TVS Motor tops electric 2W sales for second month in a row

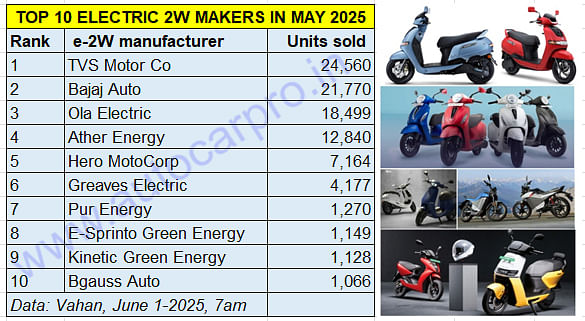

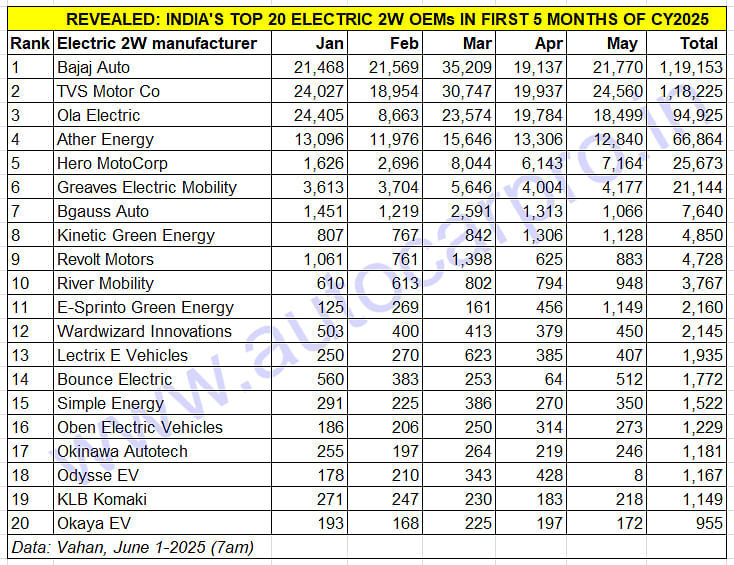

With 24,560 units retailed in May 2025, TVS Motor Co and its iQube have taken the e-2W monthly crown for the second straight month after April when it topped the market for the first time. Bajaj Auto, with 21,770 Chetaks, is ranked second while Ola Electric sold 18,499 e-scooters and e-motorcycles. The Rizta continues to be the mainstay for Ather Energy which is fourth with 12,840 units.

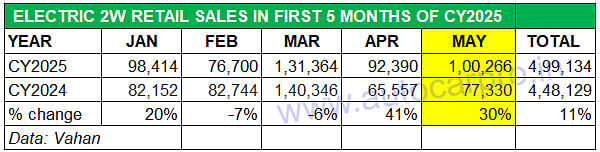

The Indian electric two-wheeler industry is in good nick. After hitting record monthly sales of 92,345 units and 45% YoY growth in April 2025, the retail sales numbers for May 2025 are also good. At 100,266 units, demand rose 30% YoY (FY2024: 77,330 units) albeit 5,307 units fewer than May 2023 (105,573 units), which remains the best-ever May for this sub-segment of the EV industry.

With 100,266 units sold, May 2025 retails are the second highest monthly numbers in the year to date after FY2025-ending March (131,364 units).

With 100,266 units sold, May 2025 retails are the second highest monthly numbers in the year to date after FY2025-ending March (131,364 units).

As per the latest retail sales statistics on the Vahan portal (June 1, 7am), cumulative e-2W sales for the first five months of this year at 499,134 units are up 11% YoY (January-May 2024: 448,129 units). This is 43% of CY2024’s record e-2W sales of 1.14 million units (11,49,374 units), and creates a firm foundation for India e-2W Inc to build on for the remaining seven months of CY2025.

Of the total 100,266 e-2Ws sold in May 2025, the Top 10 manufacturers together accounted for 93,623 units or an overwhelming 93%, while the Top 4 – each with five-figure sales – 77,669 units or 77 percent. Let’s take a closer look at each of the top six players in detail and how they fared in May.

Of the 100,266 e-2Ws sold in May, the Top 10 OEMs together account for 93,623 units or an overwhelming 93 percent. TVS and Bajaj both have a 24% share.

Of the 100,266 e-2Ws sold in May, the Top 10 OEMs together account for 93,623 units or an overwhelming 93 percent. TVS and Bajaj both have a 24% share.

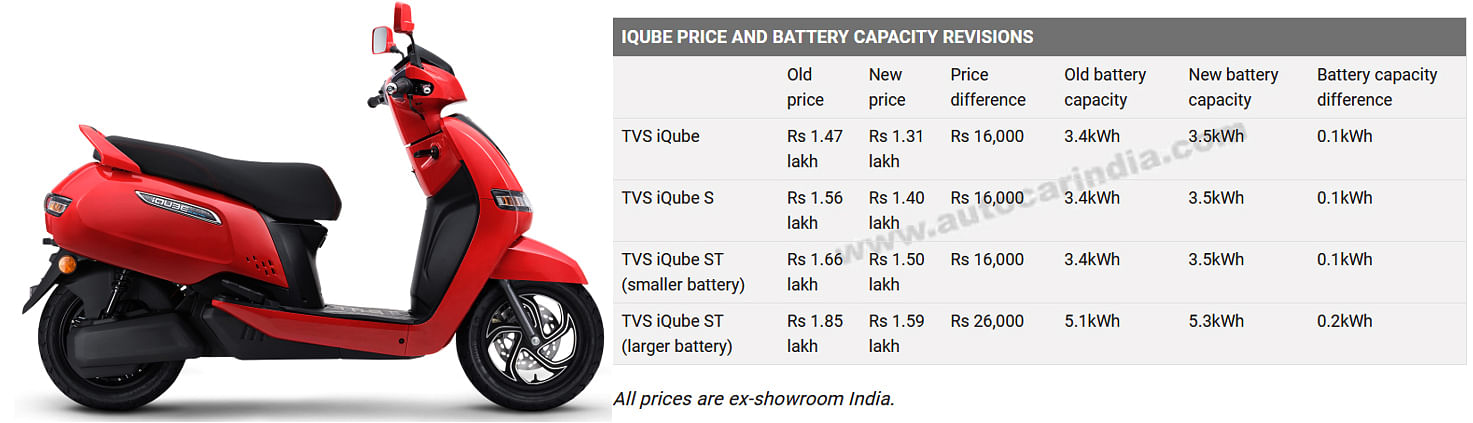

With 24,560 units, TVS iQube tops e-2W sales for the second straight month in May 2025, which saw the company slash prices by up to Rs 26,000 as well as increase battery capacity marginally.

With 24,560 units, TVS iQube tops e-2W sales for the second straight month in May 2025, which saw the company slash prices by up to Rs 26,000 as well as increase battery capacity marginally.

TVS MOTOR CO

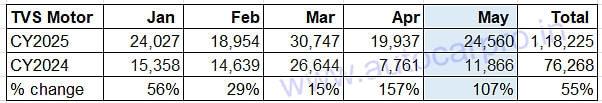

May 2025: 24,560 units, up 107% YoY / Market share: 24%

May 2024: 11,866 units / Market share: 15%

January-May 2025: 118,225 units / Market share: 24%

TVS Motor Co, which opened FY2026 on a peppy note in April 2025 and topped monthly e-2W retail sales for the very first time since its launch over five years ago, continues to wear the crown in May 2025. With 24,560 units, up 107% YoY (May 2024: 11,866 units), the iQube has raced ahead of its rivals once again for the second straight month.

TVS Motor Co, which opened FY2026 on a peppy note in April 2025 and topped monthly e-2W retail sales for the very first time since its launch over five years ago, continues to wear the crown in May 2025. With 24,560 units, up 107% YoY (May 2024: 11,866 units), the iQube has raced ahead of its rivals once again for the second straight month.

This performance gives TVS and the iQube a monthly market-leading share of 24 percent, considerably improving upon its May 2024 share of 15 percent. Cumulative sales of the iQube for the first five months of CY2025 at 118,225 units are up 55% YoY (January-May 2024: 76,268 units)

What would have given iQube sales a boost is TVS Motor Co slashing prices by up to Rs 26,000 and also increased the battery capacity of some variants (see data sheet above). The battery capacity of the base variant of the iQube, iQube S and iQube ST has been increased by 0.1 kWh and now has a claimed riding range of 145km per charge. The iQube S and iQube ST come with a fast 950W charger, which means a 0-80% top-up takes just three hours. While the S variant (Rs 140,000) receives a 0.1 kWh bump up to 3.5 kWh, the lower version of the higher-spec ST iQube also gets the same 3.5 kWh battery pack upgrade. The higher ST variant now houses a 5.3 kWh battery, up 0.2kWh, and is priced at Rs 159,000.

Speaking in a recent conference call after the company’s Q4 FY2025 results, K N Radhakrishnan, director and CEO of TVS Motor Co, said that a number of new EVs are in the final developmental stage and are slated to be launched in the coming quarters. It is understood that a lower priced – read ‘affordable’ – electric scooter targeted at first-time EV buyers in semi-urban India is in the new product pipeline and slated for launch later this year.

TVS, which has ample manufacturing capacity on hand, is strategically expanding the iQube dealer network. Currently estimated at around 950 touchpoints across India, TVS is aggressively increasing its EV network each month.

Left: The Chetak 3503, priced at Rs 110,000 is the most affordable Bajaj EV on two wheels. Right: The Chetak Urbane continues to witness strong demand.

Left: The Chetak 3503, priced at Rs 110,000 is the most affordable Bajaj EV on two wheels. Right: The Chetak Urbane continues to witness strong demand.

BAJAJ AUTO

May 2025: 21,770 units, up 135% YoY / Market share: 22%

May 2024: 9,249 units / Market share: 12%

January-May 2025: 119,153 units / Market share: 24%

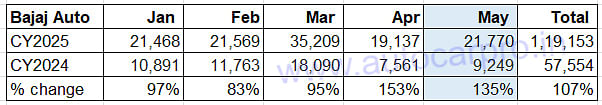

Bajaj Auto, which had topped monthly e-2W sales in February (21,563 units) and March (35,160 units) has moved up one rank from April’s No. 3 position (19,135 units) to No. 2 in May 2025. The Pune-based manufacturer of the Chetak e-scooter sold 21,770 units last month, 135% on year-ago sales of 9,249 units. This gives it a monthly market share of 22%, nearly double its April 2024 share of 12 percent.

Bajaj Auto, which had topped monthly e-2W sales in February (21,563 units) and March (35,160 units) has moved up one rank from April’s No. 3 position (19,135 units) to No. 2 in May 2025. The Pune-based manufacturer of the Chetak e-scooter sold 21,770 units last month, 135% on year-ago sales of 9,249 units. This gives it a monthly market share of 22%, nearly double its April 2024 share of 12 percent.

For the January-May 2025 period, Bajaj Auto has sold a total of 119,153 Chetaks, up 107% YoY (January-May 2024: 57,554 units). This is 928 units more than TVS’ five-month sales on account on being ahead in two months of this year to date.

The Chetak currently has four variants with the base Chetak 2903 costing Rs 99,999 and the top-end Chetak 3501 having a sticker of Rs 132,000. In April 2025, Bajaj Auto launched the new Chetak 3503 at Rs 110,000, its most affordable model in the 35 Series. The newest Chetak has a claimed range of 155km, 63kph top speed but a slower charging time than its 35 Series siblings. The new Chetak 3503 joins its siblings, the 3501 and 3502, which were launched in December 2024 and have since given a new charge to Chetak sales. The Chetak retail sales network is now spread to over 300 Chetak experience centres and 4,000 touch-points across the country.

Rakesh Sharma, executive director, Bajaj Auto confirmed the launch of a new variant this month (June 2025) in an investor call on May 30. He said: “With the introduction of the third 35 Series variant (the Chetak 3503) as well as the impending launch of a new variant in June – an upgrade to the entry-level and high-selling 2903 – the Chetak portfolio will become very potent. Further expansion of this portfolio is envisaged in FY2026 to address emerging sub-segments.”

Will the soon-to-be-launched new entry-level Chetak help Bajaj go past TVS Motor Co, which has topped e-2W months sales for the past two months? We’ll have to wait and see.

The S1 range of e-scooters forms the bulk of Ola’s sales. Right: Deliveries of the Roadster X electric motorcycle have begun.

The S1 range of e-scooters forms the bulk of Ola’s sales. Right: Deliveries of the Roadster X electric motorcycle have begun.

OLA ELECTRIC

May 2025: 18,499 units, down 51% YoY / Market share: 18%

May 2024: 37,388 units / Market share: 48%

January-May 2025: 94,925 units / Market share: 19%

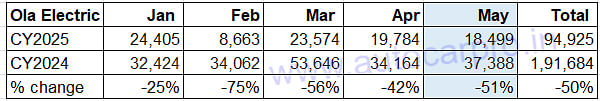

Ola Electric sold a total of 18,499 electric scooters and motorcycles in May 2025, down 51% YoY (May 2025: 37,388 units). The company had last topped the monthly sales chart in January 2025 but lost that spot to Bajaj Auto in February and March 2025, and to TVS in April and May 2025.

Ola Electric sold a total of 18,499 electric scooters and motorcycles in May 2025, down 51% YoY (May 2025: 37,388 units). The company had last topped the monthly sales chart in January 2025 but lost that spot to Bajaj Auto in February and March 2025, and to TVS in April and May 2025.

Ola’s market performance last month gives it an e-2W share of 18%, considerably down on its year-ago 48% share (May 2024: 37,388 units). Cumulative five-month sales at 94,925 units are down 50% on year-ago sales (January-May 2024: 191,684 units) as per Vahan data.

The bulk of Ola’s sales come from the 14-variant S1 e-scooter, which straddles multiple price-points starting from entry level mass mobility through to premium (Rs 65,000 to Rs 170,000). The S1 Pro, equipped with a 4kWh battery, has a claimed 142km range on a single charge and has an ex-showroom price of Rs 154,999.

May 2025 saw Ola begin customer deliveries of its Roadster X electric motorcycle. The company is targeting strong growth with the X, what the ICE motorcycle market being much bigger than scooters. The Ola Roadster X, which develops peak power of 11 kW, top speed of 125kph and has a range of 501km, is claimed to offer “15X lower running cost than comparable ICE models”. Roadster X first-in-segment features include ABS, cruise control, advanced regen, reverse mode, and advanced safety tech including geo and time fencing, theft detection, and ‘Find Your Vehicle’.

Ola, which commenced deliveries of the Gen 3 model range across India in March 2025, states that Gen 3 accounted “for 56% of its scooter deliveries by the month-end”. As a part of its product strategy, it will continue to offer both Gen 2 and Gen 3 scooters, targeting different customer segments.

Meanwhile, Ola has stated that it is “delaying the S1 Z, Gig/Gig+ and some other future products and will sequentially launch these products such that each product receives the right customer mindshare.”

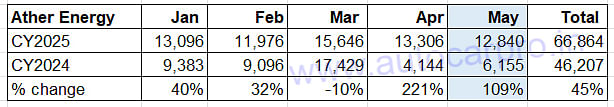

With retail sales of 12,840 units, demand for Ather e-scooters jumped 109% on May 2024’s 6,155 units. The Rizta family scooter has surpassed 100,000 units since its launch last year.

With retail sales of 12,840 units, demand for Ather e-scooters jumped 109% on May 2024’s 6,155 units. The Rizta family scooter has surpassed 100,000 units since its launch last year.

ATHER ENERGY

May 2025: 12,840 units, up 109% YoY / Market share: 13%

May 2024: 6,155 units / Market share: 8%

January-May 2025: 66,864 units / Market share: 13%

Smart electric scooter OEM Ather Energy continues to be ranked fourth on the e-2W OEM ladder-board. With 12,840 units, sales in May 2025 were up 109% on May 2024’s 6,155 units. This sees its market share rise to 13% compared to 8% a year ago.

Smart electric scooter OEM Ather Energy continues to be ranked fourth on the e-2W OEM ladder-board. With 12,840 units, sales in May 2025 were up 109% on May 2024’s 6,155 units. This sees its market share rise to 13% compared to 8% a year ago.

Ather’s main growth driver is the Rizta family e-scooter launched a year ago – cumulative Rizta wholesales have surpassed 100,000 units last month, just 11 months after deliveries began in July 2024. This is creditable given that the three-variant flagship scooter is a premium product priced from Rs 104,999 (Rizta S) to Rs 122,000 (Rizta Z 2.9) and to Rs 142,000 (Rizta Z 3.7).

In April 2025, the Rizta (10,052 units) accounted for 73% of the company’s total wholesales of 10,773 units. Expect the Rizta to have sold over 10,000 units in May 2025, which would take its cumulative sales since launch to over 110,000 units. In FY2025, the share of the Rizta (89,639 units) in Ather’s 12-month sales of 155,405 e-scooters was 58 percent.

While the Rizta S version (2.9 kWh battery) has a 123km range, the Z variant (3.7 kWh) has a 160km range. The Rizta’s highlights include the largest two-wheeler seat in India and storage space aplenty. The Ather Rizta was the winner of Autocar India’s Electric Two-Wheeler of the Year 2025 award.

The Vida V2 has given Hero MotoCorp a fresh sales charge. May 2025's 7,164 units are the company's third highest monthly retails to date.

The Vida V2 has given Hero MotoCorp a fresh sales charge. May 2025's 7,164 units are the company's third highest monthly retails to date.

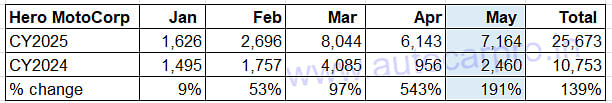

HERO MOTOCORP

May 2025: 7,164 units, up 191% YoY / Market share: 7%

May 2024: 2,460 units / Market share: 3%

January-May 2025: 25,673 units / Market share: 5%

Hero MotoCorp has sold 7,164 Vida 2 e-scooters in May, up 191% YoY on its year-ago base of 2,460 units. This performance sees its e-2W share more than double to 7% from 3% a year ago. This is the company’s third highest monthly sales after March 2025 (7,982 units) and October 2024 (7,355 units).

Hero MotoCorp has sold 7,164 Vida 2 e-scooters in May, up 191% YoY on its year-ago base of 2,460 units. This performance sees its e-2W share more than double to 7% from 3% a year ago. This is the company’s third highest monthly sales after March 2025 (7,982 units) and October 2024 (7,355 units).

The company is benefiting from expansion of its EV portfolio with the launch of the new Vida V2 in December 2024. The Vida 2 is essentially an evolution of the V1 range that the world’s largest ICE two-wheeler OEM began its electric mobility journey in October 2022. The Vida V2 is available in three variants: Lite (Rs 96,000), Plus (Rs 115,000) and Pro (Rs 135,000). The most affordable of the lot, the V2 Lite comes with a small 2.2kWh battery pack that has a claimed 94km IDC range.

In an earnings call held on May 14 after the Q4 FY2025 results were announced, Vikram Kasbekar, acting CEO, said: “The EV business is on a sustained growth curve helped by investments behind the brand, brand building, pricing interventions and launch of the VIDA V2 scooter. In 30-plus towns, we have 20%-plus market share. And in 60-plus towns, we have 10%-plus market share.”

Vivek Anand, CFO, added: “We are planning two new affordable products in first-half, most likely in July. And that will continue to really strengthen our product portfolio, which will help us really drive our growth, accelerate our growth and help us gain market share.”

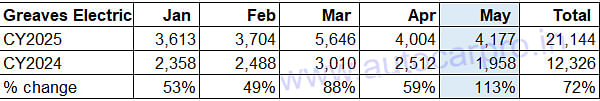

GREAVES ELECTRIC MOBILITY

GREAVES ELECTRIC MOBILITY

May 2025: 4,177 units, up 113% YoY / Market share: 4%

May 2024: 1,958 units / Market share: 2.53%

January-May 2025: 21,144 units / Market share: 4%

Greaves Electric Mobility (GEM), the EV arm of Greaves Cotton, has clocked retail sales of 4,177 e-scooters in May 2025, as per Vahan data. This sees the company maintain the same market share it had a year ago: 4 percent.

Greaves Electric Mobility (GEM), the EV arm of Greaves Cotton, has clocked retail sales of 4,177 e-scooters in May 2025, as per Vahan data. This sees the company maintain the same market share it had a year ago: 4 percent.

The company has a six-model portfolio of e-scooters comprising the Nexus (pictured above), Primus, Magnus LT/EX (100km+ range), Ampere Magnus Special, entry level Rio Li/La Plus and Zeal EX.

GEM’s FY2025 retails of 40,161 units were up 28% on its FY2024 sales of 31,276 units and give it a market share of 3.49%, marginally improving upon its 3.29% share of FY2024.

The Ampere Nexus, GEM’s e-scooter launched a year ago in April 2024, is a key growth driver. Targeted at families, the Ampere Nexus has been designed and developed in-house at the Ranipet facility in Tamil Nadu. Equipped with a 3 kWH LFP battery, the Nexus has a claimed top speed of 93kph and a certified range of 136km. Sold in two variants, prices start at Rs 110,000 (ex-showroom) and go up to Rs 120,000.

There are three other e-2W manufacturers which have sold over 1,000 units in May 2025. At No. 7 is Pur Energy (1,270 units), which is followed by E-Sprinto Green Energy (1,149 units). Kinetic Green, with its clutch of e-scooter as well as the e-Luna moped, takes ninth position with 1,128 units, and is followed by Bgauss Auto (1,066 units).’

River Mobility with 948 units is the 11th highest e-2W selling OEM in May 2025 and is followed by Revolt Motors, India’s leading sole electric motorcycle OEM, which sold 883 units.

RELATED ARTICLES

SUVs and scooters shine in May, enable India Auto Inc’s 2 million units and 2% growth

Utility vehicles and scooters were the only major sub-segments to register growth in May 2025 and helped India Auto Inc ...

Honda sells 4,178 e-scooters in four months, QC1 outsells Activa e

Honda Motorcycle & Scooters India, a recent entrant in the EV market, has manufactured 9,432 Activa e and QC1 electric s...

TVS maintains e-2W lead over Bajaj Auto, Ola and Ather in first two weeks of June

TVS Motor Co, which topped monthly electric two-wheeler sales in April and May, maintains its lead in the first two week...

01 Jun 2025

01 Jun 2025

5662 Views

5662 Views

Autocar Professional Bureau

Autocar Professional Bureau