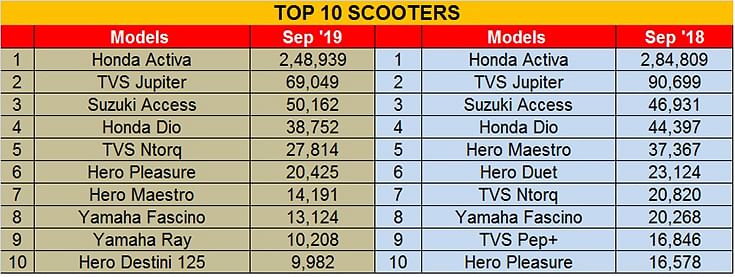

India's Top 10 Scooters – September 2019 | Activa sales improve, Jupiter and NTorq rev up, Access in power mode

Even as the scooter market struggles for traction in a difficult market, some models like the Access and NTorq are showing some spine on the sales front.

Once the darling of the two-wheeler world, the scooter segment has felt the hammer of the economic slowdown, particularly in rural India. In September 2019, total scooter sales fell by 16.60% to 555,829 units and in the April-September period, overall numbers were down similarly by 17% to 3,177,433 units. But there are some products which refuse to be cowed down. Here's looking at them.

The Honda Activa is to the scooter market what Maruti is to the passenger vehicle market: a mover and shaker. While the Activa remains the unassailable scooter market leader, its sales have slowed over the past year. The Activa is India's No. 1 two-wheeler and scooter in September with sales of 248,939 units. This performance is better than August's 234,279, July's 243,605 or June's 236,739, which means month on month, the Activa numbers are going up, albeit marginally. A clutch of new products is helping.

In end-May, the company launched the Activa 5G Limited Edition, with prices starting at Rs 55,032 (for the Activa 5G Limited Edition STD) and going up to Rs 56,897 for the Activa 5G Limited Edition DLX). More recently, in mid-September, Honda launched the BS VI Activa 125 – the new Activa 125. its first BS VI-compliant two-wheeler – in three variants – Standard, Alloy and Deluxe. The Standard is priced at Rs 67,490, while Alloy and Deluxe cost Rs 70,990 and Rs 74,490, respectively (all prices, ex-showroom Delhi). It is powered by a 124cc engine which develops 8.1hp, a slight drop from the 8.52hp on the outgoing model. However, while the BS IV model uses a carburetted engine, the one on the new BS VI Activa is fuel injected.

For the April-September 2019 period, Honda has sold a total of 13,93,256 Activas, down a sizeable 22% YoY (H1 FY2019: 17,86,687), which is also reflected in the scooter segment's H1 sales being down by 16.60% YoY, what with the Activa being the market leader.

Jupiter targets Grande effect, Suzuki Access a game-changer

TVS Motor Co's best-selling scooter is India's No. 2 scooter – the Jupiter. In an effort to rev up sales, the Chennai-based OEM has been busy launching a flurry of variants of top-selling models, and it looks like the move is working. In September, it launched the new Jupiter Grande, priced at Rs 62,346 (ex-showroom, Delhi). The Bluetooth console-equipped Grande becomes the most expensive one in the range, Rs 2,446 more expensive than the Jupiter Grande Disc SBT at Rs 59,900 and Rs 8,855 more than the standard Jupiter. This variant also gets feature functions like call and text notifications, an over-speeding alert, among other regular data, like the trip and odometer.

In September the Jupiter sold a total of 69,049 units, contributing to total April-September 2019 sales of 352,664 units, down 14% on year-ago sales 410,980 units.

The Suzuki Access, the 125cc scooter which has single-handedly enabled Suzuki to increase its scooter market share to 10.97% in H1 FY2020 and contributed to its growth in two-wheeler market share to 3.77%. The Access 125 has turned out to be a game-changer for the company. This popular buy and Suzuki's best-selling scooter is a consistent No. 3, after the Activa and Jupiter. On July 16, Suzuki launched a refreshed version, the Access 125 Special Edition (SE) equipped with a disc brake variant. It is powered by the same all-aluminium, four-stroke, single-cylinder 124cc engine which develops 8.7ps at 7000rpm and 10.2 Nm of torque at 5000rpm.

In September, the Access 125 went home to 50,162 buyers, up 7% (September 2018: 46,931) and one of the only two scooters to have bettered year-ago numbers. The performance is even better on the H1 FY2020 front: 299,549 units, up 15% YoY (H1 FY2019: 259,872).

The past few months have seen TVS, along with Suzuki Motorcycle India, expand their two-wheeler market share thanks to their scooters' peppy sales.

At No. 4 is the Honda Dio, which saw despatches of 38,752 units. The Dio has strong brand equity among young college-going buyers, with Jharkhand, Karnataka and Maharashtra being strong markets. Now, in a bid to rev up sales, Honda Motorcycle & Scooter India (HMSI), which is targeting semi-urban and rural India to drive up sales, has tied up with Cholamandalam Investment & Finance Co for offering retail finance. What will help is Cholamandalam’s strong nationwide presence with over 1,000 branches, most of them rural and semi-urban areas, and a base of a million.

The TVS NTorq is turning out to be a standout performer for the company. Compared to a year ago, the 125cc scooter has jumped two ranks to be at No. 5 spot with 27,814 units, and is the other model after the Suzuki Access to post better year-ago sales. The snazzy-looking scooter has a lot going for it including its youthful appeal. The scooter is riding the growing wave of demand for 125cc scooters, so expect better numbers to come its way later in the year.

In H1 FY2020, the NTorq has sold 140,159 units, which constitutes robust 39% YoY growth (H1 FY2019: 101,165). Little wonder, in a bid to further accelerate sales, on September 15, TVS launched the NTorq 125 Race Edition at Rs 62,995 (ex-showroom, Delhi). The new model features a new LED headlight with a T-shaped diffused LED DRL, as well as a few other changes. Aside from the new LED headlight, the Race Edition of the 125cc scooter features a unique colour scheme. The body panels are red-, black- and silver-coloured and the scooter also gets chequered-style decals on the front apron and side panels. Interestingly, what would be regular black plastic on the standard scooter is painted in red near the footboard of the Race Edition. It also features a hazard light, this time around.

With the addition of the new colour scheme the NTorq is now available in a total of eight colour options, three of which are metallic and five have a matte finish. The scooter is powered by a 124.8cc, single-cylinder engine that makes 9.4hp at 7,500rpm and 10.5Nm of torque at 5,500rpm.

Two Hero MotoCorp scooters take the next two places. The Hero Pleasure with 20,425 units rides it at No. 6 position. In May 2019, the company rolled out the new Pleasure Plus. Hero is known for its competitive pricing and at Rs 47,300 (drum variant) and Rs 49,700 (disc variant) the manufacturer has corroborated this. It costs just around Rs 2,000 more than the older 100cc Pleasure, that in comparison feels outclassed. The scooter also comfortably undercuts rivals like the Yamaha Fascino (Rs 55,623), Honda Activa-i (Rs 50,974), TVS Scooty Zest (Rs 50,020) and the TVS Wego (Rs 52,162). Easy to ride, easy to own and easy on the eyes.

Coming up seventh is the Hero Maestro with 14,191 units, sharply down on the 37,367 units it sold a year ago. In May 2019, Hero launched the Maestro Edge 125 in three variants – a carburettor drum brake variant priced at Rs 58,500, a carburettor disc brake variant at Rs 60,000 and a fuel-injected variant at Rs 62,700. These prices are on par with rival products like the TVS NTorq and the Honda Grazia.

At No. 8 is the Yamaha Fascino with 13,124 units, a number which the company knows could be better considering that it had sold 15,479 units in May and 14,873 units in April 2019. Yamaha needs to do more if the current sales momentum is to be maintained, especially when you consider that it now has a direct rival from Hero in form of the new 110cc Pleasure Plus.

The Yamaha Ray takes ninth position with 10,208 units, maintaining its monthly average in a difficult market, This scooter recently got updated with a combined braking system and got a new blacked-out colour scheme.

The final entry on this Top 10 list is the Hero Destini 125, which is positioned as a family scooter for a more mass-market appeal, the new Maestro, in Hero’s own words, is "designed for today’s young generation." The Hero Destini 125's sales have dipped below the 10,000 unit mark and in September, 9,982 units were despatched. Five months ago, it was No. 5 position in May, has dropped to No. 6 in June with 11,292 units, a good 5,460 units less than the 16,752 units of May. In April 2019, the Destini 125 had 16,301 units to its name. The aggressive pricing (sub-Rs 55,000 ex-showroom) seems to have worked for a while for the family scooter but consumer preferences are clearly changing.

Gearless scooters have, over the past decade, brought new life to the mobility scenario in the country and have, among other things, enabled women to commute on their own. For a good amount of time, the scooter segment's growth rate had kept pace with the SUV segment. With the SUV sector bucking the downturn, will scooters follow? Watch this space.

Also read: Top 10 2-Wheelers in September 2019

Top 5 Utility Vehicles in September 2019

Top 10 Passenger Cars in September 2019

RELATED ARTICLES

Mahindra Farm Equipment Posts 46% Domestic Growth, Sells 38,484 Tractors in January 2026

Mahindra Farm Equipment reports 46% January tractor sales surge driven by strong rural demand and record Rabi sowing, wi...

SML Mahindra Records 30% Sales Growth in January 2026 Amid Broader Market Softness

SML Mahindra posts 30% January sales increase with balanced growth across cargo and passenger segments, bucking broader ...

Mahindra Auto Clocks 63,510 SUVs and 104,309 Total Vehicle Sales in January 2026

Mahindra & Mahindra reports 24% January sales growth with record SUV demand reaching 63,510 units, alongside strong comm...

20 Oct 2019

20 Oct 2019

118427 Views

118427 Views

Shahkar Abidi

Shahkar Abidi