Passenger cars record highest sales growth in 5 years during 2015-16

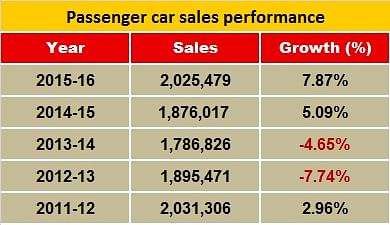

Starting from 2011-12 passenger cars reported a domestic sales growth of 2.96 percent, a negative 7.74 percent in 2012-13 followed by another negative 4.65 percent in 2013-14, 5.09 percent in 2014-15 and 7.87 percent in 2015-16.

Despite the slow recovery in the Indian automotive market, passenger cars speeded up the growth trajectory by posting their highest domestic sales growth in five years in percentage terms, according to the latest annual results of the Society of Indian Automobile Manufacturers of India (SIAM).

Starting from 2011-12 passenger cars reported a domestic sales growth of 2.96 percent, a negative 7.74 percent in 2012-13 followed by another negative 4.65 percent in 2013-14, 5.09 percent in 2014-15 and 7.87 percent in 2015-16. In volume terms the sales figures stood at 2,031,306 in FY’12, 1,895,471 in FY’13, 1,786,826 in FY’14, 1,876,017 in FY’15 and 2,025,479 in FY’16.

Sugato Sen deputy general manager SIAM attributes this milestone in the passenger car segment to signs of recovery in the market. Car companies had also launched models suited for the market and were pushing their products supported by promotional campaigns and incentives like discounts to woo customers.

FY2015-16 ends on positive note

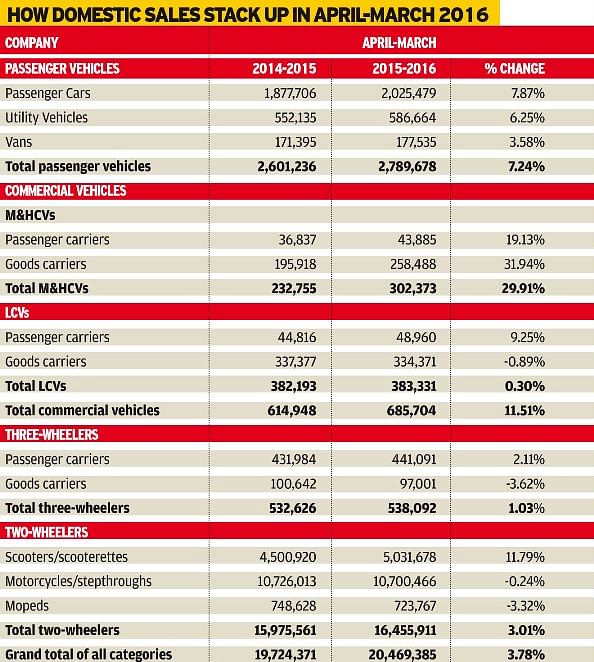

Cumulatively, the automotive industry ended financial year 2015-16 on a positive note growing 3.78 percent in domestic sales. Passenger vehicles grew 7.24 percent with cars, utility vehicles and vans rising by 7.87 percent, 6.25 percent and 3.58 percent.

The overall commercial vehicles segment reported a growth of 11.51 percent with medium and heavy commercial vehicles (M&HCVs) clocking 29.91 percent and light CVs growing marginally by 0.30 percent.

The slowdown in the rural markets and high interest rates however continued to dog the sales of goods carriers in both the LCV and three-wheeler categories. Despite the Reserve Bank of India cutting repo rates Sen maintains that no visible impact in terms of lowering of interest rates can be seen on the ground. Interest rates for car loans range between 10.18 percent to 14.38 percent while interest rates for CV loans ranged between 12.50 percent to 17.25 percent. This affected sales in rural areas coupled with erratic monsoons.

Meanwhile, three-wheelers posted a growth of 1.03 percent with passenger carriers seeing a step up of 2.11 percent and goods carriers declining by 3.62 percent. A laggard in the two-wheeler market continued to be the motorcycle segment declining by 0.24 with mopeds facing a steeper drop of 3.32 percent. Scooters however continued to grow at 11.79 percent plateauing the two-wheeler growth to 3.01 percent.

Overall exports rose marginally by 1.91 percent with passenger vehicles, CVs, three-wheelers and two-wheelers growing 5.24 percent, 16.97 percent, -0.78 percent, and 0.97 percent.

Domestic sales in Q4 2016

Some segments proved to be better performers than others with higher growth recorded in domestic sales in Q4 of FY’16 over Q4 FY’15. Two-wheelers for instance, grew 9 percent in Q4 F16 but 0 percent in Q4 FY’15 over Q4 FY’14. CVs witnessed a growth of 19 percent in the last quarter of FY’16 when it had grown a meagre 5 percent in Q4 FY’15. Three-wheelers saw a rise of 21 percent in Q4 FY’16 while it had notched a zero percent in Q4 FY'15. In passenger vehicles, a decline in growth was seen with 2 percent recorded in Q4 FY'16 compared to a rise of 5 percent in Q4 FY’15.

Some of the reasons for the vacillating performance of the market can be attributed to abrupt policy changes, such as the ban on diesel vehicles of more than 2,000cc in Delhi, that impacted sales of diesel vehicles to some extent. The ban has now been extended beyond March indefinitely.

In addition, commodity prices of hot roll steel and cold roll steel picked up in the last quarter of FY’16 boosting prices. About 20 percent safeguard duty was slapped on hot roll steel coils. Globally and in India both CVs and PVs showed an improved performance with markets like UK, USA, Germany, France and Italy also growing in these segments. But laggards remained Japan, Brazil and China where either PV or CVs did not fare well. But overall during CY 2015, the global market grew though some markets were up only marginally in the first few months of 2016 like Brazil and Japan.

Also read:

- SIAM forecasts positive outlook for India auto sales in 2016-17

RELATED ARTICLES

Maruti Jimny Crosses 150,000 Sales Since Launch, 80% Comprise Exports

Launched in June 2023, the Maruti Jimny five-door SUV has sold 158,678 units till January 2026, with exports (127,442 un...

Kia India Drives Towards Highest-Ever Sales in FY2026

Kia India has sold 259,923 vehicles in the first 11 months of FY2026, just 9,306 units short of its all-time high of 269...

Bajaj Auto Outsells Mahindra in e-3Ws for Second Month in a Row, TVS Ranked Third in February

Bajaj Auto, after overtaking Mahindra Last Mile Mobility for the first time in January, repeated the feat in February wi...

By Shobha Mathur

By Shobha Mathur

08 Apr 2016

08 Apr 2016

14837 Views

14837 Views

Ajit Dalvi

Ajit Dalvi

Autocar Professional Bureau

Autocar Professional Bureau