India car sales rise 18% in April, M&HCVs 25%, bikes down 2.7%

With the Society of Indian Automobile Manufacturers (SIAM) releasing the industry sales statistics for April 2015

With the Society of Indian Automobile Manufacturers (SIAM) releasing the industry sales statistics for April 2015, the sales numbers for the passenger vehicle and medium and heavy commercial vehicle (M&HCV) sector augur well for the rest of the year.

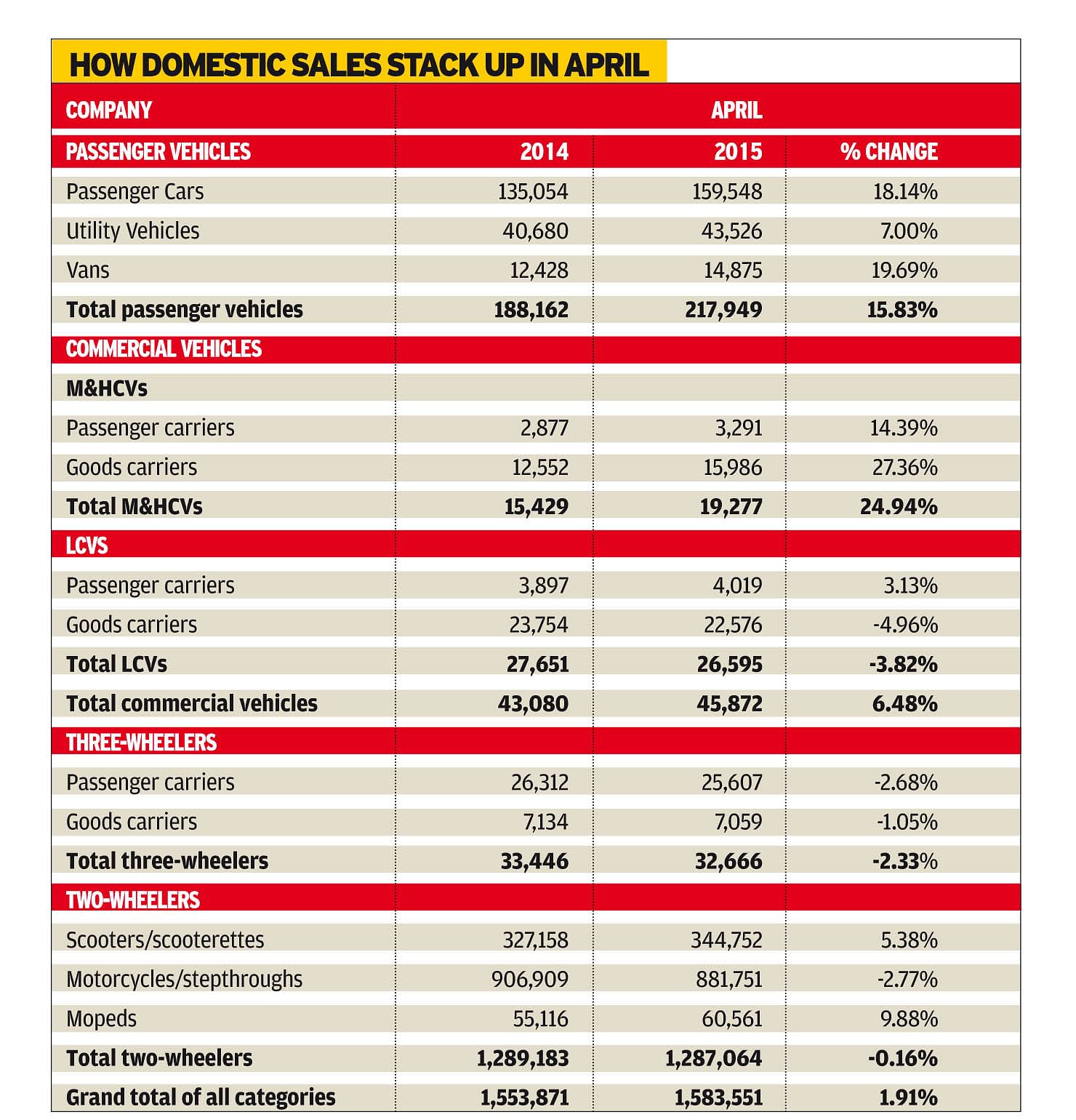

While passenger car sales, at 159,548 units, notched an 18.14% increase over sales in April 2014, sales of M&HCVs rose 24.94% to 19,277 units. While car sales rose for the sixth month in a row, thanks to improved market sentiment, good deals in the market and stable interest rates, M&HCV numbers are up for the ninth consecutive month as fleet owners bought more vehicles and the mining activities too have been re-opened recently.

Also read: INDIA SALES ANALYSIS: APRIL 2015

Overall passenger vehicle sales rose 15.83% to 217,949 units, with cars up 18.14% (159,548), UVs up 7% (43,526) and vans up 19.69% (14,875). Most of the big players in the passenger car sector reported good gains in April 2015 and Maruti Suzuki, Hyundai Motor India, Honda Cars India, Toyota Kirloskar Motor and Tata Motors all notched double-digit sales increases.

Given the M&HCV segment’s smart performance, overall CV sales should have been better than the 6.48% in April 2015. What pulled growth down is continuing poor sales of LCVs – April 2015 sales were down 3.82% to 26,595 units.

Vishnu Mathur, director general of SIAM, said that the consumer durable industry has not been doing too well and in turn has affected sales of LCVs. However, he added that LCV sales are showing a movement from negative to moderate in the past 5-6 months and the next few months should witness a positive pick up of this segment.

The two-wheeler segment saw de-growth (-0.16%) in April, the third month in a row with motorcycles pulling down overall sales. While bike sales are down by 2.77% (881,751) scooters have grown by 5.38% (344,752). Three-wheelers have also been poor performers, down by 2.33% with both passenger carriers and goods carriers down by 2.68% and 1.05% respectively.

“Three-wheelers depend on permits issued by the state government that controls demand for them. New registrations have not happened for passenger carriers due to a large number already being on the roads. Sales of two-wheelers are a matter of deep concern as rural demand continues to affect motorcycle sales. In fact, around 50 percent of the bike demand comes from rural markets where due to untimely rainfall, crops have been destroyed affecting demand. Scooter growth has been fairly regular as these are driven by urban markets,” added Mathur.

Overall, Mathur is of the opinion that the Indian auto sector is going through the recovery phase and still has to reach the peak levels of 2011-12 before real growth will be witnessed.

RELATED ARTICLES

Maruti Jimny Crosses 150,000 Sales Since Launch, 80% Comprise Exports

Launched in June 2023, the Maruti Jimny five-door SUV has sold 158,678 units till January 2026, with exports (127,442 un...

Kia India Drives Towards Highest-Ever Sales in FY2026

Kia India has sold 259,923 vehicles in the first 11 months of FY2026, just 9,306 units short of its all-time high of 269...

Bajaj Auto Outsells Mahindra in e-3Ws for Second Month in a Row, TVS Ranked Third in February

Bajaj Auto, after overtaking Mahindra Last Mile Mobility for the first time in January, repeated the feat in February wi...

11 May 2015

11 May 2015

6777 Views

6777 Views

Ajit Dalvi

Ajit Dalvi

Autocar Professional Bureau

Autocar Professional Bureau