Rural market demand drives two-wheeler sales in July

What augurs well for OEMs is that despite the 10-15% price increase in products due to the shift to BS VI, consumers are going ahead with their purchase decisions.

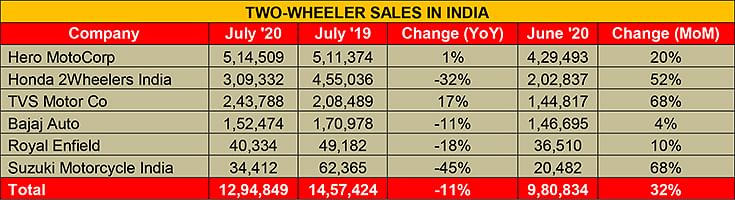

Like the passenger vehicle market, the two-wheeler segment too is seeing an uptick in sales which essentially is good news for the industry. Of the five OEMs which announced their July 2020 sales numbers, the marked month-on-month growth is proof enough that better days lie ahead for the two-wheeler industry, the most affordable form of motorised transport in the country. Dealer body FADA too has pinned its hope on an industry revival led by rural market demand.

What augurs well for OEMs is that despite the 10-15% price increase in products due to the shift to BS VI, consumers are going ahead with their purchase decisions. Importantly, it is understood that the first wave of demand is coming from rural India, which is riding on a good monsoon which has set all over the country.

Look at the month-on-month sales growth (see table below) and it’s amply clear that demand is back. This six-OEM lot has registered total sales of 12,94,849 units in July 2020, up a sizeable 32% over June 2020’s 980,834 units.

Let’s take a closer look at the OEM performance.

Hero MotoCorp: 514,504 units (1%)

Industry leader Hero MotoCorp sold a total of 514,509 units of motorcycles and scooters in July 2020, which is a marginal 1% growth (July 2019: 511,374). This is quite a performance in a market environment that continues to be volatile.

Despite the prevailing economic slowdown on account of the Covid-19 pandemic, the company registered 20% growth over the previous month (June 2020: 429,493) and reached more than 95% of wholesale despatch numbers of the corresponding month in the previous year (July 2019).

The company says its July volumes were driven by strong retail sales due to the positive market demand. While there is cautious optimism on the demand trajectory going forward, sales continue to be impacted by the micro-lockdowns in several parts of the country. For the growth momentum to continue, it is imperative for state and local authorities to provide a stable and consistent business environment as the situation evolves.

Honda Motorcycle & Scooter India: 309,332 units (-32%)

Honda Motorcycle & Scooter India's total domestic market despatches in July stood at 309,332 units, which is a 53% increase over June 2020’s despatches 202,837 units. However, compared to the year-ago sales performance (July 2019: 455,036), July 2020 numbers are a sizeable 32% down.

Yadvinder Singh Guleria, Director – Sales & Marketing, Honda Motorcycle & Scooter India said, “Meeting market demand with safety and increased efficiency, Honda’s sales momentum continues to accelerate in the three months since resuming operations – jumping 400 percent from 54,000 in May to 200,000 units in June, and now breaching the 300,000 mark. Intermittent regional lockdowns across India slowed down the retail momentum gained in June as the percentage of operational networks dropped to 80 percent in July. With India moving to Unlock 3.0, we are cautiously optimistic of the demand. While the physical inventory level at our dealerships is less than a month’s sales, giving us confidence is the growth in new enquiries on back of increasing acceptability of Honda’s newly launched BS-VI models with advanced technology & features.”

HMSI clearly is targeting rural India for sales because in June and July, it has launched two commuter motorcycles – the 2020 CD Dream 110 at Rs 62,729 and the Livo 110 at Rs 69,442.

TVS Motor Co: 243,788 units (17%)

TVS Motor Company reported despatches of 243,788 units in July 2020 as against 208,489 units in July 2019, which is a 17% YoY increase. Importantly, it is a 68% month-on-month increase over June 2020’s sales of 144,817 units. On July 23, the company launched its BS VI Zest 110 with ET-Fi technology priced at Rs 58,460.

TVS Motor says it resumed its operations from second week of May 2020 in a graded manner across all its factories in Hosur, Mysuru, and Nalagarh. During Q1 FY2021, the company sold around 255,000 two-wheelers (including exports) as against sales of 884,000 units reported in the quarter ended June 2019. This includes 119,000 motorcycles (Q1 FY2020: 417,000 units) and around 82,000 scooters (Q1 FY2020: 295,000 scooters). Total exports were 81,000 units compared to 209,000 units a year ago.

Bajaj Auto: 152,474 units (-11%)

Pune-based Bajaj Auto has reported sales of a total of 152,474 motorcycles in the domestic market, down 10.82% YoY (July 2019: 170,978 units). However, seen month on month, this is an improvement because in June 2020, the company sales had gone down by 26 percent to 146,695 units (June 2019: 199,340 units).

Even on the year-to-date front, Bajaj Auto has reported improving numbers. In the April-July 2020 period, the sales of 338,455 units are down 57% on year-ago sales of 781,914 units. The rate of decline is slowing when compared to the three-month April-June 2020 period, where domestic sales went down by 70 percent to 1,85,981 units (April-June 2019: 6,10,936 units).

This performance resonates with what Rakesh Sharma, Executive Director, Bajaj Auto, told Autocar Professional in early June: "We've lost two months of sale, but who is to say that two months of sale can’t come back and get recovered in the balance 10 months? That likelihood is there but a lot depends on whether society will be comfortable living with this pandemic or not. We also need to understand this point that it is not that the industry was in a very good shape before Covid-19.

The economic scenario, the burden of the regulation (BS VI, ABS, insurance) on the industry, and the additional costs were weighing heavy. Even before Covid, we were all preparing for a very tough financial year 2021. If there are stimulus packages, they will hopefully also address not just the Covid-related issues, but some of the general economic issues facing the consumer and the industry."

Royal Enfield: 40,334 units (-18%)

Royal Enfield posted sales of 40,334 motorcycles in July 2020, against the sales of 49,182 units a year ago, down 18 percent. End-July saw the Chennai-based OEM launch ‘Service on Wheels’, a new, customer-friendly initiative, aimed at safe, seamless and hassle-free motorcycle service experience to customers at their doorstep. Under this initiative, Royal Enfield has deployed 800 units of purpose-built Royal Enfield motorcycles across the dealerships in the country.

Suzuki Motorcycle India: 34,412 units (-45%)

Suzuki Motorcycle India sold 31,421 units in July 2020, which is a marked decline of 45% over July 2019’s 62,365 units but a near-70% improvement over June 2020 sales. The company is now gearing up for better performance. “With the unlock phase, the automobile industry is now marching towards normalcy in terms of production, distribution and sales while continuing to adhere to all the precautionary measures. From August 2020, we will try our best to achieve pre-Covid-19 production and sales volume,” said Koichiro Hirao, managing director at Suzuki Motorcycle India.

While it is early days yet for India Auto Inc and the two-wheeler industry to confirm that they are firmly in growth mode, the two-wheeler industry will be the first to register gains as and when the economy sees an uptick. Rural India is already showing the way with growing demand for tractors and commuter motorcycles.

RELATED ARTICLES

Mahindra Farm Equipment Posts 46% Domestic Growth, Sells 38,484 Tractors in January 2026

Mahindra Farm Equipment reports 46% January tractor sales surge driven by strong rural demand and record Rabi sowing, wi...

SML Mahindra Records 30% Sales Growth in January 2026 Amid Broader Market Softness

SML Mahindra posts 30% January sales increase with balanced growth across cargo and passenger segments, bucking broader ...

Mahindra Auto Clocks 63,510 SUVs and 104,309 Total Vehicle Sales in January 2026

Mahindra & Mahindra reports 24% January sales growth with record SUV demand reaching 63,510 units, alongside strong comm...

02 Aug 2020

02 Aug 2020

19675 Views

19675 Views

Shahkar Abidi

Shahkar Abidi