Strong export growth buffers domestic market decline for PV, 2W and 3W OEMs

Growing demand for made-in-India vehicle on two-, three- and four-wheels spells good news for an industry hit by downturn in the domestic market.

It’s been a difficult year for India Auto Inc, faced as it is with multiple challenges – be it the ongoing chip shortage, rising commodity prices, high fuel prices and resultant lacklustre consumer demand. Captains of industry were hopeful that November with Diwali would bring in the sales but their hopes were belied. Apex industry body SIAM released wholesales numbers for November and April-November and there’s ample red ink splattered across all vehicle segments.

Passenger vehicle sales are down 19% YoY (215,626 units), two-wheelers down by 34% (10,50,616 units) and three-wheelers also down by 7% (22,471 units). Combined, these three segments are down 32% in November but worryingly month-on-month growth is also down, by 28%. All these numbers depict the domestic market story.

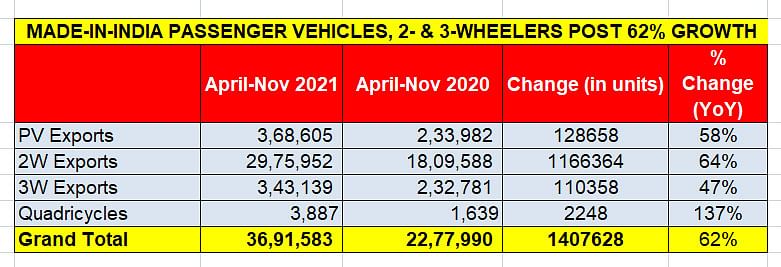

India automobile exports up 62% in April-November 2021

The export story is vastly different and as the April-November 2021 export statistics reveal, the PV, two- and three-wheeler segments are firing on all cylinders.

Look at the segment-wise data table above and it’s amply clear that there’s reason for cheer for Made-in-India products when it comes to shipping them overseas. Total export sales of 36,91,583 units are a strong 62% YoY growth. Importantly, each segment has delivered in spades. PVs at 368,605 units are up 58%, two-wheelers with nearly 3 million units have notched 64% growth and three-wheelers, with 343,139 units, are up 47 percent. And Bajaj Auto’s quadricycles too are contributing their bit with 137% growth. Let’s take a closer look segment-wise.

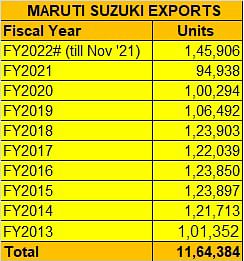

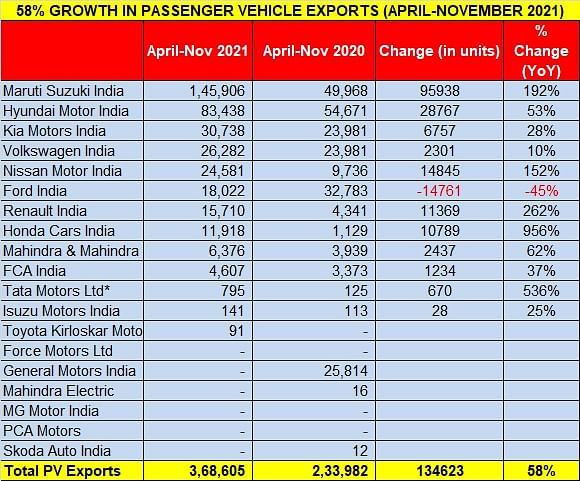

Maruti Suzuki takes big lead, records best exports yet

Eight months into the fiscal year, Maruti Suzuki India has firmed up its grip on the export market. With despatches of 145,906 units, it has posted 192% YoY growth and accounts for 40% of total PV exports. In the process, and with four months of the fiscal year still left, the carmaker has already recorded its best annual exports – see data table below

What’s remarkable about this performance is that despite witnessing tough times in the domestic market, mainly due to shortage of electronic components and chips, the carmaker has focused on delivering overseas shipments, catering to demand.

Expect the Baleno, S-Presso, Dzire, Swift, Vitara Brezza and Jimny to be top six models for the carmaker on the export demand front.

FY2021 export market leader Hyundai Motor India, at this stage, is considerably behind Maruti. While it has 83,438 export units to its credit (up 53%), it looks difficult for Hyundai to catch up with Maruti Suzuki which has set a strong pace this year. The gap between the two OEMs is 62,468 units. Key contributors to Hyundai sales were the Creta (19,840), Verna (19,301) and Venue (4,903). The new Alcazar is also begun to be exported (1,672).

Hyundai Motor India, which wrested the No. 1 made-in-India passenger vehicle (PV) exporter title from Ford India in FY2020, and also took the title in FY2021, will have to export plenty more if it is to retain the No. 1 PV exporter title in FY2022.

Kia India, with 30,738 units and 28% YoY growth, is at No. 3 position, which it gets thanks to the Seltos (19,500) and the Sonet (11,238), However, YoY demand for the Seltos is down 13% (April-November 2020: 22,495) while that for the Sonet has jumped 656% (April-November 2020: 1,486) albeit on a low year-ago base.

Fourth-placed Volkswagen India shipped 26,282 units, up 10%, with the main models comprising the Vento (18,987) sedan and Polo (7,295) hatchback. Nissan Motor India is a strong fifth with 24,581 units and 152% YoY growth with the export only Sunny sedan selling 18,044 units and recording 147% YoY growth (April-November 2020: 7,299)

Ford India, which has pulled out of the domestic India market but is continuing export operations, despatched 18,022 vehicles from Chennai Port. Its main export product was, as always the EcoSport SUV with 15,382 units, down 35% YoY. It is the sole OEM to be in negative territory.

Renault India (15,710 units / 262%) and Honda Cars India (11,918 units) have both posted strong exports.

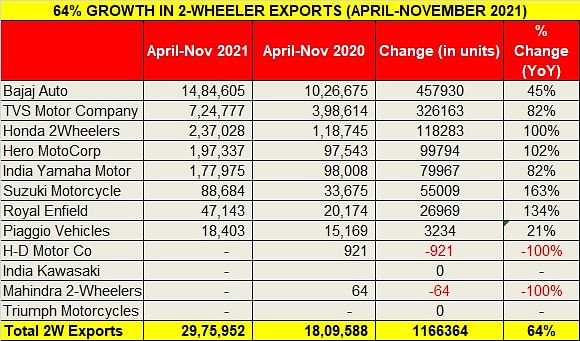

Bajaj the big boss of two-wheeler exports

The two-wheeler industry, which is witnessing slackened demand in the domestic market particularly for entry level products, is firing on all cylinders in the export market. Its performance in April-November is indicative of that – 29,75,952 units, up 64% YoY (April-November 2020: 18,09,58).

Bajaj Auto, which has always being strong on export, maintains its firm grip with shipments of 14,84,605 units (up 45%) and accounting for 50% of total two-wheeler exports.

TVS Motor Co, India’s No. 2 exporter, registered a robust performance with 724,777 units (up 82%) and accounts for 24.35% of total exports. Bajaj Auto and TVS together command nearly 75% of India’s overall two-wheeler exports.

The big positive for the Indian two-wheeler industry is that export demand is driven across all the key players. While Honda Motorcycle & Scooter India (HMSI), which exported 237,028 units, has doubled its export performance, Hero MotoCorp despatched 197,337 units, posting 102% YoY growth. The export sales table below depicts the growth story, which can only get better.

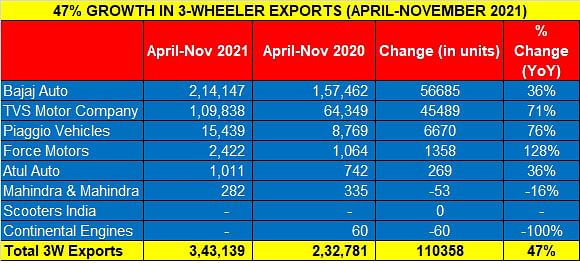

Bajaj and TVS also power three-wheeler exports

The three-wheeler industry is also making the best of the export demand coming its way. With total shipments of 343,139 units in the first eight months of FY2022, growth has been a solid 47% year on year.

The top two players in this segment are the same as in the two-wheeler segment: Bajaj Auto and TVS Motor Co. While Bajaj Auto with 214,147 units (up 36%) accounts for 62% of total exports, TVS with 109,838 units (up 71%) accounts for 32% of the export market share. Together, they make up 94% of the three-wheeler exports. At No. 3 is Piaggio Vehicles with 15,439 units (up 76%) has a 4.49% market share.

Growth outlook

With four months still to go for FY2022 to end, the cumulative made-in-India export story can on ly get better. PV exports are set to cross FY2021’s 404,400 units albeit they will be much below FY2020’s 662,118 units. Likewise, two-wheeler exports, currently at 29,75,952 units, will easily surpass FY2021’s 32,77,724 units and even get close to FY2020’s 35,19,405 units. Three-wheelers – 343,139 in April-November 2021 – are within reach of FY2021’s 392,941 units but a long way away from FY2020’s 501,651 units, a year which was pre-Covid.

All said and done, the export mantra per se remains a winner: not only is it a high-margin revenue earner but it keeps the manufacturing plant buzzing even in difficult times in the domestic market.

RELATED ARTICLES

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

The 200cc Motorcycle: India’s Quiet Premiumisation Story

While the motorcycle market’s attention remains on 110cc volumes and the 350cc Royal Enfield phenomenon, a quiet revolut...

100,000 and Holding: Electric Scooters Cross a Threshold

India’s electric two-wheeler market has achieved a landmark, with monthly wholesale volumes now consistently exceeding 1...

12 Dec 2021

12 Dec 2021

10668 Views

10668 Views

Ajit Dalvi

Ajit Dalvi

Arunima Pal

Arunima Pal