Passenger car sales recover in July, UVs shine, industry notches 13.22% YoY growth

Passenger car sales which had dipped 5.18% in June to 154,237 units, have risen to 177,604 units in July, up 9.62% YoY. UVs have posted their second best-ever sales this calendar year – 64,105 units (+41.85%),

The start of the second quarter of FY2016-17 has brought good tidings for the Indian automobile sector, coming close on the heels of the fallouts of the positive announcement of the clearance of the Goods and Services Tax (GST) Bill by the Rajya and Lok Sabhas.

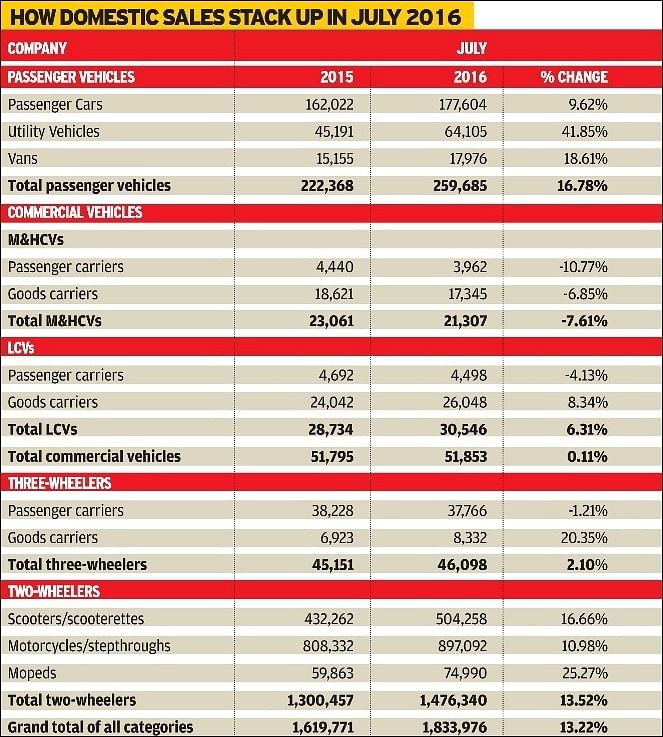

As per the sales data released by apex industry body SIAM today, overall industry across vehicle segments grew by 13.22 percent with sales of 1,833,976 units in July 2016. Importantly, passenger car sales which had dipped 5.18% in June to 154,237 units, have risen to 177,604 units in July, up 9.62% year on year. Utility vehicle manufacturers have posted their second best-ever sales this calendar year – 64,105 units (+41.85%), clearly pointing out to the standout success of the Maruti Vitara Brezza and the Hyundai Creta, among others. In March 2016, UV sales had hit 64,252 units (21.32%) – the highest in at least two years.

The overall Passenger Vehicle segment (cars, UVs and vans) has posted its best results for both the ongoing fiscal and calendar year – July numbers at 259,685 are up 16.78% YoY and better than the previous three months (April 2016: 242,060/ May 2016: 231,640/ June 2016: 223,454). Reason enough to believe that the PV sector is headed for much-improved sales, thanks to the good monsoon and the not-so-far-away festive season.

M&HCVs take a hit, two-wheelers maintain sales tempo

What is of concern though is 7.61% decline in medium and heavy commercial vehicle (M&HCV) sales, its first fall in this fiscal and in recent times. This segment has had a good run for nearly 20 months on the trot.

Meanwhile, the green shoots of recovery seen in the LCV segment seem to be firming up with the sector posting 6.31% YoY growth.

The overall two-wheeler sector posted growth of 13.52%, selling 1,476,340 units. While motorcycles sales comprised 897,092 units (+10.98%), surging demand for scooters saw the segment cross the 500,000 market for the first time this fiscal – 504,258 (+16.66%).

Speaking to Autocar Professional, Sugato Sen, deputy director general of SIAM, said: “Right now, there is not much difference between passenger cars and utility vehicles and they are becoming interchangeable. While UVs have been growing at a fast pace, cars have not grown so rapidly due to the launch of many new UVs that have become very popular. This has led to the growth of the SUV market.

In terms of CVs, there is a problem as the bus segment has been facing an issue and goods carriers have also not performed so well. While the replacement demand is being met, the industry is waiting for new demand that will boost truck sales.

While the rural markets are becoming buoyant, there is still not much movement of cars there but motorcycle sales have started picking up in rural regions in the last two months. This will further stimulate the market.

There are expectations that the festive season will see good sales this time as money is flowing into the hands of government officials with the announcement of the 7th Pay Commission report that has announced pay hikes for them.

As far as exports are concerned, passenger vehicles and two-wheelers are moving away from the traditional markets and have gained traction in Africa and LATAM geographies. These markets are highly dependent on exports of commodities and petroleum products and these have gone down due to lower foreign exchange in their hands. Hence these countries are focused on imports of essential goods rather than cars and two-wheelers.

April-July 2016: Industry growth up 13.37%

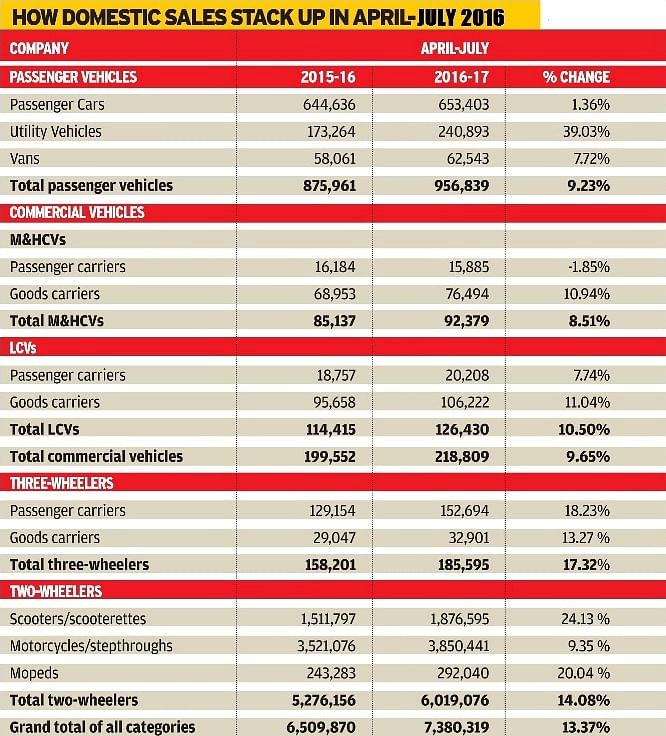

A snapshot of the April-July 2016 period shows 13.37% growth, mainly buffered by the passenger vehicle and two-wheeler segments.

Domestic PV sales grew 9.23% to 956,839 units with sales of passenger cars, UVs and vans increasing by 1.36%, 39.03% and 7.72% respectively.

CV sales overall are up 9.65% (218.809 units) but the slowing rate of growth in the once-buoyant M&HCV sector is a cause for concern. LCV sales, at 126,430 units, are up 9.65% YoY for the four-month period.

The two-wheeler industry continues to see a smart uptick, thanks to demand returning to the commuter bike market from rural India following a good monsoon and burgeoning demand for scooters from across the country. The sector rose 14.08% with sales of 6,019,076 units comprising 3,850,441 motorcycles (+9.35%), 1,876,595 scooters (+24.13%) and mopeds 292,040 (+20.04).

Exports decline

While the domestic market is on the upswing, the export story is not looking very good at this time of the year. April-July 2016 numbers at 1,134,070 are 10.20% down YoY and July 2016 sales too are down 11.53% (305,060). What is hitting overall numbers are slowing sales of three-wheelers and two-wheelers, particularly to key export markets of Latin America and Africa.

The PV segment though is seeing smart growth, with sales of 220,665 units (+9.49%) and CVs too at 36,364 units have seen a YoY growth of 8.84%.

Three-wheeler sales at 95,746 units (-40.42%) and two-wheeler sales at 780,256 units (-10.03%) have pulled down overall industry export numbers.

Recommended: Detailed India Sales Analysis: July 2016

RELATED ARTICLES

Maruti Jimny Crosses 150,000 Sales Since Launch, 80% Comprise Exports

Launched in June 2023, the Maruti Jimny five-door SUV has sold 158,678 units till January 2026, with exports (127,442 un...

Kia India Drives Towards Highest-Ever Sales in FY2026

Kia India has sold 259,923 vehicles in the first 11 months of FY2026, just 9,306 units short of its all-time high of 269...

Bajaj Auto Outsells Mahindra in e-3Ws for Second Month in a Row, TVS Ranked Third in February

Bajaj Auto, after overtaking Mahindra Last Mile Mobility for the first time in January, repeated the feat in February wi...

By Shobha Mathur

By Shobha Mathur

10 Aug 2016

10 Aug 2016

7790 Views

7790 Views

Ajit Dalvi

Ajit Dalvi

Autocar Professional Bureau

Autocar Professional Bureau