Tata, Toyota, Hyundai and FCA India increase UV market share in H1 FY2019

Utility vehicles continue to account for a fourth of the overall passenger vehicle market but growth is slowing down in a time of steep fuel prices. We take a close look at the UV market’s performance between April-September 2018.

Utility Vehicles (UVs) have been the growth drivers for the overall passenger vehicle (PV) segment for over two years now. In FY2018, UVs clocked handsome 20.97 percent year-on-year growth with sales of 921,780 units. Clearly the segment has come a long way since FY2015, when Indian UV sales totalled 525,942 units (-5.01%). From recording growth of 5.30 percent in FY2015, 6.25 percent in FY2016, the segment notched 29.91 percent growth in FY2017, a year when compact SUVs became the talk of the town.

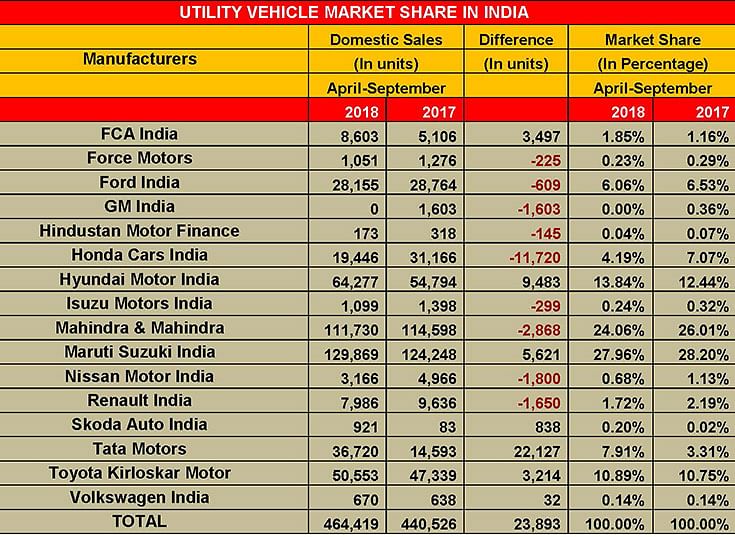

With apex industry body SIAM having revealed the sales numbers for the first half of FY2019 (April-September 2018), UV performance has moderated in the current fiscal, leading to a relatively slow H1 with a 5.42 percent growth rate with sales of 464,419 units.

With fuel prices consistently on the rise and the price of diesel closing in on petrol to narrow down the price differential to a mere Rs 8 (September 2018, Delhi), PV customers are again taking a re-look at sedans and premium hatchbacks, which are much more fuel efficient than their UV brethren.

Of the total PV sales of 1,744,305 units between April and September 2018, UVs accounted for 464,419 units (April-September 2017: 440,526), registering moderate growth of 5.42 percent. Meanwhile, in the same period, passenger cars sold 1,169,497 units and clocked 6.80 percent growth. While UV growth has slowed down, the fact of the matter is that a slew of new models have been launched the passenger car space over the past six months.

HOW THE UV PLAYERS STACK UP

While the country’s bellwether of the PV industry, Maruti Suzuki India faced a marginal decline in its UV market share in H1 of FY2019, players such as Tata Motors and FCA India have made considerable progress, with their latest offerings including the Nexon compact SUV and the Jeep Compass faring well in the sub-compact and premium sub-compact categories respectively. Both the vehicles have built a solid image in buyers’ minds due to their strong value preposition, which has made even the heavyweights from the competition stand up and take note.

Maruti Suzuki India, which remains the PV market leader with a solid 52.10 percent market share, sold 129,869 UVs between April and September 2018 (April-September 2017: 124,248), the company saw its market share falling to 27.96 percent with a growing overall market (April-September 2017: 28.20%).

Tata Motors, which has been aggressively driving its PV programme, has notched 151 percent YoY growth in its UV sales. In the first six months of FY2019, the company sold a total of 36,720 UVs (April-September 2017: 14,593), helping it expanding its UV market share to 7.91 percent from 3.31 percent during the same period in 2017.

The company has seen its Nexon crossover grow its market share to more than double, with sales touching 29,270 units over the last six months, making it consistently average a respectable 5,000 units a month, with 5,049 units going home to buyers in September. Launched in September 2017, the Nexon surpassed the 50,000th mark within a year in August.

The country’s No. 2 carmaker, Hyundai Motor India too saw a notable increase in its UV market share, which grew from 12.44 percent between April and September 2017, to now account for 13.84 percent of the overall UV market in H1 of FY2019. The company registered cumulative sales of 64,277 units over the last six months, a growth of 17 percent (April-September 2017: 54,794 units). The Creta crossover has been the sole growth driver for the company and after getting a refresh in May in with a host of feature updates, the premium crossover even went ahead to de-throne the segment-king Maruti Vitara Brezza, breaking its 23-month rally at the top-spot in the UV space.

Fiat Chrysler Automobiles India’s Jeep brand is gradually getting a solid foothold in the UV market, with the company selling 8,603 units of the Compass crossover between April and September (April-September 2017: 5,106), up 68 percent YoY, and growing its market share to 1.85 percent from 1.16 percent a year-ago.

Meanwhile, Toyota Kirloskar Motor maintained its share in a growing UV market, selling 50,553 units and keeping hold of 10.89 percent of the market (April-September 2017: 47,339 / 10.75%). Its popular Innova Crysta MPV contributed 39,347 units and the Fortuner SUV accounted for 11,124 units of the company’s total sales over the six-month period.

Honda Cars India, on the other hand, has taken the biggest hit, with the carmaker seeing its UV sales down substantially by 31.6 percent to 19,446 units (April-September 2017: 31,166 units). While its Jazz-based WR-V crossover had sold 25,251 units in G1 FY2018, WR-V sales dropped 35 percent to 16,323 units in H1 FY2019, having a dramatic impact on its market share, cutting it down to 4.19 percent (April-September 2017: 7.07%).

UV specialist Mahindra & Mahindra too saw its sales going down in the first half of the fiscal, with the numbers declining to 111,730 units (April-September 2017: 114,598), and its market share coming down notably to 24.06 percent (April-September 2017: 26.01%). While its popular models including the Scorpio, XUV500 and the Bolero clocked 53,328 units (April-September 2017: 51,442), sales of the TUV300, Quanto and Thar declined to 58,359 units (April-September 2017: 63,153) in the six-month period.

The coming months are critical for the overall PV industry’s growth, even as OEMs look to festive season demand to pep up sales numbers. With diesel, which is also seeing its price hit record highs, being the preferred UV fuel, fuel efficiency is increasingly playing a key part in buyers’ purchase decision.

Nevertheless, UVs still constitute around 26 percent of the overall PV market with one out of every four PVs being sold being a UV or SUV. Also, with elections around the corner, UVs remain the preferred mode of transport in the hinterland, which could spur demand in certain pockets of the country.

In FY2018, total UV sales fell short of the million mark by 78,220 units. Will they surpass the milestone in FY2019 or will FY2020 be that year? Stay tuned to Autocar Professional.

Also read: Top 5 UVs – August 2018

Also read: CV industry firing on all cylinders, Tata Motors leads gains in H1 FY2019, wrests LCV leadership from Mahindra

RELATED ARTICLES

Maruti Ertiga and Brezza Each Surpass 1.4 Million Sales in February

Launched four years apart, India’s highest-selling MPV and compact SUV each notch individual milestones, account for a 6...

Maruti Jimny Crosses 150,000 Sales Since Launch, 80% Comprise Exports

Launched in June 2023, the Maruti Jimny five-door SUV has sold 158,678 units till January 2026, with exports (127,442 un...

Kia India Drives Towards Highest-Ever Sales in FY2026

Kia India has sold 259,923 vehicles in the first 11 months of FY2026, just 9,306 units short of its all-time high of 269...

16 Oct 2018

16 Oct 2018

12728 Views

12728 Views

Ajit Dalvi

Ajit Dalvi

Autocar Professional Bureau

Autocar Professional Bureau