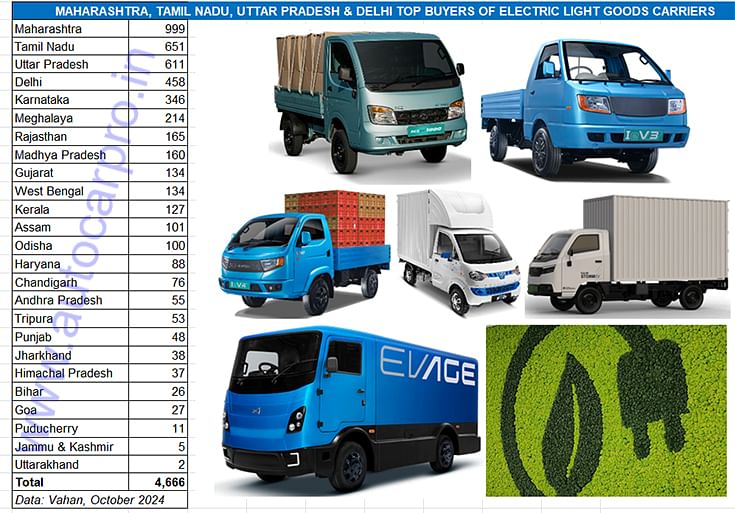

Maharashtra, Tamil Nadu, UP and Delhi top buyers of electric LCVs in January-September

The electric light goods carrier sub-segment, which saw retail sales of 4,689 units in the first 9 months of 2024, sees its share of the India’s e-CV market jump to 59% from 44% a year ago. In terms of state-wise retails, Maharashtra leads with a 21% share in an e-LCV market which is seeing entry of new players and a host of new models targeted at zero-emission mid- and last-mile transportation.

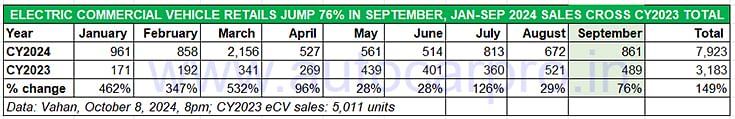

Demand for electric commercial vehicles in India is on the rise and cumulative nine-month sales between January-September 2024 at 7,923 units is a marked increase of 149% YoYv (January-September 2023: 3,183 units). Furthermore, the e-CV industry has already surpassed entire CY2023 sales of 5,011 units and could set a new record of over 10,000 units sold in CY2024.

The CV sector essentially comprises light-, medium- and heavy-duty goods carriers and passenger-transporting buses. As compared to personal electric mobility in the form of e-two-wheelers and passenger vehicles, the CV industry is where electric mobility makes wallet-friendly TCO sense given the much larger number of kilometres driven every day.

As the monthly sales numbers (see retail sales data table above) shows, the FY2024-ending month of March 2024 witnessed the highest demand – 2,156 e-CVs, followed by January (961 units). Combined retails for the first six months of FY2025 at 3,948 units are up 59% YoY (April-September 2023: 2,479 units). Total e-CV sales in FY2024 were 8,232 units, up 218% on FY2023’s 2,598 units.

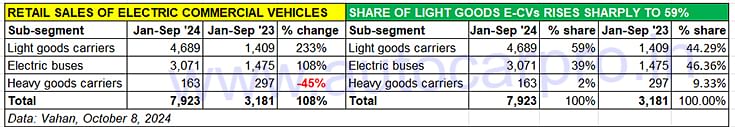

Demand for zero-emission light goods carriers, at 4,689 units, rose 233% YoY in January-September. This segment's share rose to 59% from 44% a year ago.

Demand for zero-emission light goods carriers, at 4,689 units, rose 233% YoY in January-September. This segment's share rose to 59% from 44% a year ago.

LIGHT GOODS CARRIER SHARE JUMPS TO 59% OF E-CV MARKET, MAHARASHTRA TOPS WITH 21% SHARE

In terms of the electric CV sub-segment-wise share in January-September 2024, electric light goods carriers (e-LCVs) have registered handsome growth – the 4,689 units are a 233% YoY increase which is reflected in their share of overall e-CV market jumping to 59% from 44% in the year-ago period. This has come about as a result of a rollout of a fair number of new models in the market and as well as being the eco-friendly option for intra-city and inter-city operations.

As per Vahan data, Maharashtra is the leading buyer of e-LCVs, with 999 e-LCV goods carriers sold in the state between January and September 2024 and accounting for 21% of the total 4,689 e-LCVs sold in the first nine months of this year. Tamil Nadu (651 e-LCVs) is second with a 14% share, followed closely by Uttar Pradesh (611 units / 13% market share). Delhi, another state where demand is picking up for e-LCVs and currently ranked fourth, accounts for 458 units in the first nine months of the year and has a near-10% e-LCV market share in India.

At a combined 2,719 units, Maharashtra, Tamil Nadu, Uttar Pradesh and Delhi account for 58% of the total retail sales of electric light goods carriers in January-September 2024 in India.

At a combined 2,719 units, Maharashtra, Tamil Nadu, Uttar Pradesh and Delhi account for 58% of the total retail sales of electric light goods carriers in January-September 2024 in India.

FAST-EXPANDING PRODUCT CHOICE FOR E-LCV BUYERS

In terms of OEM retails which constitutes combined sales tally of goods carriers and passenger-transporting buses, Tata Motors is the strong e-CV market leader with 448 units in September (comprising 271 light goods carriers and 177 e-buses) and 4,844 units in January-September 2024 (comprising 1,235 buses). This performance gives Tata Motors a market share of 52% in September and 61% in January-September.

Of the total 4,844 e-CVs that Tata Motors has sold in the first nine months of CY2024, light goods carriers account for 3,609 units for 74.50% while e-buses (1,235 units) account for the balance 25.50 percent. Tata Motors' leadership in this e-CV segment stems from demand for its Tata Ace EV as well as from the recent launch of the new Ace EV 1000 small mini-truck in May. The new zero-emission Ace EV 1000 offers a higher rated payload of one tonne and a certified range of 161km on a single charge. Targeted at last-mile mobility providers, the newest variant of the Ace EV has been developed to address evolving needs of sectors like FMCG, beverages, paints and lubricants, and dairy.

Switch Mobility, the electric vehicle arm, has its LeV Series targeted at mid- and last-mile transportation and last-mile logistics. The company currently has two products – the leV3 and lev4 – built on 330 V high-voltage EV architecture and with a cargo body extending up to 9.7 feet. The two EVs have a range of up to 140km (for the leV3) and 120km (for the leV4) on a single charge. While the leV3 develops peak power of 40 kW and 190 Nm of torque, the leV4 develops 60 kW and 230 Nm. In May, Switch Mobility signed an MoU with Magenta Mobility to supply 500 Switch IeV4s over two years.

Recognising the growing potential of the e-LCV market, EV OEMs are rolling out new products.

Earlier this month, on October 3, Mahindra Last Mile Mobility launched the Mahindra Zeo, a four-wheeled e-LCV specifically engineered to meet the evolving demands of urban logistics. Priced from Rs 752,000, ex-showroom, all-India, MLMM states that the Mahindra Zeo can enable users to save up to Rs700,000 in seven years, when compared with a diesel-powered SCV. The Mahindra Zeo, which is built on an efficient high-voltage 300+ V architecture, develops 30 kW power and 114 Nm torque. The Zeo, which has a payload capacity of up to 765kg, has a top speed of 60kph, a 2250mm cargo box to enhance loading capacity, and a real-world driving range of 160km. The zero-emission vehicle comes with two driving modes—Eco and Power— that increases the range and reduces turnaround times. The 21.3 kWh liquid-cooled battery has a seven-year/ 150,000km warranty.

Meanwhile, Euler Motors recently entered the four-wheeled electric LCV market with the launch of its Storm EV LongRange 200 (intercity) priced at Rs 12.99 lakh and Storm EV T1250 (intracity) priced at Rs 899,000 (ex-showroom Delhi). Both come with a 1,250kg payload capacity and ADAS (Advanced Driver Assistance System) features for the first time in the LCV segment in India, along with 10 other segment-first features.

ALSO READ:

Electric car and SUV sales in September lowest in 19 months: 5,733 units

Electric 2W sales jump 40% in September, Bajaj Chetak outsells TVS iQube, Ola share falls to 27%

Bajaj Auto sells 5,000 electric 3Ws for the first time in September, market share rises to 8%

RELATED ARTICLES

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

The 200cc Motorcycle: India’s Quiet Premiumisation Story

While the motorcycle market’s attention remains on 110cc volumes and the 350cc Royal Enfield phenomenon, a quiet revolut...

100,000 and Holding: Electric Scooters Cross a Threshold

India’s electric two-wheeler market has achieved a landmark, with monthly wholesale volumes now consistently exceeding 1...

12 Oct 2024

12 Oct 2024

6388 Views

6388 Views

Ajit Dalvi

Ajit Dalvi

Arunima Pal

Arunima Pal