Record Navratri retail sales power October to best month in first seven months of FY2024

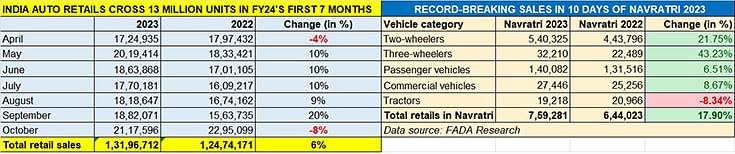

Best-ever Navratri tally of 759,281 units in 10 days help buck the tepid demand in the first fortnight of October, which at 2.11 million units turns out to be the best month in current fiscal year; all vehicle segments log month-on-month growth; April-October 2023 sales at 13 million units are up 6% YoY.

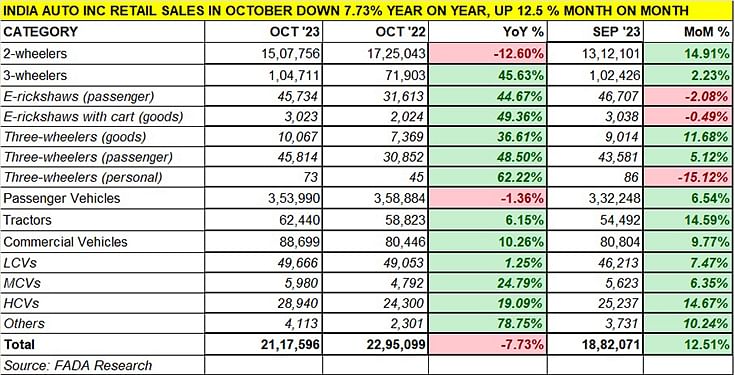

The Federation of Automobile Dealers Associations of India (FADA) has released retail sales data for October 2023. At a combined five sub-segment (two- and three-wheelers, passenger and commercial vehicles, and tractors) total of 21,17,596 units, October numbers are down 7.73% (October 2022: 22,95,099) but are 12.51% up on September 2023’s 18,82,071 units and also the best monthly retail sales in the first seven months of the ongoing fiscal year (see data table below).

Last month’s sales would easily have been much higher but for the fact that that the first half of October 2023 was marked by the Shraddh period, when new purchases are typically deferred across India. Which is why the second half of October, with the 10-day Navratri period (October 15-24) in it, saw demand surge across all segments.

Record-breaking cumulative Navratri 2023 sales of 759,281 units were up 18% of 2022 and also surpassed the previous best Navratri sales of 2017. All segments other than tractors saw growth (see data table below).

Two-wheelers, three-wheelers, passenger vehicles and commercial vehicles grew by 22%, 43%, 6.5% and 9% respectively, while tractors witnessed an 8% decline.

Commenting on last month’s numbers, FADA president Manish Raj Singhania said: "The month commenced under the shadow of the inauspicious Shraddh period, persisting until the 14th. Consequently, a YoY comparison may not accurately reflect the actual trajectory of growth in the Indian auto retail sector. When compared month on month, auto retails flourished, achieving a 13% increase, with contributions from all categories.”

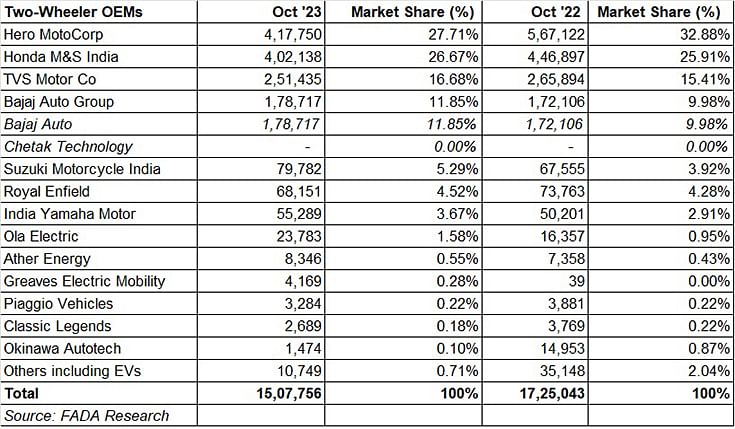

TWO-WHEELER RETAILS: 15,07,756 UNITS, down 12.60 YoY, up 15% MoM

The largest of the five segments saw 15% MoM growth over September, which is indicative of forward movement in the sector. Buoyed by festive cheer and stronger demand from rural India, which is a key driver of mass-market commuter bike sales, this vehicle category benefited from enhanced availability of models and plenty of financial schemes from OEMs.

Given the 42-day festive season in October and November, most motorcycle and scooter manufacturers ensured that their dealers were well stocked with the in-demand models even as a number of new models were launched in the preceding months. According to the FADA president, another growth-enhancing factor is of States going into elections, which has injected optimism into the market, leading to an increase in government spending and improved liquidity.

A quick look at the FADA data analytics for October reveals that market leader Hero MotoCorp and arch rival Honda Motorcycle & Scooter India are separated by only 15,612 units. Both OEMs have retailed over 400,000 units each, which reflects their market strength. While Hero MotoCorp gave its sales a boost with low interest rates of 6.99% and the ‘Buy Now, Pay in 2024’ campaign, HMSI has packed a new product punch with over 10 bikes and scooters launched in the past 45 days. While Hero has ceded market share YoY – currently 27.71% share, down from 33% a year ago – HMSI has 26.67%, up from the 26% in October 2022.

TVS Motor Co, with 251,435 units, has increased its market share to 16.68% as has Bajaj Auto, which now has a share of 12% compared to 10% a year ago. Suzuki Motorcycle India, Royal Enfield and India Yamaha Motor have each seen steady growth. And in sync with the growing demand for EVs, Ola Electric, Ather Energy and Greaves Electric Mobility have also made gains. TVS too has substantially benefited with demand rising for its iQube e-scooter.

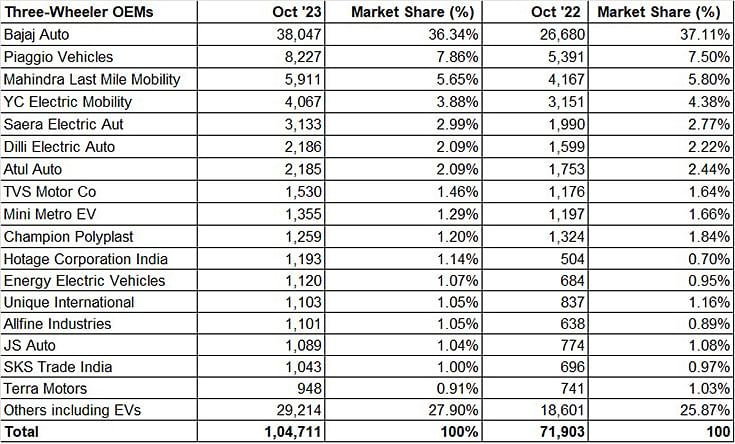

RISING DEMAND FOR ELECTRIC HELPS 3-WHEELER RETAILS CROSS 100,000 UNITS FOR SECOND STRAIGHT MONTH

Along with the SUV segment, the other real growth story at India Auto Inc is that of three-wheelers. At 104,711 units, three-wheeler retails have gone past the 100,000-unit mark for the second month on the trot, after September’s 102,426 units. August retails, at 99,907 units, had missed the big number by a whisker – just 93 units.

Electric three-wheelers, along with their two-wheeled brethren, are the low-hanging fruit of the EV industry and, at 48,757 units in October 2023, were up 45% YoY. In October, they had a 47% share of the total three-wheeler market. This e-three-wheeler sub-segment, which sells passenger-transporting e-rickshaws and cargo-carrying three-wheelers, continues to witness strong double-digit growth thanks to sustained demand for passenger transportation and from last-mile operators for e-commerce applications, food deliveries and other applications.

According to FADA president Manish Raj Singhania, “The three-wheeler segment continued the uptick in demand during Navratri, largely driven by competitive finance options and a significant rise in e-rickshaw interest, signalling a healthy move towards electrification.

Market leader Bajaj Auto, which sold 38,047 units including its recently launched electric model, now has a 35% share – 35,639 units, up by a strong 43% YoY. Piaggio Vehicles sold 8,227 units, up 53% YoY, bettering its September total of 7,550 units and improves its market share to 8%. Mahindra Last Mile Mobility is in third position with 5,911 units and a 5.65% market share.

MARUTI AND HYUNDAI MAINTAIN PV MARKET SHARE, SUVs POWER MAHINDRA TO 10% SHARE, TKM TO 5%

The passenger vehicle (PV) segment, thanks for the unabating demand for SUVs, crossed the 350,000-unit sales mark for the 10th month in a row. While overall sales of 353,990 units are down marginally by 1.36% YoY mainly due to the tepid sales in the first fortnight of October 2023, the month-on-month growth is 6.54% (September 2023: 332,248 units).

The top 6 OEMs, which account for 319,068 units or 90% of total PV retails in India last month. Maruti Suzuki India (145,047 units) improved upon its September sales of 139,640 units as did and Hyundai Motor India (50,713 units) versus September 2023’s 49,625 units. Third-placed Tata Motors, which has updated and launched its best-selling model, the Nexon and Nexon.ev, sold 48,858 units, up 25% over September 2023’s 38,984 units. Meanwhile, Mahindra & Mahindra, riding on the surging demand for its SUVs (32,989 units), sees its PV market share increase to 10% from 9.25% a year ago. Toyota Kirloskar Motor is another outlier – its 18,195-unit sales in October 2023 are up 1.31% on September’s 17,959 units and a strong 29% up on year-ago 18,195 units. This sees TKM’s PV market share rise to 5.14% from 3.14% a year ago. TKM is among the few players which is also seeing demand for its non-SUV models like the Glanza.

In his comments on the PV sector, FADA president Manish Raj Singhania said: “The PV category experienced a stimulating resurgence as the market enjoyed improved vehicle availability and an influx of new and refreshed models from various OEMs. This uplift was supported by enhanced supplies and an increasing variety in the product portfolio, answering to a diversifying consumer demand. The market showed consistent demand for luxury cars and SUVs, signifying a robust consumer appetite for premium segments. The segment also witnessed the benefit of good pending bookings and the launch of promising products, laying the groundwork for potential growth in the upcoming festive season."

He added, “Throughout the month, the anticipation for Diwali in November and the launch of new models generated a steady demand. The period overall saw a resilient PV market, supported by a stronger product line-up unlike last year, when stock availability was a major issue."

However, Singhania has issued a cautionary note for the PV segment. He said: “With passenger vehicle inventory levels soaring to an all-time high of 63-66 days, dealerships are signalling capacity concerns. FADA has issued a red flag, urging OEMs to not only moderate vehicle dispatches but also to introduce more aggressive and attractive schemes promptly. This dual approach is essential to help dealers clear their inventory before year-end, averting the potential financial repercussions associated with excess unsold stock.”

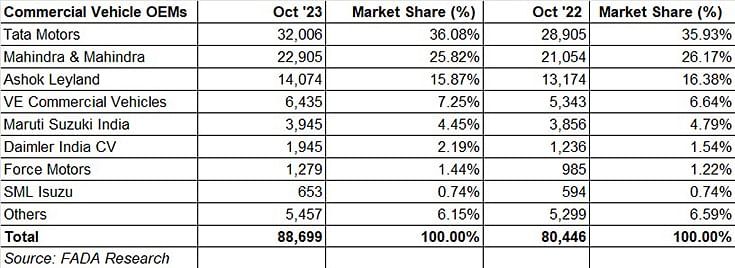

COMMERCIAL VEHICLE SALES UP 10%, DEMAND GROWS FOR LCVs, M&HCVs

The retail sales growth story for the critical commercial vehicle sector is growing better with every passing month. October 2023’s 88,699 units are up 10% both YoY and MoM and importantly the growth is democratised across all three sub-segments – light CVs, medium CVs and heavy CVs. What’s not to like?

LCVs, with 49,666 units, have a 56% share of the overall CV market, followed by HCVs (32% share) and MCVs (6.74% share). The CV sector is benefiting from the growing need for transportation of coal, cement and general market load, even as the passenger carrier segment (buses) is also witnessing an uptick in demand. This positive trend can be attributed to the adequate deployment of funds from the Central government towards infrastructure development, which fostered an environment for bulk deals, especially in tippers and government sectors.

In its commentary on the sector, FADA states: “The CV segment experienced robust bookings and a positive uptake in retail sales, buoyed by festive cheer and strategic price support from manufacturers. The demand for light and small commercial vehicles surged, driven by infrastructure development activities and the need for vehicle replacement. Healthy demand was witnessed especially in segments like cement, iron ore and coal transport. The festive seasons, including Navratri, catalysed market activity, with customers taking advantage of favourable finance schemes.”

NEAR-TERM OUTLOOK: FINGERS FIRMLY CROSSED

FADA’s near-term growth outlook, which was ‘optimistic’ in September is somewhat tempered after the October retail sales. “The near-term outlook for the auto sector is a blend of highs and lows as we approach year-end. Festivities along with harvest season (especially paddy) are expected to boost two-wheeler sales (average inventory between 40-45 days), with optimism fuelled by new schemes and a push towards electrification, despite supply concerns. CVs are looking at a strong November, with festive and construction activities enhancing demand, alongside anticipated financial schemes.

“However, the PV segment is navigating through a tricky phase. Festive days might spike bookings, yet the shadow of year-end discounts looms over immediate sales. High inventory levels in PVs, at a critical 63-66 days’ range, demand urgent attention from OEMs. Without substantial interventions and if Diwali sales don't rise to the occasion, the weight of unsold stock could lead to significant dealer distress, echoing FADA's concerns for potential industry-wide repercussions. Immediate and decisive action is imperative to counter the risk of a financial squeeze as the year closes.”

RELATED ARTICLES

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

The 200cc Motorcycle: India’s Quiet Premiumisation Story

While the motorcycle market’s attention remains on 110cc volumes and the 350cc Royal Enfield phenomenon, a quiet revolut...

100,000 and Holding: Electric Scooters Cross a Threshold

India’s electric two-wheeler market has achieved a landmark, with monthly wholesale volumes now consistently exceeding 1...

06 Nov 2023

06 Nov 2023

5952 Views

5952 Views

Ajit Dalvi

Ajit Dalvi

Arunima Pal

Arunima Pal