November auto retails are India's best ever at 2.38 million units

With all five vehicle segments recording strong double-digit growth, November 2022 retails are the best ever for the Indian automobile industry.

The resilient Indian automobile industry handled tough times with fortitude, always expecting good things to happen and the good times to return. A month before 2022 wraps up, India Auto Inc is well positioned on growth road and looking to shift gear into speed lane across segments. What has helped is a combination of growth-driving factors like improving customer sentiment, pent-up demand, ramped-up factory production following better supplies of semiconductors and also stock market gains that are giving a new charge to vehicle sales in India. The real-world retail sales story is looking good at this stage of the fiscal as well as calendar year.

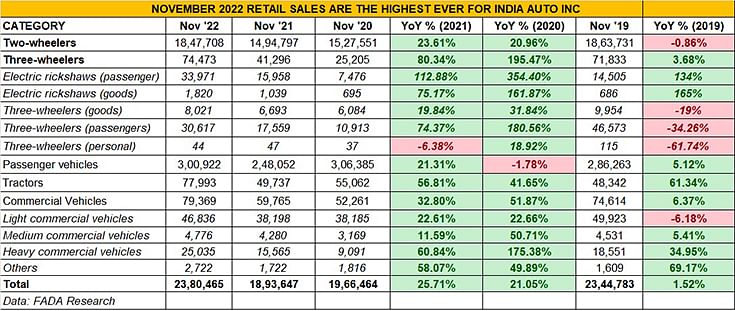

Apex body FADA (Federation of Automobile Dealers Associations) today released the retail sales numbers for five vehicle categories – two- and three-wheelers, passenger vehicles, tractors and commercial vehicles – for November 2022. Cumulative sales of 23,80,465 units, up 26% year on year (November 2021: 18,93,647 units) have set a new monthly benchmark. That translates into 79,349 vehicles, across segments, sold on every single day of November.

The November retails are a 13.65% month-on-month increase on festive October 2022’s numbers and a 65% increase over January 2022’s 1.43 million units (see data table below). FADA President Manish Raj Singhania said, “November 2022 has clocked highest retails in the history of the Indian automobile industry with March 2020 (23,12,868 units) as an exception when retails were higher due to BS-4 to BS-6 transition.”

The November retails are a 13.65% month-on-month increase on festive October 2022’s numbers and a 65% increase over January 2022’s 1.43 million units (see data table below). FADA President Manish Raj Singhania said, “November 2022 has clocked highest retails in the history of the Indian automobile industry with March 2020 (23,12,868 units) as an exception when retails were higher due to BS-4 to BS-6 transition.”

November retails have taken off from festive October 2022 (2.09 million units / 26%), which was part of the 42-festive season which had begun in September. According to the FADA president, the continuing sales momentum is also thanks to the “Great Indian Wedding Season (from November 14 to December 14) where around 32 lakh weddings will be solemnised across the country.”

All vehicle segments in strong growth territory

What augurs well for the coming year is that growth is democratised across all five categories – PVs (up 21%), two-wheelers (up 24%), three-wheelers (80%), CVs (up 33%) and tractors (up 57%). Compared to the pre-Covid November 2019, all vehicle segments other than two-wheelers (marginal decline of -0.9%) are in growth territory.

India Auto Retails in 2022

Jan 2022: 14,39,747 units / -10.69%

Feb 2022: 13,74,516 units / -9.21%

Mar 2022: 16,19,181 units / -2.87%

April 2022: 16,27,975 units / 37.06%

May 2022: 16,46,773 units / 206%

June 2022: 15,50,855 units / 27.16%

July 2022: 14,36,927 units / -7.84%

Aug 2022: 15,21,490 units / 8.31%

Sep 2022: 14,64,001 units / 10.94%

Oct 2022: 20,94,378 units / 47.62%

Nov 2022: 23,80,465 units / 25.71%

Total YTD retail sales: 1,81,56,308 units

Passenger Vehicle Retails in 2022

Jan 2022: 2,58,329units / -10.12%

Feb 2022: 2,38,096 units / -7.84%

Mar 2022: 2,71,358 units / -4.87%

April 2022: 2,64,342 units / 25.47%

May 2022: 2,63,152 units / 204%

June 2022: 2,60,683 units / 40.15%

July 2022: 2,50,972 units / -4.66%

Aug 2022: 2,74,448 units / 6.51%

Sep 2022: 2,60,556 units / 9.71%

Oct 2022: 3,28,645 units / 40.55%

Nov 2022: 3,00,922 units / 21.31%

Total YTD PV retail sales: 29,71,503 units

As is known, the passenger vehicle (PV) industry has been on a roll and has crossed the 300,000-unit retail mark for the second month in a row in November with 300,922 units, up 21% YoY. October retails were 328,645 units while September 2022’s were 260,556 units. According to Singhania, what has helped power demand is the “better availability of model mixes from past months, new launches and increase in rural demand. Compact SUV and SUV category coupled with higher variant models continues to rule the roost.”

Return of good times for the CV industry

What is heartening for the overall industry is that commercial vehicles, which are billed as the barometer of the country’s economy, are back in growth mode.

At a cumulative 79,369 units across the LCV, MCV and HCV sub-segments, YoY growth is a strong 33% and 6% compared to the pre-Covid November 2019. A closer look at the numbers reveals that all three sub-segments have recorded double-digit growth which augurs well for the coming months and beyond. The massive government spend in infrastructure development across the country is having an impact, amply seen in HCVs posting 61% growth with sales of 25,035 units. Intra-city logistics operational demand is also seen in the 4,776 MCVs sold last month, up 51% while the hub-and-spoke model and last-mile mobility businesses continue to drive sales of LCVs including small CVs and pickups – 46,836 units, up 22.61%.

Commenting on the CV sales, Singhania said: “With the government’s continued focus in the infrastructure space and new mining projects, replacement demand continued to pour in along with healthy inter-state passenger movement enabling bus sales.”

The two-wheeler industry’s retail sales at 18,47,708 units constitute 24% YoY growth albeit it’s the sole segment that’s down versus November 2019 sales albeit that marginal decline should be defeated soon. According to Sinhania, “This segment is slowly turning the tide from negative to positive as the same can be witnessed from retail sales due to the ongoing wedding season.”

EVs account for 48% of three-wheeler sales

If there’s a growth story which shows immense potential, particularly in view of the shift to electrification, then it’s the three-wheeler segment which is witnessing the highest growth rate.

A total of 74,473 units were sold in November 2022, up a sterling 80% YoY (November 2021: 41,296). Of this, 48% – 35,791 units – are electric three-wheelers, clearly showing the trend where the three-wheeler market is headed. Growth is robust across both electric passenger models (33,971 units / 113%) and cargo-carrying models (1,820 units / 75%). And this growth has come at the cost of the IC-engined models with all sub-segments here in the red, in double-digit percentage.

FADA’s near-term outlook remains 'cautiously optimistic'

India Auto Inc’s strong showing in November notwithstanding, FADA remains cautiously optimistic about near-term growth, balancing the positives with some challenges.

India’s spending cycle gets a fresh charge usually after the harvest season starts, which is when farmers get money in hand. According to FADA president Singhania, “We expect spending for auto sales to go up once the harvest comes into the market and farmers start getting money in their hands.”

“Most of the OEMs are announcing price hikes. To counter this and for the lower end of the pyramid, OEMs have started announcing discounts for slow-moving products, lower variants and to clear their year-end stocks. This may help year-end sales to remain healthy.”

He added, “While the above actions are positive, RBI has yesterday increased the repo-rate by 35 bps (225 bps increase since May 2022) and continues to hint at more hikes in future. This increase now brings the repo rate to 6.25%, the highest since February 2019. This will further lead to a higher cost of borrowing apart from the price hikes done by OEMs and may dent the consumer confidence specially in two-wheelers and entry-level PVs. Along with this, the China lockdown may play its part in slowing the supply of semiconductors. If this happens, it may act as a speedbreaker and add to the supply-demand mismatch, which was improving since last few months. Due to the above reasons, FADA remains cautiously optimistic in the near term.”

RELATED ARTICLES

Top 10 MPVs in First 10 Months of FY2026: Maruti Ertiga to Kia Carnival

Demand for multi-purpose vehicles remains strong, with their share of UV sales rising to 17% in FY2027 from 11% in FY202...

Skoda Slavia and VW Virtus Sales Cross 150,000 Units, Virtus First to Cross 75,000 Units

Skoda Volkswagen India’s two MQB-A0-IN–based sedans have reached a new milestone, with the Slavia at 73,378 units and th...

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

09 Dec 2022

09 Dec 2022

10012 Views

10012 Views

Ajit Dalvi

Ajit Dalvi

Autocar Professional Bureau

Autocar Professional Bureau