Mahindra Treo takes 45% of electric 3W market in H1 FY2022, Piaggio No. 1 goods carrier

The low total cost of ownership that e-three-wheelers offer along with robust demand for last-mile delivery services revs up the segment.

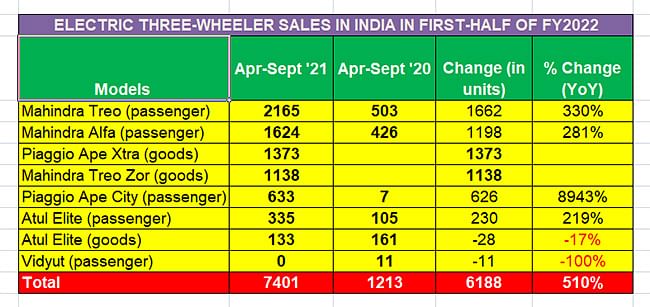

The electric three-wheeler market which, along with the electric two-wheeler segment, is the ‘low-hanging fruit’ of the EV industry in India, is on a roll. In the first six months of the ongoing fiscal year, this segment has seen sales of 7,401 units, which constitutes 510% year-on-year growth (April-September 2020: 1,213 units).

What’s helping accelerate growth in the electric three-wheeler market is the high prices of petrol and diesel (even after the recent excise duty cut) as well as the massive demand for last-mile delivery across the country from the booming e-commerce industry. And for three-wheeler operators, the road to personal growth is the low total cost of ownership (TCO) that electric three-wheelers offer.

Mahindra Electric, which has two products – the Treo passenger and cargo carriers and Alfa passenger carrier – accounts for 4,927 units of total e-three-wheeler sales in H1 FY2022. While this number sees the company take 66% of the market, the cumulative Treo sales at 3,303 units sees them command 44.62% of the market. Of this, the Treo passenger carrier contributed 2,165 units and the Treo Zor cargo carrier 1,138 units. Since its launch in 2018, the Mahindra Treo brand has sold over 10,000 units in India and is the country’s largest selling lithium-ion electric auto.

The Treo Zor was launched on October 29, 2020, about two years after Mahindra Electric launched the passenger-carrying Treo three-wheeler. The TreoZor, priced at Rs 273,000 (ex-showroom Delhi, net of FAME 2 and state subsidies), comes in 3 variants – Pickup, Delivery Van and Flat Bed. Mahindra Electric claims the TreoZor offers “an excellent value proposition to its owners” in the form of higher savings of over Rs 60,000 a year compared to existing diesel cargo three-wheelers, which is a result of its maintenance cost of just 40 paise/km. The TreoZor delivers develops 8kW and best-in-class torque of 42 Nm. Treo Zor also comes with a claimed best-in-class payload of 550kg.

Piaggio delivers the goods: Ape Extra No. 1 e-goods carrier

The No. 1 electric cargo carrier though is Piaggio Vehicles’ Ape Xtra with 1,373 units. The Ape E-Xtra FX, which develops maximum power of 9.5 Kw, comes with a full metal body architecture and six-feet cargo deck length. It is customisable for multiple applications like delivery van and garbage collection, among other uses. The company is implementing a speedy retail network expansion programme and on October 26 opened a new Experience Centre in Mumbai. And two weeks before that, it inaugurated all of 12 showrooms in Bihar, a state where the company is seeing strong traction for its electric three-wheelers.

Recognising the huge market potential, Piaggio recently tied up with global energy major BP to develop and roll out a comprehensive set of services for the rapidly growing number of two- and three-wheeled electric vehicles across Europe, India and Asia. Under their MoU, Piaggio Group and bp, along with affiliate Jio-bp in India, will explore opportunities to work together to offer charging and battery swap stations, as well as developing all-encompassing services such as ‘Battery as a Service’ (BaaS) – leasing, management and recycling of vehicle batteries – and ‘Vehicle as a Service’ (VaaS) – leasing, repair, maintenance and smart energy management of these vehicles. Initial efforts and focus will be on India, where Jio-bp and Piaggio are already engaged in developing EV solutions.

Growth outlook

Growth outlook

In the face of high petrol and diesel prices and the accelerated need for speedy last-mile deliveries, the electric three-wheeler goods carrier segment has notched handsome 1,542% YoY growth to 2,644 units in H1 FY2022 from a low-base of just 161 units in H1 FY2021. This is also reflected in the growing share of EVs in the overall three-wheeler segment, which saw sales of 32,198 units: to 8.21% from just 0.62% a year ago.

In comparison, growth in the electric passenger carrier segment is more muted: 352% -- 4,757 units in H1 FY2022 from 1,052 units in H1 FY2021. Of the total 63,223 units sold in the overall three-wheeler passenger carrying segment, this marks more than doubling of market share: to 7.52% from 3.14% in H1 FY2021.

With a number of growth tailwinds for this segment of mobility, things can only get better for the electric three-wheeler industry.

ALSO READ

Tata Nexon, MG ZS EV grab 86% of electric car market in first-half FY2022

RELATED ARTICLES

Maruti Jimny Crosses 150,000 Sales Since Launch, 80% Comprise Exports

Launched in June 2023, the Maruti Jimny five-door SUV has sold 158,678 units till January 2026, with exports (127,442 un...

Kia India Drives Towards Highest-Ever Sales in FY2026

Kia India has sold 259,923 vehicles in the first 11 months of FY2026, just 9,306 units short of its all-time high of 269...

Bajaj Auto Outsells Mahindra in e-3Ws for Second Month in a Row, TVS Ranked Third in February

Bajaj Auto, after overtaking Mahindra Last Mile Mobility for the first time in January, repeated the feat in February wi...

06 Nov 2021

06 Nov 2021

81484 Views

81484 Views

Ajit Dalvi

Ajit Dalvi

Autocar Professional Bureau

Autocar Professional Bureau