Surge in demand for 25- and 31-tonners driving M&HCV growth in India

According to a recent Roland Berger Strategy Consultants’ report on the M&HCV segment in India, there is a clear trend of demand for heavy vehicles especially 25T and 31T trucks.

With the medium and heavy commercial vehicle (M&HCV) sector, which is seen as the barometer of a country’s economy, showing consistent growth over the past 10 months, albeit on a low sales base, CV majors are breathing a sigh of relief.

This growth comes after nearly two years of a prolonged slump amid economic uncertainty. Thanks to the opening up of the mining sector and the government’s focus on infrastructure projects, demand is looking up for higher-tonnage vehicles, especially the 25-tonne and above Gross Vehicle Weight (GVW) truck market. Gradually, a good number of fleet operators are either replacing their fleet and/or moving towards high-tonnage vehicles for operational efficiency.

According to a recent Roland Berger Strategy Consultants’ report on the M&HCV segment in India, there is a clear trend of demand for heavy vehicles especially 25T and 31T trucks. While 2014-15 saw the 25T segment record 15 percent YoY growth, customers are now preferring higher-tonnage vehicles like 31T vehicles, which saw 53 percent YoY growth in the last fiscal.

The 31T is the only segment in the M&HCV industry that has shown growth, albeit marginal, over the past five years. While 25T volumes fell from 86,000 units in FY11 to 50,000 units in FY15, the same period saw the 31T segment notch improved numbers -- from 44,000 in FY11 to 48,000 in FY15.

Meanwhile, over the past couple of years, another product segment – the 37T GVW truck – has emerged and is gaining ground among fleet operators who are keen to transport heavier loads. Talking to Autocar Professional, a South India-based large fleet operator said that the 37T truck is a perfect model for transporting goods on longer-distance routes as such a vehicle has the same operational expenses as a 31T but can carry more payload as well as returns better profits.

Despite foreign players like Scania, Daimler and Volvo entering the M&HCV market in recent years, home-grown and well-entrenched players like Tata Motors and Ashok Leyland still dominate the heavy vehicle segment by a big margin.

As per the Roland Berger report, in FY15, VE Commercial Vehicles and Mahindra & Mahindra has managed to get a 7% share of the 25T market while Ashok Leyland and AMW have ceded market share. Nevertheless, Tata Motors and Ashok Leyland account for an overwhelming 80% share of the segment.

How the main players have fared

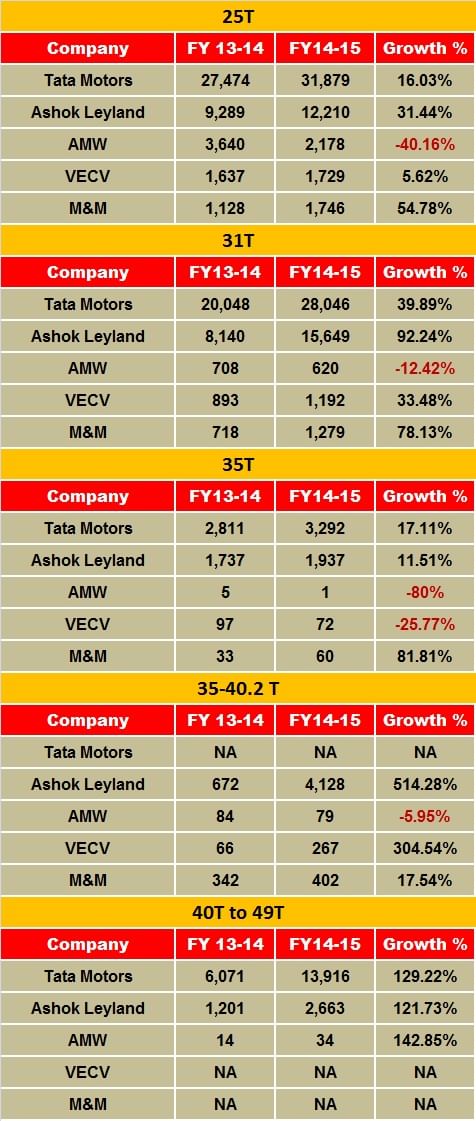

The sales table below reveals how the key M&HCV players have performed in the past two fiscals, segment-wise. Tata Motors gained 16% in the 25T segment with its two products (LPT2518, LPK2518) selling 31,879 units during 2014-15. Ashok Leyland, which has three products in the category (6x2 Mav, 6x4 Mav, 6x4Tipper) registered strong 31% growth and sold 12,210 units in 2014-15. Mahindra & Mahindra sales rose 50% with 1,746 units sold (MN25) while VE Commercial Vehicles’ sales grew 5% with sales of 1,729 units of two products (Eicher 30.25, Terra 25). Meanwhile, AMW saw de-growth of 40% with sale of 2,178 units (2518 HL, 2516 HL, 2518 TP, 2523TP, 2518TM).

In the 31T segment, Ashok Leyland posted 92% growth selling 15,649 units with its two products (8x2 Haulage, 8x4 Tipper). Tata Motors gained 40%, selling 28,046 of its popular LPT3118 model in the category. M&M also did well to grow 78% YoY with sales of 1,279 units of its MN31. VECV reported a 33 percent increase and sold 1,192 units of its 35.31 truck. AMW, whose sales fell 12%, sold 620 units (3118HL, 3118TP).

Long-term growth headed the M&HCV way

Dr Wilfried Aulbur, managing partner – India, Roland Berger Strategy Consultants, is optimistic on the growth of the M&HCV market: “In the M&HCV segment, particular focus is currently on large-tonnage vehicles such as 31-tonne vehicles, 35T and 49T tractor-trailers. These vehicles are seeing a large amount of activity driven by the fact that truck operators understand that the economics of these vehicles in an environment where infrastructure is getting better and overloading bans are strictly enforced. We see profit and benefits from Goods and Service Tax (GST) once it is rolled out and it would drive growth of these vehicles.”

“From a long-term perspective, we believe that by 2020, the M&HCV segment should account for about 342,000 units, which makes India one of the key markets globally. As far as M&HCVs are concerned, this also means about 15 percent more as compared to the previous high in 2012 of 299,000 units,” he adds.

RELATED ARTICLES

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

The 200cc Motorcycle: India’s Quiet Premiumisation Story

While the motorcycle market’s attention remains on 110cc volumes and the 350cc Royal Enfield phenomenon, a quiet revolut...

100,000 and Holding: Electric Scooters Cross a Threshold

India’s electric two-wheeler market has achieved a landmark, with monthly wholesale volumes now consistently exceeding 1...

18 Jun 2015

18 Jun 2015

16064 Views

16064 Views

Ajit Dalvi

Ajit Dalvi

Arunima Pal

Arunima Pal