Tata Nexon is India’s No. 1 UV for third fiscal in a row, Punch beats Brezza

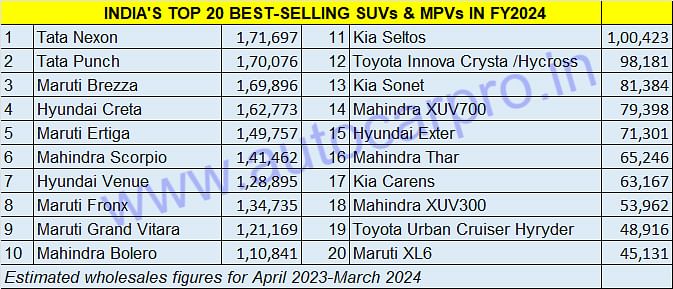

Tata Nexon with 171,697 units holds onto its crown while sibling Punch with 170,076 units goes past a hard-charging Brezza’s 169,896 units. Hyundai Creta, ranked No. 2 in FY2023 and FY2022, is the fourth best-selling SUV. We reveal India’s Top 20 utility vehicles which have helped increase the UV share of the passenger vehicle market to 60% in FY2024.

The Tata Nexon has retained its title as India’s best-selling utility vehicle (UV) for the third fiscal year in a row in FY2024 with estimated wholesales of 171,697 units in the 12-month period of April 2023 to March 2024. The Nexon, which is equipped with petrol, diesel and electric powertrains, was also the country’s best-selling SUV in FY2023 and FY2022.

The battle to be the SUV boss in FY2024 was close. At end-February 2024, only 2,356 units separated the Tata Nexon and the Maruti Brezza, which was perceived to be its main challenger to the No. 1 UV title in FY2024.

While the Nexon (171,697 units), which sold 0.25% less than the 172,138 units it sold in FY2023, has once again taken the crown, interestingly another Tata Motors’ SUV – the Tata Punch with 170,076 units – has snatched the No. 2 rank from the Brezza, which was ahead of the Punch till February 2024. The Brezza is now ranked third with 169,896 units and retains the same ranking it had in FY2023 (145,665 units), its sales increasing by 17 percent.

Surging demand for the Punch meant that its 17,547 units in March 2024 not only made it the best-selling SUV for the month but notably it was also India’s best-selling passenger vehicle for the first time last month. The Punch, initially available only with petrol power, continues to punch above its weight and is clearly benefiting from its recently launched CNG and electric variants, having sold 27% more units in FY2024 compared to the 133,819 units it sold in FY2023.

As a result of the continuing robust customer demand for compact SUVs and the no-holds-barred battle between the top three compact SUVs, the Hyundai Creta midsize SUV, ranked second in FY2023 (150,372 units) as well as FY2022 (118,092 units), takes fourth position in FY2024 despite delivering a much better performance 162,773 units. This is its best yet in a fiscal, energised by the launch of the new Creta in mid-January 2024.

Cumulative sales of the Top 20 UVs at 2.16 million units account for 86% of the total estimated UV sales of 2.52 million units in FY2024, which are a strong 26% YoY increase over FY2023's 2 million units.

Cumulative sales of the Top 20 UVs at 2.16 million units account for 86% of the total estimated UV sales of 2.52 million units in FY2024, which are a strong 26% YoY increase over FY2023's 2 million units.

Tata Nexon remains India's No. 1 SUV for third straight year in FY2024. While the Mahindra Bolero ruled between FY2013 and FY2016, the Maruti Vitara Brezza topped four fiscals after that. The Hyundai Creta was the best-selling SUV in FY2021.

Tata Nexon remains India's No. 1 SUV for third straight year in FY2024. While the Mahindra Bolero ruled between FY2013 and FY2016, the Maruti Vitara Brezza topped four fiscals after that. The Hyundai Creta was the best-selling SUV in FY2021.

Compact SUVs rule, demand grows for midsize SUVs

Maruti Suzuki, Hyundai Motor India, Tata Motors, Mahindra & Mahindra, Kia India and Toyota Kirloskar India are the top six UV manufacturers in the country and are well represented in the Top 20 UV rankings, some more than others.

The Top 20 UV data table for FY2024 reveals that the market leader Maruti Suzuki has five models (Brezza, Ertiga, Fronx, Grand Vitara and XL6). Mahindra & Mahindra also has five models (Scorpio, Bolero, XUV700, Thar and XUV300). While Hyundai has three (Creta, Venue, Exter) as does Kia (Seltos, Sonet and Carens), Tata Motors has two models (Nexon and Punch) like Toyota (Innova Crysta/Hycross and Urban Cruiser Hyryder).

In terms of vehicle category, compact SUVs lead with 10 models, followed by midsize SUVs with seven models and MPVs with three models.

Utility vehicles’ share of India PV market jumps to 60%

While apex industry body SIAM will release the official data for FY2024 later this week, total wholesales (dispatches to showrooms) of passenger vehicles are estimated to be a record 4.23 million units, up 9% on what is now the previous best – FY2023’s 3.89 million.

The big news is that UVs, at an estimated 2.52 million units – surpassing the 2.5-million-units milestone for the first time – will account for nearly 60% of total PV sales, substantially improving upon their 51.50% share (20,03,718 UVs to 38,90,114 PVs) in FY2024.

The consumer in this segment, particularly for SUVs, is truly spoilt – a deep dive into Autocar India’s Buyer’s Guide reveals that there are 30 OEMs comprising 16 mainstream OEMs in the Indian market (who are SIAM members), and 14 luxury OEMs, retailing around 115 UV models and a mind-boggling 810 variants! Given this hugely competitive marketplace vying for the value-conscious and demanding Indian UV, SUV and MPV customer, these Top 20 UVs are true champions. Their cumulative wholesales of 2.16 million units account for 86% of the total estimated UV sales of 2.52 million units in FY2024.

With the wave of demand for SUVs and MPVs continuing, expect vehicle manufacturers with UV-heavy portfolios to achieve gains month after month in FY2025.

ALSO READ: FY2024 India auto retail sales rise 10% to 24.53 million units

RELATED ARTICLES

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

The 200cc Motorcycle: India’s Quiet Premiumisation Story

While the motorcycle market’s attention remains on 110cc volumes and the 350cc Royal Enfield phenomenon, a quiet revolut...

09 Apr 2024

09 Apr 2024

22907 Views

22907 Views

Autocar Professional Bureau

Autocar Professional Bureau

Ajit Dalvi

Ajit Dalvi

Arunima Pal

Arunima Pal