TVS Motor and Suzuki take big strides in India’s surging scooter market

While Honda remains unassailable with its band of six scooters, strong demand for the Jupiter helps TVS ride past Hero MotoCorp to be the new No. 2. Suzuki, meanwhile, is quietly increasing market share with its Access.

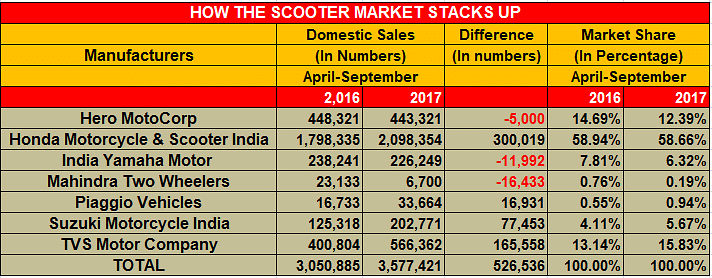

In a manner similar to the SUV market in India, accelerating demand for scooters is giving a leg up and more to the overall two-wheeler segment. For the ongoing fiscal half-year (April-September 2017), total scooter sales were 3,577,421 units, which marks smart 17.26 percent year-on-year growth and accounts for 34 percent of the total two-wheeler sales of 10,507,308 units including 6,508,952 motorcycles (+7.71%) and 420,935 mopeds (-5.63%).

While this a marginal 2 percent increase in its share of the overall two-wheeler market over the year-ago period, the growth road ahead points to a sharpening of demand for scooters across the country. The continuous pace of growth for the segment has come about as a result of new demand from rural markets, where women are slowly taking to gearless scooters, as well as burgeoning demand from urban India and Tier 2 and 3 towns.

TVS is the new No 2 scooter market OEM

While Honda Motorcycle & Scooter India (HMSI) continues to hold sway over the market by a massive margin – 2,098,354 units and 58.66 percent market share – with its band of six scooters and the soon-to-be-revealed Grazia, the big news is that TVS Motor Co has gone past No. 2 player Hero MotoCorp in the scooter market share stakes.

Thanks to growing demand for its flagship Jupiter, TVS now has a market share of 15.83 percent (566,362 units) compared to Hero MotoCorp’s 12.39 percent (443,321 units). A year ago (April-September 2016), the two rivals had an inverse relation: Hero had 14.69 percent of the market and TVS was third with 13.14 percent. In a span of a year, TVS’s scooter fortunes have seen a huge jump, rising 41 percent.

Suzuki Motorcycle India too is experiencing a similar rise in numbers. The two-wheeler arm of the Japanese carmaker, which is now at No. 5 spot, has sold a total of 202,771 units in H1 FY2018 (+61%), riding mainly on demand for the Access 125 scooter and helping itself to an increase in market share: 5.67 percent in April-September 2017 from 4.11 percent a year ago.

Notably, Suzuki's scooter growth is coming on the back of a single model, the Access 125 which was relaunched last year after Auto Expo 2016. Since then, there has been no looking back for this Suzuki on two wheels. The Access 125 has been the longtime rival to the Honda Activa in the domestic market.

At No. 4 is Yamaha Motor India with sales of 226,249 units in H1 FY2018, down 5 percent over sales of 238,241 units in April-September 2016.

Yamaha stands out as the only potential scooter manufacturer which is not aligned with the market growth. Hence, as a result, it has visibly lost out on market share.

Piaggio Vehicles, the No. 6 scooter OEM, is recording an uptick in its sales – 33,664 units that give it a market share of 0.94 percent, up marginally from the 0.55 percent share it had in H1 2016.

Piaggio is expected to roll out a 125cc scooter under the popular Aprilia brand, which has performed well for the company in the 150cc scooter category in the form of the Aprilia SR150.

In FY2017, the scooter segment sold a total of 5,604,601 units (+11.39%), accounting for 32 percent of overall two-wheeler industry sales of 17,589,511 units including motorcycles (11,094,543 / +3.68%) and mopeds (890,367 / +23.02%). Now, from the looks of it, the scooter segment looks set to carve a speedy growth path of its own. What’s more, with Hero MotoCorp, HMSI and TVS Motor Co all readying a gaggle of 125cc scooters, things can turn only more exciting.

Also read: 125cc, 150cc scooter market to see expansion in India

Hero MotoCorp aims for leadership in 125cc scooters

TVS readying 125cc scooter, mulls new scooter brand

RELATED ARTICLES

Bajaj Auto Outsells Mahindra in e-3Ws for Second Month in a Row, TVS Ranked Third in February

Bajaj Auto, after overtaking Mahindra Last Mile Mobility for the first time in January, repeated the feat in February wi...

Mahindra Sells 600,000 SUVs in 11 Months of FY2026, Goes ahead of Tata Motors

Mahindra’s 600,004 SUV wholesales put it ahead by 34,809 units over Tata Motors’ 565,195 passenger vehicles in the first...

Tata Motors, JSW MG, M&M Command 86% of e-PV Sales in February, Maruti Sells 214 e-Vitaras

With 5,558 units sold, Tata Motors captured a 41% share of the 13,669 e-PV market last month, while JSW MG Motor and Mah...

24 Oct 2017

24 Oct 2017

10114 Views

10114 Views

Autocar Professional Bureau

Autocar Professional Bureau

Ajit Dalvi

Ajit Dalvi