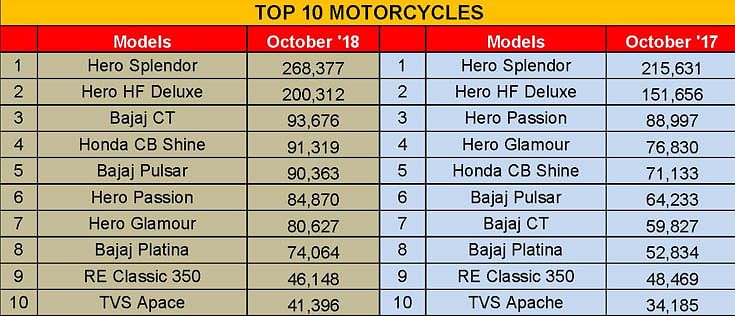

Top 10 Motorcycles – October 2018 | Hero MotoCorp and Bajaj Auto dominate demand

October sees sharp rise in demand for commuter motorcycles such as the Hero Splendor, Hero HF Deluxe, Honda CB Shine, Bajaj CT 100 and Bajaj Platina.

Even as growth moderates for scooters in India, the motorcycle segment, which has come out of a recent slump, is gradually accelerating on growth road. In October, total motorcycle despatches from OEMs comprised 13,27,758 units, up 20.14 percent YoY (October 2017: 11,05,140). Clearly, the motorcycle segment is on a healthy run with an overall growth rate of about 14 percent YoY during the first seven months of the ongoing fiscal.

This can be attributed to the sharp rise in the demand for commuter motorcycles such as the Hero Splendor, Hero HF Deluxe, Honda CB Shine, Bajaj CT 100 and Bajaj Platina. Then there are some other key brands that continue to bank upon this momentum. These primarily include Bajaj Auto’s Pulsar and TVS Motor’s Apache brands.

Hero MotoCorp’s Splendor brand continues to lead the motorcycle segment with total domestic dispatches of 2,68,377 units, up 24.46 percent YoY. The company had dispatched 2,15,631 units of its Splendor motorcycles in October last year. The HF Deluxe, on the other hand, continues to be the second bestselling motorcycle brand in October with total despatches of 2,00,312 units during the month as against 1,51,656 units in October 2017.

The Bajaj CT 100, the most affordable mass commuter motorcycle in India, reported a record number of despatches in October 2018. Grabbing the third spot in the Top 10 motorcycles list, the Bajaj CT 100’s wholesale numbers stood at 93,676 units, thereby marking handsome growth of 56.58 percent YoY.

Autocar Professional estimates that Bajaj Auto’s aggressive product pricing (of CT 100 variants) has been able to draw a number of potential scooter customers in the Tier 2 and 3 and even smaller towns across India. It can be recalled that earlier this fiscal, Bajaj Auto deployed an aggressive product pricing strategy thereby discounting prices of its entry-level models along with offering freebies, namely the ‘555’ offer, which stands for 5 free services, 5-year warranty and 5-year product warranty.

Along with that, Bajaj Auto’s efforts at continued portfolio expansion (across the Pulsar and Platina range) appears to be fetching results too. This can be seen in the growth in despatch numbers of both these brands. The wholesale despatches of the Pulsar and Platina stood at 90,363 units and 74,064 units respectively in October 2018. While the Bajaj Pulsar ranked fifth (against sixth in October 2017), the Platina range grabbed the eighth spot during the month.

Honda’s CB Shine, India’s bestselling 125cc motorcycle, reported despatches of 91,319 units in October, up 28.38 percent YoY. It ranked fourth in the list.

Meanwhile, Hero MotoCorp’s Passion ranked sixth with total despatches of 84,870 units, down 4.64 percent YoY. Its 125cc Glamour range ranked seventh with despatches of 80,627 units during the month recording a YoY growth of about five percent.

At the ninth spot was Royal Enfield’s top-selling model, Classic 350, which recorded despatches of 46,148 units, down about five percent YoY, during the month. TVS Motor’s Apache umbrella brand continues to be at No. 10 with total despatches of 41,396 units in October 2018 as against 34,185 units in October 2017. The thorough re-engineering of its RTR series appears to be fetching good results to the company as the brand has registered about 21 percent growth YoY.

With a number of new launches including facelifts as well as new models, it would be interesting to note how the motorcycle manufacturers fare during the remaining the months of the ongoing fiscal.

Also read: Top 10 Scooters in October 2018

Top 5 Utility Vehicles in October 2018

Top 10 Passenger Vehicles in October 2018

Top 10 Passenger Cars in October 2018

FADA voices concern about industry de-growth in festive season

RELATED ARTICLES

Bajaj Auto Outsells Mahindra in e-3Ws for Second Month in a Row, TVS Ranked Third in February

Bajaj Auto, after overtaking Mahindra Last Mile Mobility for the first time in January, repeated the feat in February wi...

Mahindra Sells 600,000 SUVs in 11 Months of FY2026, Goes ahead of Tata Motors

Mahindra’s 600,004 SUV wholesales put it ahead by 34,809 units over Tata Motors’ 565,195 passenger vehicles in the first...

Tata Motors, JSW MG, M&M Command 86% of e-PV Sales in February, Maruti Sells 214 e-Vitaras

With 5,558 units sold, Tata Motors captured a 41% share of the 13,669 e-PV market last month, while JSW MG Motor and Mah...

29 Nov 2018

29 Nov 2018

15046 Views

15046 Views

Autocar Professional Bureau

Autocar Professional Bureau

Ajit Dalvi

Ajit Dalvi