Suzuki nets big gains in scooter market share in April-October 2021

By selling 110,096 more scooters than it did a year before, Suzuki increases its market share by four percentage points to 14% in April-October 2021.

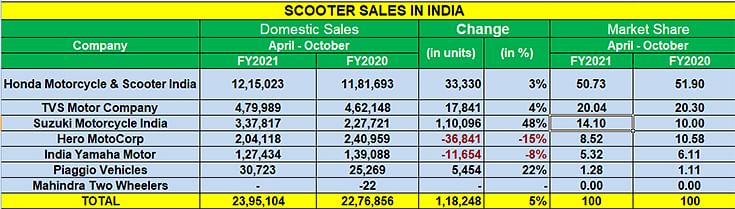

The scooter market in India is seeing tepid times and in the first seven months of FY2022 has seen just about 5% year-on-year growth. While Honda and TVS Motor Co remain the top two players in this segment, Suzuki has made the maximum gains in the April-October 2021 period.

Of the total 23,95,104 scooters sold (up 5%), Honda Motorcycle & Scooter India (HMSI) accounted for 12,15,023 units or 50.73% of total sales in India. Its market share has dipped marginally from 51.90% a year ago. In FY2021, HMSi had sold a total of 23,28,778 scooters, down 26% YoY (FY2020: 31,47,919). The popular Activa, India;;s best-selling scooter remains the mainstay of the company.

TVS Motor Co, with sales of 479,989 units (up 4%) in the first seven months of the ongoing fiscal year, has a 20% share of the market. The TVS Jupiter is its lead sales driver followed by the NTorq. Last month, the company launched the new Jupiter 125 at Rs 73,400, hoping to make inroads into the expanding 125cc scooter market.

Suzuki Motorcycle India, in what is a sterling performance, sold all of 337,817 units, up a handsome 48%, its numbers increasing by 110,096 units from a year ago (April-October 2020: 227,721). Look at the data table below and this volume increase dwarfs both Honda and TVS’ combined 51,171 unit increase. Clearly, Suzuki is doing something right in a difficult market. This strong performance, not surprisingly, sees Suzuki increase its scooter market share by four percentage points to 14% and is the OEM which has made the maximum market share gains in the period under review. The Access 125 is the company's best-seller.

In the April-October 2021 period, the Access 125 clocked 49% YoY growth with sales of 282,000 units (April-October 2020: 189,222), which accounted for 83% of Suzuki's total sales in the first seven months of FY2022.

RELATED ARTICLES

Mahindra Farm Equipment Posts 46% Domestic Growth, Sells 38,484 Tractors in January 2026

Mahindra Farm Equipment reports 46% January tractor sales surge driven by strong rural demand and record Rabi sowing, wi...

SML Mahindra Records 30% Sales Growth in January 2026 Amid Broader Market Softness

SML Mahindra posts 30% January sales increase with balanced growth across cargo and passenger segments, bucking broader ...

Mahindra Auto Clocks 63,510 SUVs and 104,309 Total Vehicle Sales in January 2026

Mahindra & Mahindra reports 24% January sales growth with record SUV demand reaching 63,510 units, alongside strong comm...

16 Nov 2021

16 Nov 2021

13980 Views

13980 Views

Shahkar Abidi

Shahkar Abidi