Record-breaking year for tractor sales at 894,112 units, Mahindra share rises to 42%

Latest FADA retail sales figures that tractor makers missed achieving the 900,000 milestone by just 5,888 units. While YoY growth was tepid at 2.5%, Mahindra & Mahindra and International Tractors led the field and registered an increase in their market share.

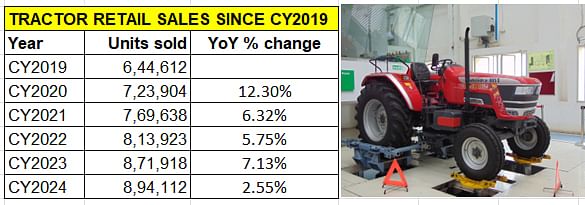

The Indian tractor industry had its best year for retail sales in 2024 as 894,112 units were sold, according to new figures from apex dealer body, the Federation of Automobile Dealers Associations (FADA). However, this translates into nominal 2.55% year-on-year growth (CY2023: 871,918 units) nd an additional 22,194 units. In CY203, OEMs had sold an additional 57,955 units and posted 7.13% YoY growth.

A quick compilation of the past six years’ tractors retails reveals that 4.71 million units have been sold in India with the industry recording consistent growth (see data table below). Sales crossed the 800,000 milestone for the first time in CY2022 (813,923 units), rose to 871,918 units in CY2023 and have not scaled a new high in CY2024 (894,112 units).

Tractor makers notched their best-ever sales in CY2024 but missed achieving the 900,000 milestone in CY2024 by a whisker: just 5,888 units.

Tractor makers notched their best-ever sales in CY2024 but missed achieving the 900,000 milestone in CY2024 by a whisker: just 5,888 units.

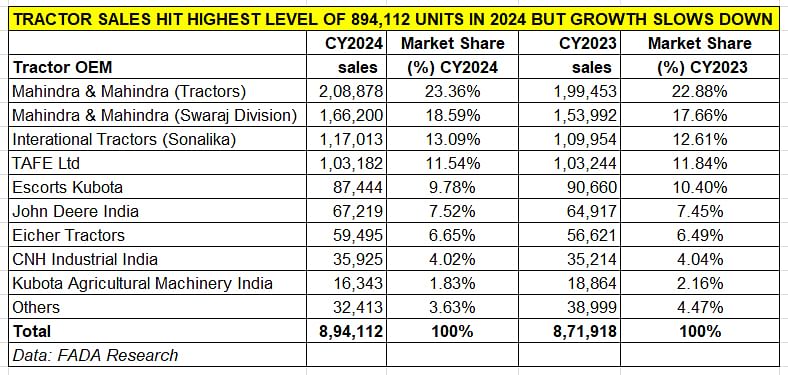

FADA’s OEM-wise sales split of the industry shows that market leader Mahindra & Mahindra (Tractor Division and Swaraj Tractors) have further increased their grip on the tractor market. With combined sales of 375,078 units in CY2024, the YoY increase was 6.12% (CY2023: 353,445 units). This gives M&M Tractors a market share of 42%, up from the 40.5% it had in CY2023.

International Tractors, the manufacturer of the Sonalika brand of farming machinery, sold 117,013 units in the domestic market, which constitutes a 6.41% increase YoY (CY2023: 109,954 units). This performance sees its market share increase marginally to 13.09% from 12.61% a year ago.

The Chennai-based Tractors & Farm Equipment Ltd (TAFE), which sells four brands of tractors – Massey Ferguson, TAFE, Eicher Tractors, and IMT – witnessed flat sales in CY2024 – the 103,182 units were down 0.6% on CY2023’s 103,254 as a result of selling 72 fewer units. This has resulted in its market share reducing to 11.54% from 11.84% in CY2023.

Escorts Kubota is ranked fourth with annual sales of 87,444 units, down 3.54% YoY (CY2023: 90,660 units). As a result of fewer YoY sales in CY2024, its market share has also dropped to 9.78% from 10.40% in CY2023.

John Deere India has had a good year with sales of 67,219 units, up 3.54%, which is reflected in its market share rising to 7.52% from 7.45% a year ago.

Eicher Tractors too did well with sales of 56,621 units last year, up 5% on CY2023’s 56,621 units, its market share improving to 6.65 percent.

CNH Industrial India clocked a 2% YoY increase with sale of 35,925 units, 711 additional tractors than CY2023’s 35,214 units.

Industry poised to farm significant growth in CY2025

Having closed CY2024 with a strong performance in December (99,292 units, up 25.7% YoY), the Indian tractor industry has entered CY2025 on a bullish note. According to Hemant Sikka, President – Farm Equipment Sector, Mahindra & Mahindra, “Sentiments have remained positive in December on account of positive cash flow momentum from the kharif harvest. Additionally, favourable reservoir levels have resulted in strong sowing for the rabi season, further bolstering demand for tractors. Looking ahead, the tractor industry is poised for significant growth, underpinned by positive agricultural sentiments and favourable terms of trade for farmers.”

FADA too is optimistic about growth this year and states that dealers across vehicle categories sense a resurgence in market confidence, fuelled by improved rural liquidity, evolving government policies and a wave of new product launches. Despite financing headwinds and heightened competition, many retailers believe that focused marketing strategies, robust supply chains and better alignment with customer preferences will create a foundation for sustained expansion.

ALSO READ: Auto retails in CY2024 rise 9% to 26 million, highest-ever sales for cars, 3Ws, tractors

RELATED ARTICLES

Maruti Jimny Crosses 150,000 Sales Since Launch, 80% Comprise Exports

Launched in June 2023, the Maruti Jimny five-door SUV has sold 158,678 units till January 2026, with exports (127,442 un...

Kia India Drives Towards Highest-Ever Sales in FY2026

Kia India has sold 259,923 vehicles in the first 11 months of FY2026, just 9,306 units short of its all-time high of 269...

Bajaj Auto Outsells Mahindra in e-3Ws for Second Month in a Row, TVS Ranked Third in February

Bajaj Auto, after overtaking Mahindra Last Mile Mobility for the first time in January, repeated the feat in February wi...

09 Jan 2025

09 Jan 2025

30775 Views

30775 Views

Ajit Dalvi

Ajit Dalvi

Autocar Professional Bureau

Autocar Professional Bureau