PV sales headed for record year, SUVs continue charge in May 2017

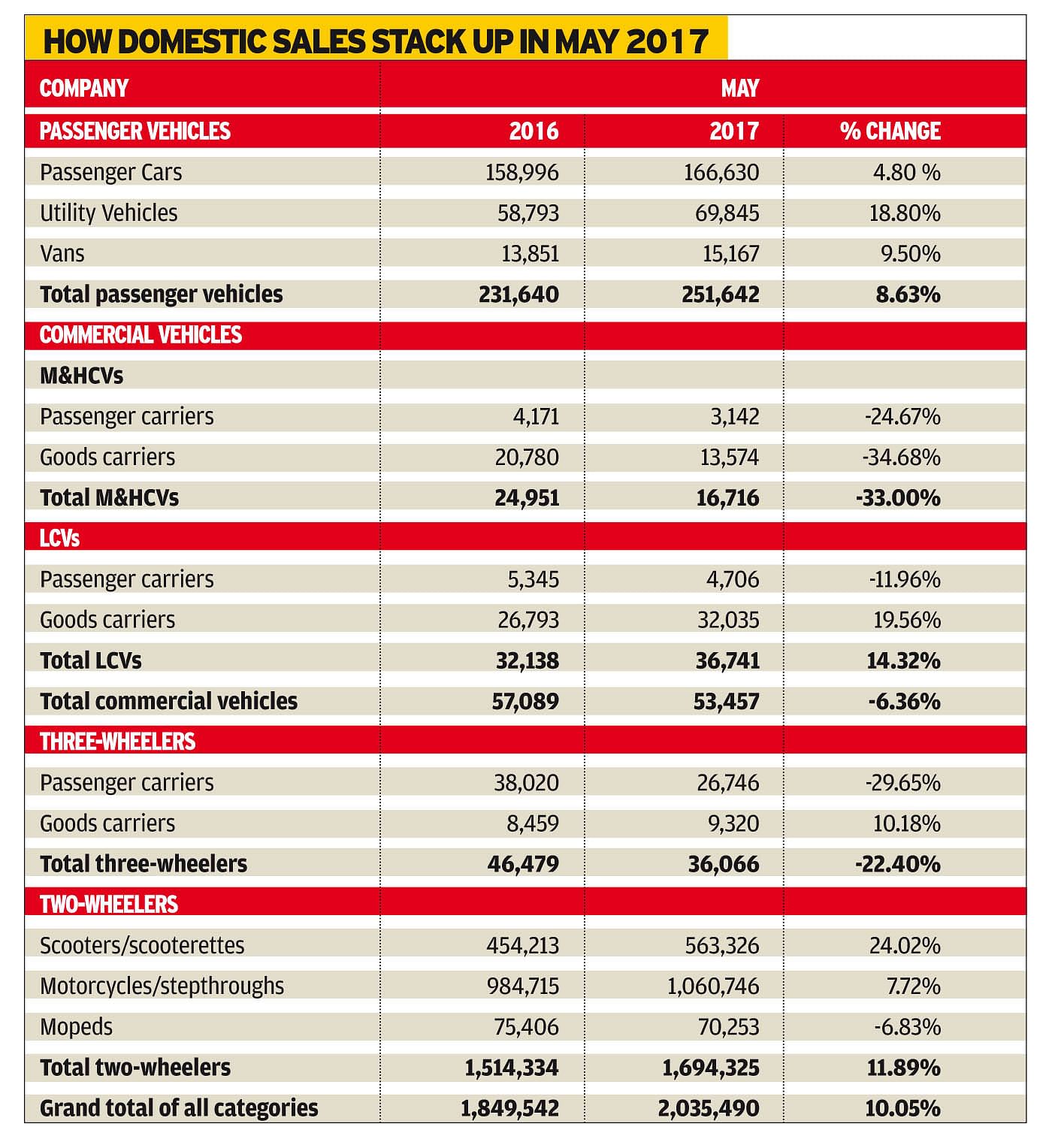

With sales of 251,642 units (+8.63%), the passenger vehicle segment bids fair to maintain growth through FY2018. Overall industry numbers cross 2 million units for the second month in a row.

The start of what looks to be a bountiful monsoon, return of consumer sentiment, banishing of demonetisation and a pipeline of new models, particularly in the passenger vehicle (PV) and two-wheeler segments, could be just what the doctor ordered to drive automobile sales in India in the ongoing fiscal.

Driving industry momentum is the PV sector which has been registering consistent growth for many months now, driven by consumer demand for new passenger cars as well as SUVs. SUVs, in fact, have been the accelerator and currently account for a fourth of all PV sales in India. It was no different in the month of May 2017, when SUVs accounted for 27.75 percent of total PVs sold. Of the total 251,642 units sold last month, SUVs comprised 69,845 units along with 166,630 passenger cars (66.21 percent) and 15,167 vans (6 percent) were sold.

While May 2017 PV numbers were up 8.63 percent year on year, they were down compared to April 2017’s 277,602 units (+14.68 percent). However, this can be attributed to some consumers delaying purchases, particularly of SUVs, in view of the expected price reductions as a result of GST kicking in from July 1. So, expect bumper PV sales next month.

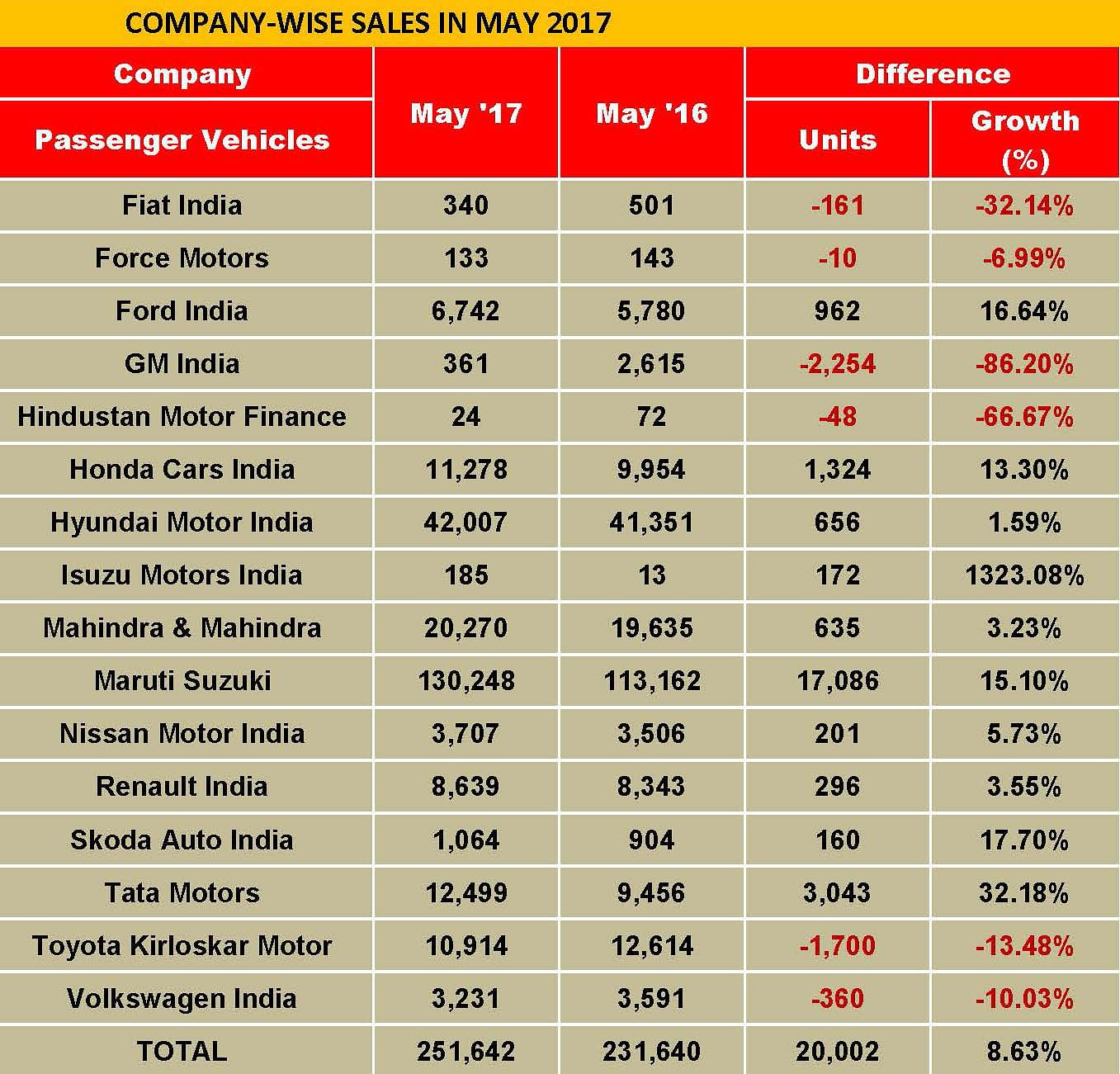

Maruti Suzuki India, which is the bellwether of the Indian market, powered last month’s sales with a total of 130,248 (+15.10%). Interestingly, thanks to surging demand for the Baleno and Vitara Brezza, the company has increased its PV market share by 3.23 percent from 48.60 percent to a humungous 51.83 percent within a year.

Other players who contributed to the overall PV sales were Hyundai Motor India with 42,007 units (+1.59%), Mahindra & Mahindra with 20,270 units (+3.23%), Tata Motors with 12,499 units (+32.18%), Honda Cars India with 11,278 units (+13.30%), Renault India with 8,639 units (+3.55%) and Ford India with 6,742 units (+16.64%).

Cumulative sales for the April-May 2017 period reveal that PV sales grew by 11.73 percent YoY. Within PVs, sales of passenger cars, utility vehicles and vans grew by 11.15 percent, 16.19 percent and 0.37 percent respectively YoY (see detailed sales table alongside).

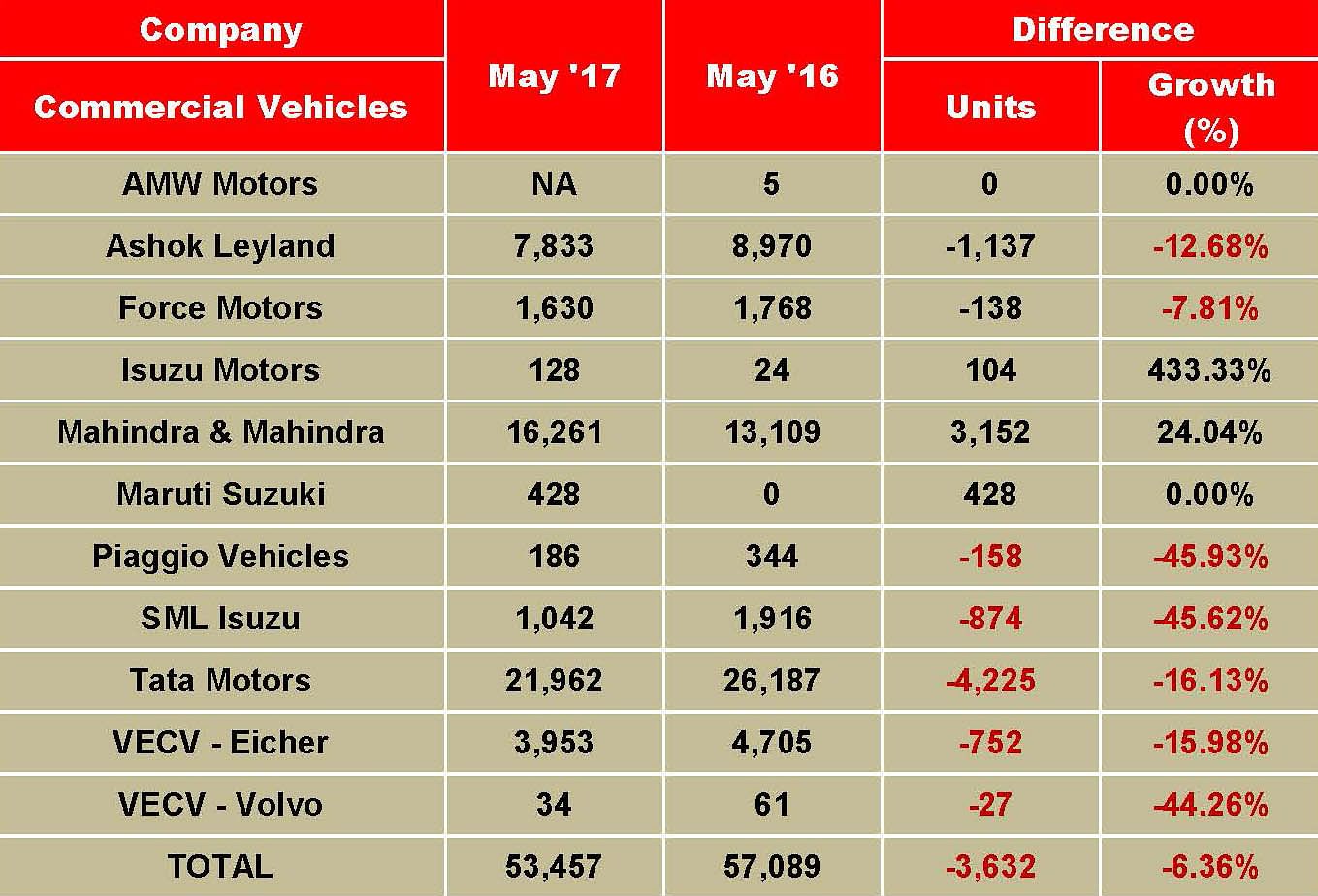

While the PV segment is notching gains, the commercial vehicle segment is seeing a pain point in the medium and heavy CV (M&HCV) sub-segment. This critical barometer of industry numbers is feeling the pressure of slowing sales and has reported a decline for the second month in a row. As a result of the upgrade to BS IV from April 1, vehicle prices have risen and fleet operators, who are still awaiting clarity on the impact of GST on total cost of ownership, have delayed purchases. In May 2017, the M&HCV segment sold 16,716 units (-33%) with declines across both the passenger and goods carrier sub-segments. LCV sales though improved month on month, with 36,741 units (+14.32%).

Overall CV sales in May 2017 were 53,457 units (-6.36%). It could be a while before CV sales drive consistently into growth lane. The gravity of the situation can be gleaned from the fact that of all the major CV OEMs, only Mahindra & Mahindra’s sales were in positive territory. May 2017 sales for Tata Motors, Ashok Leyland and VE Commercial Vehicles were down sizeably YoY.

Demand, likewise, is down for three-wheelers. This segment has seen numbers keeling over since November 2016. May 2017 was no different with sales of 36,588 units (-18.05%). Going forward, three-wheeler sales will see continued pressure as demand gradually shifts to four-wheeled small CVs, mainly from Tata Motors and Mahindra & Mahindra.

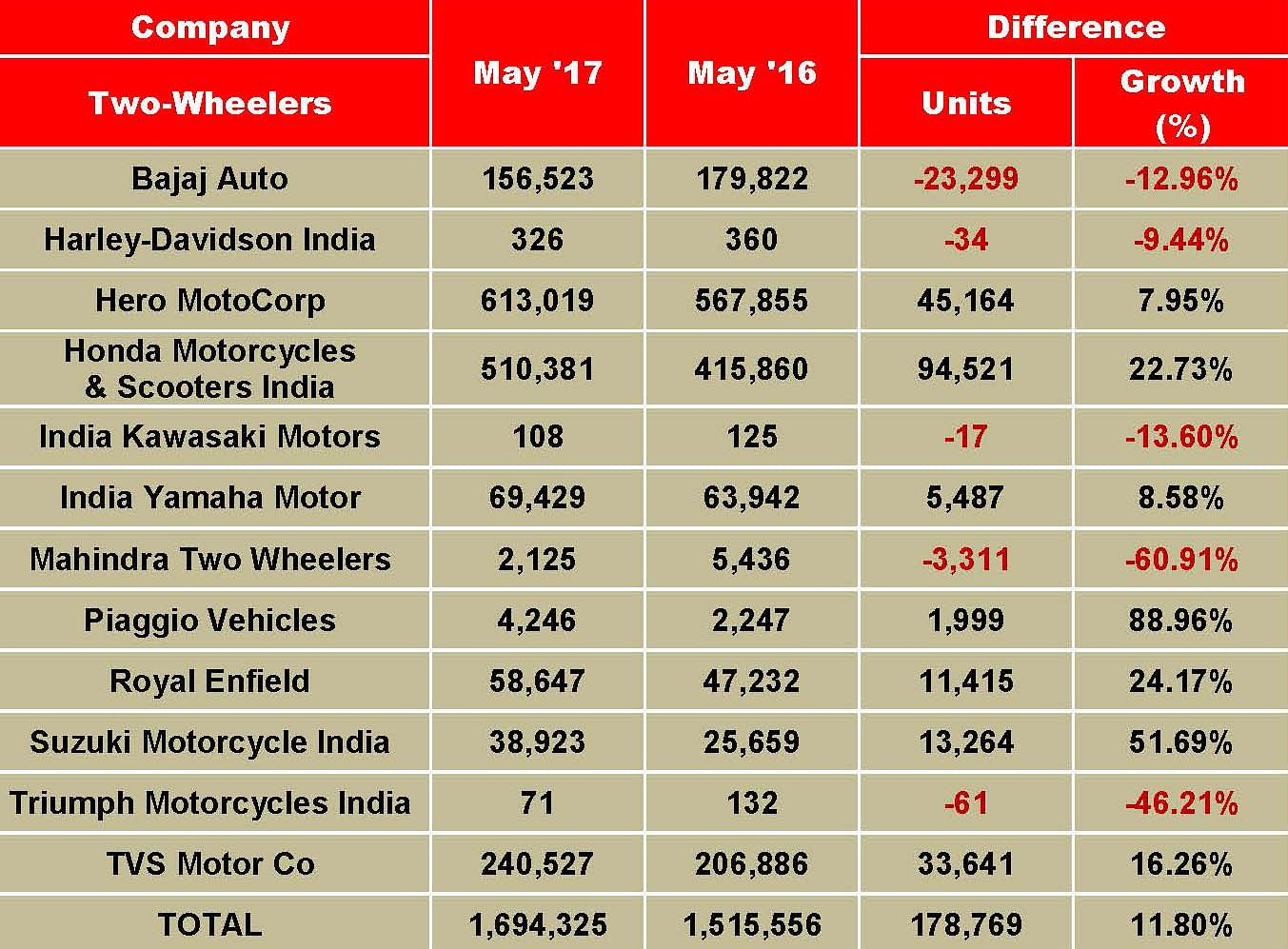

Meanwhile, the two-wheeler industry is riding smoothly onto growth path, registering sales of 1,694,325 units (+11.89%). While demand for scooters continues unabated – 563,326 units (+24 %) – what will bring cheer to OEMs is the uptick in motorcycle sales – 1,060,746 units (+7.72%), indicative of the fact that good times have returned to the rural market. Expect motorcycle numbers to improve month on month this fiscal.

Scooters are to the overall two-wheeler market what SUVs are to the PV market, accounting for a fourth of overall sales. At 563,326 units, scooter numbers posted 24 percent YoY growth. Motorcycle sales at 1,060,746 units (+7.72%) returned to the million-unit mark after a gap of six months. After October 2016’s sales of 1,144,516 units (+7.37%), the industry speedbreaker in the form of demonetisation hugely impacted rural India and motorcycle sales which had slid to their lowest in recent years in December 2016 – 561,690 (-22.50%).

Another indicator of the return of good times for the Indian automobile sector is the fact that like, the motorcycle segment, overall industry sales numbers have crossed the 2-million mark after six months, putting the demon of demonetisation firmly behind. Now, with the monsoon making itself present in most parts of the country and driving prosperity in rural India, it can be surmised that OEMs should be flush with business in the months to come. The overall industry growth accelerator will, of course, come when M&HCV numbers return to positive territory, which is expected to happen later this year.

HOW THE PASSENGER VEHICLE OEMS FARED IN MAY 2017

Maruti Suzuki India, the country’s largest carmaker, has reported total sales of 130,676 units in the domestic market. This marks 15.1 percent year-on-year growth (May 2016: 113,162). The entry level, bread-and-butter duo of the Alto and Wagon R sold 39,089 units, up 18.1 percent (May 2016: 33,105).

The company’s six compact cars comprising the Swift, Ritz, Celerio, Ignis, Baleno and Dzire sold 51,234 units, up 10.1 percent (May 2016: 46,554). However, this is considerably lesser than the robust 39 percent growth of 63,584 units in April 2017. The Ciaz premium sedan, which is now sold only from the premium Nexa channel, went home to 4,724 buyers, down 8.9 percent (May 2016: 5,188). The two vans – Omni and Eeco – sold 12,593 units, up 3.5 percent (May 2016: 12,164). The surging consumer demand for the Vitara Brezza refuses to slow down, as a result of which Maruti Suzuki posted a 66.3 percent YoY increase in sales of its UVs (Gypsy, Ertiga, S-Cross, Vitara Brezza) to 22,608 units (May 2016: 13,596). And, Maruti’s Super Carry, its entry model into the LCV segment, sold a total of 428 units in May 2017.

Hyundai Motor India registered domestic sales of 42,007 units, slightly better at 1.6 percent than the 41,351 units sold in May 2016. Commenting on the sales numbers, Rakesh Srivastava, director, Sales and Marketing, said, “Hyundai volumes at 42,007 units maintain the growth momentum in passenger vehicles on the strength of the demand pull created by the Grand i10, Elite i20, Creta and the newly launched new Xcent.”

Homegrown UV major, Mahindra & Mahindra sold 20,290 units in May 2017, registering marginal growth of 3 percent (May 2016: 19,635). UVs, typically, are the prime contributors to the sales of 19,331 units, up 4 percent YoY (May 2016: 18,648). With the Indian Meteorological Department predicted a near-normal monsoon for FY2018, demand for workhorses like the Bolero in the hinterlands can only be expected to further rise in the coming months.

Honda Cars India sold 11,278 units (+13.3%) in the domestic market (May 2016: 9,954). The main driver continues to be the Honda City sedan, which has again been on a roll, after introduction of its facelift, in January 2017. The car went home to 4,046 buyers, followed by the recently launched WR-V crossover, which saw 2,814 units being driven away from showrooms. Waiting period for the WR-V have risen to up to 3 months in some cities. Yoichiro Ueno, president and CEO, Honda Cars India, said: “We are happy to have achieved positive growth in May. We continue to receive strong demand for the new City and the WR-V. The government’s plan for timely rollout of GST and a better monsoon forecast will aid in sales growth in the coming months.”

Toyota Kirloskar Motor closed the month of May 2017 with sales of 10,914 units, down 13.48 percent (May 2016: 12,614). The company is witnessing strong pull in the UV space from its Innova Crysta MPV. One of the factors for this slowdown in the premium SUV and UV space could be attributed to the foreseeable significant tax cut, to the tune of 7 percent, which is expected soon due to the implementation of GST tax reforms from July 1. According to Toyota, this has been holding customers back from making an impromptu purchase just ahead of the upcoming deadline. Commenting on the monthly sales, N Raja, director and senior vice-president, Sales & Marketing, Toyota Kirloskar Motor, said, “The Innova Touring Sport, launched in May, has been appreciated by customers for being the first mover in the MPV segment with an SUV styling. With the ambiguity surrounding the upcoming GST proposed tax structure, customers are postponing their plan of purchasing the vehicle after the GST implementation. We expect this impact to magnify in June 2017 until the customers have a clear understanding of the final pricing after the GST rollout.”

Tata Motors saw an uptick of 27 percent in the month of May 2017 with sales of 10,855 units (May 2016: 7,926), most of them being the Tiago hatchback, Tigor sedan and Hexa SUV. Mayank Pareek, Head, PV business unit, Tata Motors, said, “Tata Motors continues to grow on a positive course at the back of strong performance of the new-generation cars like the Tiago, Tigor and Hexa. However, the uncertainty and different interpretations of GST will impact the buying sentiment in June 2017.” Meanwhile, Ford India recorded sales of 6,742 units (+16.64%) in the domestic market (May 2016: 5,780). The company’s exports rose 45 percent YoY to 16,761 units during the month.

TWO-WHEELER OEMS REPORT GROWTH

The top six two-wheeler manufacturers, who have shared their May 2017 sales data, have jointly reported a growth of 11.62 percent year-on-year (YoY).

The six companies together have reported sales of 16,69,391 units in May 2017, up by a 11.62 percent YoY. This marks good growth for the second month in a row, thus marking a clear recovery from the impact of demonetisation as the IMD (India Meteorological Department) forecasts advancement of southwest monsoon.

Industry leader, Hero MotoCorp, recorded total sales of 633,884 units in May 2017, up by 8.71 percent YoY. The company had sold 583,117 units in May last year. It is understood that Hero MotoCorp has plans to launch half-a-dozen new models (including refreshes and facelifts) later this year.

An official release from the company quotes: “With monsoon already hitting some parts of the country and forecast of normal rains this year, the industry is expecting a boost in demand and consumption in the rural markets. Having lined up a slew of new launches across various segments, the company is confident of maintaining the growth trajectory in the coming months.”

The company has commenced production at its Bangladesh-based plant on June 1, which is also its second manufacturing plant at a foreign location. The facility is located at Jessore in Bangladesh and has an installed capacity of 150,000 vehicles per annum. It is operated by its subsidiary named HMCL Niloy Bangladesh. Notably, Hero MotoCorp’s first overseas plant, based in Vila Rica, near Cali in Colombia, became operational in 2015.

INDIA SALES: Top 10 Passenger Vehicles – May 2017

The second largest two-wheeler company in India, Honda Motorcycle & Scooter India (HMSI), has reportedly sold 510,381 units in May 2017, up by an impressive 22.73 percent YoY, almost double of the overall industry growth.

Interestingly, the fast-growing company stands as the largest volume gainer in the industry, as it continues to inch closer to Hero MotoCorp’s monthly sale numbers.

While May 2017 marked second month for Honda in terms of achieving over 500,000 domestic sales, it also indicates the company’s improving demand for its motorcycles. HMSI stands as the second largest motorcycle player in the domestic market for second month in a row in May.

The company sold 334,165 scooters in May, which recorded YoY growth of 24 percent. On the other hand, it retailed 176,216 motorcycles last month, up by 20 percent YoY.

Commenting on HMSI’s performance, Yadvinder Singh Guleria, senior VP (Sales and Marketing), said, “Honda continues to outpace the two-wheeler industry growth growing nearly three times that of the industry in April-May 2017. Increased acceptance of Honda’s newly launched motorcycles has resulted in Honda maintaining its No. 2 position in the motorcycle segment for the second month in a row. Overall, the two-wheeler industry has once again bounced back to double-digit growth after six months indicating early signs of recovery. However, with upcoming GST implementation, industry sentiment is cautiously optimistic.”

Honda has recently launched its premium adventure-touring motorcycle, the CRF1000L Africa Twin, which is its second locally assembled big bike after the CBR650F. The company has commenced bookings of the 1000cc model for first 50 customers already.

TVS Motor Company sold 240,527 units, up by 16.26 percent YoY. It had reported sales of 206,886 units in May last year. According to the company, its scooter sales grew by 30.9 percent increasing from 65,434 units in May 2016 to 85,681 units in May 2017. On the other hand, the motorcycles sales grew by 22.3 percent increasing from 96,485 units (May 2016) to 118,014 units in May 2017.

Just like its arch-rivals Hero MotoCorp, HMSI and Bajaj Auto, TVS Motor too has planned new model launches for the year ahead.

The fourth largest two-wheeler player in the domestic market, Bajaj Auto has clocked sales of 156,523 units in May 2017, down by 12.96 percent YoY. The Pune-based company is the only manufacturer among the top six performers with negative growth YoY.

However, the company management is optimistic about the V-Series, along with the BS IV line up of its Avenger and Pulsar portfolios to fetch growing numbers. At the premium end, the company is also hopeful that its KTM portfolio would touch 45,000-50,000 units of sales during FY2018.

Bajaj Auto has lately begun exporting its entry-level midsized motorcycle, the Dominar 400 to foreign markets.

India Yamaha Motor recorded sales of 69,429 units (including Nepal) in May 2017, up by 10.65 percent YoY. The company had sold 62,748 units in May last year. The company continues to expand in tier II and III cities with its service network and is working to ensure availability of spare parts across its national footprint.

Roy Kurian, senior vice-president, Sales & Marketing, Yamaha Motor India Sales said, “Yamaha will defy the ongoing trends by bringing in products that rev hearts. Since the past four years, it has reached out to a considerably larger customer base with its stylish and innovative products. Yamaha’s innovation in design and technology required a finer connect with the mass. It took it forward by revolutionising buyers’ inclinations to match two wheelers with personality and comfort levels of riding.”

Continuing its dream run, Royal Enfield has reported YoY growth of 24.17 percent at domestic sales of 58,647 units in May 2017. The company had sold 47,232 motorcycles in May last year.

Parent company Eicher Motors had announced an investment of Rs 800 crore in FY 2017-18 towards Royal Enfield’s upcoming manufacturing facility at Vallam Vadagal near Chennai, product development, two technical centres in UK and India and market expansion.

The new plant in Vallam Vadagal is expected to commence operations by August 2017. According to the company, with its third plant going on stream, its combined capacity will stand at 825,000 motorcycles in FY2018.

An official communication from Royal Enfield quotes, “The company’s immediate business outlook remains strong as the brand (Royal Enfield) continues to grow consistently, competitively and profitably towards leading and expanding the midsized motorcycle segment globally.”

HCV SALES REMAIN UNDER PRESSURE

As in April, sales of the critical medium and heavy commercial vehicle (M&HCV) segment continued to remain under pressure in May 2017. Even as manufacturers rolled out their BS IV-compliant vehicles, fleet operators are delaying purchase decisions in anticipation of GST implementation from July 1. Expect June 2017 sales to also remain muted, if not low.

Tata Motors and Ashok Leyland, the two big players in M&HCVs, both recorded a sharp drop in their sales last month. The LCV segment though is positive with sales recording almost double-digit growth on the back of strong demand from rural areas and last-mile connectivity in urban India.

Listing out the reasons for the sales decline since April, Vinod K Dasari, managing director, Ashok Leyland, said, “March 2017 sales were good as a lot of buying happened in BS III vehicles. Secondly, customers are researching which BS IV vehicle is better and thereby delaying their buying decisions. The third issue for the industry is the serious supply chain difficulty which has been sorted out now. The dip in the past two months is temporary and demand is very strong in the market.”

Speaking to Autocar Professional, Rajesh Kaul, head – Marketing (M&HCV Trucks), Tata Motors, said, “The first two months of this financial year have seen a dip in total industry volume but I believe starting June things will be positive simply because the overall economic scenario is intact and our interactions with customers indicate the same to us. The government is playing a key role and M&HCV sales should take off soon.”

IFTRT in its monthly report said, “With diesel price down by Rs 1.92 a litre in May 2016, truck rentals outpaced the drop by sliding to 4-4.5 percent as summer agricultural crop tapered off and factory output took a steep cut as wholesalers / traders curtailed lifting of inventories due to GST migration fears, thereby sharply causing a drop in cargo offerings for wholesale markets across the country. On the other hand, heavy truck sales have been less than half in May 2017 in comparison to the same period last year with resistance to high-priced BS-IV vehicles.”

“Existing oversupply of National Permit truck fleets and M&HCV buyer hesitancy before implementation of GST, which promises hassle-free movement of goods across the country, sees fleet owners being extraordinarily cautious on BS IV truck purchases,” says IFTRT.

INDIA SALES: Top 10 Two-Wheelers – May 2017

In May 2017, Tata Motors’ overall commercial vehicle sales declined by 13 percent to 23,606 units (May 2016: 27,026). Overall sales of M&HCV trucks were down by 40 percent at 6,522 units.

According to Tata Motors, “The market continues to remain weak and demand has still not picked up. There are early signs of retails of BS IV vehicles but it has still been slow. The sale in M&HCVs was affected primarily due to severe global supply constraints of fuel injection pumps for BS IV engines. ILCV truck sales were 2,368 units, lower by 12 percent over 2,697 units sold in May 2016, also impacted by late supplies of fuel injector systems. These issues are expected to be resolved on short notice with full capacity available as of July 2017.”

Sale of Tata Motors’ small cargo vehicles were up by 10 percent to 10,572 units last month (May 2016: 9,645 units). “The SCV and pick-up segments have registered a strong sales recovery with full availability of BS IV products and a good market response to new variants like the Xenon Yodha and Ace Mega,” says the company.

Ashok Leyland’s sales in May were in negative mode, its numbers falling by 8 percent YoY at 9,071 units (May 2016: 9,875). M&HCV sales remain under stress and saw a decline of 18 percent at 6,139 units (May 2016: 7,469). Its LCVs, which were down in April, have turned positive with strong 22 percent growth with sales of 2,932 units (May 2016: 2,406).

Mahindra & Mahindra’s total CV sales were up 24 percent at 16,255 units (May 2016: 13,109). However, its M&HCV sales remain negative with a drop of 13 percent and 438 units (May 2016: 501). The below-3.5T GVW products maintain strong double-digit growth with a 27 percent increase to 15,111 units sold (May 2016: 11,852), while those in the above-3.5T GVW segment declined by 7 percent to 706 units (May 2016: 756).

VE Commercial Vehicles’ domestic sales were down 16 percent with total sales of 3,953 units (May 2016: 4,705).

RELATED ARTICLES

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

The 200cc Motorcycle: India’s Quiet Premiumisation Story

While the motorcycle market’s attention remains on 110cc volumes and the 350cc Royal Enfield phenomenon, a quiet revolut...

100,000 and Holding: Electric Scooters Cross a Threshold

India’s electric two-wheeler market has achieved a landmark, with monthly wholesale volumes now consistently exceeding 1...

05 Jun 2017

05 Jun 2017

15171 Views

15171 Views

Ajit Dalvi

Ajit Dalvi

Arunima Pal

Arunima Pal