INDIA SALES ANALYSIS: SEPTEMBER 2016

The festive season seems to have come a little early for the Indian passenger vehicle and two-wheeler segments as sales in September jumped on the back of record despatches by top manufacturers.

The festive season seems to have come a little early for the Indian passenger vehicle industry as car sales in September 2016 jumped on the back of record despatches by top manufacturers.

Anticipating a strong festive season on the back of an above-normal monsoon boosting farm production across the country, improved market sentiment and also a flurry of new, affordable models in the past 6-8 months, most carmakers pushed the stock in bulk to dealers in September.

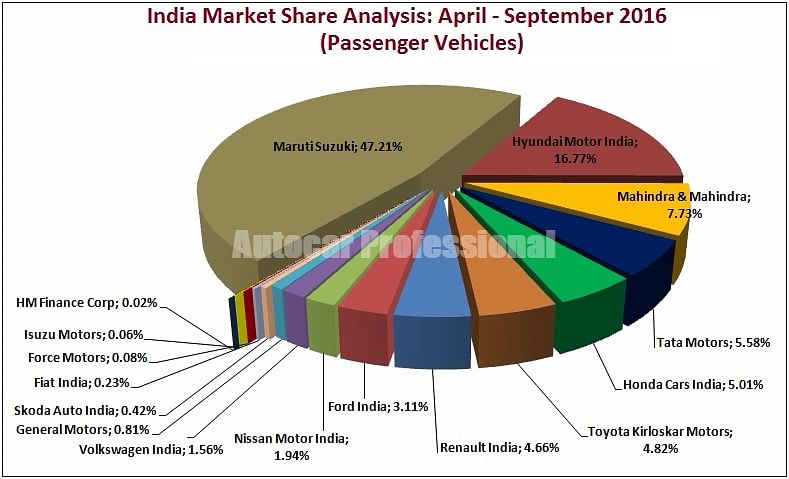

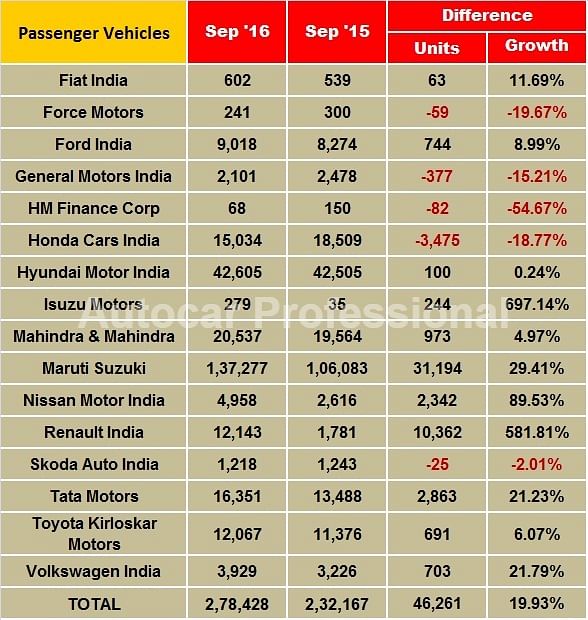

Maruti Suzuki India, the largest carmaker, recorded its highest ever sales during the month – a humongous 137,321 units – which mark a sharp 29.4% year-on-year growth in the domestic market.

Sales across all categories have done well. The entry-level duo of the Alto and Wagon R sold a total of 44,395 units, up 24.8%, indicating that sales momentum has returned to this pair. The compact car quintet of the Swift, Ritz, Celerio, Baleno and Dzire went home to 50,324 buyers last month, up 12.3% YoY.

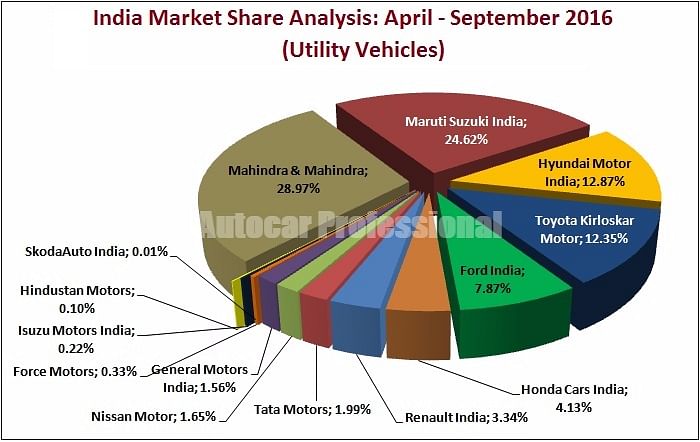

The premium Ciaz sedan also increased its contribution to group sales by 6,544 units, up 52.5%. With this Maruti’s passenger cars sold a total of 105,236 units, up 19.7% YoY. The big boost to sales though came from the utility vehicles which, as a segment of the overall industry, is notching handsome gains month on month.

Maruti sold a total of 18,423 UVs last month compared to 6,331 units in September 2015, a 191% YoY growth. The big contributor to September’s big number is the much-in-demand Vitara Brezza which continues to command a sizeable waiting period. Meanwhile, the Omni and Eeco vans too see demand coming their way, selling 13,618 units, growing 15% YoY.

Hyundai Motor India registered domestic sales of 42,605 units, up marginally in September. The Korean carmaker’s exports of 16,606 units resulted in cumulative sales of 59,211 units for the month of September 2016.

According to Rakesh Srivastava, senior vice-president (Sales and Marketing), Hyundai Motor India: “We hope that the festive season will see a benchmark growth in the industry with the evenly spread monsoon along with the 7th Pay commission building to positive sentiments in the market.”

The carmaker, which recently introduced the new Elantra sedan for the executive segment is all set to bring the Tucson SUV to India later this month. A rival to the CR-V, the Tucson is likely to get both petrol and diesel engines; prices to start from Rs 17 lakh. Both the new models are likely to further contribute to the growing sales of the Korean manufacturer.

Mahindra & Mahindra’s passenger vehicles division clocked sales of 20,537 vehicles in September 2016 as against 19,564 vehicles during September 2015, a growth of 5%. This number comprised 19,206 UVs (+3%) and 1,331 cars and vans (+57%).

Commenting on the auto sales performance for September 2016, Pravin Shah, president and chief executive (Automotive), said, “A good and near-normal spread of monsoon, as well as new vehicle launches, have helped the auto industry perform positively. We do hope that the upcoming festive season brings in better demand due to improved sentiments. We are happy to have achieved an 11% growth (across PV, M&HCV and three-wheeler divisions) during the first six months of the current financial in spite of the various uncertainties and challenges. Our exports during the six- month period have seen a good growth of 18%. We hope to continue this momentum for the remaining part of the year.”

Toyota Kirloskar Motor sold a total of 12,067 units in the domestic market, thereby registering a 6% growth when compared to the same period last year. In addition, the company exported 1100 units of the Etios series.

Commenting on the monthly sales, N Raja, director and senior vice-president (Sales & Marketing), Toyota Kirloskar Motor, said: "The recently launched Innova Crysta has received an overwhelming response from the market including the Delhi and NCR region. The lifting of the ban has opened the order flow for Innova Crysta diesel vehicles in Delhi, resulting in an average waiting period of 1.5 to 2 months. We are trying our best to bring the waiting period down."

"The unfortunate unrest in Bangalore and the imposition of Section 144 in the State resulted in a two-day production shutdown, impacting our commitment of on-time delivery of cars and parts to our customers. However, we have resumed production at our Bidadi plant and are geared up to meet demand during the upcoming festive season."

Tata Motors’ passenger vehicles business sold 14,601 units during the month to record 24% growth. The passenger car sales continued its growth momentum due to strong demand for the recently launched Tiago hatchback.

Cumulative sales growth of all Tata passenger vehicles in the domestic market were 72,665 units, a growth of 12%. The automaker is also set to launch another SUV in the form of the new Hexa soon. Given the good response to the Tiago, the Hexa is also expected to stir up the market and could give a much-needed boost to sales.

Meanwhile, Honda Cars India continued to face headwinds in the domestic market and sales fell for the third straight month in September. The Japanese carmaker despatched 15,034 units in the month, down 16.7% YoY marking another month of slowing sales.

The model-wise split of its sales is City (5,855), Amaze (2,861), Jazz (2,608), Brio (1,209), BR-V (2,193), CR-V (47) and Mobilio (261).

Nissan Motor India reported domestic sales of 4,948 vehicles in September 2016 versus 2,616 units a year ago in September 2015. The Japanese carmaker reported 89% year-on-year growth in sales for September 2016.

Closing the first half of this financial year on a high note, Nissan also reported a robust 48% growth, with 29,029 units sold in the period between April and September this year against 19,563 units in the same period last year.

Commenting on the sales results, Arun Malhotra, managing director, Nissan Motor India, said, “Fiscal 2016 has been encouraging for us, especially the last quarter. Nissan has delivered solid results and we will begin the next quarter & festive season on a good note. Datsun Redigo sales continue to be strong and we are delighted by its acceptance with consumers in India.”

Two-wheeler OEMs hit peak sales in September 2016

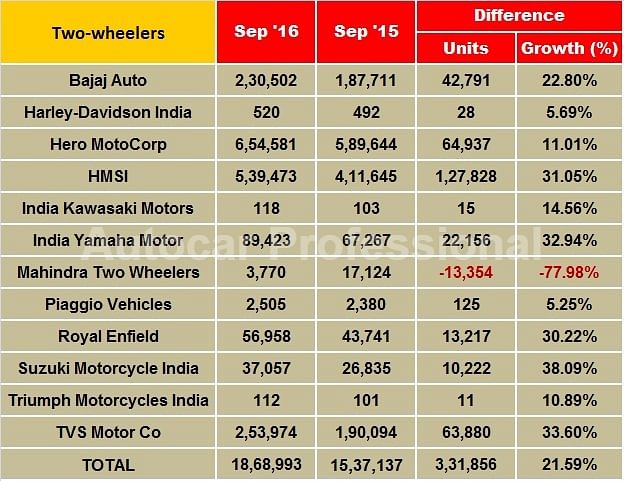

As expected, monthly sales reported by two-wheeler companies in India reflect surging sales across the domestic market on the back of the festive season. While the companies are working hard to build up their stock inventories across regional yards and dealerships, most of them have also reported their best-ever market performance for September 2016.

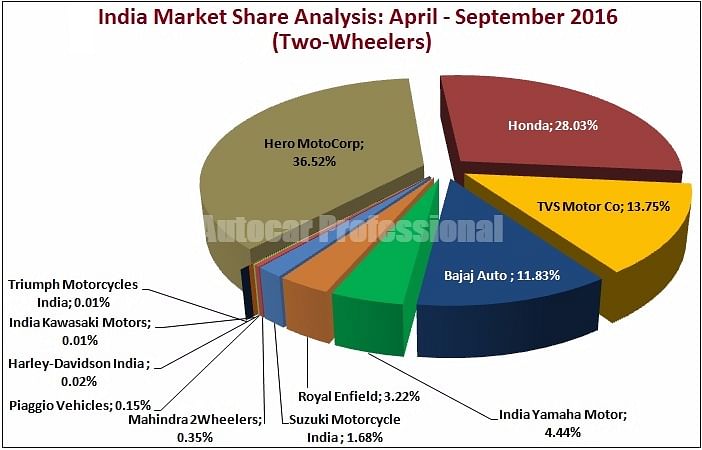

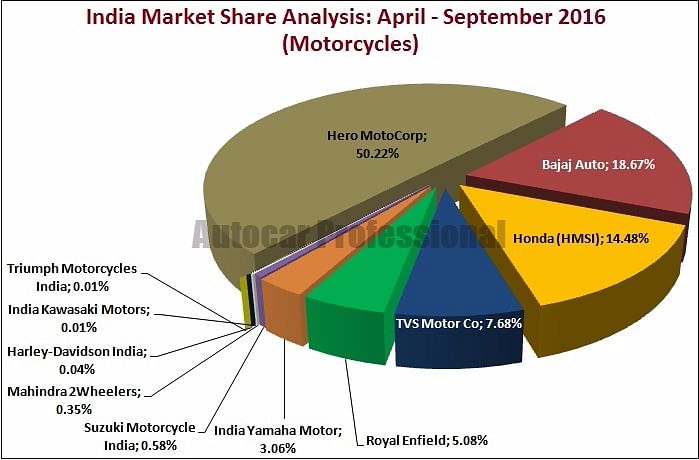

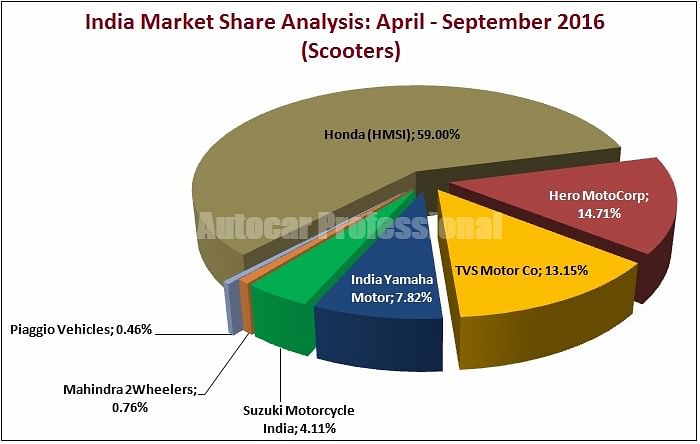

Hero MotoCorp (HMCL), Honda Motorcycle & Scooter India (HMSI), Bajaj Auto (BAL), India Yamaha Motor (IYM), Royal Enfield (RE) and others have reported to have achieved their peak monthly sales last month. While the two-wheeler industry is scaling new volumes, this also highlights a maturing and expanding market, which is being led by the growth in the scooter segment from the front. The growing market is also good news for the vendor community.

Hero MotoCorp sells 674,961 units, up 11%

Hero MotoCorp, India’s largest two-wheeler manufacturing company, has reported its highest-ever monthly sales for September 2016. The company sold 674,961 units last month, up by 11 percent YoY (September 2015: 606,744). Its previous highest was recorded in October 2015, when it had reported total sales of 639,802 units.

“This is the second consecutive month that Hero has sold 600,000-plus units, having clocked 616,424 unit sales in August; and the fourth this calendar year (March – 606,542 units & April – 612,739 units),” quotes the official press release.

The company, in its official communication today, credits growing sales of its scooter models, its 125cc Glamour and the successful reception of the Splendor iSmart 110 in the market. The latest Splendor model is the first grounds-up motorcycle designed and developed by the company’s in-house R&D team.

Hero has also rolled out an all-new 150cc Achiever motorcycle, which is now powered by a BS IV- compliant engine and comes equipped with Hero-patented start-stop (i3S) technology for enhanced impact on the fuel economy. It is clear that the company is looking to consolidate its position in the premium commuter segment, which is currently dominated by Bajaj Auto and India Yamaha Motor in the 150cc segment. Hero MotoCorp also has a clear focus on the basic commuting needs of its core customers including design and utility elements.

In terms of cumulative sales, the company has reported sales of 3,568,887 units in H1 FY2016-17 – its best-ever H1 performance in any financial year. According to the company, its previous highest H1 sales was recorded last year, when it had sold 3,407,652 units during the period.

In the press release, Hero MotoCorp has also claimed that it commands dominating market shares of 65 percent and 55 percent in 100cc and 125cc categories respectively.

Honda reports sales of 539,662 units, up 31%

Scaling new heights, Honda has also reported its best-ever performance for September 2016. Breaching the 500,000 unit mark for the first time in its history of Indian operations, Honda’s monthly sales skyrocketed to 569,011 units (including exports) in September 2016. The domestic sales for the month stood at 539,662 units, up by 31 percent YoY (September 2015: 411,635).

HMSI’s scooter sales crossed the 350,000 unit mark for the first time and peaked at 355,655 units for September 2016. Scooter sales grew by 35 percent over the 264,408 units sold in September 2015. The company also reported an impressive growth of 25 percent in its motorcycle sales, which stood at 184,007 units in September 2016. It had sold 1,47,227 units in the corresponding month last year.

Commenting on the new record sales in September 2016, Yadvinder Singh Guleria, senior vice-president, (Sales and Marketing), HMSI, said, “September was a historic month for Honda. The positivity in the economy led by 7th Central Pay Commission, One Rank One Pension (OROP) disbursements and favourable monsoon has translated to a robust return of demand in two-wheeler sector ahead of festivals. With total sales breaching 568,000 units in September 2016, Honda is the volume driver of the two-wheeler industry in India.”

“Honda’s festive planning started six months ago. By leveraging the 12 lakh additional production bandwidth coming from the fourth plant (Gujarat-based scooter facility), Honda is for the first time ever ensuring ready availability of all its models including the Activa throughout the festive season right up to its last mile rural network. Overall, led by festive buying, Honda is confident of bumper October sales.”

On the export front, the company has reported its best performance for the last month. An official release from Honda says, “With exports commencing from its third plant in Narsapura (Karnataka) Honda 2Wheelers India recorded its highest ever monthly exports of 29,349 units in September 2016 compared to 19,089 units last September.”

Honda’s H1 FY2016-17 sales stood at 2,809,878 units as against 2,272,129 units reported during the same period last year, marking a YoY growth of 24 percent.

In order to maximise the sales during this festive season, Honda is also offering several benefits to its customers in the form of direct cash benefits to central government and PSU employees, exchange bonus at pre-owned outlets, low interest rates through preferred finance partners and others.

Bajaj Auto sells 230,502 units, up 23%

Bajaj Auto, India’s leading motorcycle manufacturer and the largest exporter, has registered record sales for the month of September 2016. The company has sold 230,502 units in the domestic market, which could possibly be its peak performance over a long time, if not its highest-ever monthly sales in the domestic market.

The company has grown by 22.80 percent YoY. It had sold 187,711 motorcycles in September last year. It is to be noted that Bajaj Auto could breach the 200,000 unit mark only twice previously in its domestic sales in the recent past. Last year it sold 202,042 units in October. During the ongoing calendar year, it crossed the monthly milestone in April, when it had registered sales of 200,433 units.

Surging domestic sales can be attributed to its recent successes in the form of new Avenger line-up and the V15 model. While its 100cc mass commuter motorcycle CT100 continues to be a volume garner, models such as Avenger 150 and V15 have fetched additional volumes to the company, ensuring its YoY growth.

Autocar Professional estimates that the Avenger and the V brands would have together contributed more than 285,000 units cumulatively during Q1 and Q2 of the ongoing financial year. The sales from Pulsar and CT100 are also estimated to be at least in the range of 290,000-300,000 units, if not starkly more, during the same period.

Furthermore, while the company is now gearing up to cater to the demand during October 2016, it is now known that it has slated the launch of an all-new motorcycle under a new brand, which only reflects its strategy of increasingly focussing on premium motorcycle segment(s), in November.

The mastermind timing of all-new single-cylinder, 375cc motorcycle – touted to be Bajaj Auto’s take on India’s growing touring segment – only highlights the company’s intent of balancing out the conventional decline in sales during the post-festive months.

Cumulatively, the company has sold 1,128,425 motorcycles in the domestic market during Q1 and Q2, up by 18.14 percent YoY. Its H1 FY2015-16 domestic sales stood at 955,148 motorcycles. It is understood that if the company continues to perform with its month-on-month growth rate, it could achieve the milestone of two-million unit sales in FY2016-17 for the first time in its history.

Nevertheless, the company has registered a 28.80 percent decline YoY in its monthly exports. While it exported 101,474 units last month, the company data says that it had shipped out 142,517 motorcycles in September last year.

Bajaj Auto’s cumulative H1 exports stand at 6,41,529 motorcycles, which is down by 22.07 percent YoY. The company had exported 8,23,184 motorcycles during the same period last year.

TVS Motor Company sells 253,974 units, up 34%

TVS Motor Company has sold 287,449 units (including exports) in September 2016, growing by 30 percent YoY. The company had sold 220,971 units in September 2015. The domestic sales stood at 253,974 units in September 2016 as against 190,063 units sold in September last year. The sales have grown by 33.6 percent YoY.

The company has stated that it has lost production of around 25,000 units in September 2016 due to the disruptions in its supply chain operations.

India Yamaha sells 89,423 units, up 33%

India Yamaha Motor (IYM) has recorded highest-ever sales milestone in the history of its operations in the country for the month of September 2016. The company, which has been consistently growing month-on-month on the back of surging demand for its scooter models, has breached one-lakh unit mark in September including its domestic as well as export sales for the first time.

In its sales data, for the month of September 2016, the company has communicated that it has sold a total of 101,153 units. Of this, the domestic sales stood at 89,423 units (including Nepal) and the remaining sales of 11,730 units (excluding Nepal) were the exports for the last month.

The domestic sale for September 2016 is also its highest-ever, breaching its previous best of 74,868 units sold in August 2016. Positive sentiments around the festive season backed by healthy monsoons this year has helped the company record an additional sales of 22,156 units over its September 2015 sales of 67,267 units, thereby registering an impressive YoY growth of 32.94 percent.

Industry sales data confirms that Yamaha had first crossed the 70,000-unit mark in October 2015, which was duly reported by Autocar Professional. Notably, the company has crossed the 70,000-unit mark only three times so far, which includes October 2015, August 2016 and September 2016.

Commenting on the company’s record growth, Roy Kurian, vice-president, sales & marketing, Yamaha Motor India Sales said, “September has been a historic month for Yamaha. The total number of sales in the market reached an all-time high, which is a direct reflection of constant faith of customers along with the immeasurable passion shown by the network partners. Yamaha’s all round initiatives - sales, service, spare parts, network expansion and customer satisfaction - with exciting product line up and strategic customer engagement programs were also the key growth driver for Yamaha.”

It is known that the company had recently expanded the production of its popular scooter model Fascino from its Chennai plant to its Surajpur facility, ensuring that the model gets rolled out at both the locations on account of its increasing order book. The company is also understood to have been receiving encouraging response for the Ray-ZR model so much so that it had to prioritise the production capacity for its scooters over its motorcycles at its Chennai plant.

M&HCV sales slide continues in September

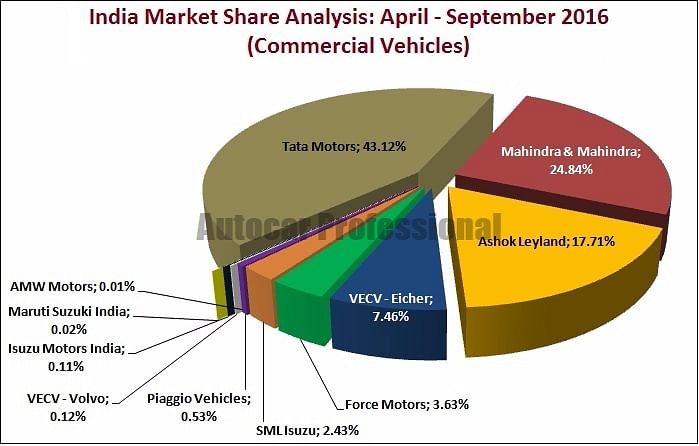

Drying replacement demand, less-than-expected Q1 GDP growth numbers and falling coal production has adversely affected demand for the medium and heavy commercial vehicle (M&HCV) segment as sales fell for the third month in a row.

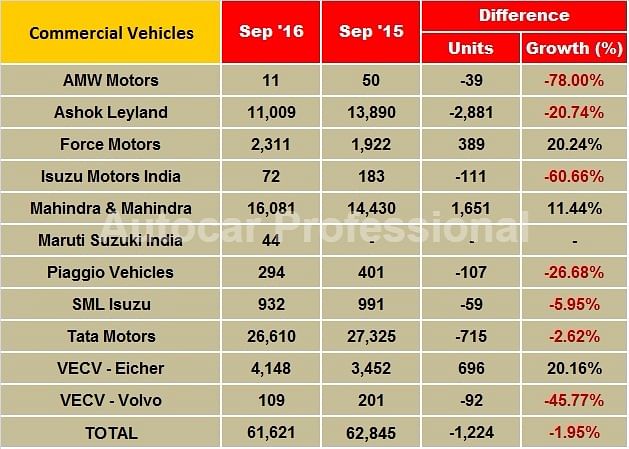

Sales numbers for September 2016 from various OEMs are indicative of a trying time for the M&HCV industry. Ashok Leyland, Tata Motors and Mahindra & Mahindra have reported lower sales in September.

Speaking to Autocar Professional, Sunny Manjani, consultant, Frost & Sullivan India, said: “FY2017 sales are expected to be flat. However, the upcoming BS VI emission norms will see pre-buying which will help the fiscal post a growth of 12-15%. Despite the fall in M&HCV sales in the past three months, numbers are expected to pick up following a good monsoon in parts of the country and rising consumption on the back of the festival season. There is still uncertainty regarding the final rate of GST; a lower rate is expected to bring truck prices down and due to this customers are delaying their buying decisions,” he said.

According to the Indian Foundation of Transport Research & Training (IFTRT), which tracks truck movements in the country, “September truck rentals went up by 4-5% on trunk routes with improvement in truck fleet round trips by 15-20%, leading to significant improvement in existing fleet utilisation as arrival of fruits, vegetables, pulses and other food items into APMC’s 'Anaj Mandis' by 20-25%. Also, after about 4-5 months, cargo shipments from the manufacturing sector too have displayed 10-15% extra movement with small and medium manufacturing units (SMEs) taking the lead due to demand for festival season items across the country. There’s more demand coming from Tier-2 and Tier-3 cities in terms of higher consumer spending and increased salaries of government employees due to Seventh Pay Commission payments. The overall factory output from consumer durables, cement, construction materials, paints, motor car/vehicle/tractor transportation, fertilisers and general merchandise have also seen extra movement from production centres to retail markets during September 2016.”

In the monthly sales, Tata Motors' overall commercial vehicles sales remain negative. The company sold 26,610 CVs in the domestic market in September 2016, down 2.62% (September 2015: 27,325 units. Sales of Tata M&HCVs plunged consecutively for the third month. However, saving the blushes for the company, its LCV sales continued their upward trend by notching 19% growth in September 2016.

Ashok Leyland’s total numbers declined 21% YoY with sales of 11,009 units (September 2015: 13,890 units). Like Tata Motors, its M&HCV numbers saw a sharp 26% decline with sales of 8,963 units (September 2015: 12,146 units). LCV sales though grew by 17% with sales of 3,094 units. (September 2015: 2,637 units).

Mahindra & Mahindra’s total commercial vehicles sales were up by 11% with sales of 16,081 units (September 2015: 14,430 units). Its M&HCV sales fell by 29%, with sales of 364 units (September 2015: 511 units). Demand for the below-3.5T GVW products rose by 14% growth with sales of 15,282 units (September 2015: 13,460 units), while those in the above-3.5T GVW segment decreased 5% YoY with sales of 435 units (September 2015: 459).

VE Commercial Vehicles maintained its double-digit growth with 20.16% with total domestic sales of 4,148 units in the domestic market (September 2015: 3,452).

Also read:

- India Sales Outlook: PV sales to post double-digit growth in FY17

RELATED ARTICLES

Suzuki Dispatches 703 e-Access Scooters in January, Delivers 201 Units to Customers

Suzuki Motorcycle India’s first electric scooter, priced at Rs 188,000 and among the most expensive two-wheeled EVs, reg...

Honda Sells 5,445 Activa-e and QC1 e-Scooters in 12 Months

Since February 2025, Honda Motorcycle & Scooter India has produced 11,168 e-scooters, dispatched 5,445 units to its deal...

Kia Carens Sells 277,000 Units in Four Years, Clavis And Clavis EVs Power 24% Growth in FY2026

The Carens MPV, which turns four years old today, accounts for a 27% share of Kia India’s sales of 10,43,126 utility veh...

By Autocar Professional Bureau

By Autocar Professional Bureau

03 Oct 2016

03 Oct 2016

41468 Views

41468 Views

Ajit Dalvi

Ajit Dalvi