INDIA SALES ANALYSIS: APRIL 2015

Most of the big players in the passenger car sector reported good gains in April 2015, which could be to a combination of slightly improved market sentiment, new models, and good retail deals offered by OEMs.

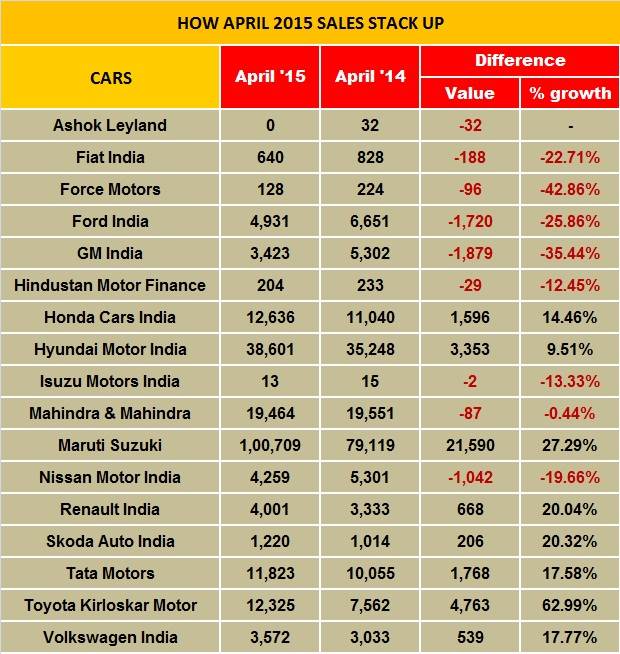

The first month of the fiscal year 2015-16 has opened with good numbers for a couple of vehicle segments. The sales numbers for the passenger vehicle and medium and heavy commercial vehicle (M&HCV) sector in April 2015 augur well for the rest of the year. While passenger car sales, at 159,548 units, registered an 18.14 percent increase over sales in April 2014, sales of M&HCVs rose 24.94 percent to 19,277 units. While car sales rose for the sixth month in a row, thanks to improved market sentiment, good deals in the market and stable interest rates, M&HCV numbers were up for the ninth consecutive month as fleet owners bought more vehicles and the mining activities too have been re-opened recently.

Overall passenger vehicle sales rose 15.83 percent to 217,949 units, with cars up 18.14 percent (159,548), UVs up 7 percent (43,526) and vans up 19.69 percent (14,875).

Most of the big players in the passenger car sector reported good gains in April 2015 and Maruti Suzuki, Hyundai Motor India, Honda Cars India, Toyota Kirloskar Motor and Tata Motors all notched double-digit sales increases.

Given the M&HCV segment’s smart performance, overall CV sales should have been better than the 6.48 percent increase in April 2015. What pulled growth down is continuing poor sales of LCVs – April 2015 sales were down 3.82 percent to 26,595 units.

Vishnu Mathur, director general of SIAM, said that the consumer durable industry has not been doing too well and in turn has affected sales of LCVs. However, he added that LCV sales are showing movement from negative to moderate in the past 5-6 months and the next few months should witness an uptick in this segment.

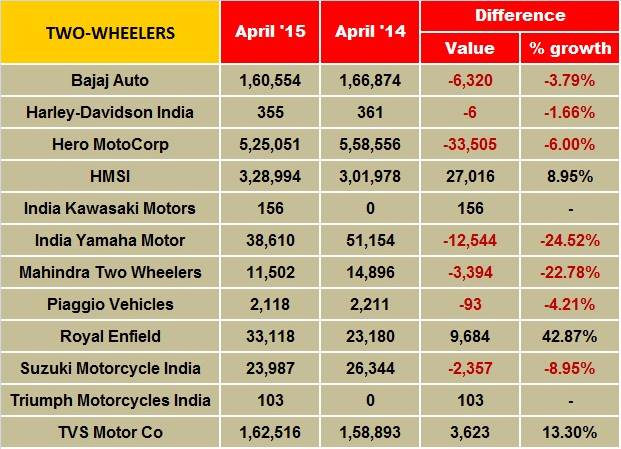

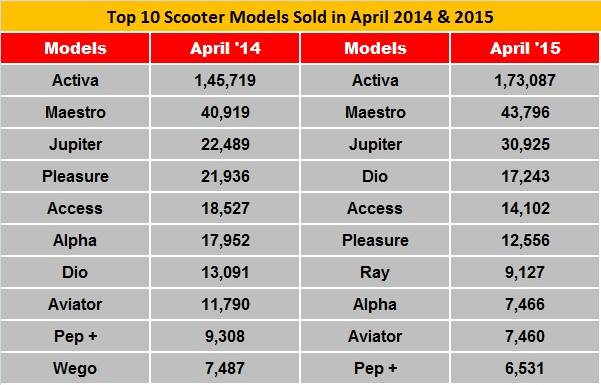

The two-wheeler segment saw de-growth (-0.16%) in April, the third month in a row with motorcycles pulling down overall sales. While bike sales are down by 2.77 percent (881,751) scooters have grown by 5.38 percent (344,752). Three-wheelers have also been poor performers, down by 2.33 percent with both passenger carriers and goods carriers down by 2.68 percent and 1.05 percent respectively.

“Three-wheelers depend on permits issued by the state government that controls demand for them. New registrations have not happened for passenger carriers due to a large number already being on the roads. Sales of two-wheelers are a matter of deep concern as rural demand continues to affect motorcycle sales. In fact, around 50 percent of the bike demand comes from rural markets where due to untimely rainfall, crops have been destroyed affecting demand. Scooter growth has been fairly regular as these are driven by urban markets,” added Mathur.

Overall, Mathur is of the opinion that the Indian auto sector is going through the recovery phase and still has to reach the peak levels of 2011-12 before real growth will be witnessed.

CAR SALES shape up

April 2015 numbers have to be seen in the light of a low base in April 2014, when passenger vehicle (cars, UVs, vans) were down 9.50 percent, CV sales down 24 percent and two-wheeler sales up 11.67 percent. Most of the big players in the passenger car sector reported smart gains in April 2015, which could be due to a combination of slightly improved market sentiment, new models, and good retail deals.

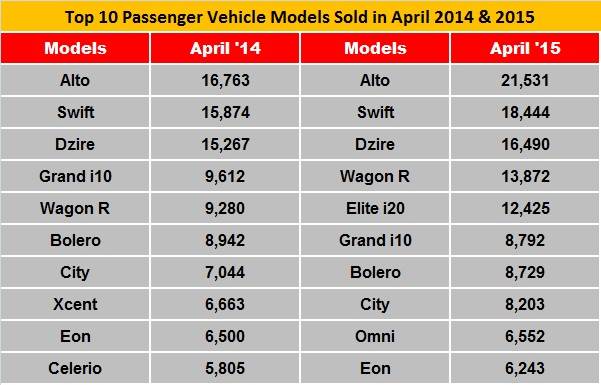

Maruti Suzuki India reported a 27 percent growth in its April 2015 sales of 100,709 cars (April 2014: 79,119). The Alto and Wagon R together sold 35,403 units, up 36 percent. (April 2014: 26,043). The Swift, Ritz, Celerio, and Dzire combined sold 42,297 units, up 8.7 percent (April 2014: 38,926) while the Ciaz sold over 4,000 units during the month.

Hyundai Motor India recorded sales of 38,601 units last month, up 9.5 percent (April 2014: 35,248). The star of the month was the Elite i20 and the Active i20 which sold 12,425 units combined, the second consecutive month of sales crossing the 12,000-mark. Rakesh Srivastava, senior VP (sales and marketing), HMIL, said, “Hyundai with a volume of 38,601 units continued the growth momentum with 9.5 percent increase over last year on the strength of strong and young product portfolio led by 12,425 units of the Elite i20 and i20 Active in a challenging market conditions especially in the rural market.”

Honda Cars India announced domestic sales of 12,636 units in April 2015, up 14 percent (April 2014: 11,040). Its sales comprised 8,203 Citys, 2,862 Amaze sedans, 827 Brios, 689 Mobilios and 55 CR-Vs.

Mahindra & Mahindra’s (M&M) passenger vehicles division which includes UVs and the Verito sold 18,314 units in April 2015 as against 18,148 units during April 2014, up just one percent. Pravin Shah, president & chief executive, Automotive, Mahindra & Mahindra said, “The auto industry is hopeful of a better financial year as we see positive sentiments on the back of various policy and project announcements leading to higher levels of economic activity.”

Toyota Kirloskar Motor registered sales of 12,325 units in April 2015, 4,763 units and 63 percent more than the 7,562 cars it sold in April 2014. The Japanese carmaker has been notching double-digit growth, month on month, right since the beginning of the year. In January it recorded 16 percent growth (12,650 units), 17 percent in February (11,802 units), 62 percent in March (13,333 units) and 63 percent in April.

N Raja, director and senior VP, (sales and marketing), TKM, said: “The Etios series along with the new Corolla Altis has helped us achieve a consistent growth month on month. Safety has always been of utmost importance to us and this has been further reiterated by our efforts to standardise airbags in all our models which has given a positive boost to our sales.”

In April 2015, Tata Motors’ passenger vehicle division recorded sales of 10,230 units, a growth of 37 percent (April 2014: 7,441), thanks to strong sales of the Zest saloon and Bolt hatchback, the company said. While passenger car sales in April 2015 at 8,925 units was higher by 58 percent over April 2014, UV sales fell 27 percent at 1,305 units in April 2015.

Volkswagen India registered an 18 percent increase in sales in April 2015 at 3,572 units as compared to 3,033 units in the same period last year. This increase in sales, the company says, comes on the back of the recent launches of the new Jetta and Vento Magnific. The Polo, the only hatch in its segment that comes with a 4-star NCAP safety rating for adult occupants, sold 2,242 units.

According to Michael Mayer, director, VW Passenger Cars, Volkswagen Group Sales India, “We are particularly encouraged by our customers’ response to the DSG-equipped variants of the Vento and the Polo GT.”

General Motors India sold a total of 3,612 vehicles in April 2015 against 5,302 units sold in the corresponding month last year. “The overall customer sentiment has not picked up as expected and the rural markets are also facing challenging times. The recent fuel price hike is also expected to impact demand going forward,” said P Balendran, vice-president, General Motors India. “We expect the interest rates to be reduced in phases and some of the reform-oriented announcements made by the government to be implemented in a timely manner to aid economic recovery,” added Balendran.

MOTORCYCLE SALES DIP, SCOOTERS UP

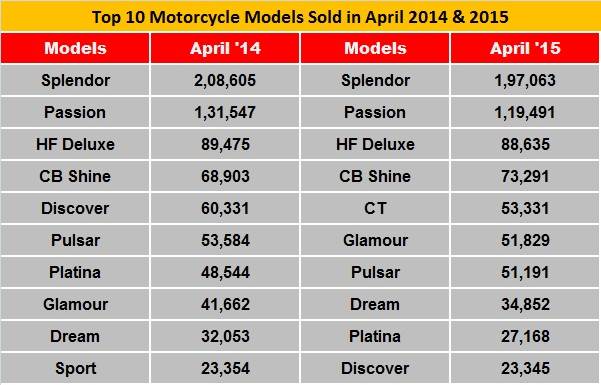

Most commuter bike manufacturers felt the pressure of slowing sales, mainly due to slackening of demand from rural India.

Hero MotoCorp registered a fall in its April 2015 sales. It sold 533,305 units during the month as against 571,04 units sold in April 2014, marking a fall of 6.61 percent YoY. In an official communication, the company said,“ Rural demand for automobiles has been adversely impacted by unseasonal rains witnessed in March. Poor crop realisation and a slowdown in rural wages have pulled back the rural economy, impacting retail off-takes in markets such as Bihar, Madhya Pradesh and sugarcane growing areas of Uttar Pradesh and Maharashtra.”

Honda Motorcycle & Scooter India posted total domestic sales of 329,092 units during the month (April 2014: 301,966), up 8.98 percent year on year. HMSI saw a downfall in sales of its motorcycle portfolio during the month. The company, which had sold 131,377 units in the domestic market in April 2014, recorded sales of 131,291 motorcycles during April 2015, 86 fewer units. However, HMSI’s foothold in the scooter segment is getting stronger. The company, which had sold 170,589 scooters in April 2014, despatched 197,801 scooters during April 2015, up 16 percent.

Bajaj Auto recorded sales of 285,791 units (including exports) during April 2015 as against 299,636 units (including exports) sold in April last year. The company has thus logged a fall of 4.62 percent in its April YoY sales. However, on the back of more launches in the pipeline, the company has already launched five new models since January 2015, and hoping to recover its lost marketshare within this fiscal. The Platina 100 ES and CT100 have begun raking in good sales for the company.

TVS Motor Company clocked 13.30 percent growth in its April 2015 domestic sales of 162,516 units.(April 2014: 143,434). While scooter sales grew by 14.98 percent increasing from 42,942 units in April 2014 to 49,375 units in April 2015, motorcycle sales grew by 12.78 percent from 66,460 units in April last year to 74,953 units in April 2015.

Royal Enfield, which is enjoying an impressive run in the market, saw domestic sales of 33,118 units in April 2015 (April 2014: 23,180), a growth of 42.87 percent.

Suzuki Motorcycle India saw flat growth of 1.09 percent in April 2015 as the company recorded sales of 27,320 units during the month. SMIL had sold 27,023 units in April 2014. “The recently launched Gixxer SF has been very well received by consumers. We look forward to continuing this upwards sales trajectory in the coming months,” said Atul Gupta, executive vice-president, SMIL.

Mahindra Two Wheelers sold 11,502 units during April 2015 in the domestic market, down 22 percent (April 2014: 14,896). The company is currently working on two new models, which it says will substantially high volumes in the near future.

HCV SALES GET MOMENTUM, LCV NUMBERS STILL DOWN

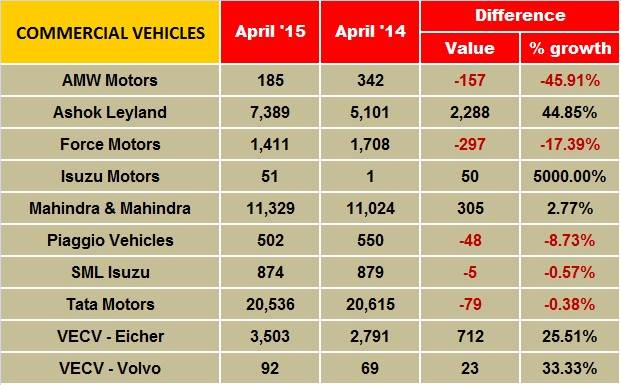

Commercial vehicle sales in April 2015 maintained the momentum in the medium and heavy commercial vehicle (M&HCV) segment which posted strong growth. However, the LCV sector remains in negative territory and still has issues with overcapacity and unavailability of finance.

According to the Indian Foundation of Transport Research and Training (IFTRT), the truck market will take another 3-4 quarters to show some serious buoyancy with fleet expansion.

Tata Motors’ domestic sales were down five percent during the month. The company sold 22,189 units (April 2014: 23,229).

Tata’s M&HCV sales posted double-digit growth of 21 percent selling 10,179 units (April 2014: 8,425 units.) Its LCV sales though were down 39 percent with sales of 9,029 units (April 2014: 14,804).

VE Commercial Vehicles registered 25 percent growth in the month. In the domestic market in the 5-tonne and above category, the company sold 3,501units (April 2014: 2,791 units).

Mahindra HCV sales were down 2 percent last month, the company selling 735 units in the month (April 2014: 750 units).

RELATED ARTICLES

Maruti Fronx sells 135,000 units in 12 months, second best-selling Nexa model in FY2024

Baleno-based Fronx compact SUV with 134,735 units accounts for 21% of Maruti Suzuki’s record utility vehicle sales of 64...

Utility vehicle share of PV sales jumps to 60% in FY2024, cars and sedans hit new low of 37%

Sixty percent of the record 4.21 million passenger vehicle sales in India came from 2.52 million UVs, a big leap from th...

Mahindra XUV300 tops 250,000 sales ahead of XUV3XO reveal

The popular compact SUV, which ranks among India’s Top 20 utility vehicles for FY2024, is among the SUVs which have powe...

By Autocar Pro News Desk

By Autocar Pro News Desk

04 May 2015

04 May 2015

25255 Views

25255 Views