SUV Share of PV Market Jumps to New High of 66% in CY2025

With record wholesales of 2.95 million units in CY2025, the share of utility vehicles in India’s passenger vehicle market has doubled from 33% in CY2019 to 66% in a year which saw five of the top six UV manufacturers achieve their best-ever sales.

If the passenger vehicle industry in India has achieved its best-ever annual wholesales of 4.48 million units in CY2025, up 5% YoY (CY2024: 4.27 million units), then the credit for the growth once again goes to the utility vehicle (UV) segment which comprise SUVs and MPVs. The UV sub-segment continues to be the shining star of the Indian PV industry, even as demand returned belatedly to the car segment (13,79,884, up 0.5% YoY) compared to CY2024 when sales were down 14 percent.

With record wholesales (factory dispatches) of 2.95 million units last year, improving upon Autocar Professional’s forecast of 2.80 million units, the UV segment grew 7.43% YoY on a high base (CY2024: 2.74 million units). This continuing strong performance has ensured that the UV share of the overall passenger vehicle market (cars, UVs and vans) has further risen in CY2025 to 66%, improving upon the 64% in CY2024 and 57% in CY2023.

Between CY2019 and CY2025, UVs have doubled their share of the PV market from 33% to 66%, which not only showcases the rapid consumer shift to UVs from hatchbacks and sedans but also how the UV segment has proved to be a bulwark against the sustained decline of the car market over the past few years.

Utility vehicle sales rose to a new high of 2.95 million units in CY2025, with their share of the passenger vehicle market doubling to 66% from 33% in CY2019.

Utility vehicle sales rose to a new high of 2.95 million units in CY2025, with their share of the passenger vehicle market doubling to 66% from 33% in CY2019.

Of the cars, vans and UV sub-segments in the overall PV segment, UVs is also the most competitive with every OEM worth its wheel fighting for a share and slice of the mega action, with the battle for supremacy highest in the compact SUV and midsize SUV categories. These two sub-segments are also where the Top 30 best-selling models reside.

The UV arena is a tough one, what with 32 SUV and MPV manufacturers (including 16 SIAM member OEMs with 75 models), nearly 130 individual models and over 1,000 variants. Buyers are really spoilt for choice which makes the performance of these best-selling models important in the overall scheme of things.

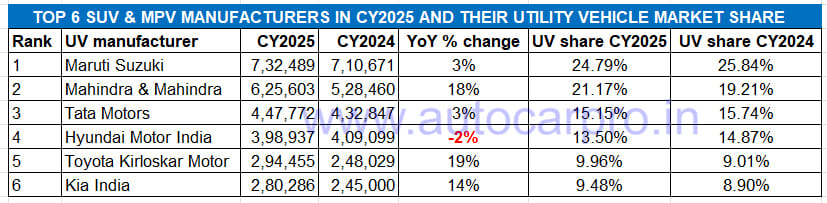

Maruti Suzuki Rules but Mahindra, Toyota & Kia Increase UV Market Share

Passenger vehicle market leader Maruti Suzuki continues to rule the UV market with its eight UVs (Brezza, Ertiga, Fronx, Grand Vitara, Invicto, Jimny, Victoris, XL6). In CY2025, the company registered its highest-ever annual UV sales of 732,489 units, up 3% YoY and an additional 21,818 units YoY. However, in a growing market with Mahindra, Toyota and Kia posting a higher level of growth, Maruti Suzuki’s UV share stands reduced to 24.79% versus 25.84% in CY2024.

A deep dive into the Top 30 UVs for CY2025 reveals that the company has six models in this listing. The Ertiga MPV is the company’s best-seller (192,004 units, up 1%, ranked No. 3 rank, down from No. 2 in CY2024). The Fronx compact SUV (179,894 units, up 15%, jumps three ranks to No. 4 in CY2025).

The Brezza compact SUV (175,310 units, down 7%) sees its India UV ranking drop to fifth from third a year ago and the Grand Vitara midsize SUV (104,209 units, down 15%) is ranked 11th, down three positions from No. 8 in CY2024. The recently launched Victoris midsize SUV (36,288 units, ranked No. 25) has sold more than the XL6 MPV (35,133 units, down 14%) with its UV ranking dropping to 25th position from No. 20 a year ago.

A hard-charging Mahindra & Mahindra, which registered its best-ever annual sales of 625,603 UVs in CY2025, selling 97,143 more units YoY, has seen its UV market share increase to 21% from 19% in a year. M&M has six SUVs in the Top 30 UV listing: Scorpio (176,988 units, up 6%, ranked No. 6), Thar Roxx and Thar (116,665 units, up 51%, jump to No. 8 from No. 16 in CY2024), Bolero (104,047 units, up 4%, maintains No. 12 ranking), XUV700 (80,704 units, down 11%, ranked No. 16, down from No. 13 in CY2024) and the two new BEVs (BE 6 and XEV 9e: 42,967 units, ranked No. 22).

Tata Motors, the No. 3 UV OEM, sold 447,772 SUVs in CY2025, up 3% YoY, a performance which sees its UV share reduce marginally to 15.15% from 15.74% a year ago. The company has four models in the Top 30 listing: Nexon (200,509 units, up 24%, ranked No. 2 in CY2025, up from No. 6 in CY2024), Punch (173,502 units, down 14%, down six ranks from No. 1 in CY2024 to UV No. 7 in CY2025), Curvv (27,531 units, up 16%) and Harrier (27,411 units, up 11%).

Hyundai Motor India is the sole OEM in the Top 6 to see a YoY sales decline. With factory dispatches of 398,937 SUVs, wholesales fell 2% (CY2024: 409,099 SUVs) due to which its UV market share has fallen from 15% to 13.50% in CY2025. While the Creta (201,122 units, up 8%) remains the best-selling model for the company and is the No. 1 UV in India in CY2025, demand for both the Venue (115,355 units, down 2%) and Exter (67,908 units, down 20%)

Fifth on the UV ladder-board, Toyota Kirloskar Motor sold a record 294,455 UVs in CY2025, up 19% YoY (CY2024: 248,029 units). This stellar show gives TKM a market share of 10% versus 9% a year ago. While the Innova MPV (111,957 units, up 5%) remains the best-selling product, it is the strong demand for the Hyryder midsize SUV (85,710 units, up 36%) which has given the company a new charge in the UV market. The Taisor compact SUV (36,268 units, up 59%) also saw sales growth.

Kia India, with 280,286 units, also scaled a new high for annual sales in CY2025 and saw its UV market share rise to 9.48% from 8.90% a year ago. The Sonet compact SUV (103,879 units, down 3%) clocked its second straight year of 100,000-plus sales. The Carens MPV, which saw the addition of new siblings Carens Clavis and the Carens Clavis EV, sold 77,173 units, up 21% YoY. The Seltos midsize SUV, however, saw a 3% decline at 71,20 units. The Syros compact SUV, launched in January 2025, sold 26,058 units.

With a record 1.43 million units (14,33,888 units) sold in CY2025 and a 48% share of the record 2.95 million UVs, the compact SUV segment remains the largest sub-segment but growth has slowed down to 5% last year. There’s growing demand for midsize SUVs which are set to come into their own in CY2026. From the return of the Renault Duster to the Maruti e-Vitara and the Tata Sierra, this year promises to be an exciting one for the utility vehicle market.

RELATED ARTICLES

Top 10 MPVs in First 10 Months of FY2026: Maruti Ertiga to Kia Carnival

Demand for multi-purpose vehicles remains strong, with their share of UV sales rising to 17% in FY2027 from 11% in FY202...

Skoda Slavia and VW Virtus Sales Cross 150,000 Units, Virtus First to Cross 75,000 Units

Skoda Volkswagen India’s two MQB-A0-IN–based sedans have reached a new milestone, with the Slavia at 73,378 units and th...

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

By Ajit Dalvi

By Ajit Dalvi

13 Jan 2026

13 Jan 2026

3854 Views

3854 Views

Autocar Professional Bureau

Autocar Professional Bureau