February retails rise 13% to 2 million units, first 11-month sales race past FY2023’s 22 million units

With all five vehicle segments registering YoY growth, February 2024 is fifth month in current fiscal to see over 2-million sales in a month; at 2,21,99,063 units, cumulative April 2023-February 2024 numbers accelerate past FY2023’s 2,21,50,222 units.

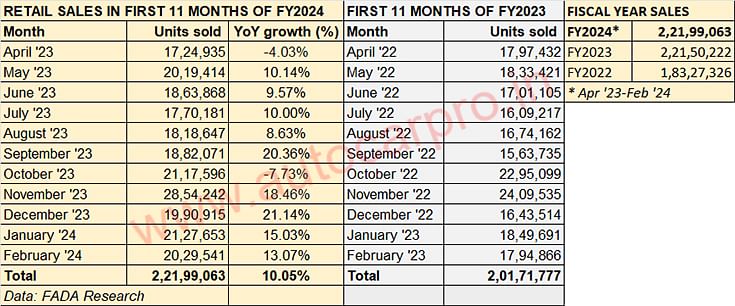

After the robust start to CY2024 with January retail sales hitting 2.12 million units and 15% growth, February has also clocked 2 million-plus sales. This is the fifth month in the first 11 months of FY2024 that retail sales surpassed two-million units, indicating the strong market momentum particularly for the passenger vehicle, two- and three-wheeler segments. What’s more, cumulative sales of the first 11 months of FY2024 at 2,21,99,063 are up 10% YoY (April 2022-February 2023: 2,21,50,222 units) and have also surpassed entire FY2023 sales.

A deep dive into FADA retail sales statistics for five vehicle categories (see data table below) reveals that at the end of February 2024, India Auto Inc has gone ahead of FY2023’s 2,21,50,222 units (up 21% over FY2022’s 1,83,27,326 units) by 48,841 units. FY2023 was the first full year without the shadow or impact of Covid which had impacted demand and sales in FY2021 and FY2022.

With March 2024 numbers still to march in, India Auto Inc could see total retail sales in the region of 24.20 million units or more in FY2024.

With March 2024 numbers still to march in, India Auto Inc could see total retail sales in the region of 24.20 million units or more in FY2024.

FY2024 has received a major boost from the record retail sales in November 2023, whose first fortnight housed the last portion of the 42-festive season. November 2023 witnessed sales of 28.54 lakh or 2.85 million vehicles, surpassing the previous monthly best in March 2020 (25.69 lakh) by 285,000 units. With March 2024 numbers yet to be counted and most likely to deliver retails of over 2 million units given that it is the fiscal-year-ending month, expect FY2024 to see total sales in the region of 24.20 million units or more.

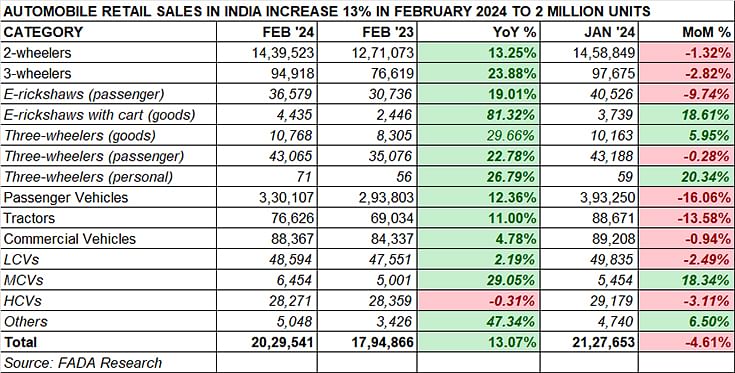

As per the data released by the Federation of Indian Automobile Dealers Associations (FADA), February 2024 saw total sales of 20,29,541 units, up 13.07% YoY (February 2023: 17,94,866 units) but down month on month on January 2024’s 21,27,653 units. As in January, the second month of this year also saw all segments register YoY growth – two-wheelers (13%), three-wheelers (24%), passenger vehicles (12%), tractors (11%) and commercial vehicles (5%).

Two-wheeler retails: 14,39,523 units, up 13.25% YoY

At 1.49 million units, retail sales of motorcycles and scooters rose 13% YoY in February, mainly due to the continued strength of demand emanating from rural India, which is a key buyer of fuel-efficient commuter motorcycles, continuing consumer demand for premium models (as seen in the 125cc motorcycle category) and strong performance of entry-level segments.

According to Manish Raj Singhania, President, FADA, what has also helped is the “broader product availability and compelling offers enhancing product acceptance. Factors like favourable marriage dates and improved economic conditions also contributed to this positive growth.”

The top four OEMs – Hero MotoCorp, Honda Motorcycle & Scooter India (HMSI), TVS Motor Co and Bajaj Auto together account for 82% of the total two-wheeler market. Market leader Hero MotoCorp sold a total of 413,470 units, accounting for a 29% market share and clearly benefitting from the resurgence of rural market demand which is a big buyer of its fuel-sipping bikes. However, Hero’s share a year ago was 30.76 percent.

HMSI, which clocked sales of 355,223 units, has a 24.68% market share, up from the 23.82% it had a year ago. The Activa brand of scooters continue to be the power source of Honda’s sales.

TVS Motor Co, with 247,880 units, has a 17.22% share in February 2024, up from the 16.68% a year ago. Likewise, Bajaj Auto, with 171,155 units, has increased its two-wheeler share to 11.89% from 11% a year ago.

Three-wheeler retails: 94,918 units, up 24% YoY

The three-wheeler segment, which is seeing the fastest transition to electric mobility, recorded strong sales of 94,918 units, up 24% YoY. Fifty-three percent of that – or 41,014 units – were EVs, which means that every second three-wheeler sold in India at present is electric. This trend is also seen in the cumulative 11-month retail sales – as per Vahan, demand for e-three-wheelers has risen by a robust 60% in the April 2023-February 2024 period to 571,726 units. With March 2024 still to be counted, e-three-wheeler OEMs will easily surpass the 600,000 EV milestone for the first time, way ahead of FY2023’s 402,096 units and also beating CY2022’s 581,696 units.

Sales last month were driven by first-time buyers, the shift towards EVs as also the improved market sentiment and consumer engagement, according to the FADA president.

Market leader Bajaj Auto maintained its stranglehold with sales of 34,677 units, which gives it a market share of 36.53 percent. Piaggio Vehicles is the second-ranked OEM here with 8,010 units, and a share of 8.44 percent, followed by Mahindra Last Mile Mobility with 5,853 units and a 6.17% market share.

Passenger vehicle retails: 330,107 units, up 12% YoY

Given the unabated demand for SUVs and MPVs in India and the fact that utility vehicles now account for over 55% of overall passenger vehicle (PV) sales, it is not surprising that February 2024 saw a 12% YoY increase, albeit it was down 16% on the record January 2024’s 393,250 units. Nevertheless, February 2024 retails are the best-ever monthly performance for the second month of the year, driven by consistent new product and variant launches and much-improved availability of popular models following ramped-up production by their manufacturers.

However, with OEMs pumping their showrooms with dispatches, FADA president Manish Raj Singhania has red-flagged the current PV inventory levels. He said: “Elevated inventory levels in the PV segment, remaining at 50-55 days, pose a significant concern, necessitating OEMs to adjust production to reduce dealer carrying costs. It is imperative for PV OEMs to undertake adjustments in production to mitigate these high inventory levels, thereby reducing the financial burden of carrying costs on dealers as it is vital for maintaining the financial health of dealers. Adopting this forward-looking stance is essential for ensuring the sustained growth and vitality of this segment.”

Commercial vehicle retails: 88,367 units, up 4.78% YoY

In what is perceived to be a challenging year for the commercial vehicle sector, in view of it being an election year, the CV industry has come out trumps in February 2024. At 88,367 units, it has achieved 5% YoY growth, overcoming challenges such as cash flow shortages and election-related purchase deferrals. Light CVs with 48,594 units accounted for 55% of the total CV sales are were up 2% YoY. Demand for medium CVs was jumped 29% to 6,454 units, while that for heavy CVs was flat at 28,271 units.

In his commentary on the CV sector’s performance last month, the FADA president said: “The CV segment grew by 5% YoY, overcoming challenges through fleet purchases and school buses, strong sectoral demand and improved financing, despite obstacles like cash flow shortages and election-related purchase deferrals, highlighting the sector's resilience and gradual recovery."

Robust rural market demand and fiscal year-end to drive March 2024 sales

FADA remains cautiously optimistic about India Auto Inc’s near-term growth outlook, given that the auto retail sector is influenced by a blend of positive trends and challenges. The rural sector's robust signals, along with an increased demand for premium and entry-level segments, are set to bolster the two-wheeler market.

Similarly, both the three-wheeler and CV sectors expect a charge up in sales this month, driven by the financial year-end rush and an infusion of funds into the market, which is expected to stimulate purchases. In the PV sector, the confluence of financial year-end buying incentives, improved availability of vehicles and seasonal factors such as marriages is likely to propel demand.

Meanwhile, the EV industry is likely to expect record sales in March 2024 given the buyer rush to buy zero-emission vehicles before the current fiscal year comes to a close and benefit from the FAME II subsidy.

There are challenges to vehicle sales though. According to Singhania, “the anticipation of elections casts a shadow over this positive scenario, with potential deferred purchases across segments. The commercial vehicle sector, in particular, might face a cautious approach from customers waiting for the outcome of general elections. Supply constraints further complicate the landscape, especially in the PV segment, where the availability of popular variants remain a concern. External factors like crop failures in rural areas could also dampen market sentiment and financial liquidity, posing additional hurdles to sustained growth.”

“Overall, the near-term outlook for March 2024 in the auto retail sector is one of cautious optimism. Financial year-end activities traditionally spur purchasing across segments, yet the feedback from dealers highlights the nuanced challenges of inventory management, extremely aggressive target settings and evolving consumer preferences. OEMs' ability to address these challenges through strategic product introductions, supportive dealer policies and adaptive sales strategies will be paramount in maintaining the sector's growth momentum and achieving success in in the near term.”

RELATED ARTICLES

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

The 200cc Motorcycle: India’s Quiet Premiumisation Story

While the motorcycle market’s attention remains on 110cc volumes and the 350cc Royal Enfield phenomenon, a quiet revolut...

100,000 and Holding: Electric Scooters Cross a Threshold

India’s electric two-wheeler market has achieved a landmark, with monthly wholesale volumes now consistently exceeding 1...

07 Mar 2024

07 Mar 2024

11159 Views

11159 Views

Ajit Dalvi

Ajit Dalvi

Arunima Pal

Arunima Pal