Maruti, Hyundai, Tata and Kia open FY2024 with double-digit wholesales growth in April

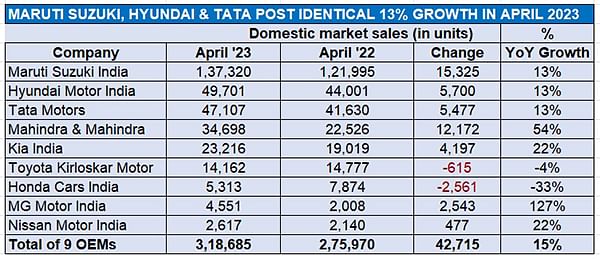

Each of the top three passenger vehicle OEMs clock identical 13 percent growth while Kia registers a 22 percent increase on a lower base; total wholesales at over 331,000 units kick off FY2024 on a strong note.

India’s passenger vehicle (PV) industry, which closed FY2023 with record wholesales of 3.89 million units, has opened FY2024 on a strong note with estimated wholesales of around 330,000 units. Sustained demand for SUVs, increasing consumer interest in sedans and OEMs ramping up production to cater to the pending order backlog of nearly 800,000 units is what is holding the market strong. Barring December 2022, when wholesales dipped to 275,352 units, April 2023 would be the 11th month in a row that PV numbers have gone beyond 300,000 units.

Of the vehicle manufacturers which released their April 2023 wholesales statistics on May 1, Maruti Suzuki India, Hyundai Motor India, Tata Motors, Kia India, MG Motor India and Nissan India reported double-digit increases while Toyota Kirloskar Motor and Honda Cars India saw sales decline. Let’s take a closer look at how the companies fared both in terms of year-on-year (YoY) and month-on-month (MoM) growth.

Maruti Suzuki India

137,320 units – up 13% YoY, 3.43 MoM

India’s passenger vehicle market leader with 137,320 units in April 2023 saw 13% year-on-year growth (April 2022: 121,995) while the month-on-month increase is 3.43% (March 2023: 132,763).

The company is still feeling the heat of slow sales in the mass-market entry-level hatchback segment – combined sales of the Alto and S-Presso at 14,110 units are down 18% (April 2022: 17,137 units). The other model in negative territory is the Eeco van with 10,504 units, down 6% YoY (April 2022: 11,154 units).

The seven-model pack of the Baleno, Celerio, Dzire, Ignis, Swift, Tour S, Wagon R together account for 74,935 units, an increase of 27% YoY (April 2022: 59,184 units). The premium Ciaz sedan sold 1,017 units last month, up 76% YoY albeit that is on a low base of 579 units in April 2022.

Maruti Suzuki India’s SUVs – the Brezza, XL6, Grand Vitara and the Ertiga – clocked 36,754 units, up 8% YoY (April 2022: 33,941 units).

Maruti Suzuki remains the unrivalled market leader but with an estimated order backlog of 373,000 PVs and a hugely competitive marketplace, the company will have to put its shoulder to the production wheel.

Hyundai Motor India

49,701 units – up 13% YoY, -1.77% MoM

The Chennai-based car and SUV manufacturer clocked wholesales of 49,701 units in April 2023, up 13% YoY (April 2022: 44,001 units). Month-on-month growth for Hyundai was down 1.77% (March 2023: 50,600 units). Nevertheless, the April 2023 wholesales are the second=best monthly numbers for the company in the past 13 months, going ahead of September 2022’s 49,700 units by one unit.

According to Tarun Garg, COO, Hyundai Motor India “This strong growth has been backed by an overwhelming response to the recently launched new Hyundai Verna that has more than doubled its volumes from its earlier version. We look to carry forward this momentum with the soon to be launched SUV from the Hyundai stable, Hyundai Exter.”

Tata Motors

47,107 units – up 13% YoY, 6.95% MoM

Tata Motors, which clocked half-a-million sales in both CY2022 and FY2023, has begun FY2023 with sales of 47,107 units in April 2023, up 13.15% year on year (April 2022: 41,630 units) and 6.95% better than March 2023’s 44,044 units.

The company, which retails seven PVs – Altroz, Tigor, Tiago, Nexon, Punch, Harrier and the Safari, has capitalised on the surging demand for its SUVs, particularly the Nexon and the Punch which are currently the best-selling and the No. 4 SUVs in India.

Last month, Tata expanded its CNG car portfolio from the Tiago and Tigor to the premium Altroz hatchback. What is creditable is that despite its recent entry into the CNG market, Tata Motors has already grabbed 13% of the CNG car market.

Where Tata Motors continues to have a strong market advantage is in the fast-growing electric vehicle market. With four products – Nexon EV, Tigor EV and Xpres-T (for fleet buyers) and the sub-Rs 10 lakh Tiago EV – the company is driving home the gains.

The highlight of April numbers is that Tata has recorded its best-ever monthly EV wholesales – 6,516 units bettering March 2023’s 6,509 units and February’s 5,318 units. Put this down to the company’s supplies for its Tiago EV, for which it has received over 20,000 bookings as also sustained demand for the Xpres-T sedan that has garnered over 49,000 orders from seven fleet operators in FY2023.

Nevertheless, in India’s expanding electric car and SUV market, Tata Motors, which had commanded an 80% EV market share, is beginning to see competition. As per Vahan retail sales data for April 2023, Tata Motors accounted for 3,748 units of the total 5,147 units, which gives it a 72.81% share. Mahindra & Mahindra, with 499 units, has moved into second place which is clearly an impact of the growing demand for all-electric XUV400, the first real challenger to the Nexon EV.

Mahindra & Mahindra

34,698 units – up 54% YoY, down 3.61% MoM

Mahindra & Mahindra despatched a total of 34,698 units, comprising 34,694 SUVs and 4 sedans, to record 54% YoY growth in April 2023. Compared to March 2023’s 35,997 units, there is a decline of 3.61 percent. SUV sales growth per se is 57% YoY versus April 2022’s 22,168 units.

M&M’s performance comes despite disruptions in the supply chain of crash sensors and airbag ECUs due to unavailability of semiconductors. According to Veejay Nakra, President, Automotive Division, M&M Ltd., “After a record-breaking year in FY2023, we continued our growth trend in SUVs by selling 34,694 units, registering a growth of 57% in April. We continue to keep a close watch on the dynamic supply chain situation, which is an industry phenomenon.”

In the electric vehicle segment, M&M has made robust gains on the retail front. As per Vahan data, the company has sold a total of 499 units in April 2023, which gives it a market share of 9.69% and puts it into second place behind EV market leader Tata Motors.

Kia India

23,216 units – up 22% YoY, 8% MoM

Kia India reported wholesales of 23,216 units in April 2023, which marks 22% YoY growth (April 2022: 19,019 units) and 8% month-on-month growth (March 2023: 21,501 units).

The Kia Sonet compact SUV has emerged as Kia’s best-seller last month with 9,744 units and accounts for 42% of total wholesales. This is the third month in a row that it has surpassed the longstanding best-seller, the Seltos midsize SUV which clocked 7,213 units. In February 2023, the Sonet had sold 9,836 units to the Seltos’ 8,012 and 8,677 units in March 2023 compared to the Seltos’ 6,554 units.

The Seltos midsize SUV, Kia’s longstanding best-seller sold 7,213 units, while the Carens MPV clocked 6,107 units. All three products were among India’s best-selling utility vehicles in FY2023 – while the Seltos was ranked eighth and the Sonet ninth, the Carens took 11th position among the Top 30. The Carens is fast turning out to be a growth driver for Kia in India.

Toyota Kirloskar Motor

14,162 units – down 4% YoY, down 24% MoM

Toyota Kirloskar Motor (TKM) has reported wholesales of 14,162 units in the domestic market in April 2023, down 4.16% year on year (April 2022: 14,777 units) and a substantial 24.14% down on March 2023’s 18,670 units, which was TKM best-monthly performance in FY2023.

The company had undertaken a week-long maintenance shutdown at its manufacturing plants in Bidadi, Karnataka from April 24 to 28, 2023 for the upkeep of machinery and equipment to sustain operational efficiencies, productivity and safety.

According to Atul Sood, Vice-President, Sales and Strategic Marketing, “TKM is continuing to witness high demand as well as good enquiries. Strong demand continues for the Toyota Hilux, Innova Hycross and the new Innova Crysta. Our SUV segment share also continues to be buoyant owing to the success of the Urban Cruiser Hyryder along with segment leadership of the Fortuner and the Legender, which are consistently leading with over 82% market share in Q1 of CY 2023. The Vellfire and the Camry Hybrid are also steadily contributing to our sales.”

Last month saw TKM launch ‘Wheels on Web’, an online retain sales platform for the Bangalore region. This enables customers to book, purchase and get delivery of models like the HyCross (petrol), Hilux, Legender, Camry, Fortuner and Innova Crysta (GX) digitally.

Honda Cars India

5,313 units – down 33% YoY, down 21% MoM

Premium carmaker Honda Cars India registered monthly domestic sales of 5,313 units in April 2023, down 33% (April 2022: 7,874). Month-on-month too, there was a sales decline – 20.60% when compared to March 2023’s 6,692 units. The export numbers for HCIL stood at 2,363 units for the month.

According to Yuichi Murata, Director, Marketing and Sales, Honda Cars India, “Our sales results for April 2023 are in line with our plan. The strong safety package of the New City with inclusion of Advanced Driver Assist System - Honda Sensing in almost all variants of the model have been appreciated by the customers. We are pleased to start the new financial year with a positive consumer sentiment and healthy market demand.”

MG Motor India

4,551 units – up 126% YoY, down 33% MoM

MG Motor India has reported retail sales of 4,551 units in April 2023, which constitutes 126% year-on-year growth (April 2022: 2,008 units). Month-on-month, April 2023 numbers are down 33% on March 2023’s 6,051 units, which was the company’s best monthly performance in FY2023.

As per the company, it continues to face supply chain constraints in a few models albeit is working towards meeting customer demand. The coming months are expected to bring in further improvements on this front.

The company, which sold a record 48,866 units in FY2023, currently produces the Astor, Gloster, Hector 5-seater, Hector Plus and the ZS EV SUVs. It is eyeing rapid growth this fiscal and has targeted sales of 80,000 to 100,000 units, which would mean doubling of sales.

One of the drivers of growth is billed to be the compact two-door Comet EV, unveiled on April 26 at Rs 798,000. MG Motor India is bullish on consumer demand for the Comet EV and is targeting a 20% share of India’s passenger EV market with its latest product which will see bookings open on May 15.

Nissan Motor India

2,617 units – up 23% YoY, down 20% MoM

Nissan Motor India’s wholesales of 2,617 units in April 2023 are a growth of 22.28% (April 2022: 2,140 units). This number is down 19.72% on March 2023’s 3,260 units.

Rakesh Srivastava, Managing Director, Nissan Motor India, commented, “The positive momentum continues on the strength of the Nissan Magnite, which has garnered over 100,000 customer bookings. Going forward, we see customer sentiment to remain positive on account of GDP growth and normal monsoon, with industry projections of high single- digit growth for the FY2023-24 period.”

In April, Nissan Motor India expanded its customer touchpoints with the addition of two showrooms and workshops in Karnal (Haryana) and Khammam (Telangana) to 267 touchpoints.

Commenting on the PV wholesales for April 2023, Rohan Kanwar Gupta, vice-president and sector head - Corporate Ratings, ICRA Ltd, said: “The wholesale dispatches of passenger vehicles continued to remain at healthy levels in April 2023, aided by robust order books across OEMs and steady demand, even as there continue to be concerns regarding moderation in demand on account of the rise in the cost of ownership. In April 2023, domestic wholesale volumes are estimated to have been around 340,000 units, representing a marginal growth on a sequential basis and a healthy 15% growth on a YoY basis. Even as the production levels of OEMs remained at healthy levels, they continue to be impacted to an extent by a shortage of electronic components.”

ALSO READ:

EV sales Iin India rise 41% in April 2023 to over 109,000 units

RELATED ARTICLES

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

The 200cc Motorcycle: India’s Quiet Premiumisation Story

While the motorcycle market’s attention remains on 110cc volumes and the 350cc Royal Enfield phenomenon, a quiet revolut...

100,000 and Holding: Electric Scooters Cross a Threshold

India’s electric two-wheeler market has achieved a landmark, with monthly wholesale volumes now consistently exceeding 1...

02 May 2023

02 May 2023

8006 Views

8006 Views

Ajit Dalvi

Ajit Dalvi

Arunima Pal

Arunima Pal