Cars, M&HCVs save the blushes for India auto in Q1, FY'16

The first indications of the likelihood of a tough fiscal year for the domestic automobile industry are in.

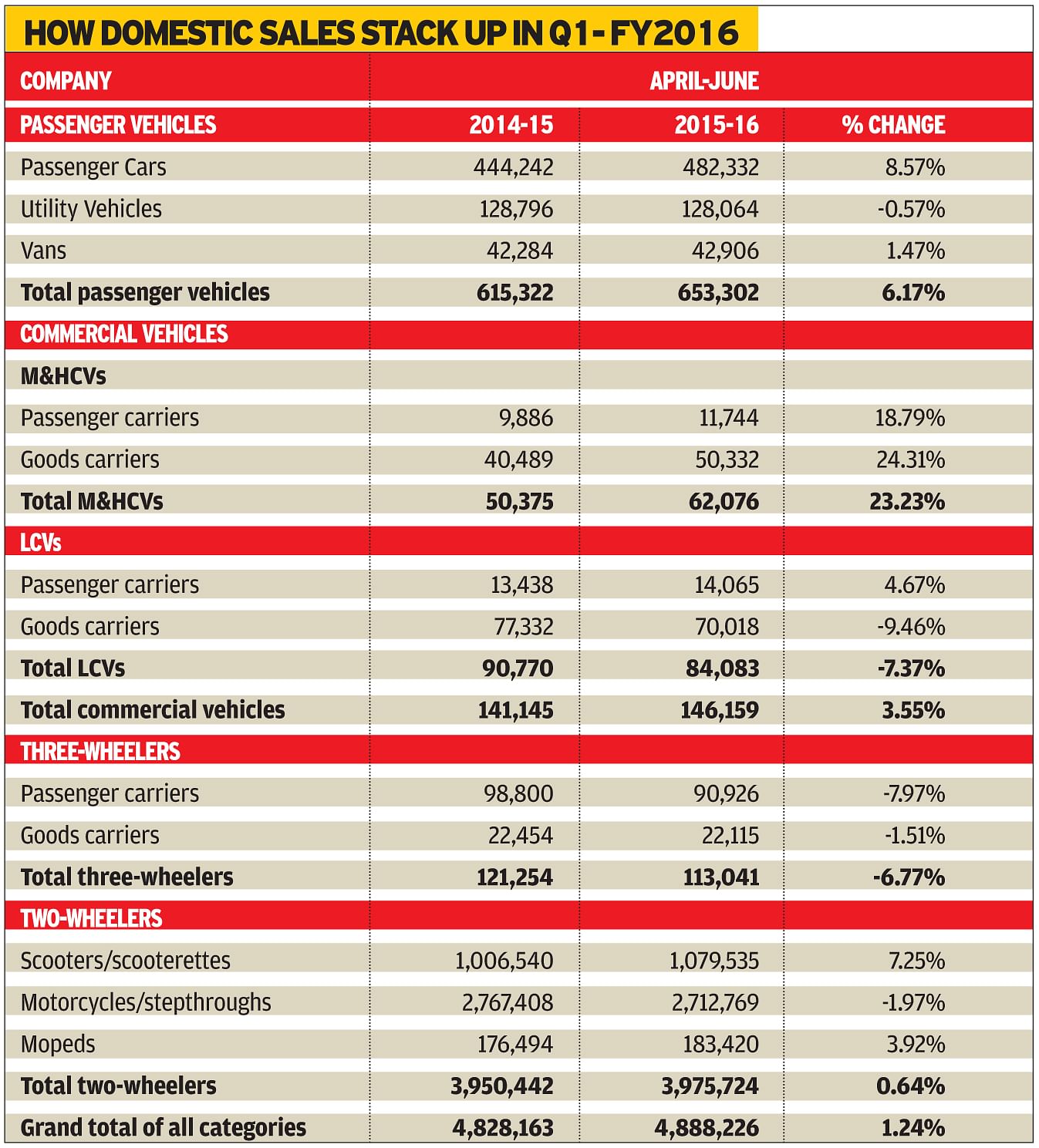

The first indications of the likelihood of a tough fiscal year for the domestic automobile industry are in. The Society of Indian Automobile Manufacturers, in its first quarterly review (April-June 2015 2015) has revealed that Q1 FY2016 numbers, at 4,888,226 units, marks a 1.24% increase over Q1 FY2015 (4,828,163 units)

Passenger vehicle (PV) sales stood at 6.17% with cars growing at 8.57% (482,332) and vans at 1.47% (42,906). But utility vehicles (UVs), which are facing the brunt of an unstable monsoon that in turn has affected incomes in rural India, have seen a fall of 0.57% (128,064).

A beacon of hope for the overall auto sector is the medium and heavy commercial vehicle (M&HCV) sector which has posted growth for the 11th month on the trot. M&HCVs grew 23.23% (62,076) albeit growth has still to filter down to the LCV segment which is down by 7.37% (84,083). Overall growth in the CV segment is 3.55% in Q1 FY2016.

Two-wheeler sales posted flat of 0.64% in Q1 2015, which is largely because of the decline in motorcycle sales (-1.97%), specifically the commuter bike segment. The scooter market continued to grow (7.25%) and while moped numbers grew by 3.92%.

Three-wheeler sales declined by 6.77% percent with passenger carriers and goods carriers down by 7.97% and 1.51% respectively.

Overall automobile exports for Q1 FY2016 grew 9.22% with PVs, CVs, three-wheelers and two-wheelers seeing 0.75%, 26.01%, 40.05% and 6.15% growth respectively.

“We used to get a 2% subsidy till now while exporting to Bangladesh and Sri Lanka under an incentive scheme but that has been now withdrawn by the government. That is affecting the bottomlines of companies by the same amount, said Sugato Sen, deputy director general of SIAM.

Compared to April 2015 (1,583,551 units/+1.91%) and May 2015 (1,683,962/-0.58%), June 2015 numbers at 1,620,673 point out to a YoY growth of 2.56%. Factory closure for 8-10 days at three carmakers contributed to de-growth of 0.54% in passenger vehicle sales. While car sales grew 1.53%, UV sales were down 5.86% and vans also down 7.19%. The last month of de-growth for PVs was in October 2014 (-7.52%).

In other segments, LCV goods carriers continued to be in the red at 14.02% bringing the segment down by 10.53% but overall CV sales were flat at 0.72%. M&HCVs though fared well, growing 20.74% but three-wheelers continue to experience de-growth of 7.40% while two-wheelers grew 3.55%.

According to SIAM president Vikram Kirloskar, the earlier peak for M&HCVs was in March 2011 when they sold over 40,000 units. In June 2015, these accounted for sales of 22,184 units, half that number. “That can be attributed to a one-off situation but the past few months have shown a continuous rise in sales every month which augurs well for the sector. The picking up of infrastructure activity in the last six months can also be attributed for this segment’s growth,” said Kirloskar.

The erratic monsoon is the big spoilsport and has adversely affected the fortunes of the LCV, UV, motorcycle and three-wheeler markets, all of which rely heavily on the rural markets.

Nevertheless, SIAM says a slow recovery is underway with more confidence seeping into the marketplace. “The outlook for CVs should be positive,” feels Vishnu Mathur, director general, SIAM. The new JNNURM scheme under a new scheme is expected to breathe life into the uptake of buses by State Transport Undertakings.

PVs are seeing high single-digit growth and even two-wheelers are expected to perform better. On the export front, the next 1-2 years will see a renewed shift in focus from Europe to other destinations. The quantum of exports to European markets has been significantly decreasing. Till 5 years ago, this market accounted for 39 percent of Indian exports but has fallen to around 16 percent with the last two years seeing a shift to the Latin American and African markets.

RELATED ARTICLES

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

The 200cc Motorcycle: India’s Quiet Premiumisation Story

While the motorcycle market’s attention remains on 110cc volumes and the 350cc Royal Enfield phenomenon, a quiet revolut...

100,000 and Holding: Electric Scooters Cross a Threshold

India’s electric two-wheeler market has achieved a landmark, with monthly wholesale volumes now consistently exceeding 1...

By Shobha Mathur

By Shobha Mathur

09 Jul 2015

09 Jul 2015

6275 Views

6275 Views

Ajit Dalvi

Ajit Dalvi

Arunima Pal

Arunima Pal