Two-wheeler sales hit 10 million units in H1 FY2025 after six years, scooters up 22%, bikes by 13%

At halfway stage in the current fiscal year, India 2W Inc is in good nick. Wholesales of 1,01,64,980 motorcycles, scooters and mopeds in April-September 2024 are up by 16% YoY and already 64% of FY2024’s sales of 1,79,74,365 units, and 48% of FY2019’s record sales of 21 million units.

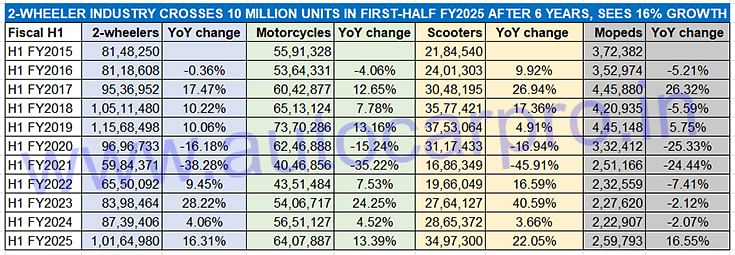

The Indian two-wheeler industry, which comprises motorcycles, scooters and mopeds, is in good nick after the first six months of the current fiscal year. Between April and September 2024, a total of 1,01,64,980 units – or a little over 10 million units – were dispatched to dealers across the country, registering strong 16.31% YoY growth (H1 FY2024: 87,39,406 units).

The last time the Indian two-wheeler industry clocked 10 million-unit wholesales in the first-half of a fiscal was in H1 FY2019 – 1,15,68,498 units.

The last time the Indian two-wheeler industry clocked 10 million-unit wholesales in the first-half of a fiscal was in H1 FY2019 – 1,15,68,498 units.

This volume segment of India Auto Inc has crossed 10-million unit wholesales after six years (see the 10-half-years’ wholesales data table above). The last time this big number was achieved was in H1 FY2019 – 1,15,68,498 units – with that entire fiscal year's total wholesales being the highest yet at 21 million two-wheelers. With the H1 FY2025 total already 56% of FY2024’s total sales of 1,79,74,365 units and 48% of entire FY2019’s record sales of 21,181,390 units, will two-wheeler sales raise the wholesales bar higher in FY2025? We’ll have to wait six months for that affirmation.

All three sub-segments have registered double-digit growth: motorcycle dispatches have risen by 16.31%, scooters by 22% and mopeds by 16.55 percent YoY. GAP BETWEEN HERO AND HONDA REDUCES TO 59,247 UNITS FROM 475,126 UNITS A YEAR AGO

GAP BETWEEN HERO AND HONDA REDUCES TO 59,247 UNITS FROM 475,126 UNITS A YEAR AGO

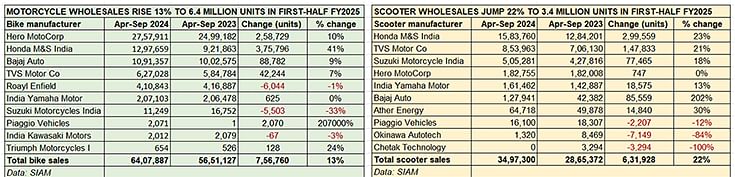

The continuing battle between the No. 1 and No. 2 players continues to make the headlines. While Hero MotoCorp, with 2.94 million units registered 10% YoY growth and gets a two-wheeler market share of 28.92%, Honda Motorcycle & Scooter India (HMSI), with 2.88 million units clocked a 31% YoY increase and a market share of 28.34%.

The gap between these two OEMs – once partners and now arch rivals – has considerably reduced. The difference between the two at the end of April-September 2024 is 59,247 wholesale units. A year ago, that was 475,126 units, with Hero MotoCorp having a two-wheeler market share of 33% and HMSI 25 percent.

Of the top six OEMs, HMSI has dispatched the highest number of additional units in H1 2025 – 675,355 scooters and bikes compared to Hero MotoCorp (259,476 units), TVS Motor Co (226,963 units), Bajaj Auto (174,341 units) or Suzuki Motorcycle India (71,962 units).

TVS Motor Co registered wholesales of 1.74 million units in H1 FY2025, up 15% YoY, which gives it a market share of 17%, the same as in H1 FY2023. Bajaj Auto, which has also delivered a strong performance with 1.21 million units, up 17% YoY, has a current two-wheeler market share of 12%, the same as it did a year ago. Suzuki Motorcycle India, which also sells scooters, clocked wholesales of 516,530 units, up 16%, for a market share of 5 percent. At 410,843 motorcycles, Royal Enfield, sold 6,044 fewer units in H1 FY2025. India Yamaha Motor with 368,565 units clocked 5% growth and e-scooter maker Ather Energy did well to register 30% growth with 64,718 units.

ALSO READ: Exclusive: Honda outsells Hero MotoCorp in Sept retails, Splendor-maker leads in first 9 months

Honda sells 1.58 million Activas in H1 FY2025, TVS, Bajaj, Suzuki and Yamaha drive growth

Bike sales rise 13% to 6.40 million in H1, Hero tops but Honda increases market share

RELATED ARTICLES

Top 10 MPVs in First 10 Months of FY2026: Maruti Ertiga to Kia Carnival

Demand for multi-purpose vehicles remains strong, with their share of UV sales rising to 17% in FY2027 from 11% in FY202...

Skoda Slavia and VW Virtus Sales Cross 150,000 Units, Virtus First to Cross 75,000 Units

Skoda Volkswagen India’s two MQB-A0-IN–based sedans have reached a new milestone, with the Slavia at 73,378 units and th...

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

15 Oct 2024

15 Oct 2024

41766 Views

41766 Views

Ajit Dalvi

Ajit Dalvi

Autocar Professional Bureau

Autocar Professional Bureau