SUVs and scooters shine in May, enable India Auto Inc’s 2 million units and 2% growth

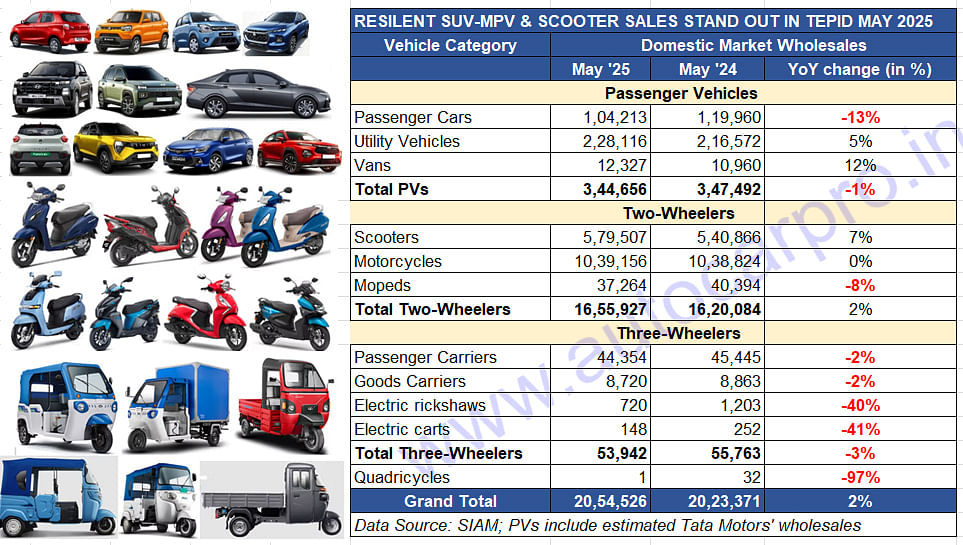

Utility vehicles and scooters were the only major sub-segments to register growth in May 2025 and helped India Auto Inc register wholesales of 2.05 million units, up 2% YoY. Demand for three-wheelers was down by 3% to 53,942 units. The industry remains cautiously optimistic about growth in the months ahead but is banking on rural demand arising out of an ample monsoon season.

India Auto Inc’s wholesales numbers for May 2025 for three vehicle segments are out and, reflective of demand slowing down in the monsoon months, are a sea of red as the data table below indicates. Other than the sub-segments of utility vehicles and vans for the overall passenger vehicle segment and scooters for the two-wheeler segment, all other sub-segments’ sales are down year on year. Combined wholesales of the PV, three-wheeler and two-wheeler segments at 2.05 million units are up marginally by 2% YoY (May 2024: 2.02 million units).

Amidst a plethora of global geo-political challenges, the Indian auto industry is keeping its fingers firmly crossed about vehicle sales in the upcoming months. What augurs well is the resilient Indian economy which, in Q4 FY2025, delivered near 6.5% growth as well as the advent of what looks to be an ample monsoon season. This should translate into stronger farm income and bolster semi-urban and hinterland demand, particularly for two-wheelers.

Rajesh Menon, Director General, SIAM, said: “Going forward, the RBI’s three repo rate cuts totalling 100 basis points in less than six months, along with a forecast of above-normal monsoons are some of the indicators which should positively impact the auto sector by improving affordability and boosting consumer sentiment in the coming months.”

PASSENGER VEHICLES: 344,656 units, down 1% YoY

Utility vehicles: 228,116 units, up 5%

Hatchbacks and sedans: 104,213 units, down 13%

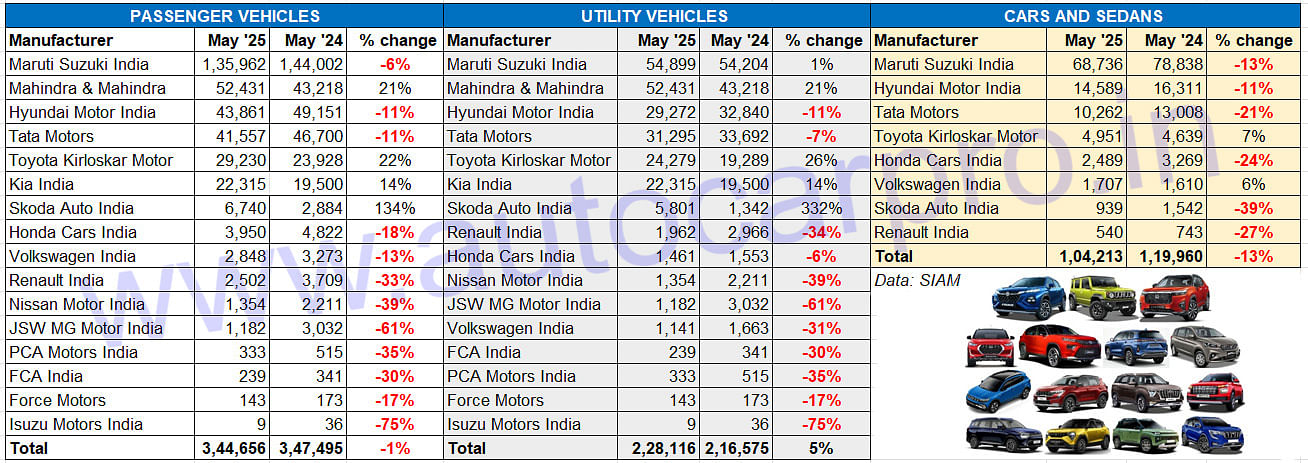

The Passenger Vehicle (PV) segment, which comprises hatchbacks and sedans, utility vehicles and vans, clocked wholesales of 344,656 units, down 0.8% YoY (May 2024: 347,495 units). This, according to SIAM, is the second highest monthly PV sales for the month of May albeit in negative growth territory. That is solely the result of the continuing decline in demand for hatchbacks and sedans – at 104,213 units, passenger car sales were down 13% YoY and their share of PV sales fell to 30% from 34% in May 2024. Van sales at 12,327 units were up 12% YoY (May 2024: 10,960) with Maruti Suzuki’s Eeco being the sole product in this category. As the data table indicates, only 2 of the 8 car makers – Toyota and Volkswagen India – registered growth last month.

The Utility Vehicle (UV) segment, which comprises SUVs and MPVs, continues its longstanding heroic role of acting as a buffer to declining car sales. In May, the 228,116 UVs sold were a 5% YoY increase (May 2024: 216,575 units) and accounted for a 66% share of PV sales versus 62% in May 2024. Maruti Suzuki tops the UV charts with 54,899 units but its YoY growth is far slower than an aggressive Mahindra, which with 52,431 SUVs and 21% YoY growth, was just 2,468 UVs behind Maruti. The two OEMs are separated by 9,160 units in the April-May 2025 period – will M&M spring a sales surprise on Maruti in the coming months? There are three other UV OEMs which have posted growth in May – Toyota Kirloskar Motor (24,279 units, up 26%), Kia India (22,315 units, up 14%) and Skoda India (5,801 units, up 332%). Each of them is benefiting from the rollout of new products – TKM with the Hyryder midsize SUV (7,573 units) and Rumion MPV (1,917 units). This is the Hyryder’s best-ever monthly sales yet after July 2024 (7,419 units). For Kia, the Sonet continues to be its best-seller with 8,054 units, followed by the Seltos (6,082 units), Carens (4,524 units), new Syros (3,611 units) and Carnival MPV (44 units). And, for Skoda, the recently launched Kylaq compact SUV with 4,949 units accounts for 85% of its UV sales last month.

TWO-WHEELERS: 16,55,927 units, up 2% YoY

Motorcycles: 10,39,156 units, 0% growth

Scooters: 579,507 units, up 13%

Mopeds: 37,264 units, down 7.74%

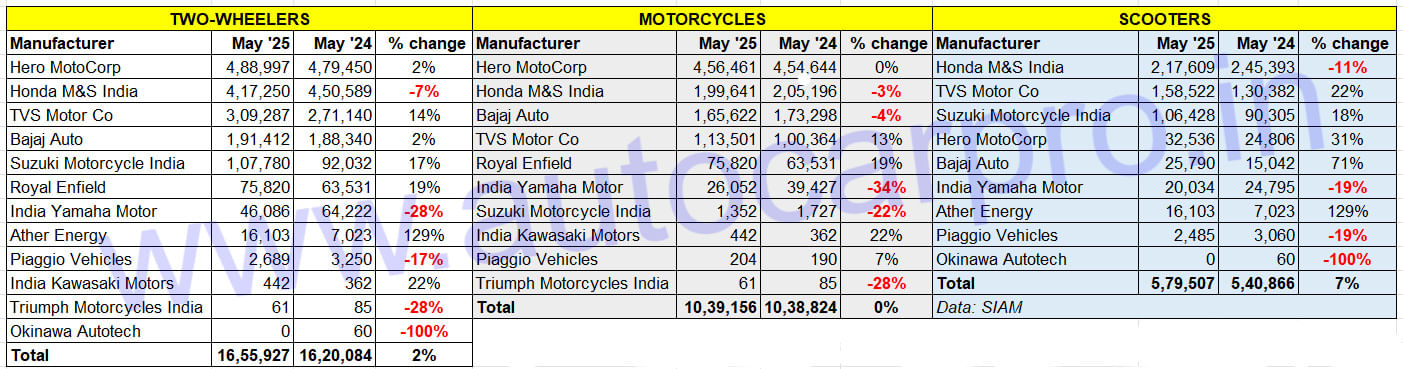

If the two-wheeler segment has been able to keep its head above water in May 2025, then it’s thanks to scooter sales which is the sole sub-segment to see YoY growth. Overall two-wheeler sales of 16,55,927 units were up 2% YoY – just 35,843 units more than a year ago. Motorcycle wholesales at 10,39,156 units were flat – 0% growth – what with just 332 units more than a year ago. And an 8% decline in moped sales to 37,264 units didn’t help either.

If the two-wheeler segment has been able to keep its head above water in May 2025, then it’s thanks to scooter sales which is the sole sub-segment to see YoY growth. Overall two-wheeler sales of 16,55,927 units were up 2% YoY – just 35,843 units more than a year ago. Motorcycle wholesales at 10,39,156 units were flat – 0% growth – what with just 332 units more than a year ago. And an 8% decline in moped sales to 37,264 units didn’t help either.

Looking at the OEM-wise performance for the overall segment, Hero MotoCorp maintains its leadership status with 488,997 units and 2% growth – an additional 9,547 units. While its motorcycle sales are flat at 456,461 units, the company’s Vida e-scooters (32,536 units) provided 31% YoY growth.

Honda Motorcycle & Scooter India (HMSI) has registered wholesales of 417,250 units, down 7% YoY as a result of both its motorcycle (199,641 units, down 3%) and scooter sales (217,609 units, down 11%) witnessing declines.

Among the top five OEMs which have five-figure sales, TVS Motor Co with 309,287 units has posted 14% YoY growth (May 2024: 271,140 units). TVS’ growth has come through both motorcycles (113,501 units, up 13%) and scooters (158,522 units, up 22%) while mopeds sales are down 8 percent.

Bajaj Auto, with 191,412 two-wheelers sold in May 2025, posted a 2% YoY increase. While its motorcycle sales are down 3% at 165,622 units, strong demand for its electric Chetak (25,790 units, up 71%), ensured the company’s sales were in the black last month.

Suzuki Motorcycle India too has benefited from demand for its scooters. The company sold a total of 107,780 two-wheelers, comprising 106,428 scooters (up 18%) and 1,352 bikes (down 22%).

Royal Enfield takes sixth rank among the 11 OEMs in the fray with 75,820 units, up 19% YoY (May 2024: 63,531 units).

ALSO READ:

Mahindra XEV 9e, BE 6 production and sales hit highest level in May

EV sales in India hit all-time high for May amid rare earth magnet supply uncertainty

Electric car and SUV sales jump 44% in first 5 months of 2025 to 60,000 units

RELATED ARTICLES

Suzuki Dispatches 703 e-Access Scooters in January, Delivers 201 Units to Customers

Suzuki Motorcycle India’s first electric scooter, priced at Rs 188,000 and among the most expensive two-wheeled EVs, reg...

Honda Sells 5,445 Activa-e and QC1 e-Scooters in 12 Months

Since February 2025, Honda Motorcycle & Scooter India has produced 11,168 e-scooters, dispatched 5,445 units to its deal...

Kia Carens Sells 277,000 Units in Four Years, Clavis And Clavis EVs Power 24% Growth in FY2026

The Carens MPV, which turns four years old today, accounts for a 27% share of Kia India’s sales of 10,43,126 utility veh...

16 Jun 2025

16 Jun 2025

6712 Views

6712 Views

Autocar Professional Bureau

Autocar Professional Bureau

Ajit Dalvi

Ajit Dalvi