India auto sales in May in slow growth mode, rural markets likely to pick up by August

Fiscal 2016-17 opened to robust sales growth of 20.04 percent in April 2016, mainly due to a flurry of customer orders during the Indian marriage season. May 2016 numbers are a reality check.

Fiscal 2016-17 opened to robust sales growth of 20.04 percent in April 2016, mainly due to a flurry of customer orders during the Indian marriage season. May 2016 numbers are a reality check.

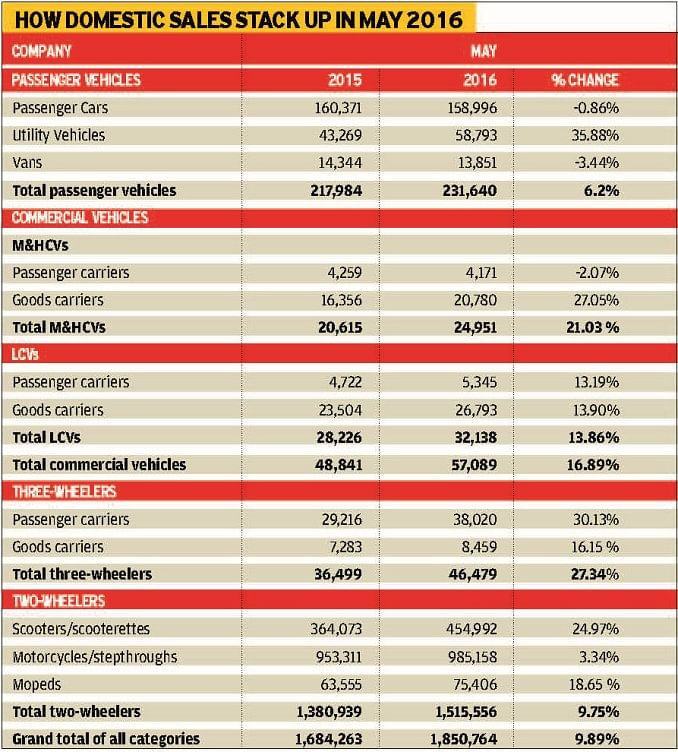

With the Society of Indian Automobile Manufacturers revealing total industry sales numbers across vehicle segments, it is amply clear that a more subdued sales pitch is underway. With the marriage season over, domestic sales of some vehicle segments like motorcycles, which had shown a spike in April, have shown a decline – 3.34 percent in May 2016 (985,158 units) from 16.24 percent in April 2016 (1,024,926 units). This has pulled down the overall growth of the industry to 9.89 percent in terms of domestic sales.

SIAM data for May 2016 reveals a lacklustre performance by the passenger car and vans segment, which are down by 0.86 percent (158,996 units) and 3.44 percent (13,851 units) respectively. Even the growth in the utility vehicle segment, which led the sales march in April 2016, is a tad down at 35.88 percent (58,793 units) pulling down the PV segment to a 6.26 percent growth.

However, Vishnu Mathur, director general of SIAM, says this is not a matter of concern as the dip is marginal. Moreover, the car and utility vehicle segments have almost merged together and many of the car sales are getting clubbed under the UV category. So differentiating sales has become difficult.

An area of concern though remains the continuing decline in the rural markets as the downslide in motorcycle sales figures reveals. Mathur is optimistic that the uptick in rural India will commence from August-September 2016 along with the onset of the monsoon season. The Met department has forecast a good monsoon and that is expected to stave off some of the worries of the rural markets in the second half of the year.

An interesting aspect of May 2016 sales though is that the LCV segment has escaped the brunt of the rural impact. This has been attributed to the growing success of the hub-and-spoke model of operations of the LCV market that is not entirely rural in character.

Overall, SIAM maintains that the recovery in the Indian automobile sector continues on a slow note. In terms of exports, which saw a year-on-year decline of 3.82 percent but a tad better than the April 2016 showing, SIAM is exploring options of a rupee trade with Africa sometime in the future. According to Mathur, markets like Algeria and Nigeria have witnessed reducing dollar income due to the dip in oil prices globally. But the rupee trade will take some time as it requires government approval.

Meanwhile, Latin American markets have their own set of internal problems but going forward some stability is expected to take place in this region that could give a push to Indian exports to this geography. As is known, both LATAM and Africa are key markets for India.

Recommended:

RELATED ARTICLES

Tata Motors, JSW MG, M&M Command 86% of e-PV Sales in February, Maruti Sells 214 e-Vitaras

With 5,558 units sold, Tata Motors captured a 41% share of the 13,669 e-PV market last month, while JSW MG Motor and Mah...

TVS Sells 31,600 e-Scooters in February for a 28% Share; FY2026 to see 1.35 Million e-2W Sales

With 31,600 e-scooters, TVS commanded a 28% market share even as Bajaj Auto, Ather Energy and Hero MotoCorp witnessed st...

Top 10 MPVs in First 10 Months of FY2026: Maruti Ertiga to Kia Carnival

Demand for multi-purpose vehicles remains strong, with their share of UV sales rising to 17% in FY2027 from 11% in FY202...

By Shobha Mathur

By Shobha Mathur

09 Jun 2016

09 Jun 2016

5941 Views

5941 Views

Ajit Dalvi

Ajit Dalvi