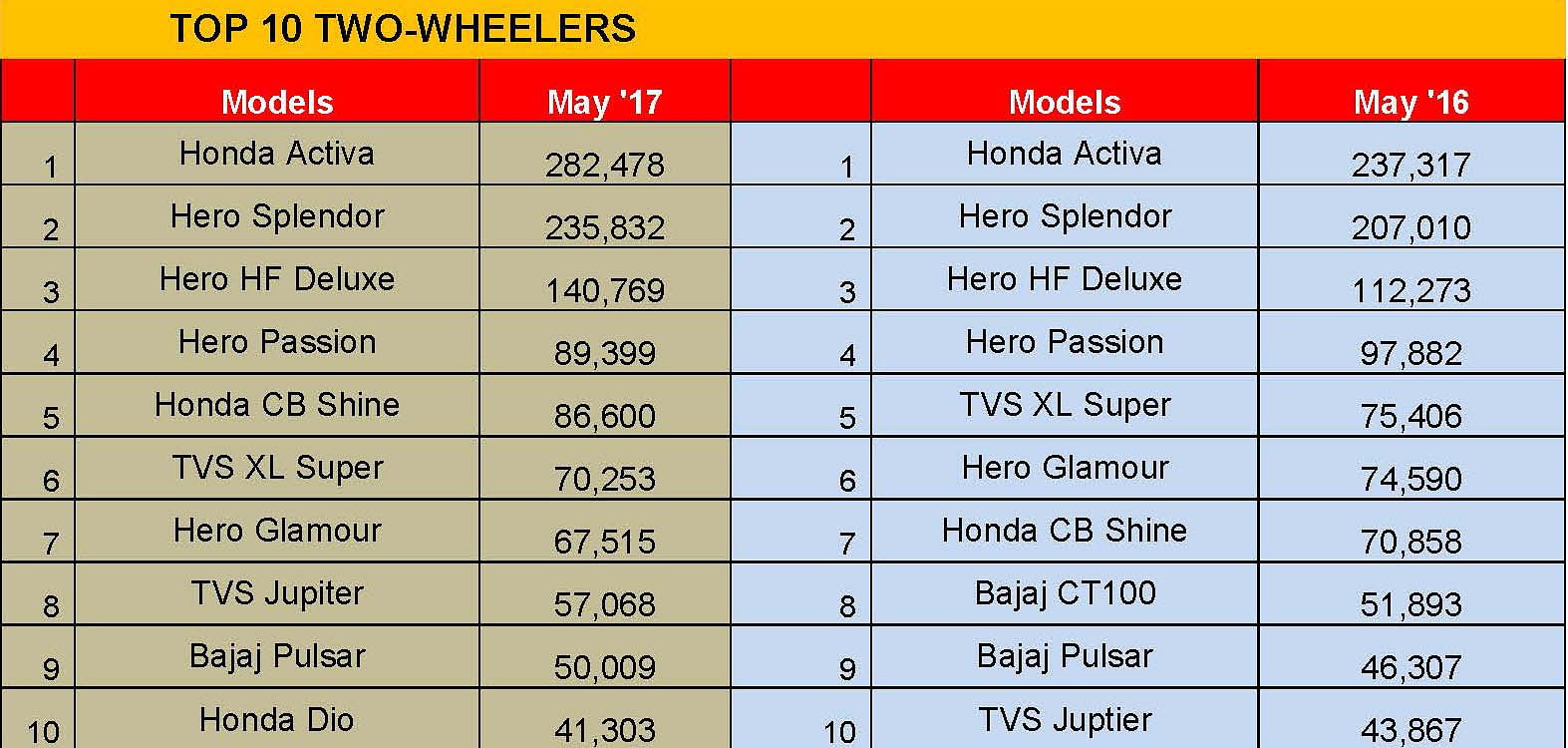

INDIA SALES: Top 10 Two-Wheelers – May 2017

The growing impact of scooterisation on the two-wheeler industry can be seen in the fact that three models have wrestled their way into the Top 10 two-wheelers list.

The ride is back into the Indian two-wheeler market, particularly the motorcycle segment which had seen the sales speedbreaker in the form of demonetisation break its momentum from November last year. The good news is that the sales pace is back and can get only better from now onwards.

The growing impact of scooterisation on the two-wheeler industry can be seen in the fact that three models have wrestled their way into the Top 10 two-wheelers list.

The best-sellers list now contains the Honda Activa, TVS Jupiter and Honda Dio. Typically, the Activa and Jupiter feature in the Top 10 list each month. The entry of another popular scooter brand points to the changing preference of Indian two-wheeler buyers as a preferred mode of commuting.

Honda Activa stays on top

Continuing to be the top selling two-wheeler in India, the Honda Activa brand reported sales of 282,478 units in May 2017, outselling its arch rival, Hero Splendor, by 46,646 units.

In May 2016, Honda’s most popular scooter brand had beaten the Hero Splendor by 30,307 units. The gap between these two high-selling models has only widened over the past 12 months. Earlier this year, the Activa crossed the 15 million sales landmark in India.

The Hero Splendor, with sales of 235,832 units in May 2017, is the second largest selling two-wheeler brand. However, Hero MotoCorp remains unbeatable in the commuter motorcycle segment as the Splendor continues to be the largest selling motorcycle family in India by far. The iSmart model, which is the most fuel-efficient two-wheeler in the country by delivering 103.5 kilometres per litre, is a big contributor to overall Splendor sales.

At No. 3 is yet another 100cc mass commuter motorcycle from Hero’s stable – the HF Deluxe. This model sold 140,769 units in May 2017 as against sales of 112,273 units sold in May last year.

Hero MotoCorp’s Passion brand stands at the fourth spot with sales of 89,399 units, down by 8.67 percent YoY.

Honda’s CB Shine, which is also the bestselling motorcycle in the 125cc executive commuter segment, stands as the fifth top-selling model with sales of 86,600 units in May 2017. The Honda CB Shine had ranked seventh in May last year with sales of 70,858 units.

TVS Motor’s moped, the XL100, ranks sixth in May 2017 with sales of 70,253 units. The iconic two-wheeler model, which is among the very few two-wheelers in India that have a customer base of more than one crore families, continues to fetch solid volumes month-on-month for the company.

At No. 7 is the Hero Glamour, arch rival to the 125cc Honda CB Shine. It sold 67,515 units in May 2017.

Moving upwards in the Top 10 list, the TVS Jupiter is now the eighth bestselling two-wheeler model in India with sales of 57,068 units in May 2017. The top selling scooter from TVS Motor’s stable is a solid performer and has grown by 30.09 percent YoY in terms of sales.

Bajaj Auto’s Pulsar remains the ninth top selling two-wheeler brand in May 2017. It sold 50,009 units, up by 7.99 percent YoY.

Honda’s Dio scooter is the latest entrant in the Top 10 two-wheelers list. The model bags the last spot with sales of 41,303 units in May 2017.

Honda grows market share while Hero MotoCorp loses some

In the market share analysis for the April-May 2017 period, it can seen that the battle between leader Hero MotoCorp and No. 2 player, Honda Motorcycle & Scooter India (HMSI) is getting hotter. Sales figures for the first two months of FY2018 reveal that while Hero MotoCorp, which sold a total of 1,198,674 units (+2.59%), has seen its market share fall from 38 percent to 31.52 percent in end-May 2017, HMSI with sales of 1,062,113 units (+27.98%) has increased its market share from 26.99 percent in May 2016 to 31.52 percent in May 2017.

The same period has seen No. 3 OEM, Bajaj Auto also lose market share. With sales of 318,453 motorcycles in April-May 2017 (-16.25%), the company has seen its market share drop from 12.37 percent to 9.45 percent.

TVS Motor, which has sold 446,049 units in the two-month period, has seen marginal market share growth, from 13.16 percent a year ago to 13.24 percent.

If the sales momentum is maintained, there is no reason why the industry would not cross FY2017 sales of 17.5 million two-wheelers.

ALSO READ:

Top 10 Passenger Vehicles – May 2017

Top 10 Passenger Cars – May 2017

Top 5 Utility Vehicles – May 2017

PV, CV and Two-Wheeler Sales in May 2017

RELATED ARTICLES

E2W OEMs open FY2026 with best-ever April sales, TVS is No. 1 for the first time

With 91,791 electric scooters, bikes and mopeds sold and stellar 40% YoY growth, April 2025 registers best-ever retail s...

Mahindra XUV 3XO sells over 100,000 units to be M&M’s second best-selling SUV in FY2025

Launched exactly a year ago, the face-lifted version of the XUV300 with sales of 100,905 units turned out be Mahindra & ...

Mahindra Thar Roxx and Tata Curvv best-selling new SUVs in FY2025

With over 125 models and a mind-boggling 1,000-plus variants, utility vehicle buyers in India are spoilt for choice. Whi...

18 Jun 2017

18 Jun 2017

45810 Views

45810 Views

Autocar Professional Bureau

Autocar Professional Bureau