CV industry firing on all cylinders, Tata Motors leads gains in H1 FY2019

Both the M&HCV and LCV segments have notched record sales in first-half of the ongoing fiscal year and look well set to crack the million-unit mark in FY2019

With six months of fiscal year 2019 over, vehicle makers and industry observers in India are taking a close look at the road ahead. Overall September 2018 numbers, based on robust year-ago sales, are low but also indicate moderation in some segments, particularly passenger cars, utility vehicles and scooters. Clearly, OEMs are looking forward to the festive season to inject some much-needed oomph into the market.

In sharp contrast to this somewhat tepid show is the commercial vehicle (CV) industry which is firing on all cylinders. Having closed FY2018 on a very strong note (856,453 units / +19.94% – M&HCVs: 340,313 / +12.48% & LCVs: 516,140 / 25.42%), the sector looks well placed to cross the one-million units sales landmark for the first time in a fiscal year.

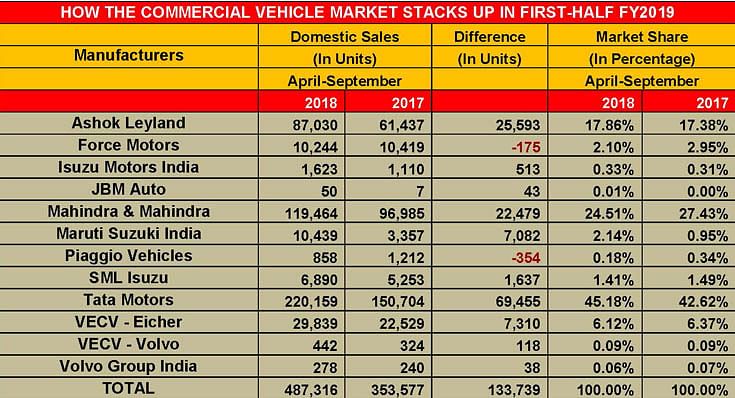

In the April-September 2018 period, the CV industry has sold a total of 487,316 units (+37.82%) comprising 190,795 M&HCVs (+47.88%) and 296,521 (+32.05%). This constitutes year-on-year growth of 37.82 percent, a performance which many global markets would be envying.

What giving the domestic CV industry momentum and a high-growth trajectory is the sustained uptick in economic activities and the government focus on developing infrastructure across the country. Key growth indicators such as GDP growth, infrastructure spend and higher mining activities point towards higher demand for the heavy trucks segment. And, increasing demand for last-mile connectivity, the boom in e-commerce and mobility needs in rural areas is helping the LCV segment move into the fast lane.

Given this nature of demand, the goods carrier segment – across both M&HCV and LCVs – is benefitting in a big way, as compared to passenger carriers (buses) which are somewhat dependent on orders from state transport undertakings, albeit demand is growing for school buses.

M&HCVs notch 48% growth in H1, Tata Motors' share expands to 53%

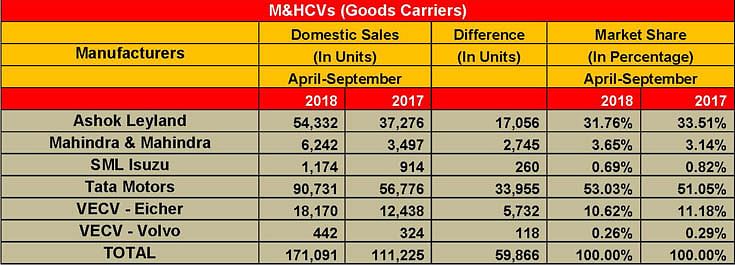

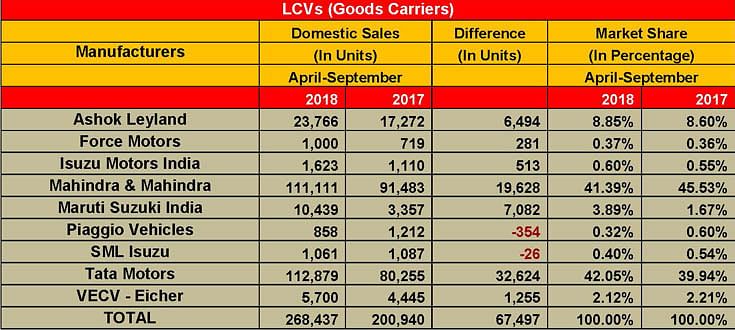

Both the M&HCV and LCV segments have notched record high sales in H1 FY2019. During the April-September 2018 period, the M&HCV goods carrier segment grew by a strong 54 percent with sales of 171,091 units (H1 FY2018: 111,225 units). Likewise, the LCV goods carrier segment is up 34 percent with total sales of 268,437 units (H1 FY2018: 200,940).

In the fiscal year till now, freight rates have seen some uptick. This is also helped by higher spend on infra projects. NHAI road contracts, awarded last year, are currently under execution in various parts of the country. Also, affordable housing and irrigation projects are contributing to the incremental demand for M&HCVs. With the upswing in infrastructure projects across the country, there is increasing demand for tippers and is likely to remain strong, given the government’s effort to stimulate the economy and create more jobs.

In such a buoyant environment, all the major CV makers are more than pleased with the surging demand for their high-margin, heavy-duty trucks. Every manufacturer has recorded significant growth – between 40-70 percent – in its H1 heavy-duty trucks sales.

CV market leader Tata Motors, which is engaged in an aggressive battle to win back lost ground in the heavy-duty truck segment, seems to be playing its cards well. Its M&HCV sales numbers jumped 60 percent in H1 FY2019 to 90,731 units, which gives it a market share of 53 percent. Tata Motors is the sole OEM in the segment which has managed to gain 2 percentage points in M&HCV market share; all the other players, barring , other than Mahindra Trucks & Buses, have either lost a few points or recorded flat growth in a market which has grown by 53.82 percent YoY to 171,091 units (H1 FY2018: 111,225 M&HCVs).

Ashok Leyland, the second largest player in the segment, sold 54,332 units with growth of a significant 46 percent; this gives it a share of 31.76 percent but it ends up losing 1.75 percent (H1 FY2018: 33.51%). Similarly, VE Commercial Vehicles, which has recently announced plans for a new plant in Bhopal, has increased its heavy duty truck sales by 46 percent with 18,170 units for a market share of 10.62 percent, losing half a percentage. Mahindra trucks & Buses is another ambitious player eyeing smart gains in this highly competitive segment. The company has grown the most during H1 albeit on a low base. It sold 6,242 units during the period, up 78 percent but marginally growing its market share to 3.65 percent from 3.14 percent a year ago.

Tata Motors wrests LCV leadership from Mahindra

Even though the M&HCV segment is the more profitable one compared to LCVs, CV makers are now realising the hidden potential in the LCV market where demand has sharply grown from the FMCG, e-commerce and last-mile transportation sectors.

The big news in H1 is that of Tata Motors driving ahead of Mahindra & Mahindra, a long-time leader in the LCV load carrier segment by gaining 2 percent market share after several years. It sold 112,879 units, up 40 percent, to get a market share of 42 percent in H1 FY2019. In comparison, M&M sold 111,111 LCVs, up 21 percent, with 41.3 percent market share but a decline of over 4 percent. Although Tata Motors’ lead is a slight one, it’s a big win for the company which has been aggressively battling with M&M to regain its lost market share.

Tata Motors’ weapon to wrest market share is the Tata Ace small CV family (Ace, Ace Zip, Ace Mega and Super Ace). These four SCVs have sold a total of 73,183 units between April-August 2018, which marks 51.82 percent YoY growth (April-August 2017: 48,202). The Tata Ace, with 50,831 units (+102%) has been the prime contributor to sales, followed by the Ace Mega (12,317 / -5.3%), Ace Zip (7,953 / -3.4%) and Super Ace (2,082 / +163%).

This said, Mahindra & Mahindra is fighting back hard. The company recently launched its Maha Bolero, which it says is India’s first pick-up with 1.7-tonne payload capacity. The new range of the Maha Bolero Pik-up (pictured below) gets all-new interior and improved seating comfort with a wider co-driver seat. The Maha Bolero Pik-up flat-bed has been launched at an introductory price, starting at Rs 666,000 (ex-showroom, Pune).

The new Bolero Pik-up comes with an extra-long cargo deck with a length of 9 feet (2765mm) – the highest in its category – which complements the highest payload carrying capacity of 1,700kg. The Maha Bolero Pik-up comes with a double-bearing axle, stronger 9-leaf suspension and wider 15-inch, 12PR tyres to support the increased load carrying capacity. The Maha Bolero Pik-up range consists of different body styles, cargo box lengths and varying payload capacities of 1,300kg, 1,500kg and 1,700kg, suitable for various customer segments and their needs. Expect to see a pitched battle on the SCV front between Tata and M&M in the coming months.

Meanwhile, Ashok Leyland is also trying to become a challenger in the segment by pushing its presence in the LCV goods carrier segments with the Dost SCV and its variants, and is learnt to be working to introduce a few more products. At present, it has an LCV market share of 8.85 percent with sales of 23,766 units between April-September 2018.

Maruti Suzuki India, a late entrant in the CV market with its Super Carry, has gained nearly 4 percent market share with sales of 10,439 units of the Super Carry in H1 FY2019. Still, it’s a number the country’s leading carmaker would not really be happy with. Nonetheless, the Super Carry is beginning to see sales pick up, albeit slowly. In September 2018, the Super Carry clocked its best-ever monthly sales yet – 2,038 units. Its previous best was in August 2018 – 1,805 units. Till end-September 2018, a total of 21,372 Super Carrys have been sold in India.

Now with the festive season underway, which is also when there is a good level of vehicle buying, particularly in rural India, CV OEMs will be looking to accelerate their sales numbers, particularly when the wind is blowing in their sails. Stay tuned for further updates on this very exciting vehicle segment.

Also read: Tata Motors, Toyota, Hyundai and FCA India increase UV market share in H1 FY2019

RELATED ARTICLES

TVS maintains e-2W lead over Bajaj Auto, Ola and Ather in first two weeks of June

TVS Motor Co, which topped monthly electric two-wheeler sales in April and May, maintains its lead in the first two week...

Maruti Jimny crosses 100,000 sales since launch, 74% comprise exports

Launched on June 7, 2023, the Maruti Jimny five-door has sold a total of 102,024 units till end-April 2025. While the do...

Exclusive: Bajaj Auto sells 75,000 electric 3Ws in two years, readies to launch e-rickshaw

India’s largest three-wheeler manufacturer and exporter, which entered the electric 3W market in June 2023, clocks new r...

16 Oct 2018

16 Oct 2018

29086 Views

29086 Views

Autocar Professional Bureau

Autocar Professional Bureau