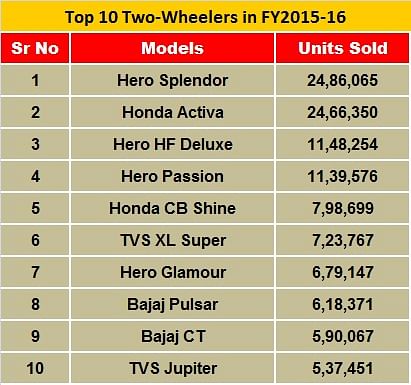

India's Top 10 Two-Wheelers in 2015-16

Sales of the Activa, at 2,466,350 in 2015-16 rose by nearly 13 percent compared to 2,178,227 units in 2014-15. It trailed the table-topping Hero Splendor by a meagre 19,715 units.

Honda Motorcycle & Scooter India’s (HMSI) flagship scooter Activa, which has helped the company in maintaining a stranglehold on the Indian scooter market, has closed in on Hero MotoCorp’s Splendor – which once again topped the charts in 2015-16.

Sales of the Activa, at 2,466,350 in 2015-16 rose by nearly 13 percent compared to 2,178,227 units in 2014-15. It trailed the table-topping Hero Splendor commuter bike series (which sold 2,486,065 units in 2015-16) by a meagre 19,715 units.

The Activa, which was launched in 2001 as Honda’s first two-wheeler for India, re-energised the Indian automatic scooter market and redefined convenient mobility. It was a successful year for the product as it crossed the 10 million sales mark in September last year. HMSI has three variants of the scooter in India. According to YS Guleria, senior VP, sales and marketing, HMSI, “The Activa 3G accounts for 75 percent of sales, while the Activa 125 and Activa-i contribute the balance of overall sales. But a lot of loyal Honda customers are upgrading to the 125cc Activa model.”

That Hero MotoCorp dominated the Top 10 two-wheelers list with four products again comes as no surprise. While the Passion series saw a 15 percent decline in year-on-year (YoY) sales (2014-15: 13,41,424 units | 2015-16: 11,39,576), the HF Deluxe brand overtook the former for the third spot with a 6 percent rise in 2015-16 numbers (11,48,254).

However, the top achiever for Hero MotoCorp, which recently opened its Rs 850 crore state-of-the-art Centre of Innovation and Technology (CIT) in Jaipur, Rajasthan, was the Glamour series with sales of 679,147 units in 2015-16. The 23 percent rise in sales of Glamour saw it jump three places from 10th in 2014-15 to seventh place.

Staying put at the fifth place despite a slight decline in sales is Honda’s CB Shine, which sold 798,699 units in 2015-16. Introduced a decade ago, the CB Shine has garnered the largest market share of 46 percent in the 125cc motorcycle segment in the country. Targeting a market share of over 50 percent in the 125cc segment, HMSI also added the CB Shine SP to its CB Shine stable in November last year.

Continuing to consolidate sales of its mopeds after entering into newer domestic territories and a new 100cc model, TVS Motor Company’s XL Super maintained its sixth position in 2015-16. The company’s most affordable commuter saw sales of 723,767 units.

Also read: Top 10 fuel efficient motorcycles in India

The eighth and ninth places belong to two Bajaj Auto products – Pulsar and CT 100 respectively. The company, which has outlined aggressive product plans for the upcoming year with a bigger Pulsar in the offing, had introduced the Pulsar RS200 last year in two variants including one equipped with ABS. The Pulsar, which is the company’s bestselling brand, accounted for sales of 618,371 units in 2015-16. Also making its entry into the top 10 list is the fuel saving CT 100 commuter bike with sales of 590,067 units since its reintroduction in 2015.

Completing the list is another newcomer, TVS Motor Co’s Jupiter scooter with sales of 537,451 units. Recognised as one of the top quality scooters in the JD Power India Two-Wheeler Initial Quality Study 2015, the 110cc scooter also crossed the 500,000 unit sales mark since its launch in September 2013.

The Indian two-wheeler industry saw overall sales of 16,455,911 units in 2015-16, an increase of 3.01 percent compared to the previous fiscal. A laggard in the two-wheeler market continued to be the motorcycle segment declining by 0.24 with mopeds facing a steeper drop of 3.32 percent. Scooters however saved the face with 11.79 percent plateauing the two-wheeler growth to 3.01 percent.

Recommended:

RELATED ARTICLES

Bajaj Auto Outsells Mahindra in e-3Ws for Second Month in a Row, TVS Ranked Third in February

Bajaj Auto, after overtaking Mahindra Last Mile Mobility for the first time in January, repeated the feat in February wi...

Mahindra Sells 600,000 SUVs in 11 Months of FY2026, Goes ahead of Tata Motors

Mahindra’s 600,004 SUV wholesales put it ahead by 34,809 units over Tata Motors’ 565,195 passenger vehicles in the first...

Tata Motors, JSW MG, M&M Command 86% of e-PV Sales in February, Maruti Sells 214 e-Vitaras

With 5,558 units sold, Tata Motors captured a 41% share of the 13,669 e-PV market last month, while JSW MG Motor and Mah...

By Takshak Dawda

By Takshak Dawda

20 Apr 2016

20 Apr 2016

21251 Views

21251 Views

Autocar Professional Bureau

Autocar Professional Bureau

Ajit Dalvi

Ajit Dalvi