Maruti, Tata and Honda pump up PV volume in May 2018

While key vehicle manufacturers have posted strong numbers for the month, rising fuel prices could prove to be a sales speedbreaker in the near future.

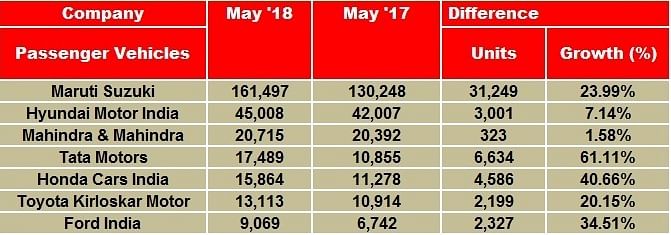

Key passenger vehicle (PV) manufacturers in India have announced their sales results for the second month of FY2019, and from the looks of it, the PV industry could very well be seen accelerating hard in the fast lane. While most companies have posted strong year-on-year growth, what remains as a serious speedbreaker to future growth is the consistently rising price of petrol and diesel, which is showing no signs of any significant respite.

Local prices of fuel, which have been soaring over the last few months, first hit a 55-month high of Rs 81.92 a litre for petrol and Rs 69.50 for diesel in Mumbai on April 19. The prices have been ascending ever since, with the next rise coming up barely within a week on April 24, taking the prices of a litre of petrol in Mumbai to Rs 82.48 and subsequently to a new high of Rs 86.24 on May 29. With no coping mechanism seemingly working in favour of the vehicle-using population, the industry’s momentum could see a setback if the trend of surging fuel prices continues.

Adding fuel to fire could also be the concept of shared mobility, which today accords wide acceptance in urban conditions and is already leading to a drop in second and third vehicle ownerships in Tier 1 households. Here's taking a look at how individual PV makers have fared in May 2018.

Maruti Suzuki India: India's No. 1 carmaker registered total sales of 161,497 units, posting notable growth of 24 percent on a year-on-year basis (May 2017: 130,248). While it had put out its best-ever performance two months ago, selling 164,434 units in April 2018 (+13.40%), with growth being majorly consistent, Maruti Suzuki looks well poised today to achieve its target of reaching 2 million annual sales by 2020.

Maruti’s growth could primarily be attributed to its range of compact cars, which includes the Swift, Baleno, Dzire, Celerio and the Ignis. These five cars collectively went home to 77,263 buyers, registering a remarkable growth of 50.8 percent (May 2017: 51,234). Of these, however, the Swift and the Dzire remain the top grossers with the hatchback and the compact sedan siblings in their latest third-generation avatar having become hot customer favourites in their respective segments.

Its UV sales, coming on the back of Gypsy, Ertiga, the Vitara Brezza and the S-Cross too posted strong results, with overall sales clocking 25,629 units and growing by 13.4 percent (May 2017: 22,608). The Vitara Brezza compact SUV, which has been leading the charge of driving the company's growth in the UV segment has also been recently updated by Maruti, giving it a breath of fresh air with a new Orange paint scheme, blackened alloy wheels, and the option of an Automated Manual Transmission (AMT) as well in its mid- and top-spec trims.

Hyundai Motor India: The No 2 player by sales volumes, Hyundai Motor India sold 45,008 units in May, growing by 7.14 percent (May 2017: 42,007). The Korean carmaker has been seeing consistent demand for its i20 hatchback and the Creta SUV, both of which now stand all refreshed and updated to tackle the rising competition in their respective segments.

While the Creta surpassed cumulative sales of 250,000 units in the domestic market since its launch in March 2015, the company has introduced its updated avatar, throwing in even more features, including a sunroof, wireless phone charging, electronically adjustable driver’s seat, LED DRLs, as well as two new paint shades on the outside.

Mahindra & Mahindra: The performance of UV specialist, Mahindra & Mahindra (M&M) remained near-flat in the month, with overall PV sales notching 20,715 units, up 2 percent compared to the 20,392 units sold in May 2017. While sales of its passenger cars registered a strong growth of 34 percent with 1,420 units going home to buyers (May 2017: 1,061), its UV sales remained flat at 19,295 units (May 2017: 19,331).

According to Rajan Wadhera, president, Automotive Sector, M&M, “May has relatively been a subdued month compared to April. At Mahindra, we have by and large maintained our growth momentum during the month of May 2018, especially in commercial vehicles. On the back of a buoyant economy, our M&HCV division continues to outperform. Exports have also been strong with a high growth. With the forecast of an upcoming normal monsoon we are confident of good growth in the coming months”.

Tata Motors: This company is going places. Tata Motors has registered sales of 17,489 units in May 2018, a substantial increment of 61 percent over the year ago sales of 10,855 units.

While Tata Motors saw continued demand for the Tiago hatchback and the Tigor compact sedan siblings, with cumulative sales of its passenger cars clocking 11,516 units and growing by 18 percent, UVs, on the other hand, brought in a substantial growth of 463 percent, with overall sales ticking at 5,973 units, primarily being driven by the Nexon and the Hexa. The company also recently introduced the option of an AMT in both the diesel as well as the petrol versions of the Nexon crossover, targeting the younger buyer in urban cities.

Honda Cars India: After a slump in sales in April, Honda Cars India has come back hard to post robust sales in May, selling 15,864 units, and growing a remarkable 41 percent (May 2017: 11,278).The main factor for this significant recovery is the commencement of dispatches of the new second-generation Honda Amaze, which was launched on May 16 and sold 9,789 units in the month, the highest number any model has ever been able to individually clock in the Japanese carmaker’s portfolio.

According to Rajesh Goel, senior VP and director, Sales and Marketing, Honda Cars India, “We are delighted with the customer response to the all-new Amaze which has helped our overall sales grow by 41 percent in May 2018. The customers have appreciated the car for its one class-above offering of unmatched bold design, sophisticated & spacious interiors, advanced engine technology and outstanding driving dynamics.”

“During last month, we prioritised Amaze production volumes to cater to the strong customer demand. We are confident that we will continue with our sales momentum in coming months,” he added.

Ford India: The American carmaker registered cumulative domestic sales of 9,069 units in May, registering a notable growth of 34.51 percent (May 2017: 6,742). While it had introduced the Freestyle cross-hatch in April, the company went on to bring in a significant update to the popular compact SUV, the Ford EcoSport’s variant line-up, getting in a new top-of-the-line Titanum S trim and offering new features like HID headlamps, sunroof, 17-inch alloys, and also brought back the 1.0-litre three-cylinder turbocharged Ecoboost petrol motor to the crossover.

According to Anurag Mehrotra, president and managing director, Ford India, “Our continued focus on executing our strategic pillars of strong brand, right products, competitive cost and effective scale have ensured our growth which continues to be better than the industry. At a macroeconomic level, the outlook is positive thanks to good monsoon forecast. However, the industry needs to be exercise caution given the rising commodity and fuel prices that are expected to result in higher inflation.”

Toyota Kirloskar Motor: Toyota Kirloskar Motor recorded cumulative sales of 13,113 units in May, posting a growth of 20.14 percent over the 10,914 units sold in May 2017.

While the Innova Crysta MPV and the Fortuner SUV have been its top grossers month-on-month, the company, for the first time ventured into the C-segment space in India, introducing its new Yaris sedan.

According to N Raja, deputy managing director, Toyota Kirloskar Motor, “We are happy to have achieved a double-digit growth of 20 percent in domestic sales in May 2018. Along with the segment-leading products Fortuner and Innova Crysta, the Yaris has been a significant contributor to the overall positive sales growth as compared to the same period last year. We would like to thank our loyal customers for their relentless support and confidence that they have on Toyota products.”

With fresh models being introduced in the domestic market since the start of the new fiscal, the PV segment is riding high on the customer excitement brought in along with these products. However, with fuel prices burning a hole in the motorist's wallet, fuel efficiency today is back to seeing the priority it once commanded in the highly price-sensitive Indian market.

RELATED ARTICLES

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

The 200cc Motorcycle: India’s Quiet Premiumisation Story

While the motorcycle market’s attention remains on 110cc volumes and the 350cc Royal Enfield phenomenon, a quiet revolut...

100,000 and Holding: Electric Scooters Cross a Threshold

India’s electric two-wheeler market has achieved a landmark, with monthly wholesale volumes now consistently exceeding 1...

01 Jun 2018

01 Jun 2018

7121 Views

7121 Views

Ajit Dalvi

Ajit Dalvi

Arunima Pal

Arunima Pal