INDIA SALES ANALYSIS: JULY 2016

The onset of a good monsoon seems to have brought good tidings for the Indian automobile industry. It is also amply clear that new models across various manufacturers are the sales drivers.

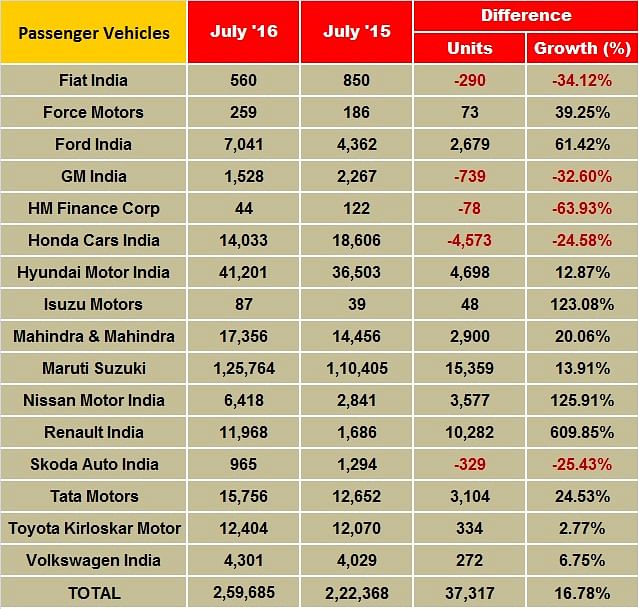

The onset of a good monsoon seems to have brought good tidings for the Indian automobile industry. Most of the passenger vehicle OEMs, which declared their July 2016 sales numbers, have reported handsome year-on-year growth.

It is also amply clear that new models across various manufacturers are the sales drivers. Whether it is Maruti Suzuki with its Baleno and the Vitara Brezza, Hyundai with its Creta and i20 or Mahindra & Mahindra with its TUV300 and KUV100, buyers are lapping up value-for-money models as fast as OEMs are rolling them out.

Here’s taking a look at how some passenger vehicle manufacturers have fared.

Maruti Suzuki India, which had seen sales dip of 10% in June 2016, has sold a total of 125,778 units in July 2016, notching growth of 13.9% over sales a year ago (June 2015: 110,405). This is the company’s highest-ever sales in a single month in the domestic market.

The company's previous highest domestic monthly sales was 121,063 units registered in October 2015. The July 2016 numbers also mean Maruti has ramped up production and increased despatches to dealers across the country to make up for the loss of over 50,000 units in June 2016 due to production stoppage at its Gurgaon and Manesar plants.

Together with exports, the carmaker has sold a total of 137,116 units in July 2016, growing 12.7 % over July 2015 (121,712 units).

What is apparent from the company’s product-wise sales split is that the new models are now the driving force behind Maruti’s sales resurgence.

The entry level duo of the Alto and Wagon R sold a total of 35,051 units, down 7.2 YoY (July 2015: 37,752) while the quintet of the Swift, Ritz, Celerio, Baleno and the Dzire sold a total of 50,362 units, up 4.1% YoY (July 2015: 48,381).

The Baleno, launched in October 2015, has consistently been in the monthly Top 10, clearly is the prime driver in this lot. The stylish hatchback currently has a waiting period of over 6 months. Expect it to have contributed over 10,000 units to Maruti's landmark sales in July 2016.

The Ciaz sedan, which is now seeing sales of over 5,000 units a month, sold a total of 5,162 units in July 2016, up 146%, albeit on a low base (July 2015: 2,099). With this, the Ciaz has sold a total of 105,434 units since its launch in October 2014.

Like the Baleno, the Vitara Brezza is another prime mover in the utility vehicle category The UVs comprising the Gypsy, Ertiga, Grand Vitara, S-Cross and the Vitara Brezza sold a17,382 units, up a handsome 151.3% Yoy (July 2015: 6,916). Expect the Vitara Brezza, which was launched in March 2016 and continues to have a longish waiting period, to have contributed the big number in the July sales for this lot.

The Omni and Eeco vans meanwhile keep up their sales act. Together they sold a total of 14,748 units last month, up 24% (July 2015: 11,887).

Maruti has also sold 14 units of the Super Carry, its first light commercial vehicle launched on July 27.

It is understood that Maruti Suzuki is rejigging production schedules to meet the massive demand for the Baleno and the Vitara Brezza. It will also be readying stock for the festive season which is barely three months away.

Hyundai Motor India, the country’s second-largest carmaker after Maruti Suzuki India, registered domestic sales of 41,201 units in July 2016, up 12.9 percent year on year (July 2015: 36,503). It also exported 14,606 units last month, up 5 percent (July 2015: 13,908).

Commenting on the July sales numbers, Rakesh Srivastava, senior vice-president (Sales and Marketing), Hyundai Motor India, said, “Hyundai continues to sustain a strong growth trajectory with a volume of 41,201 units with a growth of 12.9 percent on the strength of a strong pull performance of the Grand i10, Elite i20 and Creta in a market showing improved customer sentiments led by good monsoons, low inflation, reduced interest rates and dropping fuel prices.”

Hyundai Motor India has seen good traction in the domestic market for its Elite 120 hatchback and the Creta SUV. The Creta has been a game-changer for the company and has been driving overall numbers for the Korean carmaker. The company currently has 451 dealers and more than 1,170 service points across India.

Mahindra & Mahindra (M&M), the leading SUV manufacturer in the country, has sold a total of 17,356 vehicles in July 2016, up 20% (July 2015: 14,456) in the domestic market. This comprises 15,962 utility vehicles, which is an increase of 21% (July 2015: 13,204), and 1,394 cars and vans, up 11% year on year (July 2015: 1,252).

Together with its commercial vehicles sales, M&M recorded overall sales of 35,305 units, up 14% YoY (July 2015: 31,087).

Commenting on the sales in July 2016, Pravin Shah, president and chief executive (Automotive), M&M, “We are happy to have achieved a growth of 14% during July 2016 in the midst of various regulatory challenges. The advent of a good monsoon so far has brought in positive sentiment for the economy and that is somewhat reflected in our performance. At Mahindra, our growth is being driven by the various product launches of the last financial year, which have been in sync with customers’ requirements. With a strong performance in our HCV business as well as our exports, we are hopeful of a positive outlook during the rest of the financial year.”

On the other hand, Honda Cars India's sales continued to head southwards as the Japanese carmaker sold 14,033 units in July 2016, 4,573 units less than July 2015 (18,606 units).

The City was Honda's highest-selling model with 4,317 units dispatched to customers in India. The Jazz and the Amaze 3,517 units and 2,309 units respectively.

However, the recently launched BR-V received a good initial response with 3,333 units sold.

Meanwhile, Tata Motors' passenger vehicles sales in the domestic market for July 2016 stood at 13,547 units, a YoY growth of 31%, compared to 10,335 units in July 2015.

Sales of passenger cars in July 2016 was higher by 43% at 12,209 units as against 8,520 units in July 2015, due to strong demand for the recently launched Tiago.

Meanwhile, Toyota Kirloskar Motor (TKM) announced that it sold a total of 12,404 units in the domestic market last monthly, registering 3% year-on-year growth (July 2015: 12,070).

The prime driver of the company’s sales is the recently launched Innova Crysta, which has bookings of over 20,000 units and a waiting period of up to 2 months at different locations across the country. TKM says the Camry too has seen a YoY sales growth in July, with more than 90% of its sales attributed to the Camry Hybrid.

TKM is among the carmakers which have been adversely affected by the ban on over 2000cc diesel-engined vehicles in the Delhi-NCR region.

Commenting on the monthly sales, N Raja, director and senior vice-president (Sales & Marketing), Toyota Kirloskar Motor, said, “Although the new Innova Crysta has been doing well, the ban on registration of diesel vehicles has stalled the extent of our growth. We respect the Supreme Court’s judgment regarding cleaning the bad air quality around us. We would fully support the authorities for creating a better environment for our future generations. We are confident that honorable court will consider our submissions during the next hearing and hope the matter is amicably resolved at the earliest.”

Further, Renault India sold 11,968 units in July 2016 in the domestic market, up 609 percent albeit on a very low base (July 2015: 1,686). The carmaker says demand for the Kwid hatchback and the New Duster is on the up.

Ford India's July domestic sales grew to 7,076 vehicles, up from 4,362 units.

"Ford in India is steadfast on its promise to deliver more value to customers. Our domestic wholesale growth is proof that the actions we are taking to enhance the entire customer experience matter to our customers," said Anurag Mehrotra, executive director, Marketing, Sales & Service at Ford India.

Nissan Motor India reported domestic sales of 6,418 vehicles in July 2016 versus 2,841 units a year ago, up 126 percent.

Commenting on the company’s performance, Arun Malhotra, managing director, Nissan Motor India, said, "Our sales have been gaining momentum over the past few months and the trend has been encouraging. The customers have responded positively to the new Datsun Redigo."

Click Next for Two-wheeler and Commercial Vehicle sales

Recommended:

- Passenger car sales recover in July, UVs shine, industry notches 13.22% YoY growth

- India Sales Analysis - June 2016

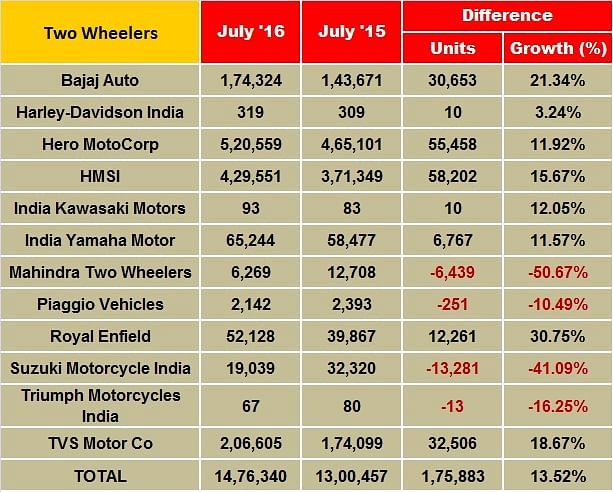

Sales rev up for two-wheeler OEMs too

The feel-good market sentiment, which has pervaded the passenger vehicle segment, has also percolated into the two-wheeler market. While the scooter market continues to increase its gains on a growth trajectory which shows no signs of slowing down, importantly, growth is returning to the motorcycle segment which has seen sales sputter over the past 8-12 months. Hero MotoCorp and HMSI have both registered strong sales, which is a pointer to the fact that the industry is en route to posting handsome numbers in 2016-17, thanks to a good monsoon and the resultant improved rural market sales of commuter motorcycles.

Hero MotoCorp, India’s largest two-wheeler maker, has reported sales of 532,113 units in July 2016, marking a YoY growth of 9.13 percent. It had sold 487,580 units in July last year.

The company launched the Splendor iSmart 110 last month, which is already on sale. The 110cc mass commuter model, also the first completely designed and developed motorcycle by Hero’s engineering team at its Centre of Innovation and Technology (CIT), Jaipur, is receiving a positive response in the market, says an official note from the company.

It is estimated that the newly launched Splendor model will give a substantial push to overall Splendor sales in the coming months as the festive season approaches. While the company commands a dominant market share of more than 70 percent in the mass commuter motorcycle segment (up to 110cc), it currently is also ruling the 125cc executive commuter segment with its Glamour model. The latter has been outselling the conventional segment best-seller, Honda CB Shine, since February this year.

“Hero MotoCorp also continues to dominate the 125cc space, with robust contributions from popular 125cc motorcycles like the Glamour and Super Splendor. In the scooter segment, the Maestro Edge and Duet also maintained their growth trajectory during the month,” quotes the release. According to the company, it has also recorded growth in the sales of its Duet and Maestro scooters last month.

The company has a positive outlook of the market demand for the coming months, thanks to the above average monsoons and the implementation of the Seventh Pay Commission by the Central government.

Honda Motorcycle & Scooter India (HMSI), which is riding a huge wave of customer demand for its Activa family of scooters and also saw additional capacity being freed up at its Gujarat plant, has set a new clutch of sales records in July 2016.

For the first time, monthly sales including exports have crossed the 450,000 unit milestone with total sales at 453,844 units in July 2016, up 17 percent (July 2015: 389,555).

HMSI’s total domestic sales comprising scooters and motorcycles grew 16% from 371,310 units in July 2015 to 429,527 units in July 2016. Led by the Activa, the largest-selling two-wheeler of 2016, Honda’s automatic scooter sales crossed the 300,000 mark for the first time. Growing a robust 19 percent, its total automatic scooter sales stood at 309,144 units. Meanwhile, motorcycle sales, which are under pressure from the commuter bike competition, grew 7% from 112,096 units in July 2015 to 120,383 unit sales in July 2016. On the export front, the company shipped 24,317 units in July 2016.

Commenting on the July 2016 sales numbers, Yadvinder Singh Guleria, senior vice-president, Sales & Marketing, HMSI, said: “July has been a historic month for Honda 2Wheelers India. The new capacity of our fourth plant has given us wings to not only grow faster than the industry, but create four records in one month. Crossing the 450,000 unit sales mark in July 2016 and growing at 21% nearly double that of the total two-wheeler industry in the first four months of FY2016-17 gives us more confidence of a bumper festive season ahead.”

HMSI says its market share has reached an all-time high of 29.1% in the domestic market (1% up) and 27% in the total market (2% up) in July 2016.

TVS Motor Company’s domestic two-wheeler sales grew by 18.7 percent, increasing from 174,099 units in July 2015 to 206,605 units in July 2016. While scooter sales declined to 68,033 units in July 2016 (July 2015: 69,626), motorcycle sales grew by 23 percent to 95,062 units (July 2015: 77,397).

Bajaj Auto sold a total of 174,324 motorcycles in July 2016, up 21 percent year on year (July 2015: 143,671). For the April-July 2016 period, it has sold a total of 723,204 motorcycles in the domestic market, a growth of 15 percent (April-July 2015: 629,489).

With numbers from the domestic market taking the charge, Bajaj Auto claims to have improved its market share in the local motorcycle segment to 19 percent during Q1 FY2017. This can be attributed to the success of its last two product launches – the 150cc V15 and the 150cc and 220cc Avenger models.

India Yamaha Motor announced 12 percent growth in domestic sales (including Nepal) in July 2016, selling 65,244 units (July 2015: 58,477). The company says it is seeing good traction for newly-launched disc brake variant of the Cygnus Alpha and the new Cygnus Ray-ZR scooters. Also, its increasing focus on expanding to Tier 2 and 3 cities is helping drive up sales.

According to Roy Kurian, vice-president, Sales & Marketing, Yamaha Motor India Sales, “Sales for the new products introduced in 2016 are picking up. Similar to performance bikes and commuter bikes, the scooter market is also growing in India, pointing out to the new customer trends.”

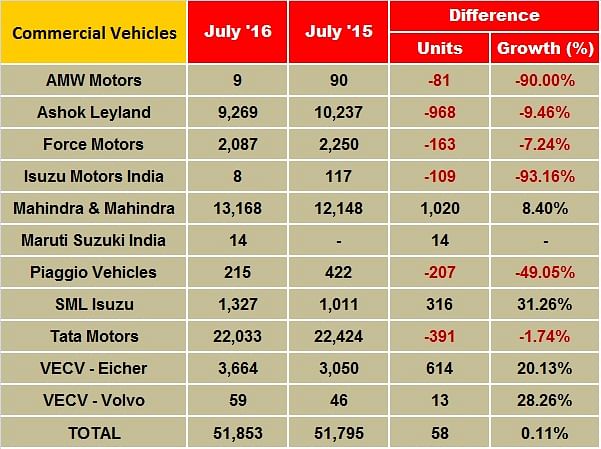

Ashok Leyland's sales come under pressure

Ashok Leyland, the second largest commercial vehicle maker in India after Tata Motors, reported a drop in its overall commercial vehicle sales in July 2016 after nearly 24 months of sustained growth. However, M&M and VE Commercial Vehicles have maintained strong double-digit growth.

According to industry analysts, the overall M&HCV segment, which posted over 30 percent growth in 2015-16, is likely to see 12-15 percent growth in 2016-17. It is also projected that the LCV segment, which has seen sluggish sales over the past two years, is likely to grow 10-12 percent and give new momentum to overall CV sales. Also, the second half of this fiscal should be very good for CV manufacturers due to pre-buying as a result of BS-IV norms coming into play from April 2017.

In what is a positive sign, heavy tippers including those in the 25T, 31T and 37T category, are primarily used in road construction activities and recent projects awarded by the government has seen their sales surge. The partial lifting of ban on mining activities has also given a boost to tipper sales.

In its monthly update, rating agency ICRA says the sharp decline in the growth momentum appears to be an aberration and is likely to get corrected over the fiscal with expectation of a healthy growth outlook from various end-user segments, especially infrastructure and mining.

In July, truck rentals have dropped by 1-1.5% on trunk routes. According to Indian Foundation of Transport Research & Training (IFTRT), which tracks truck movements in the country, “Heavy rains and steep drop in cargo arrivals in form of fruits and vegetables by 25 percent into APMCs and a similar drop in arrival of pulses in wholesale markets coupled with weak activity in core and manufacturing sector led to further drop in truck rentals by 1-1.5% on trunk routes during July 2016. The Rs 0.91 per litre diesel price cut on July 16 further accentuated the truck freight market and August 1’s Rs 2.01 per litre diesel cut may further push down truck rentals by 2-2.5% on the weak indicators of trucking activities in the country.”

“Falling truck rentals on trunk routes due to weak cargo offerings results in a direct impact on new heavy truck purchases as truck sales and passage of key tax reforms like the GST will be key for the sector,” observes IFTRT.

Tata Motors' overall commercial vehicles sales continued to decline. The company managed to sell 22,033 CVs in the domestic market in July 2016 as against the 22,424 CVs it sold in the same month last year, a decrease of 1.74%.

The decline was majorly due to the M&HCV segment reporting negative numbers. The company sold 10,698 M&HCVs in July, down 9% YoY. The segment saw subdued demand due to lower freight rates, heavier than usual monsoon in some of the states and some slowdown in the replacement market.

However, sales of Tata Motors LCVs went up by 5% YoY to 13,544 units.

Ashok Leyland’s total numbers dropped close to 10% YoY with sales of 9,269 units in July 2016 (July 2015: 10,237 units). Its M&HCVs, after posting consistent growth for 25 months, have skidded 6% at 8,182 units (July 2015: 8,835 units). LCV sales grew marginally by 4% 2,310 units. (July 2015: 2,219 units).

Mahindra & Mahindra’s M&HCVs maintained their double-digit growth of 22% by selling 382 units last month (July 2015: 314 units). The below-3.5T GVW products posted 9% growth with sales of 12,230 units (July 2015: 11,230), while those in the above-3.5T GVW segment dropped 8% year-on-year with sales of 556 units (July 2015: 604).

VE Commercial Vehicles maintained its double-digit growth with 20.1% with sales of 3,664 units in the domestic market (July 2015: 3,050).

RELATED ARTICLES

Mahindra Farm Equipment Posts 46% Domestic Growth, Sells 38,484 Tractors in January 2026

Mahindra Farm Equipment reports 46% January tractor sales surge driven by strong rural demand and record Rabi sowing, wi...

SML Mahindra Records 30% Sales Growth in January 2026 Amid Broader Market Softness

SML Mahindra posts 30% January sales increase with balanced growth across cargo and passenger segments, bucking broader ...

Mahindra Auto Clocks 63,510 SUVs and 104,309 Total Vehicle Sales in January 2026

Mahindra & Mahindra reports 24% January sales growth with record SUV demand reaching 63,510 units, alongside strong comm...

By Autocar Professional Bureau

By Autocar Professional Bureau

01 Aug 2016

01 Aug 2016

22266 Views

22266 Views

Shahkar Abidi

Shahkar Abidi