INDIA SALES: Top 10 scooters in December 2016

Honda Activa and Hero Maestro biggest volume-shedders as scooter market feels the full force of the cash crunch in December 2016. Honda Activa and Hero Maestro lost monthly volume of 35,674 units and 34,735 units respectively on a YoY basis.

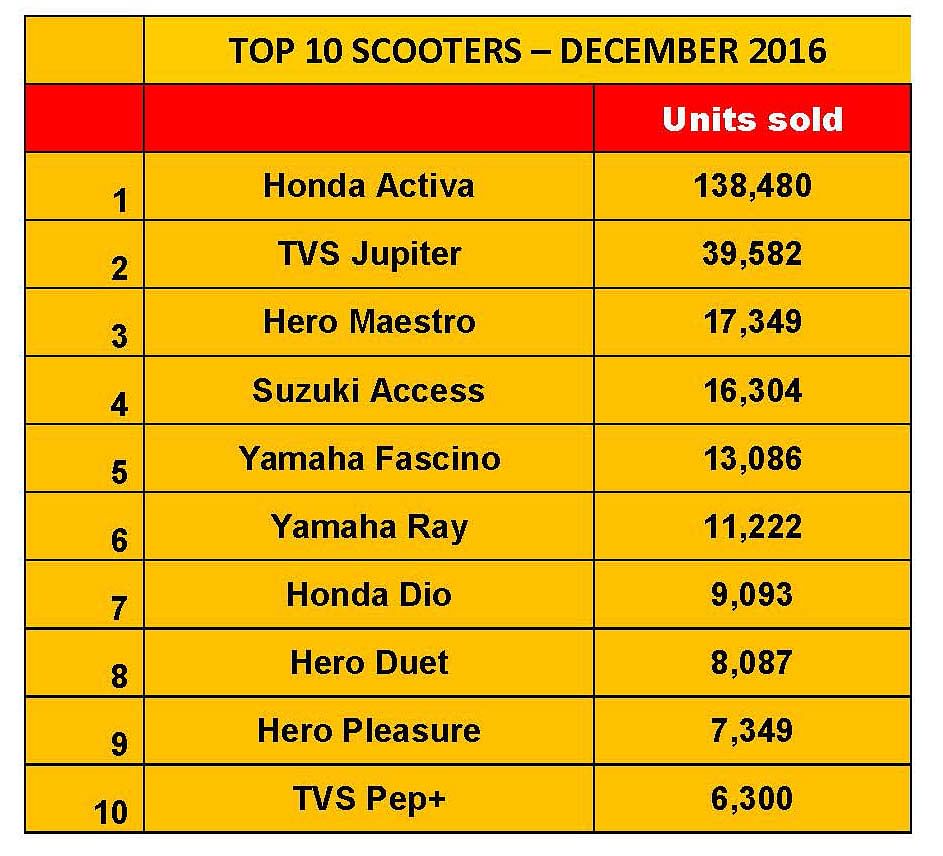

The Honda Activa and Hero Maestro stood out to be the two scooter brands losing maximum YoY monthly volumes in December 2016. With sales of 138,480 units, the Honda Activa, which remained the unchallenged leader of the Indian scooter market, reported a loss of 35,674 units at a YoY decline of 20.48 percent in December 2016.

While TVS’ Jupiter ranked second with sales of 39,582 units in December 2016 (down by 7,635 units and a YoY decline of 16.17 percent), Hero Maestro, at number three, reported sales of 17,349 units. The bestselling scooter brand from Hero MotoCorp lost a volume of 34,735 units on YoY basis, which also marked a sharp decline of 66.69 percent YoY.

At the fourth spot was Suzuki’s popular 125cc scooter Access, which reported sales of 16,304 units and was the one scooter model that recorded growth in its YoY sales. The Suzuki Access added sales of 4,286 units to its December 2015’s volume of 12,018 units.

All the other scooter models saw shrinking volumes to possibly their lowest sales during December 2016.

Yamaha’s Fascino, at fifth spot in the top 10 scooters’ list, recorded sales of 13,086 units, down by 9.36 percent YoY. Following that was the Yamaha Ray series, which reported sales of 11,222 units during the month. Interestingly, the volumes for Yamaha Ray more than doubled and reported a growth of 149 percent YoY in December 2016, all thanks to the fast-moving Ray-ZR variant.

At number seven was Honda’s trendy Dio model, which sold 9,093 units. The model that garnered substantial volumes for HMSI earlier during the year, reported a YoY decline of 41.27 percent in its monthly volume for last month.

While the Hero Duet ranked eighth with sales of 8,087 units (down by 45.70 percent YoY), Hero Pleasure scored 7,349 units (down by 52.71 percent YoY) and settled for the ninth rank.

TVS’ Scooty Pep+ continued to rank tenth (as it was in October and November 2016) with sales of 6,300 units in December 2016.

RELATED ARTICLES

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

The 200cc Motorcycle: India’s Quiet Premiumisation Story

While the motorcycle market’s attention remains on 110cc volumes and the 350cc Royal Enfield phenomenon, a quiet revolut...

100,000 and Holding: Electric Scooters Cross a Threshold

India’s electric two-wheeler market has achieved a landmark, with monthly wholesale volumes now consistently exceeding 1...

30 Jan 2017

30 Jan 2017

15962 Views

15962 Views

Ajit Dalvi

Ajit Dalvi

Arunima Pal

Arunima Pal