INDIA SALES ANALYSIS: December 2016

The ongoing cash crunch with passenger vehicle (PV) buyers, following the demonetisation scheme is weighing heavy on Maruti Suzuki India, Hyundai Motor India and Mahindra.

The ongoing cash crunch with passenger vehicle (PV) buyers, following the government’s demonetising of Rs 500 and Rs 1,000 currency notes on November 8, 2016, is weighing heavy on Maruti Suzuki India, Hyundai Motor India and Mahindra & Mahindra.

All three manufacturers have reported a decline in their sales numbers for December 2016, the first full month of sales after demonetisation kicked in.

While it is known that December typically sees slow sales as PV buyers are not so keen to put their money down on new cars with registration in the last month of the year, consumers aren’t so forthcoming despite most OEMs offering handsome discounts.

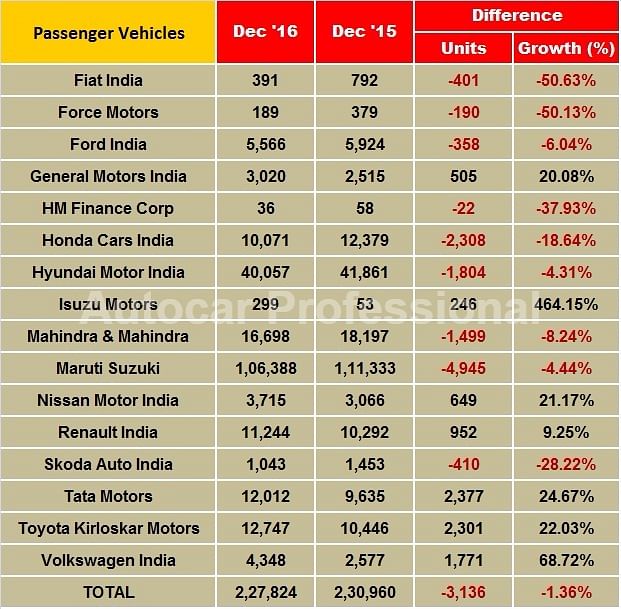

Maruti Suzuki India, the bellwether of the Indian passenger vehicle industry, has recorded a year-on-year sales decline of 4.4% in December 2016 with 106,414 units going home to new car buyers (December 2015: 111,333). Clearly, the cash crunch has not spared even the country’s largest carmaker.

The December 2016 numbers results are contrary to what the company was expecting for the month. On December 23, Maruti car bookings were reported to be higher by 7 percent compared to the same period in December 2015.

What is worrying for Maruti is that the bread-and-butter duo of the Alto and Wagon R, which sold 31,527 units in December 2016 (December 2015: 37,234), down a sizeable 15% YoY, is bearing the brunt of the cash crunch, which has come about after the government initiated the demonetisation exercise on November 8, 2016. While Maruti’s November numbers were in the black for that month, those numbers could be a result of the festive season of Diwali.

If that’s not bad enough, sales of the compact car quintet of the Swift, Ritz, Celerio, Baleno and Dzire are also down – at 43,295 (December 2015: 47,354), down 8.6% YoY. The Dzire Tour, which is sold only as a taxi, sold 2,559 units (December 2015: 3,614), down 29% YoY. Even the two vans – Omni and Eeco – which usually give a fillip to overall sales numbers are down 17% to 9,224 units (December 2015: 11,122)

The carmaker would have posted a higher level of YoY sales decline if it weren’t for the smart performance of its UVs (Gypsy, Ertiga, S-Cross, Vitara Brezza) and the Ciaz premium sedan. Thanks to surging demand for the Vitara Brezza compact SUV, Maruti’s UV sales soared 75% YoY to 16,072 units (December 2015: 9,168).

For the fiscal year till date (April-December 2016), Maruti Suzuki India has sold a total of 971,958 units, which is a 9.3% YoY growth. The company had recorded toal cumulative domestic sales of 1,305,351 units in FY2015-16. The sales target for FY2016-17 is around 10% growth, which translates to 1,435,886 units. Will the carmaker achieve it?

It is understood that the Budget for FY2017-18, to be announced on February 1, 2017, will be a consumer- and industry-friendly one. If that is the case, it might give a fillip to PV sales. Also, the currenty heavily-strapped-for-capacity Maruti will see its all-new Gujarat plant go on stream in early February, rolling out at least 10,000 units by end-March 2016.

Although most automakers were loathe to admit it in November, the demonetisation exercise and the resultant aftermath of the cash crunch are set to inflict further pain in the months to come. If Maruti Suzuki, which was considered to be less impacted because of the large number of bookings it has in hand for the popular Baleno hatchback and Vitara Brezza SUV, has seen its numbers decline by nearly 5,000 units last month, expect most passenger vehicle manufacturers to report similar if not a higher percentage of sales declines.

Hyundai Motor India's sales also saw a YoY decline of 4.31% with 40,057 units sold in December 2016 compared to the 41,861 units it sold in the same month in 2015.

However, YK Koo, MD & CEO of Hyundai Motor India was bullish: "In 2016, we celebrated 20 years in India, rolled out our 7 millionth car in November, crossed 5 lakh domestic sales and the fastest 50,000 unit sales in the month of October. Hyundai brands have also scored top rankings in both quality and design parameters in IQS and APEAL studies."

Mahindra & Mahindra (M&M), which sees a large part of its sales come from rural India, has reported sales of 16,698 passenger vehicles (comprising UVs, cars and vans), down 8.24 percent (December 2015: 18,197). This comes on the back of its November 2016 numbers which were down 33 percent year-on-year.

Commenting on the performance for December 2016, Pravin Shah, president and chief executive (Automotive), M&M, said, “The auto industry continues to go through challenging times, grappling with the short-term effects of demonetisation as well as reduced and postponed purchase decisions. However, we believe there will be a gradual pick-up in demand starting next few months. We do hope that the implementation of GST along with some right initiatives taken by the government in the upcoming Union Budget on February 1, will provide a veritable boost to the auto industry and the economy in general. I believe, this, coupled with stable fuel prices and reduced inflation and interest rates, will fuel the automotive industry’s growth going forward.”

Toyota Kirloskar Motor (TKM), however, was immune to the demonetisation as domestic sales of the carmaker went up by 22.03% to 12,747 units in December 2016 (December 2015: 10,446 units).

The newly launched Toyota Fortuner and the new Innova Crysta were the main growth drivers for the Japanese automaker.

Meanwhile, Renault India, whose domestic sales have been powered by the game-changing Kwid hatchback, has registered a year-on-year growth of 9.2 percent in Decemeber 2016 with sales of 11,244 units (December 2015: 10,292 units). For calendar year 2016, the carmaker sold a total of 132,235 units, up 146 percent (CY2015: 53,847).

Commenting on the December sales numbers, Sumit Sawhney, country CEO and MD, Renault India Operations, said: “India is a priority market for Groupe Renault and plays an important role in Renault’s international growth. In a short span of time, Renault has grown its presence exponentially, becoming one of the youngest and fastest growing automotive brands and the number one European brand in India.

"We are on track with a 4.5 percent market share at the end of 2016, achieving a robust three-digit growth over 2015. Our focus for 2017 will be to continue and build on our growth journey, reflecting our long-term commitment to the Indian market. We plan to launch at least one new product every year, over the next five years, beginning with some exciting product innovations starting this year. We will continue to build our network this year as well, with strategic measures to make our cars more accessible to customers across the country,” added Sawhney.

Further, Tata Motors has reported sales of 10,827 passenger vehicles in December 2016, a year-on-year growth of 12.49 percent compared to the 9,625 units it sold in December 2015.

The sales growth is attributed to growing consumer demand for the Tiago hatchback. According to Mayank Pareek, president, Passenger Vehicle Business, Tata Motors, “We continued our growth momentum in December on the back of robust sales, led by the positive response for the Tata Tiago. This has resulted in planned stock reduction in the network. We also saw good traction on retail sales towards the end of the month. The new year holds tremendous opportunity for further growth as we enhance our product lineup with a slew of new models.”

Cumulative sales growth of all passenger vehicles in the domestic market, this fiscal, were 112,539 units, up 17% compared to 95,979 units in last fiscal.

The company’s sales from exports stood at 5,119 units in December 2016, up 12% compared to 4,557 vehicles sold in December 2015. The cumulative sales from exports for the fiscal was at 48,547 units, up 19% over 40,900 units sold last year.

Honda Cars India sold a total of 10,071 units in December 2016, down 18.64% (December 2015: 12,379). The Amaze sedan was the best-seller with 3,322 units, followed by the City with 2,898 units. While the Jazz and BR-V had identical sales of 1,601 units, the Brio sold 443 units, the Mobilio sold 151 units and the CR-V 55 units.

Yoichiro Ueno, president and CEO, Honda Cars India, said, “After a severe impact of demonetisation in November 2016, December 2016 sales continued to be challenging. We expect the new year to gradually bring back normalcy in the market.”

Nissan Motor India has reported domestic sales of 3,711 units in December 2016, a 21 percent year-on-year increase (December 2015: 3,065).

The carmaker has also reported that for the first three-quarters of the fiscal year 2016, combined Nissan and Datsun sales have registered 50 percent YoY growth.

Commenting on the sales results, Arun Malhotra, MD, Nissan Motor India, said, “Nissan India achieved healthy sales in December by posting 21 percent year-on-year growth despite the challenges of the demonetisation issue. This strong performance came on the back of the continued success of the Datsun Redigo and the great customer response to the Redigo Sport. We have achieved consistently strong sales in the first three-quarters of this fiscal year. The growth we’ve achieved from April through December positions us as the second-fastest growing company in the passenger vehicle segment in India, a significant feat for a comparatively young company,” added Malhotra.

In October 2016, the Nissan Motor India Group, which manages the sales and service support for both the Nissan and Datsun brands, announced plans to introduce up to eight new cars from the two brands to India by 2021. These new products include the recently-launched Nissan GT-R and the launch of X-Trail Hybrid in 2017.

Meanwhile, Ford India's domestic sales were down by 6.04% to 5,566 units in December 2016, compared to the 5,924 units it sold in the same month last year.

On the other hand, the carmaker is hugely benefiting from its Make In India manufacturing and export strategy. The Chennai-based carmaker has today reported strong exports of 17,904 units in December 2016, up 262% year on year (December 105: 4,941). In calendar year 2016, Ford India has shipped a total of 151,638 units to overseas markets.

The surge in export numbers has come about thanks to the growing demand from overseas markets for the made-in-Chennai new Figo, which is sold as the Ka+ in the UK and Europe. The new Figo gave a fillip to Ford’s exports in end-July when it started shipments to European countries.

Meanwhile, in another testament of the growing importance of India as an export hub for global car manufacturers, it is learnt that Ford Motor Co will sell its made-in-India EcoSport in the US. The Detroit-based auto major unveiled the facelifted version of the EcoSport at the Los Angeles Motor Show in mid-November. The compact SUV, a first for the North American market by Ford, will make its debut in the US by early 2018.

PV sales likely to miss the 3-million mark in CY2016

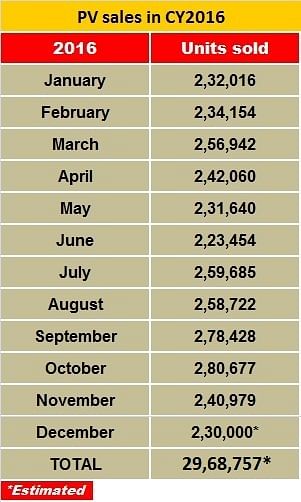

Given the slowing sales of the top three PV manufacturers, particularly Maruti Suzuki India and Hyundai Motor India, it would not be wrong to surmise that the industry could miss hitting the three-million PV sales mark in calendar year 2016 by a whisker. In November 2016, PV sales grew by barely 1.82 percent to 240,979 units. With December typically seeing lower sales, with buyers preferring to delay purchases to the new year, overall numbers and growth could be flat or maybe in negative territory.

As the domestic PV sales table for 2016 indicates, and given that overall December sales finally round off at around 230,000 units (December 2015: 230,960), it could be estimated that overall numbers for the year fall short of the three-million mark by just 31,243 units.

Two-wheeler sector feels the heat of demonetisation in December

The cash crunch, following the demonetising of Rs 500 and Rs 1,000 currency notes on November 8, is now being felt acutely in the Indian two-wheeler sector. As OEMs announce their sales numbers for December 2016, it is clear that the sector is grappling with a slowdown. What’s more, the hit could be mainly from rural India, which constitutes the bread-and-butter entry-level commuter models for manufacturers.

Hero MotoCorp (HMCL) reported sales of 330,202 units in December 2016, down 33.92 percent (December 2015: 499,665 units).

On the cumulative front, the company has registered its highest ever sales in any calendar year. It reportedly sold a total of 6,762,980 units in the calendar year 2016, which marks a YoY growth of 4.3 percent (CY2015: 6,486,103).

Also, in the context of the ongoing fiscal, Hero MotoCorp has crossed the milestone of five million unit sales during the nine-month period (April-December 2016) with 5,024,129 units sold during this period.

Honda Motorcycle & Scooter India (HMSI) sold a total of 231,654 units in December 2016 as against 306,607 units sold in December 2015 (both including exports), thus recording a YoY decline of 24.45 percent.

Giving his outlook and commenting on the sales, YS Guleria, senior vice-president – sales and marketing, HMSI, said: “Demonetisation continued to negatively impact customer sentiments for the second consecutive month and domestic two-wheeler industry closed at an 80 month low of 909,000 units in the traditionally lean month.”

However, he further added, “Despite continued pressures of demonetisation in December, Honda sales grew over 50 percent faster (in terms of percentage points) than industry in CY 2016 and volumes grew by nearly half-a-million (0.48 million units) to 4,988,512 units. As the macro-economic situation after demonetisation is steadily improving, upcoming festive season and with expectations of a growth-propeller Union Budget, Honda is cautiously optimistic for the last quarter of current financial year, and hopes to close 2016-17 with double-digit growth.”

According to the company, it fared well on the export front, where it recorded a growth of around 66 percent YoY, thanks to the focus on the same. Total exports for December stood at 26,602 units as against 16,067 units exported in December 2015. HMSI is understood to have started exporting Dio scooter model from its Gujarat plant in November 2016, and had also begun exporting Navi to Sri Lanka in the same month. Notably, HMSI has exported more than 2000 units of Navi last month.

On the cumulative front, the company has registered its highest ever sales for any calendar year. In CY2016, HMSI has sold 4,988,512 units, up 11 percent YoY. It had sold 4,508,222 units in CY2015.

Bajaj Auto’s domestic sales last month stood at 106,665 units as against 120,322 units sold in December last year. The monthly volumes were down by 11 percent.

However, as regards year-to-date (YTD) numbers, Bajaj Auto’s total domestic volumes registered a growth of 11 percent YoY. The company has sold 1,587,852 units in the April- December 2016 period in the domestic market as against sales of 1,430,175 units during the corresponding period of last fiscal.

The recently launched Dominar 400 model, which was launched last month, will see the commencement of deliveries in January 2017.

TVS Motor Company has reported that its domestic two-wheeler sales stood at 153,413 units in December 2016, down 8.77 percent YoY (December 2015: 168,160).

India Yamaha Motors has recorded domestic sales (including Nepal) of 49,775 units in December 2016, up by 28 percent YoY (December 2015: 38,833). On the cumulative front, the company has registered total sales of 786,000 units in CY2016, up by 32 percent YoY (CY2015: 594,000).

It is understood that Yamaha is targeting domestic sales of one million units in CY2017, and has laid out its product strategy and capacity expansion plan accordingly. Commenting on the company’s sustained growth, Roy Kurian, vice-president (Sales & Marketing), Yamaha Motor India Sales, said, “2016 has been a landmark year for us. Yamaha managed to perform strongly in all aspects and maintained a steady sales growth across the year. This year Yamaha crossed the 100,000 sales figure first in India consecutively in two months (September and October). The continuous growth numbers are a sign of Yamaha’s robust business plans and strategic customer engagement programs. 2017 holds tremendous opportunity for further growth as Yamaha will enhance its product portfolio with the launch of new and exciting models and will intensify its network expansion plan across the country with a target of achieving 1 million sales in 2017.”

Meanwhile, continuing to register strong sales, Royal Enfield, which operates according to its order backlogs, has recorded domestic sales of 56,316 units in December 2016, marking a YoY growth of 41 percent. The company had sold 40,037 units in December 2015.

Rounding up the year, Rudratej Singh, president, Royal Enfield, said: “2016 has been a remarkable year for Royal Enfield. In February this year, we launched the Himalayan purpose- built for adventure touring that introduced a whole new category of motorcycles in India. The motorcycle has received encouraging response from our customers across the country and on the back of this confidence we launched the Himalayan outside of India in Australia and Colombia in November 2016.”

“The EU-compliant Himalayan with an EFI engine was also showcased at the EICMA auto show in Milan, Italy. Royal Enfield recently launched its first exclusive store in Australia and first exclusive gear store outside India in Jakarta, Indonesia in December,” he added.

Commenting on the company’s dealership footprint, he said: “In India, we continued to strengthen our presence adding 117 dealerships (April to December 2016), taking our total footprint to 642 dealerships across India as on December 2016. Our retail growth is a significant milestone for Royal Enfield and is a testimony of our collective focus and passion for constantly enhancing consumer experience.”

“We have continued to increase our production capacity and we have sold 488,262 units for the April to December 2016 period, growing over 36 percent YoY. Despite demonetisation, our order books continue to be well ahead of our ever increasing production capacity," he concluded.

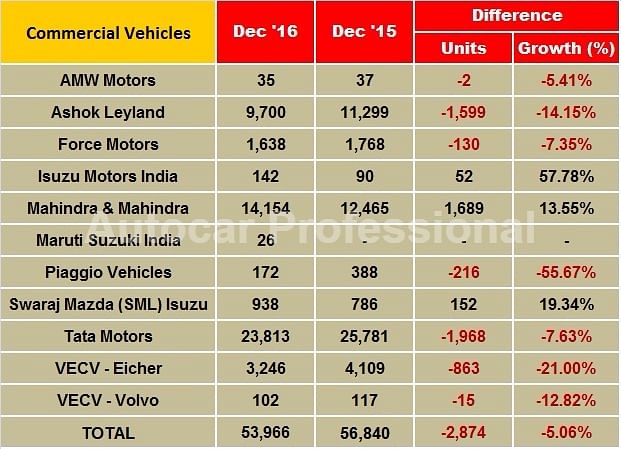

India Commercial Vehicle sales remain under pressure in December

Like the passenger vehicle industry, the critical medium and heavy commercial vehicle (M&HCV) segment in India is feeling the pressure of slowing sales.

For most of 2016, the light commercial vehicle (LCV) segment remained largely positive barring November when following the November 8 demonetisation, sales fell by nearly 10%. The M&HCV segment, after recording buoyant sales early in 2016, saw a gradual sales decline due to replacement demand tapering down. After the first six months of sustained growth, M&HCV numbers started falling from July 2016. After three months of de-growth, M&HCV sales turned positive in October by an impressive 17% but November numbers were hit by demonetisation.

The overall CV market is currently seeing muted conditions and freight transport demand has been sizeably impacted due to a slowdown in supply chains across the country’s economy. As a result, fleet operators have deferred their purchases. Also, with BS IV becoming mandatory for all CVs in April 2017, fleet owners are delaying their purchases to March 2017 which is when a considerable uptick in sales is expected.

In December 2016, except for Ashok Leyland, most OEMs reported sales declines across segments. While Mahindra & Mahindra posted overall positive growth, thanks to a strong performance by its small CVs (both less-than-3T and above-3T vehicles) its HCVs numbers remained negative.

Tata Motors, which has posted a 17% decline in its overall sales in November 2016, continued to see de-growth in December, selling a total of 24,998 units, lower by 9% year on year. The company says the market will continue to remain under pressure due to the impact of demonetisation felt across segments, particularly in the long-haul cargo segment. However, what can be seen an encouraging sign, the construction vehicle segment continues to grow strongly (+22%) due to an increase in road construction activities; the coal and mining vehicle market is also gaining momentum. Meanwhile, Tata Motors saw its bus sales rise by 59% in December 2016 as a result of orders from government/STUs, intercity and staff segments.

Ashok Leyland’s total sales were down 12% YoY at 10,731 units (December 2015: 12,154 units). After recording positive growth in October and November, its M&HCV numbers slipped into negative territory (-9%) with sales of 8,782 units (December 2015: 9,703s). LCV sales dropped sizeably by 20% to 1,949 units (December 2015: 2,451 units).

Mahindra & Mahindra’s total CV sales were up by 14% to 14,154 units (December 2015: 12,465). The company sold 476 M&HCVs, down 10% YoY (December 2015: 528). However, it saw its below-3.5T GVW products recover after November 2016’s sharp fall – sales were up by 14% to 13,147 units (December 2015: 11,530). Vehicles in the above-3.5T GVW segment maintained their strong growth and sales rose 30% to 531 units (December 2015: 407).

VE Commercial Vehicles’ sales remained in negative territory. At 3,246 units, its sales in the domestic market declined by 21% (December 2015: 4,109).

Seen overall, it might be a while before CV numbers consistently ride into the black. The muted market sentiment, considerable reduction in freight transport across the country and potential buyers awaiting sops in the Budget to be announced on February 1, 2017, are all factors that are weighing heavy on the sector. Stay tuned for more updates.

Also read:

- Demonitisation hits Indian auto hard: December sales lowest in 16 years

RELATED ARTICLES

Mahindra Sells 600,000 SUVs in 11 Months of FY2026, Goes ahead of Tata Motors

Mahindra’s 600,004 SUV wholesales put it ahead by 34,809 units over Tata Motors’ 565,195 passenger vehicles in the first...

Tata Motors, JSW MG, M&M Command 86% of e-PV Sales in February, Maruti Sells 214 e-Vitaras

With 5,558 units sold, Tata Motors captured a 41% share of the 13,669 e-PV market last month, while JSW MG Motor and Mah...

TVS Sells 31,600 e-Scooters in February for a 28% Share; FY2026 to see 1.35 Million e-2W Sales

With 31,600 e-scooters, TVS commanded a 28% market share even as Bajaj Auto, Ather Energy and Hero MotoCorp witnessed st...

By Autocar Professional Bureau

By Autocar Professional Bureau

02 Jan 2017

02 Jan 2017

52887 Views

52887 Views

Ajit Dalvi

Ajit Dalvi