Tata Motors No. 1 CV OEM in H1 FY2023 but loses market share in 3 sub-segments

India’s commercial vehicle market is back in growth mode. While M&HCVs are up 88%, LCV demand has grown by 59%. An in-depth look at the first-half FY2023 sales data reveals interesting dynamics.

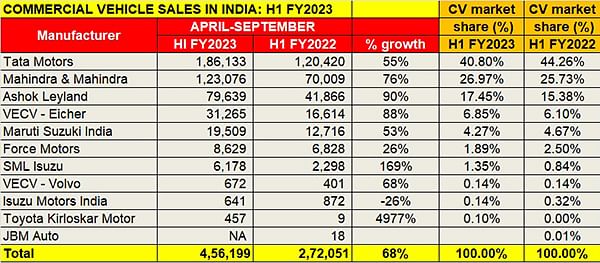

India’s commercial vehicle industry, which typically sees cyclical growth, is seeing revival of demand after a torrid two years of sales declines. From a high of over a million units in FY2019 (10,07,219 units), the double whammy of a slowdown and the pandemic saw sales slide hugely in FY2020 (717,593 units / -29%) and in FY2021 (568,559 units / -21%). Now, as per SIAM’s first-half sales numbers for FY2023, demand for CVs has improved to 456,199 units, up 68%.

The domestic CV industry is witnessing revival of demand, driven by the huge infrastructure spend by the government translating into sale of M&HCVs as well as the replacement demand for passenger-transporting buses. The LCV segment is also benefiting from the demand for smaller buses but the booming e-commerce business is giving a huge fillip to sale of small CVs engaged in last-mile deliveries.

Intense battle underway for market share

Looking at the overall SIAM CV industry sales numbers (above) shows that of the 11 CV manufacturers in the fray, all but one has recorded strong year-on-year growth albeit on a low-year ago base. Demand is on the upswing for both M&HCVs and LCVs. While overall M&HCV numbers at 155,335 units are up 88% YoY, LCV sales at 300,864 units constitute a YoY growth of 59 percent. While most OEMs are making gains, albeit on lower-year-ago sales, the competition, particularly at the top, remains intense.

From the market share perspective, despite recording YoY growth, four OEMs – Tata Motors, Maruti Suzuki India, Force Motors and Isuzu Motors India – see their share decline, which reflects the growing competition, particularly in some sub-segments.

Tata Motors sees growing competition

Looking into company-wise performance across the four sub-segments – M&HCV passenger carriers (buses), M&HCV goods carriers, LCV buses and LCV (goods), the SIAM data reveals that while Tata Motors with 186,133 units and 55% YoY growth remains the leader with a good lead over its rivals, its overall market share has reduced by 3 percentage points to 40.80% from 44.26% a year ago.

Closer analysis of the four sub-segments reveals that other than LCV (buses), where it has increased its share sizeably from 27% in H1 FY2022 to 44% in H1 FY2023, its share has reduced in the other three sub-segments (see data table below).

Despite a good performance in H1 FY2023, an expanding market and growing competition mean that Tata’s market share in M&HCV buses (to 29% from 42% in H1 FY2022) as well as goods carriers (to 51% from 57% in H1 FY2022) is down.

Despite a good performance in H1 FY2023, an expanding market and growing competition mean that Tata’s market share in M&HCV buses (to 29% from 42% in H1 FY2022) as well as goods carriers (to 51% from 57% in H1 FY2022) is down.

Expect the CV market leader to take speedy action to protect its turf and also regain lost market share. One such move can be seen in the recent launch of the Intra V20, a dual-fuel vehicle which runs on petrol and CNG and has a 700km range.

Mahindra’s CV market share up by 1.2%

Mahindra & Mahindra, with 123,076 units (up 76%), is at No. 2 position. Its sales comprised 2,646 heavy goods carriers, 504 LCV-buses and 119,926 small goods carriers, registering 51%, 1226% and 76% YoY growth respectively. Its overall performance in H1 FY2023 gives it a near-27% share of the CV market, up 1.24% from a year ago.

Sub-segment sales data, in terms of market share, reveals that while its slice of M&HCV goods carriers reduced to 1.89% from 2.20% in H1 FY2022, strong demand for its smaller vehicles in the form of LCV (buses) helped it expand market share to 2.27%. In the small CV (goods) where M&M stands supreme thanks to its Bolero pickups and vehicles like the Jeeto, the company’s market share gains are up by a sizeable 5 percentage points – to 43% from 38% a year ago.

Sub-segment sales data, in terms of market share, reveals that while its slice of M&HCV goods carriers reduced to 1.89% from 2.20% in H1 FY2022, strong demand for its smaller vehicles in the form of LCV (buses) helped it expand market share to 2.27%. In the small CV (goods) where M&M stands supreme thanks to its Bolero pickups and vehicles like the Jeeto, the company’s market share gains are up by a sizeable 5 percentage points – to 43% from 38% a year ago.

Ashok Leyland's M&HCV goods carriers shine

Chennai-based Ashok Leyland with 79,639 units clocked 90% YoY growth with the sales coming from 48,215 M&HCVs (3,793 buses and 44,422 goods carriers) and 31,424 LCVs (404 buses and 31,020 small CVs). These numbers see the company expand overall market share by 2% to 17.45% from 15.38% a year ago.

The company, which has a strong product portfolio in the tippers segment, is benefitting from the huge spend on infrastructure development underway in the country. It is particularly benefiting from demand for its modular AVTR truck platform, which offers a comprehensive truck range from 19T to 55T GVW, in a variety of axle configurations, loading spans, cabins, suspensions, and drivetrain options.

The company, which has a strong product portfolio in the tippers segment, is benefitting from the huge spend on infrastructure development underway in the country. It is particularly benefiting from demand for its modular AVTR truck platform, which offers a comprehensive truck range from 19T to 55T GVW, in a variety of axle configurations, loading spans, cabins, suspensions, and drivetrain options.

Thanks to its 8 percentage points increase in M&HCV goods carriers (to 31.73% from 23.61%), the company has managed to cushion the substantial market share decline in the M&HCV bus segment – to 25% from 35% a year ago.

VECV (Eicher) puts on a strong show

VE Commercial Vehicles (Eicher) saw overall sales of 31,265 units, which are an 88% YoY increase and see it grow its market share to 6.85% from 6.10% a year ago. These sales comprised 25,316 M&HCVs and 5,949 LCVs.

Within the M&HCV segment, Eicher sold 5,269 buses which constitutes 960% growth over the year-ago sales of 497 units and has helped the company double its M&HCV bus share to 34% from 17.58%. This also means Eicher has taken away market share in this sub-segment from Tata Motors and Ashok Leyland, both of whom have seen declines.

Within the M&HCV segment, Eicher sold 5,269 buses which constitutes 960% growth over the year-ago sales of 497 units and has helped the company double its M&HCV bus share to 34% from 17.58%. This also means Eicher has taken away market share in this sub-segment from Tata Motors and Ashok Leyland, both of whom have seen declines.

Growth outlook: Very good

At half-way stage in FY2023, the growth prospects for the Indian CV industry are looking good. Speaking at the IAA India Day in Hanover on September 21, Vinod Aggarwal, President, SIAM and Managing Director & CEO, VE Commercial Vehicles, had said: “In 2022, the CV industry’s market size was 716,000 units. We are expecting very speedy growth in this sector – a CAGR of 14% to 1.2 million units by 2025. The sectors which are going to boost this industry are infrastructure and real estate, e-commerce is getting stronger and transportation and logistics which are fundamental to the economy. Therefore, the confidence level on this growth is very high.”

More recently, after the SIAM H1 FY2023 sales numbers were announced, while speaking to Autocar Professional in New Delhi, Aggarwal said: “Over the last six months, LCV sales in FY2023 (300,864 units – 22,185 buses and 278,679 small CVs) have already crossed their earlier peak of FY2019 (252,959 units – 26,303 buses and 226,656 small CVs) . But we're still lagging behind in the M&HCV category. Having said that, there also the prospects are good with a lot of pent-up replacement demand as well as investment that is happening in the mining and infrastructure space.”

Mr Aggarwal added, “While these factors are driving growth in this category, it doesn't look like that the CV industry will cross the FY2019 peak – 10,07,319 units –this year with exports being down and buses too being away from their peak. Having said that, bus sales are picking up on account of schools getting reopened, people having resumed intercity travel as well as tourists coming back to see new places. So, the bus market is coming back on its feet but heavy-duty trucks are still less than their earlier peak sales.”

(With inputs from Mayank Dhingra)

ALSO READ:

Indian automakers sell nearly 11 million vehicles in first-half FY2022

Resilient India Auto Inc’s production up 23% in H1 FY2023 to 1.36 million vehicles

RELATED ARTICLES

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

The 200cc Motorcycle: India’s Quiet Premiumisation Story

While the motorcycle market’s attention remains on 110cc volumes and the 350cc Royal Enfield phenomenon, a quiet revolut...

100,000 and Holding: Electric Scooters Cross a Threshold

India’s electric two-wheeler market has achieved a landmark, with monthly wholesale volumes now consistently exceeding 1...

23 Oct 2022

23 Oct 2022

21831 Views

21831 Views

Ajit Dalvi

Ajit Dalvi

Arunima Pal

Arunima Pal