India auto sales in slow growth mode in November

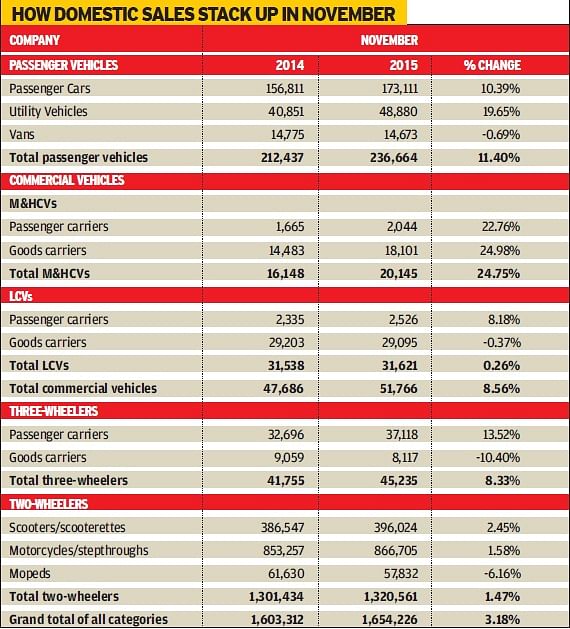

The November 2015 numbers are discreet, with overall sales of 1,654,226 vehicles across segments, with growth a marginal 3.18 percent over November 2014.

The Society of Indian Automobile Manufacturers (SIAM) today revealed the November 2015 sales numbers. What’s clear is that a reality check for the industry is underway, after the sterling performance in October when industry across segments clocked 13.91 percent growth year on year with overall sales of 2,035,821 vehicles. That’s also because of Diwali when consumers opened their wallets to make the most of festive discounts offered by OEMs.

The November 2015 numbers are more discreet, with overall sales of 1,654,226 vehicles across segments, with growth a marginal 3.18 percent over November 2014. Compared to October 2015 numbers, only the M&HCV and three-wheeler segments clocked better growth in November 2015.

Sales of passenger cars last month were 173,111, a 10.39 percent increase over the year ago figure (November 2014: 156,811). Utility vehicle sales grew 19.65 percent to 48,880 units, while vans saw just 0.69 percent growth to 14,673 units.

The commercial vehicle sector saw overall sales of 51,766 units to clock 8.56 percent growth over November 2014 sales of 47,686 units. Medium and heavy commercial vehicles (M&HCVs) continued to be in growth mode with sales 20.145 units for a 24.75 percent increase. Importantly, LCVs were in positive territory with 8.56 percent growth and sale of 31,621 units.

Three-wheelers clocked 8.33 percent growth last month with sales of 45,236 units.

The two-wheeler sector continues to bear the brunt of the rural slowdown. It sold a total of 1,320,561 units to register flat growth of 1.47 percent. While scooters posted 2.45 percent growth with sales of 396,024 units, motorcycles saw growth of 1.58 percent to 866,705 units.

Production in November down 9.76 percent

On the production front in November, overall industry numbers are down by a substantial 9.76 percent to 1,799,478 units. This means that there must have been an inventory build-up as manufacturers increased production to cater to demand in October when Dhanteras and Diwali took place. Sales of passenger cars, utility vehicles, M&HCVs, three-wheeler passenger carriers, scooters and motorcycles were in positive territory in November 2015. This indicates OEMs had enough stock to cater to them in November. But for the low level of rural offtake, sales numbers last month would have been better.

For the April-November 2015 period, the industry produced a total of 16,060,865 vehicles comprising passenger vehicles, commercial vehicles, three-wheelers and two wheelers as against 15,820,978 in April- November 2014, registering a marginal growth of 1.52 percent.

April-November 2015 numbers

Sales of Passenger Vehicles grew by 8.87 percent in April-November 2015 over the same period last year. Within the PV segment, Passenger Cars, Utility Vehicles and Vans grew by 11.37 percent, 3.05 percent and 1.12 percent respectively during April- November 2015 over the same period last year.

The overall Commercial Vehicles segment registered a growth of 8.08 percent in April- November 2015 as compared to same period last year. M&HCVs registered a growth at 31.38 percent while Light Commercial Vehicles declined by (-) 4.56 percent.

Three-wheeler sales declined by (-) 6.60 percent in April-November 2015 over the same period last year. Passenger Carrier & Goods Carrier sales declined by (-) 6.58 percent & (-) 6.70 percent respectively in April-November 2015 over April- November 2014.

Two-wheeler sales registered a marginal growth at 1.69 percent during April- November 2015 over April-November 2014. Within the segment, scooters grew by 12.44 percent while motorcycles and mopeds dropped by (-) 2.10 percent and (-) 5.37 percent respectively in April-November 2015 over April- November 2014.

With barely 20 days for the year to close, manufacturers particularly in the passenger car and two-wheeler markets are offering handsome discounts. But are consumers biting? It is a well-known fact that a good number of vehicle buyers tend to delay purchase decisions to the new year so that they own a vehicle registered in the new year.

Also read: INDIA SALES ANALYSIS NOVEMBER 2015

RELATED ARTICLES

Kia India Drives Towards Highest-Ever Sales in FY2026

Kia India has sold 259,923 vehicles in the first 11 months of FY2026, just 9,306 units short of its all-time high of 269...

Bajaj Auto Outsells Mahindra in e-3Ws for Second Month in a Row, TVS Ranked Third in February

Bajaj Auto, after overtaking Mahindra Last Mile Mobility for the first time in January, repeated the feat in February wi...

Mahindra Sells 600,000 SUVs in 11 Months of FY2026, Goes ahead of Tata Motors

Mahindra’s 600,004 SUV wholesales put it ahead by 34,809 units over Tata Motors’ 565,195 passenger vehicles in the first...

By Autocar Professional Bureau

By Autocar Professional Bureau

11 Dec 2015

11 Dec 2015

5281 Views

5281 Views

Ajit Dalvi

Ajit Dalvi