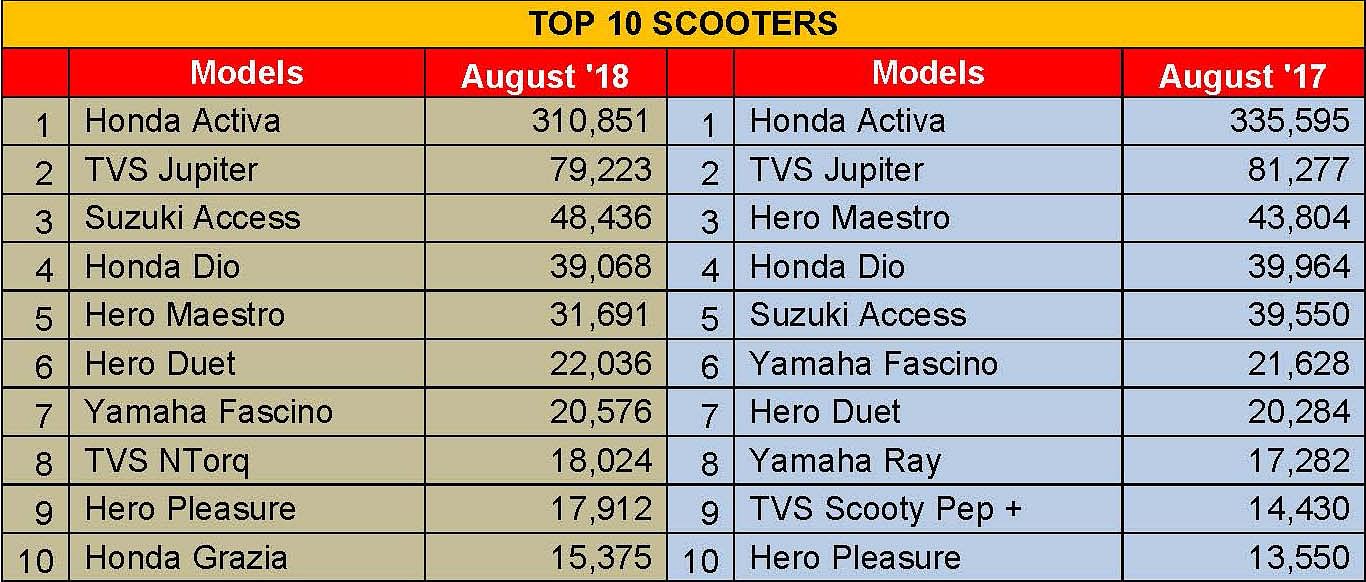

Top 10 scooters – August 2018 | Suzuki Access seals No. 3 spot, TVS NTorq beats Honda Grazia for the third time

Even as the Honda Activa and TVS Jupiter stay well entrenched at the top two leaders, the Suzuki Access is quietly making its presence felt on the podium.

Although the Honda Activa and the TVS Jupiter remain immovable from the top two positions in the list of the Top 10 bestselling scooters in India, it appears that the Suzuki Access is now beginning to seal the third slot in the toppers list.

The Suzuki Access, which has been the top selling 125cc scooter in India for a long time now, is understood to be Suzuki’s bestselling scooter model in the whole of Asia. Demand for the Suzuki Access has been phenomenal despite the scooter brand’s presence of over 10 years in India. Notably, the Suzuki Access 125 has been the conventional and the strongest rival to the Honda Activa in the local scooter market. Just like the latter, the Suzuki Access has also played a crucial role in driving scooters as the preferred mode of commuting in the domestic markets.

In a manner similar to the Honda Activa, the Suzuki Access has earned customer trust over years through its robust performance, reliability, comfortable and ease of ride and pocket-friendly fuel-efficiency. According to market research on domestic scooter demand, most customers who test ride a Honda Activa also test ride the Suzuki Access.

However, the 125cc Access could not capitalise on its market demand just the way Honda did with its Activa umbrella due to several limitations. These primarily included constraints in two areas: production capacity and Suzuki Motorcycle’s all-India dealership footprint.

Nevertheless, the company has now identified these longstanding limitations and is working to leverage on the demand of its products, primarily the new Access scooter, launched in the 2016 Delhi Auto Expo. As a result, Suzuki Motorcycle India is able to increase the dispatches of its Access scooter to its all-India dealership footprint.

This late but still-in-time correction also works in Suzuki’s favour as other scooter manufacturers have identified the 125cc scooter category as the next avenue to drive scooterisation and fuel growth in the domestic market. Honda launched its 125cc Grazia last year and TVS Motor launched its 125cc NTorq 125 earlier this year. Both these models are now among the top 10 bestselling scooters every month. Hero MotoCorp too is expected to debut via two variants in this 125cc scooter category soon.

It, therefore, gets critical for Suzuki to bank upon its existing strengths to further consolidate its presence in India.

At the third position, the Suzuki Access has sold 48,436 units in August 2018, thereby recording an impressive YoY growth of 22.47 percent. Notably, the model had ranked fifth with sales of 39,550 in August 2017.

Autocar Professional estimates that if Suzuki continues to capitalise on the demand of the Access scooter and continues to expand its retail network locally, the model will soon breach the 70,000-75,000 unit mark per month. This also means that it will be able to sell volumes similar to that of the TVS Jupiter today. However, it remains to be seen how soon Suzuki Motorcycle India is able to achieve the expected feat for its popular scooter.

Meanwhile, the Honda Activa and the TVS Jupiter have reported sales of 310,851 units (down 7.37 percent YoY) and 79,223 units (down 2.53 percent YoY) respectively for the last month as they continue to occupy the top two ranks.

At No. 4 is Honda’s funky-looking 110cc Dio scooter, which is popular among the young college-going crowd across cities. The model has reported sales of 39,068 units, down 2.24 percent YoY. The Honda Dio was number four in August last year too.

As against its third rank in August 2017, Hero MotoCorp’s Maestro now stands at the fifth spot in the top 10 scooters’ list in August 2018. The Hero Maestro has reported sales of 31,691 units, down by a sharp 27.65 percent YoY. Another 110cc scooter brand from the stable of Hero MotoCorp, Duet, has ranked sixth with sales of 22,036 units in August. Surprisingly, Hero Duet sales have reported a YoY growth of 8.63 percent.

At No. 7 is India Yamaha Motor’s top-selling scooter, the 113cc Fascino, which sold 20,576 units in August, down 4.86 percent YoY. The declining volumes of the Yamaha Fascino have picked up, thanks to new marketing and promotional activities around the model. However, it is time that the company must roll out at least new variants of the Fascino to keep up its demand in the market.

Meanwhile, at No. 8 is TVS Motor’s 125cc NTorq 125, which has yet again beaten its rival Honda Grazia. This, interestingly, is the third instance when the TVS NTorq 125 has scored more monthly volume than the Honda Grazia since its launch in February 2018. The first time the NTorq breasted ahead was in May 2018 (the same month when it debuted in the Top 10 Scooters list), followed by July 2018.

While the TVS NTorq 125 sold 18,024 units last month, it outperforms the Honda Grazia, which is at the 10th spot with sales of 15,375 units. In about seven months of its commercial launch, the TVS NTorq 125 has cumulatively sold more than 100,000 units in the domestic market. This is a big plus for TVS Motor given that the festive demand is yet to catch pace in the market in the coming months.

Lastly, the 100cc Hero Pleasure, which has ranked ninth, continues to be a consistent performer for Hero MotoCorp. The Hero Pleasure fetched sales of 17,912 units in August, and is up 32.19 percent YoY.

Also read: Top 10 Two-Wheelers in August 2018

Top 5 Utility Vehicles in August 2018

Top 10 Passenger Vehicles in August 2018

RELATED ARTICLES

The 200cc Motorcycle: India’s Quiet Premiumisation Story

While the motorcycle market’s attention remains on 110cc volumes and the 350cc Royal Enfield phenomenon, a quiet revolut...

100,000 and Holding: Electric Scooters Cross a Threshold

India’s electric two-wheeler market has achieved a landmark, with monthly wholesale volumes now consistently exceeding 1...

Maruti Wins in Mid-SUV Space with New Models

Maruti Suzuki’s UV1 volumes nearly doubled in four months. The cause is not the GST cut — it is a deliberate product por...

19 Sep 2018

19 Sep 2018

39736 Views

39736 Views

Arunima Pal

Arunima Pal

Shruti Shiraguppi

Shruti Shiraguppi