India Market Analysis - March 2014

No year-end boost, sales remain in a rut

No year-end boost, sales remain in a rut

2013-14 ends on a flat note for industry. Brian de Souza reports.

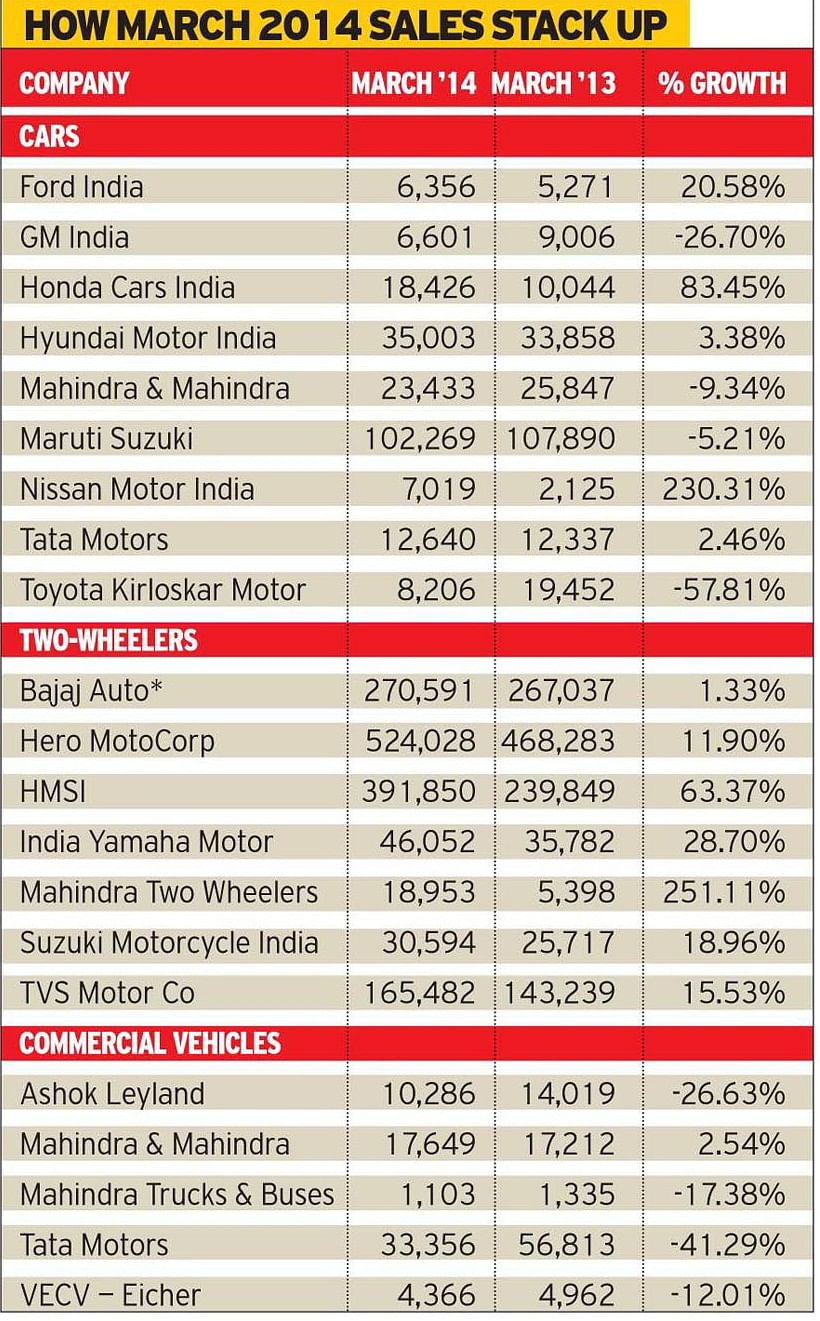

Passenger car sales remained largely flat with the big three players recording declines in their March 2014 tallies. Maruti Suzuki India saw its sales dip by 5.2 percent as compared to the last year even as its 2013-14 fiscal tally was flat at 0.25 percent. Towards the end of the fiscal, the Celerio launched at the Auto Expo in February racked up sales of about 16,000-and-odd units so far and garnered bookings of about 20,000 units.

In terms of models, the compact car segment that includes the Alto and Wagon R sold 40,085 units as against 45,047 units, a fall of 11 percent. The Alto sold 25,590 units while the Swift sold 19,304 units. Sales of the Wagon R and Dzire sold 14,495 and 17,237 respectively, both down from their year-earlier month tallies.

Hyundai Motor India’s sales fell 3.38 percent to 35,003 units (March 2013: 33,858 units). The Grand i10 racked up another 10,000-unit milestone in March 2014 with sales of 10,614 units, completing the fiscal with over 70,000 units sold. The company will be looking to repeat the success of the Grand with its sedan sibling, the Xcent which debuted in March with sales of 1,716 units.

Mahindra & Mahindra’s (M&M) sales (for UVs, Verito and Vibe) fell 10 percent in the month to 23,433 units (March 2013: 25,847), a drop of 9.3 percent. Pravin Shah, chief executive, Automotive Division, M&M, said: “After the reduction in excise duty, the number of inquiries has gone up but we have not witnessed any major surge in sales. We do hope that sentiments improve and change after the elections and lead to an increase in demand as well.” The company’s Scorpio and Bolero sold 5,605 and 11,249 units respectively last month, their highest tallies for the fiscal respectively. For 2013-14, M&M sold 229,155 vehicles, down 17.94 percent (2012-13: 279,270).

Tata Motors recorded a slight increase of 2.46 percent to 12,640 units (March 2013: 12,347). While the Nano sold 2,452 units, the Indica sold 4,287 units and the Indigo and Manza sold 3,022 units. Cumulative sales of passenger vehicles for 2013-14 were 138,455 units (2012-13: 222,112), down 37 percent.

The company that put in a stellar performance was Honda Cars India which sold 18,426 units, up 83 percent over March 2013 sales. The City sold a whopping 9,518 units (the city petrol was introduced in February) while the Amaze sold 7,374 units. With its second shift taking off, the company has cut the waiting period for the Amaze to about three weeks, top sources told Autocar Professional.

Toyota Kirloskar sold just 8,206 units in the month, down 57 percent as compared to March 2013, mainly due to the worker strike at the Bidadi plant that affected output of about 2,000 cars. The Etios sold 2,811 units in March 2014.

General Motors India sold 6,601 vehicles in March 2014 (March 2013: 9,006), down 26 percent. The sales included 2,293 units of the Beat, 1,351 Taveras and 1,310 Chevrolet Enjoys.

Nissan Motor India got an addition of 2,072 units to its March tally of 7,019 units (March 2013: 4,894). Almost 15,000 out of a total of 38,217 vehicles that Nissan sold in India during 2013-14 comprised its SUV, the Terrano. Launched in November, the Terrano sold 3,075 units in March, and cumulatively 15,169 units for the fiscal. That translates to 39 percent of the company’s total sales volume for 2013-14. Nissan saw growth of 3.4 percent in 2013-14 (2012-13: 36,975).

Ford India sold 6,356 units last month (March 2013: 5,271), of which the EcoSport comprised 3,904 units. “Cautious is how we should define the first quarter of 2014. The excise duty reduction has definitely been a positive step. As India goes to the polls, we look forward to such industry-friendly initiatives being sustained to support the automotive sector,” said Vinay Piparsania, executive director of marketing, sales and service at Ford India.

Two-wheelers buck downturn

In the two-wheeler segment, Hero MotoCorp sold 524,028 units (March 2013: 468,283 units), up 11.9 percent year-on-year. In its press note, the company said it clocked its highest annual sales for any fiscal by selling 62,45,895 units, registering flat growth of three percent over 2012-13, when it had sold 60,75,583 units.

Honda Motorcycle & Scooter had a tremendous fiscal year, going to No 2 in the segment with sales of 37,21,935 units. Its March 2014 sales alone were 391,850 units. The company says it sold 55,000 units on a single day – March 31 – in west and south India due to Gudi Padwa and Ugadi respectively. In the fiscal as a whole, the Dream Yuga and Neo bikes brought in sales of 630,000 units. The CB Shine sold 740,000 units in the fiscal and 94,000 units in March 2014 alone.

Bajaj Auto sold 270,591 motorcycles in March 2014, up one percent over 267,037 units in the year-earlier period. For the entire fiscal, sales were down for its bikes by 9 percent to 34,22,416 as against 27,57,105 units in 2012-13.

TVS Motor Co's domestic two-wheeler sales saw a growth of 16 percent, increasing from 143,239 units in March 2013 to 165,482 units in March 2014. Scooter sales grew by 63 percent, increasing from 29,261 units in March 2013 to 47,766 units in March 2014. Motorcycle sales grew by 10 percent, up from 61,808 units in March 2013 to 68,158 units in March 2014.

Suzuki Motorcycle India recorded 19 percent growth, selling 30,594 units in March 2014 (March 2013: 25,717). Atul Gupta, executive VP, said, “We have received a good response for all our products. Building on existing goodwill, we expect that the four products launched at the Auto Expo – the 150cc Gixxer, the 110cc Let’s automatic scooter, the Tourer V Strom CBU and the 250cc Inazuma will also show good performance in the upcoming fiscal.”

Yamaha Motor India Sales sold 29 percent more in the domestic market in March 2014, selling 46,052 units (March 2013: 35,782). Roy Kurian, VP – sales and marketing, said, “With the launch of our Alpha family scootero along with the Ray and Ray-Z, we were able to maintain consistency in our overall growth and the results projected the same. We are expanding our sales and service network to get closer to our customer base.”

In 2013-14, the government allowed oil companies to raise diesel prices by 50 paise a month, to narrow the price differential with petrol. Several passenger car models have seen a swing in favour of petrol too. The two-wheeler segment had its shining point in scooters that boosted sales of the entire segment. A year-end boost in the form of an excise duty cut seems to have been a damp squib but OEMs remain hopeful of a revival after a new government takes office.

CV sales remain firmly in the slow lane

Fiscal 2013-14 saw commercial vehicle domestic sales dip 23 percent. While LCV sales declined by 20 percent, M&HCV sales fell 28 percent.

Vijay Kakade, director, automotive and transport practice, Frost & Sullivan, said, “2014-15 is expected to remain flat in terms of growth as compared with 2014. Even if we have a stable government in place to drive economic measures, policies made will have an impact only in FY’16 sales. Broadly, the negative sentiments among customers/transporters may phase down by the end of this year and we will start seeing clear signs of revival only next year.”

The dip in LCV sales, specifically the less-than 2.0-tonne small CV segment, indicates oversupply in the market which has resulted in an idle fleet and reduced freights. Due to lower demand, stagnant freight rates and overcapacity of fleet, there have been pressures on truck owners to repay their loans.

Delhi Rajasthan Transport Corporation, a Jodhpur-based fleet operator, which has about 200 small and heavy duty vehicles and operates across seven Western and Southern states, saw its parcel segment doing good business with double-digit growth; however the fleet division saw a decline. Director Ashok Rathi said, “Rising diesel prices, stagnant freight rates and exorbitant toll are affecting business.”

Bhim Baweja, director, Delhi Baroda Road Carrier, said 2013-14 was a mixed bag. While the first half of the year was tough, things started improving towards the second half due to

various factors as the company introduced more vehicles into the two-

wheeler transportation business.

In March, Tata Motors sold 33,356 units as compared to 56,813 units in March 2013, a drop of 41 percent. The entire fiscal year sales stand at 378,348 units as against 537,143 during 2012-13, a fall of 30 percent.

Ashok Leyland saw a 27 percent drop in its March 2014 sales of 10,286 units (March 2013: 14,019 units). The overall tally for 2013-14 is 89,342 units (2012-13: 114,611 units), a decline of 22 percent.

Mahindra Trucks and Buses sold 1,103 units last month (March 2013: 1,335), down 17 percent. Its 2013-14 sales were down 31 percent at 8,161 units against 11,902 units a year ago.

VE Commercial Vehicles’ March 2014 sales fell 12 percent with 4,366 units sold as compared to 4,962 units in March 2013.

(Additional reporting by Kiran Bajad)

RELATED ARTICLES

Mahindra Farm Equipment Posts 46% Domestic Growth, Sells 38,484 Tractors in January 2026

Mahindra Farm Equipment reports 46% January tractor sales surge driven by strong rural demand and record Rabi sowing, wi...

SML Mahindra Records 30% Sales Growth in January 2026 Amid Broader Market Softness

SML Mahindra posts 30% January sales increase with balanced growth across cargo and passenger segments, bucking broader ...

Mahindra Auto Clocks 63,510 SUVs and 104,309 Total Vehicle Sales in January 2026

Mahindra & Mahindra reports 24% January sales growth with record SUV demand reaching 63,510 units, alongside strong comm...

15 Apr 2014

15 Apr 2014

9156 Views

9156 Views

Shahkar Abidi

Shahkar Abidi