

US BEV sales grew a modest 18% in Q1 2025 to reach 301,000 units, representing just 8% market share—far below both China and Europe. The report attributes this growth partly to consumer behavior: "Many consumers have wanted to take advantage of the existing tax credit of up to $7,500 before its possible reduction or cancellation under the new presidential administration."

More tellingly, PHEV sales actually declined 11% to just 79,000 units (2% market share), marking "the third quarter in succession to witness such a decline." The report explains this drop as partially due to "some popular PHEV models have recently become ineligible for tax credits due to battery sourcing requirements."

Where the US market truly distinguishes itself is in hybrid adoption. Hybrid sales surged 47% to reach 473,000 units with 12% market share, representing "the ninth consecutive quarter" of hybrid growth. This hybrid enthusiasm mirrors European trends but from a much smaller EV base.

Most significantly, "ICE vehicles remain much more dominant than in Europe or China, with a market share of 78%"—highlighting just how far the US lags in overall electrification compared to its global counterparts.

Three Distinct Philosophies

These contrasting trends reflect fundamentally different national approaches to automotive electrification:

China's "Leapfrog" Strategy: The Chinese market demonstrates confidence in electric technologies, with consumers comfortable adopting both BEVs and PHEVs. This reflects robust government support, extensive charging infrastructure development, and domestic manufacturing advantages that have driven down costs.

Europe's "Cautious Transition": European consumers appear to prefer incremental electrification, embracing hybrids while remaining hesitant about plug-dependent vehicles. This middle path suggests ongoing concerns about infrastructure readiness and range limitations, despite strong policy support for electrification.

America's "Wait-and-See" Approach: The US market shows the most conservative adoption patterns, with strong hybrid growth but limited BEV penetration. Policy uncertainty, infrastructure concerns, and deeply entrenched consumer preferences for larger vehicles contribute to this cautious stance.

Scale and Implications

The sheer scale differences are striking and consequential. China's Q1 2025 BEV sales of 1.64 million units dwarf the combined BEV sales of Europe (574,000 units) and the US (301,000 units). This 2:1 advantage over both Western markets combined demonstrates not just different consumer preferences, but also the manufacturing and supply chain advantages that come with massive domestic scale.

These volume differences have profound implications for global EV development. Chinese manufacturers benefit from enormous domestic scale that drives down costs and accelerates innovation, while Western manufacturers face more fragmented and cautious home markets that may limit their competitive positioning in the global transition to electric mobility.

The Q1 2025 data suggests we're witnessing the emergence of distinct regional electrification strategies that may persist for years to come. China's aggressive push toward full electrification contrasts sharply with Europe's gradual, hybrid-heavy transition and America's even more conservative approach.

For automakers, these trends demand region-specific strategies rather than global standardization. Success in China requires full commitment to BEV and PHEV technologies with competitive pricing enabled by scale. European success may depend on offering compelling hybrid alternatives while gradually improving pure electric options and addressing infrastructure concerns. US market success appears to require patient hybrid development while slowly building consumer confidence in electric alternatives.

The question is whether Europe and the US are building sustainable foundations for eventual electric adoption or falling dangerously behind in the global race toward automotive electrification. China's continued acceleration suggests that rapid EV adoption is possible when market conditions align—leaving Western markets to determine whether their more cautious approaches represent prudent development or a failure to seize the electric vehicle moment.

RELATED ARTICLES

Bajaj Auto Sells More Electric 3Ws Than Mahindra in January 2026, TVS in Third Place

With 8,510 units, Bajaj Auto, which entered the e-3W market in June 2023, has outsold market leader Mahindra Last Mile M...

Kia Seltos Sells 600,000 Units in India, Second-Gen Model off to a Good Start

Kia’s first made-in-India SUV, which shook up the midsize SUV segment after launch in August 2019, registers new sales m...

Tata Motors Well Set to Sell 600,000 Cars and SUVs, 100,000 EVs in FY2026

Bolstered by its highest monthly sales of 70,222 units in January, Tata Motors with 10-month dispatches of 502,866 passe...

By Shruti Shiraguppi

By Shruti Shiraguppi

29 May 2025

29 May 2025

4137 Views

4137 Views

Ajit Dalvi

Ajit Dalvi