INDIA EXPORTS: Passenger vehicle shipments up 15% in H1 FY2017

For the April-September 2016 period, total shipments of PVs totalled 367,110 units, which marks a year-on-year rise of 15.38%.

Things are looking good for the Indian passenger vehicle (PVs) industry. While sales in the domestic market rose 12.34% to reach 1,494,039 units in the first half of FY2016-17 (H1 - April-September 2016), PV exports too are beginning to see an uptick.

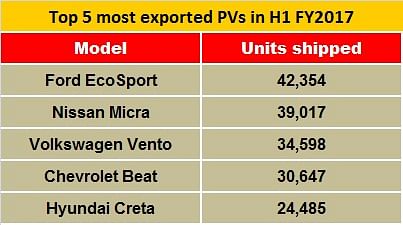

For the April-September 2016 period, total shipments of PVs totalled 367,110 units, which marks a year-on-year rise of 15.38%. The big gainer for H1 FY2017 is Ford India which has exported 73,821 units (+32%), thanks to demand for the new Figo which is sold as the Ka+ in the UK. Meanwhile, the EcoSport replaced the Nissan Micra as the country’s most exported PV in the fiscal so far.

Volkswagen India has notched near-20% YoY gains with despatches of 43,114 units. GM India has also seen a surge in its exports, particularly of the left-hand-drive Chevrolet Beat to many countries including Mexico, Chile, Peru, Central American and Caribbean Countries, Uruguay and Argentina.

In H1 FY2017, the company exported 30,647 units, a massive 863% YoY growth albeit on a very low base. Nissan Motor India, which shipped a record 11,999 cars in September 2016 (+20%), however, has seen a 7.81% YoY decline in its overall numbers for the six-month period under review – 49,611 -7.81%).

These four carmakers typically see higher sales for these made-in-India cars in export markets than their sales in the Indian market. Ford India has sold 46,422 units in H1 FY2017 (+33.75%), Volkswagen India 23,329 (0.45%), GM India 12,059 units (-28%) and Nissan Motor India 29,040 (48.44%).

Meanwhile, export biggies like Hyundai Motor India and Maruti Suzuki India are seeing fluctuating fortunes on the export front, but that could be largely due to manufacturing capacity constraints. Both carmakers are running at near-peak capacities and with surging domestic demand, exports have taken a hit.

Hyundai has exported 87,499 units in H1 2017 (+2%) while Maruti’s exports at 87,499 units have seen a decline (-7.87%) for the six-month period. The Creta has been a large export volume driver for the Korean carmaker in India along with the Grand i10. Meanwhile, the Baleno hatchback has been the largest driver of exports for Maruti Suzuki this fiscal.

Also read: Ford beats Hyundai as top Indian passenger vehicle exporter in August

RELATED ARTICLES

Skoda Slavia and VW Virtus Sales Cross 150,000 Units, Virtus First to Cross 75,000 Units

Skoda Volkswagen India’s two MQB-A0-IN–based sedans have reached a new milestone, with the Slavia at 73,378 units and th...

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

By Autocar Professional Bureau

By Autocar Professional Bureau

19 Oct 2016

19 Oct 2016

8139 Views

8139 Views

Ajit Dalvi

Ajit Dalvi