INDIA SALES ANALYSIS: AUGUST 2016

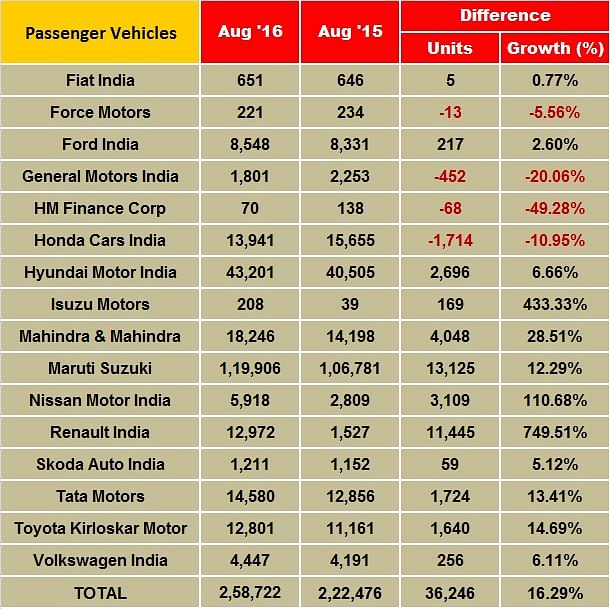

Going by the sales numbers of Maruti Suzuki India, Mahindra & Mahindra, Toyota Kirloskar Motor, Renault India and Nissan India, passenger carmakers are clearly benefiting from the flurry of new models introduced in the past year.

As Indian passenger vehicle manufacturers began revealing their domestic market sales numbers for August 2016, it was amply clear that the tide has turned in their favour.

With an above-normal monsoon boosting farm production across the country, improved market sentiment and a flurry of new, affordable models in the past 6-8 months, good times have returned to the PV market. What’s more, with the festive season all set to open in a few days from now, expect the sales numbers to get better in the coming months.

Maruti Suzuki India, the bellwether for the Indian automobile industry, set the tone for the month. Sustaining the strong momentum from July, the country’s largest carmaker reported yet another month of robust sales, clocking 12% YoY growth in despatches at 119,931 units in August.

A flourishing monsoon, high demand for its new models and the improving buyer sentiment ahead of the festive season augured well for the country’s largest carmaker during the month. Together with exports, the carmaker has sold a total of 132,211 units in August 2016, growing 12.2 % over August 2015 (117,864 units).

The company’s product-wise sales split clearly points out to that the new models are now the driving force behind Maruti’s sales juggernaut. In August, the entry level duo of the Alto and Wagon R sold a total of 35,490 units, down 5.8% YoY (August 2015: 37,665) while the quintet of the Swift, Ritz, Celerio, Baleno and the Dzire sold a total of 45,579 units, up 9.9% YoY (August 2015: 41,461), with the Baleno being the prime driver in this segment.

The Ciaz sedan, reported yet another month of sales over 5,000 units, likely outselling its closest rival Honda City with 6,214 units in August 2016, up 49.5% YoY (August 2015: 4,156).

The utility vehicle segment continued to provide the sales fillip to the company in August with the Vitara Brezza clocking impressive numbers.

The UVs comprising the Gypsy, Ertiga, Grand Vitara, S-Cross and the Vitara Brezza sold 16,806 units, up 114.5% YoY (August 2015: 7,836). The Vitara Brezza, which was launched in March 2016, became the country’s most sold UV in July with sales of over 10,000 units and is expected to once again be a top contender for the title in August. Though Maruti is working on ramping up production for the Vitara Brezza, it continues to command a waiting period of over six months.

The Omni and Eeco vans meanwhile keep up their sales act. Together they sold a total of 12,831 units last month, up 2.7% (August 2015: 12,491).

Hyundai Motor India, the country’s second-largest carmaker, registered domestic sales of 43,201 units, up 6.7 percent year on year (August 2015: 40,505) and exports of 16,506 with cumulative sales of 59,707 units for the month of August 2016.

Commenting on the August sales, Rakesh Srivastava, senior vice-president (Sales and Marketing), Hyundai Motor India, said, “ Hyundai’s volume of 43,201 units continues to build on the growth momentum with the added multiplier effect with the launch of the new Elantra.”

UV manufacturer Mahindra & Mahindra posted a 29% YoY growth in UV sales in August. It sold a total of 18,246 passenger vehicles (cars, utility vehicles and vans) in August 2016, up 29% (August 2015: 14,198). This includes 17,119 UVs, which is a smart 29% year-on-year growth (August 2015: 13,307).

Commenting on the auto sales performance for August 2016, Pravin Shah, president and chief executive (Automotive), M&M, said, “The improved spread of monsoon, as well as new product launches, have helped the auto industry perform positively. Coupled with this, the uncertainty surrounding diesel vehicles has been lifted by the Supreme Court giving the customer the choice to buy his preferred vehicle which will help improve sentiments going forward. At Mahindra, we are happy to have garnered an overall growth of 14% and a growth of 29% in UVs during the last month and we hope that the ensuing festive season will give us a further boost.”

Toyota Kirloskar Motor, which will see sales moving again in Delhi-NCR after the lifting of the diesel ban, has sold a total of 12, 801 units in the domestic market, posting a 15% growth in its domestic sales in the corresponding period last year (August 2015: 11,161). The company exported 1,244 units of the Etios series in August compared to 1,386 units in August 2015.

Commenting on the monthly sales, N Raja, director and senior vice-president (Sales & Marketing), Toyota Kirloskar Motor, said: "We launched the Innova Crysta petrol last month and have received a very good response from the market. Being the first in its segment, the petrol variant will further contribute to the success of the new Innova Crysta. We welcome the Supreme Court's decision on lifting the ban on registration of over 2000cc diesel vehicles in NCR-Delhi. The lifting of the ban has opened the order flow for Innova Crysta diesel vehicles in Delhi and this might increase the waiting period for the Crysta. We are doing our best on reducing the waiting period.”

You may like: Passenger vehicle sales in India double in a decade

Meanwhile, the Camry has already sold more than 1,060 units from January to August 2016, which exceeds the total number of Camry sold in 2015 (1,048). Toyota says nearly 95% of this sale is contributed by the Camry Hybrid alone.

Honda Cars India registered monthly domestic sales of 13,941 units in August 2016, down 10.95 percent (August 2015: 15,655). The model-wise split of its sales is City (4,255), Amaze (2,488), Jazz (3,818), Brio (784), BR-V (2,229), CR-V (77) and Mobilio (290).

Speaking of the company’s performance, Yoichiro Ueno, president and CEO, Honda Cars India, said, “We have been continuing our sales efforts to streamline our stock levels at the dealerships and are geared up for the festive season starting from this month in some parts of the country. We are witnessing good demand for models and expect good sales on account of the favourable monsoon and the upcoming festive season.”

Meanwhile, Tata Motors' passenger vehicles division recorded domestic sales of 13,002 units, up 16.47% compared to the 11,163 units its sold in August 2015.

Sales of passenger cars in August 2016 was higher by 17% at 11,435 units, compared to 9,814 units in August 2015, due to strong demand for the recently launched Tiago. Cumulative sales growth of all passenger vehicles in the domestic market stood at 58,064 units a growth of 10%, compared to 52,986 units in August 2015.

Riding on the game-changing Kwid hatchback, Renault India has registered its highest ever monthly sales of 12,972 units in August 2016 (August 2015: 1,527). The carmaker recently launched the Kwid 1.0-litre SCe (Smart Control efficiency), which offers an upgrade to a more powerful engine and one that consumers were missing.

Together with its product offensive strategy to drive volumes in India, Renault is also substantially increasing its sales and network reach in India. From the current network strength of 221 outlets, Renault aims to increase its reach to 270 outlets by the end of 2016.

Nissan Motor India is also seeing a good run of sales in the domestic market. The carmaker has reported domestic sales of 5,918 vehicles in August 2016, up 110% year on year (August 2015: 2,809).

Commenting on the sales results, Guillaume Sicard, president, Nissan India Operations, said, “This is the third straight month that Nissan Motor has sold over 5,000 vehicles in one month. Our robust performance continued in August thanks to the strong sales of the Datsun Redigo and its positive reception across India. We were also delighted to be ranked second in the JD Power Asia Pacific 2016 India Sales Satisfaction Index (SSI), which shows we are providing a better experience to customers.”

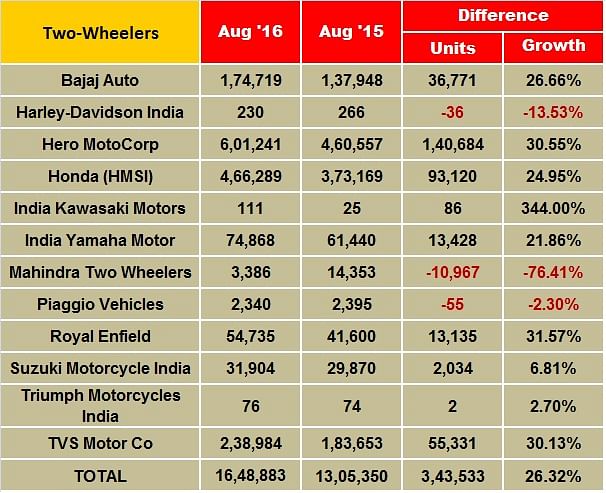

Two-wheeler sales surge in August 2016, OEMs record 30% growth

Like the passenger vehicle industry, the two-wheeler industry too is seeing sales surge following a good monsoon, return of demand from the rural markets, and release of funds from the Seventh Pay Commission.

Among the two-wheeler companies which have reported their August 2016 sales, Hero MotoCorp stands as the largest volume gainer. The total volumes of the big four (Hero, Honda, TVS and Bajaj Auto), India Yamaha and Royal Enfield add up to 1,626,072 units for the last month. This marks a record 27.20 percent YoY growth. In August last year, these companies had jointly sold 1,278,314 units.

Hero MotoCorp (HMCL), India’s largest two-wheeler manufacturer, has reported total sales of 616,424 units in August 2016 including exports. This marks a YoY growth of 28.28 percent for the month. The company had sold 480,537 units in August 2015. However, it is still to be seen if Hero MotoCorp’s domestic sales for August 2016 have breached the 600,000-unit mark. Nonetheless, August 2016 sales remain the highest for the company so far for this fiscal.

While the company, in its official note, says that August 2016 marks the third month when it has sold more than 600,000 units this year; industry sales data shows that Hero MotoCorp had last breached the 600,000 mark in April 2016. It had sold 600,525 units in the domestic market and had exported 12,214 units overseas.

The company, which has recently launched an all-new Splendor iSmart 110, is receiving a good response to the model. Additionally, it continues to outsell Honda in the 125cc motorcycle segment, thanks to the Glamour model, which also has a fuel-injection variant on sale.

To further boost its growing sales and bank upon the high demand during the festive season, Hero MotoCorp plans to soon roll out upgrades of its three existing motorcycles. This will include the 150cc Achiever, 125cc Super Splendor and a 100cc Passion Pro. The new launches are a part of its massive product rollout plan to push sales globally.

In an official release, the company has said, “Hero MotoCorp will launch 15 new products across segments in its domestic and global markets this fiscal, out of which three motorcycles will be introduced in the domestic market before the festive season. These include the new Achiever 150cc motorcycle and the Super Splendor and Passion PRO with the Hero patented i3S technology.”

Notably, the company aims to realign itself in the highly competitive 150cc segment by rolling out a new variant to Achiever. Additionally, it eyes further consolidation in the 125cc segment (via new Super Splendor) and lift the falling sales of Passion by equipping the 100cc Passion Pro with its popular iSmart technology.

Market analysts say that the company is already working to build its inventory and stock up its dealerships to cater to the anticipated demand during September and October.

Registering its best-ever monthly performance, Honda Motorcycle & Scooter India (HMSI), has reported total sales of 492,416 units for August 2016, growing by 24.60 percent YoY. It had reported total sales of 395,196 units in August last year.

On the domestic front, HMSI has recorded sales of 466,342 units last month, outselling its August 2015’s sales by a solid margin of 93,206 units. This marked a YoY growth of 25 percent for the company, which has come on the back of the soaring sales of its Activa scooter models.

HMSI’s scooter sales have yet again crossed the 300,000-unit mark – the second month in a row – to reach its bestselling volumes in August 2016. According to Honda, it sold 336,393 units of its scooters during the last month and marked a YoY growth of 27 percent. It had sold 246,763 scooters in August last year.

On the motorcycle sales front, it has reportedly sold 129,949 units last month, growing by 11 percent YoY. The company credits growing customer demand and additional production capacity going on stream as the primary factors behind achieving its record sales in August 2016. The company has also recorded its best-ever exports, which stood at 26,074 units for last month.

Commenting on HMSI’s sales, Yadvinder Singh Guleria, senior VP (Sales & Marketing), said, “August has been a historic month for Honda 2Wheelers India. Adding over 93,000 units (YoY basis), Honda’s total sales, automatic scooter sales and exports reached all-time high in August 2016. In just two months’ record time and before schedule, Honda has achieved 100 percent peak production levels at its second assembly line at the recently inaugurated Gujarat plant. The new capacity of our fourth plant gives us wings to grow at a faster pace and prepare for the festive period like never before.”

HMSI will look forward to cross the monthly milestone of 550,000 units during the festive months – September and October 2016. It is also pushing for sales under its pre-owned two-wheelers’ division, Best Deals. It has a Best Deal network of 107 outlets in 81 cities across 20 States.

TVS Motor Company too has reported an impressive growth in its domestic sales for last month. It has sold 238,984 units in August 2016, marking a jump of 30.13 percent YoY. The company had sold 183,653 units in August 2015. Leading TVS’ growth is its best-selling Jupiter scooter, also a potent rival to Honda Activa in the 110cc segment.

The company is now expected to soon roll out the BMW G 310 R, an entry-level naked street motorcycle powered by a single-cylinder, 313cc engine, built under TVS Motor Company’s alliance with Germany’s BMW Motorrad.

Autocar Professional had earlier reported that the motorcycle will reach the retail showrooms in the second half of FY2017. With the latest news broken by our sister publication, Autocar India, the companies may plan several models based on the 313cc powertrain, and this may also include an adventure-tourer. TVS had already displayed a faired version of the naked model built on the BMW’s G 310 R platform at the Auto Expo earlier this year.

It would be interesting to see TVS Motor climb higher in the mid-size motorcycle segment, possibly in the coming months.

Bajaj Auto has recorded total domestic sales of 174,719 units in August 2016, up by 26.66 percent YoY. The Pune-based company had reported sales of 137,948 units in August last year. The company, which has been gearing up to redefine the touring segment with its incoming Pulsar model based on a KTM-derived single-cylinder, 375cc engine, looks to further enhance its presence in the premium motorcycle space with the said model. Bajaj Auto has witnessed successful models in the recent past including Bajaj V15, new Avenger 150cc and 220cc models and the Pulsar RS200. The Pulsar brand, along with CT100 variants, helps the company amass volumes in the growing market.

Reporting its highest sales for any month, India Yamaha Motor has announced a 22 percent growth in its domestic sales, which also includes Nepal, in August 2016. The company has sold 74,868 units as against 61,440 units sold in August 2015.

The company has recently expanded the production of its best-selling scooter model, the 113cc Fascino to its Surajpur plant in North India. The model has been produced at the Chennai plant since its launch in June last year. According to Roy Kurian, vice-president (Sales & Marketing), Yamaha Motor India Sales, the company had to recently prioritise its limited production capacity to scooters for quickly meeting the soaring demand backlog.

The Fascino, which has been allocated additional production capacity, and the Ray-ZR are witnessing record demand in the market, say company officials.

According to an official company release, Yamaha’s increasing focus on expanding to Tier 2 and Tier 3 cities, thus reaching out to larger groups of the target population, has also been instrumental in boosting sales.

Commenting on his company’s sustained growth, Kurian said, “Yamaha has received a fantastic response from the market for its impeccable line-up of scooters like the Yamaha Fascino, Cygnus Alpha (disc brake) and newly introduced Cygnus Ray-ZR.”

Yamaha’s 110cc Saluto RX, which undercuts all other 110cc motorcycles in the market currently, is estimated to see some notable traction in the market in the coming months.

Royal Enfield posted total domestic sales of 54,735 units in August 2016, marking a YoY growth of 31.57 percent. The company had sold 41,600 units in August last year. The company has recently increased the prices of its models in the range of Rs 1,000 – Rs 4,000 across all models. Analysts attribute Royal Enfield’s surging brand equity in the market over this development.

Faring decently with the Himalayan, the company has found buyers for its latest product, which is powered by the single-cylinder, 411cc long-stroke engine. The adventure-tourer Himalayan is estimated to be fetching steady sales of close to 1,000 units every month.

Royal Enfield’s monthly production is estimated to reach the 60,000-unit mark by the end of the ongoing fiscal.

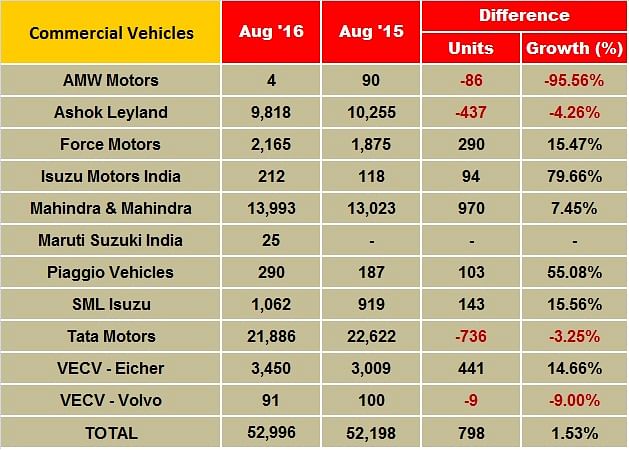

Tata Motors’ M&HCV sales drop 17% in August

Tata Motors, the largest commercial vehicle manufacturer by volumes in India, has seen its M&HCV vehicle sales slide for the second consecutive month in August 2016.

After July’s 9% sales decline, M&HCV sales for Tata Motors, which has been expecting overall growth of the M&HCV sector in FY2017, plunged by 17% last month. Ashok Leyland also saw its M&HCV sales decline by 8% while Mahindra & Mahindra and VE Commercial Vehicles maintained growth levels.

Also read: M&HCV sales in India fall after 23 months of growth

Talking to Autocar Professional, Ravi Pisharody, executive director, commercial vehicles, Tata Motors, said, “This dip was not expected and I would wait for another 2-3 months to see how this sustains. There could be a couple of reasons for this as generally monsoon are soft and we don’t expect the volume to go below last year, given that last year’s base is quite high which was close to the previous peak. We still see a good pipeline of orders and the deals are taking a longer time to take place.”

In its August report, ratings agency ICRA said, “The sudden contraction in M&HCV (truck) sales can be explained by a confluence of factors including waning of replacement-led demand, weak cargo generation from industrial sectors and a slowdown in construction and mining activity owing to severe rainfall in some parts of the country. The recent correction in CV demand also appears to be on account of higher channel inventory, which is expected to correct in the next few months.”

“Given the weak industrial activity and seasonal impact (on account of monsoon), the demand for CVs is likely to be subdued in the near-term. In addition, the growth in percentage terms would also be influenced by high-base effect as sales in Q2 FY 2016 benefitted from pre-buying due to the implementation of ABS from October 2015 onwards,” said Subrata Ray, senior group vice-president at ICRA Ratings.

Recommended: Tata Motors pushes CV exports to ease domestic headwinds

“We believe that demand would revive from H2 FY2017 on account of pre-buying ahead of the implementation of BS-IV norms (due to 6-10% price differential between BS-III and BS-IV) across India from April 2017; pick up in construction and mining activity after the monsoon season; and expectation of revival in consumption-driven sectors owing to rural recovery as well as favorable impact of the Seventh Pay Commission and OROP on disposable incomes”, he says.

Fall in truck rentals

In August, truck rentals have dropped by 2.5-3% on trunk routes. According to the Indian Foundation of Transport Research & Training (IFTRT), which tracks truck movements in the country, “While truck rentals dropped further by 3% during the first three weeks of August on the back of weak arrivals from agricultural food sector as manufacturing was moderately stable as diesel price was cut down by Rs 4.01 a litre in two trenches, the last week of August saw the tapering off of monsoon rains in different parts of the country and helped the sudden jump in arrival of fruit and vegetables by 20%-25% in the APMCs. This gave support to truck rentals to stabilise with better fleet utilisation.”

“Implementation of GST also has created panic among fleet owners and they have somewhat put a brake on fresh buying of heavy trucks. Even the pre-buying rush of BS-III trucks is looking to be somewhat uncertain as the GST will bring down BS-IV norm trucks as against the fear of price rise. Thus, the truck market situation is very fluid,” notes IFTRT.

How the OEMs fared in August

In the monthly sales, Tata Motors' overall commercial vehicles sales remained negative. The company sold 23,464 CVs in the domestic market in August 2016 (August 2015: 24,284), down by 3%. After the 9% fall in July, M&HCV sales fell sharply by 17% to 9,969 M&HCVs (August 2015: 12,017). However, sales of Tata Motors’ LCVs rose by 10% YoY to 13,495 units.

Ashok Leyland’s total numbers dropped close to 6% YoY with sales of 10,897 units in August 2016 (August 2015: 11,544 units). Its M&HCVs, as in July, dropped 8% to 8,201 units (August 2015: 8,903 units). LCV sales grew marginally by 2% 2,696 units. (August 2015: 2,641 units).

Mahindra & Mahindra’s M&HCV sales dropped to a single-digit growth of 9% by selling 371 units last month (August 2015: 341 units). The below-3.5T GVW products posted 6% growth with sales of 13,049 units (August 2015: 12,254), while those in the above-3.5T GVW segment grew strong 34% year-on-year with sales of 573 units (August 2015: 428).

VE Commercial Vehicles maintained its double-digit growth with 14.7%, albeit on a low base, with sales of 3,450 units in the domestic market (August 2015: 3,009).

Recommended:

- UVs and motorcycles drive growth in August as industry volumes rise 24% YoY

RELATED ARTICLES

E2W OEMs open FY2026 with best-ever April sales, TVS is No. 1 for the first time

With 91,791 electric scooters, bikes and mopeds sold and stellar 40% YoY growth, April 2025 registers best-ever retail s...

Mahindra XUV 3XO sells over 100,000 units to be M&M’s second best-selling SUV in FY2025

Launched exactly a year ago, the face-lifted version of the XUV300 with sales of 100,905 units turned out be Mahindra & ...

Mahindra Thar Roxx and Tata Curvv best-selling new SUVs in FY2025

With over 125 models and a mind-boggling 1,000-plus variants, utility vehicle buyers in India are spoilt for choice. Whi...

By Autocar Professional Bureau

By Autocar Professional Bureau

01 Sep 2016

01 Sep 2016

26695 Views

26695 Views