Electric two-wheeler sales bounce back in August to 60,000 units

Maturing Indian EV market returns to 60,000-unit levels just two months after the sharp fall in June due to slashed FAME subsidy and higher product prices; Ola commands 29% market share, TVS has 24%, Ather Energy 11%, Bajaj Auto 10%; January-August 2023 retails already 87% of CY2022’s record 631,169 units.

August 2023 has turned out to be an august month for the electric two-wheeler industry in India. With sales of nearly 60,000 units, August 2023 is ample proof that India EV Inc on two wheels is back in action. Sales have revived after the 56% month-on-month crash in June and a 11-month low of 45,734 units, following the slashing of the FAME II subsidy by 25 percent.

At the end of day on August 31 (9pm), as per the government’s Vahan website, a total of 59,313 e-two-wheelers were retailed across the country. This was the total as of the last day of August but expect the total tally to rise as new vehicle registrations get added on to the month over the first few days of September, which should see August 2023 retails cross the 60,000 mark.

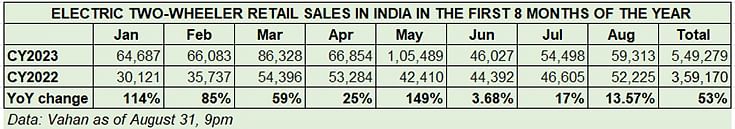

Look at the data table below and you can see the month-on-month growth in July and August. July 2023’s 54,498 units were up 18% on June’s 46,027 units, and August 2023’s 59,313 units are up 9% on July. Given the sustained momentum, there’s year-on-year growth too – 3.68% in June, 17% in July and 13% in August.

That nearly 160,000 EV users have chosen to purchase an e-two-wheeler between June-August 2023, despite the reduced-by-25% FAME subsidy and in turn a higher product price, indicates a maturing of the marketplace.

Importantly, for India Auto Inc, the fact that 159,838 e-two-wheelers have been bought across India in the three-month June-August period, despite the higher EV prices as a result of the reduced FAME subsidy, points to a maturing of the market and the Indian EV buyer, both individual as well as fleet. Compared to petrol-engined two-wheelers, electric scooter and bike buyers benefit from hugely reduced operating costs, estimated at a fourth of what it takes on a petrol-engined scooter or motorcycle.

Meanwhile, cumulative sales in the first eight months of 2023 – 549,279 units – are up 53% over January-August 2022 retails and already 87% of total sales of record 631,169 units in CY2022. With another four months to go for the year to end and the festive season having begun with Onam and continuing through to October, it can be surmised that the electric two-wheeler industry could close CY2023 with total sales in the region of 750,000 to 800,000 units, which means between 18% to 25% YoY growth.

Ola leads with 25% market share, TVS, Bajaj, Greaves, Okaya log strong MoM growth

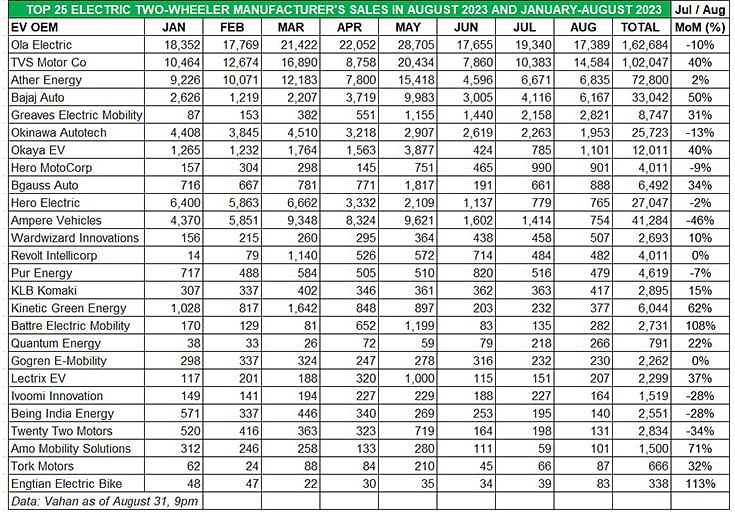

A deep dive into the Vahan retail sales data reveals that of the 147 OEMs in the fray, the top seven EV makers have sold in excess of 1,000 units each, their combined total adding to 50,850 units, or an overwhelming 86% of total retail sales in August. Of this, market leader Ola Electric has a commanding share of 29.31 percent. Of the top 25 OEMs, 16 have registered month-on-month growth over July 2023 while nine have seen a decline (see Top 25 Vahan sales data table below).

Ola Electric, which recently launched its refreshed S1 series of e-scooters and has already garnered over 75,000 bookings, sold 17,389 units in August, bettering June’s 17,655 units but below July’s 19,340 units. Given the surge in demand for its products, expect Ola to clock in excess of 20,000 units a month from September onwards. Ola’s market share in August was 29% – it is the same for the January-August 2023 period with 162,684 units out of a total of 549,279 units for the industry.

TVS Motor Co, with 14,584 units, saw 40% MoM growth (July 2023: 10,383), and had a 24% share in August, up from the 19% it had in July. If one doesn’t factor in the record May 2023 sales for TVS or other OEMs, then last month’s numbers are TVS’ best monthly iQube sales in the first five months of FY2024, after April (8,758), June (7,860) and July (10,383). In the calendar year to date, TVS had surpassed the 100,000-unit milestone with a total of 102,047 units. Last month saw the company launch its new and premium EV flagship, the TVS X, priced at Rs 250,000, at a mega event in Dubai.

Bengaluru-based smart e-scooter OEM Ather Energy is ranked third with 6,835 units, up a marginal 2% over July’s 6,671 units. Ather Energy is among the EV OEMs making moves to enable easy finance to potential buyers. In July, the company announced 100% on-road financing for its e-two-wheelers, barely a month after it introduced a 60-month loan product, resulting in monthly EMIs as low as Rs 2,999, in collaboration with IDFC First Bank, HDFC Bank, Hero FinCorp, Bajaj Finance, Axis Bank, and Cholamandalam Finance.

Bajaj Auto, which has sizeably ramped up production of the Chetak scooter and is also expanding its network, sold 6,137 EVs in August, up 50% on July’s 4,116 units. This is Bajaj Auto’s second-best monthly performance after the best-yet 9,983 units in May 2023.

Greaves Electric Mobility, which was ranked sixth in July, moves up one rank to fifth position in August as a result of the 31% increase in month-on-month retails to 2,821 units (July 2023: 2,158 units).

Okinawa Autotech comes in at No. 6 with 1,953 units, down 13% MoM. Considering the company had opened CY2023 with 4,408 units in January, it is clearly feeling the heat of slowed-down sales. Seventh-ranked Okaya EV has done well to shift 1,101 e-scooters, up 40% on its July sales of 785 units.

Hero MotoCorp with its Vida scooter is next in the Top 25 ranking with 901 units, down 9% on July’s 990 units but going past Hero Electric (765 units) for the second straight month

Maturing of the Indian EV market

If August numbers have touched 60,000 units, then September and beyond should be better what with the festive season having opened. Despite EV prices having risen since June, electric two-wheeler buyers are game to invest their money in the zero-emission, eco-friendly machines that deliver wallet-friendly returns compared to their petrol-engined counterparts.

Proof of this is that between June and August 2023, nearly 160,000 EV users have chosen to purchase an e-two-wheeler, despite the reduced-by-25% FAME subsidy and in turn a higher product price.

Given the likelihood of the FAME subsidy scheme not being extended, OEMs and EV buyers will have to contend with the fact that market dynamics will take over even as OEMs and their component and technology supplier ecosystem are hard at work to reduce developmental and product costs to enhance EV affordability.

Companies are also working on developing lower-cost versions of their popular EVs. For instance, it is learnt that TVS Motor Co is working on a lower-priced iQube which, while it is already priced lower than its key rivals from Ather, Bajaj Auto or Ola Electric, would mean use of a smaller battery pack and possibly fewer features.

As in the petrol-engined two-wheeler market, stiff competition for the EV buyer will result in OEMs rolling out newer and improved products, with focus on the latest technologies and higher riding range. There will also be some OEMs which will develop variants with optimised features to drive down costs but with lower sticker prices.

All said and done, the EV story is here to stay as a value proposition in terms of mobility. What is helping accelerate demand is the growing number of new product launches, gradual improvement in EV charging infrastructure and EV-friendly policies from the Central and nearly all State governments. Sustained demand from both personal buyers and last-mile delivery operators should keep the momentum for the electric two-wheeler industry till the end of the year.

ALSO READ:

EV sales in India race past 800,000 units in first 7 months of 2023

India has over 2.8 million EVs on its roads, Central and South India dominate EV ownership

RELATED ARTICLES

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

The 200cc Motorcycle: India’s Quiet Premiumisation Story

While the motorcycle market’s attention remains on 110cc volumes and the 350cc Royal Enfield phenomenon, a quiet revolut...

01 Sep 2023

01 Sep 2023

24104 Views

24104 Views

Autocar Professional Bureau

Autocar Professional Bureau

Ajit Dalvi

Ajit Dalvi

Arunima Pal

Arunima Pal