Electric car and SUV sales drive past 40,000 units in H1 2024, up 21%

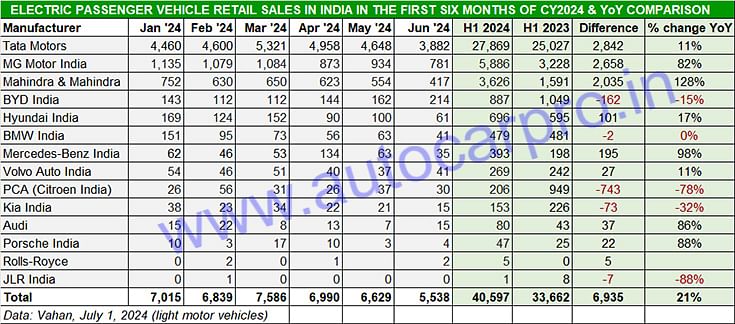

Between January 1 and June 30, 2024, retail demand for electric passenger vehicles maintained a strong double-digit growth rate and is 55% of CY2023’s 73,267 EVs. Market leader Tata Motors continues to dominate but sees its share reduce to 68% as a result of growing competition. Luxury EV makers sell 1,274 cars and SUVs for a 3% share of the market.

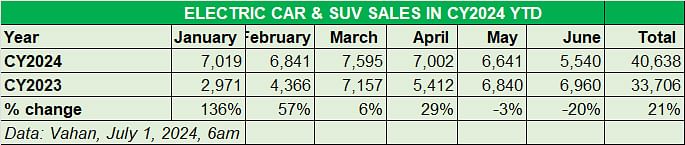

With the first half of calendar year 2024 over, a quick look at the retail sales data of the electric passenger vehicle sales industry reveals that a total of 40,638 zero-emission cars, SUVS and MPVs have been sold in India. This constitutes a strong 21% year-on-year increase (January-June 2023: 33,706 units) and is already 55% of CY2023’s total sales of 73,267 units.

In June 2024, as per Vahan retail sales data (as of 6am on July 1, 2024), for the light motor vehicle category, a total of 5,540 units were sold, down 20% year on year (June 2023: 6,960 units) but marginally up on May 2024’s 6,840 units. In the first six months of the ongoing calendar year, the FY2024-ending March 2024 delivering the highest sales – 7,595 units.

Tata Motors sells 27,869 EVs in H1 2024

Electric passenger vehicle market leader Tata Motors, which has the largest portfolio comprising the Nexon EV, Tigor EV, Tiago EV, Xpres-T (for fleet buyers) and the Punch EV, retailed a total of 27,869 EVs in H1 2024, which helps it maintain its lead with a 68.54% market share, albeit down on 74% share it had a year ago (January-June 2023: 25,027 EVs). The company’s highest monthly sales in the year to date have been in March (5,321 units). Year on year, the H1 2024 performance is a growth of 11 percent (H1 2023: 25,027 units) and 54% of CY2023’s sales of 51,636 units.

The company’s share of the EV market, which was not too long ago upwards of 75%, has been reducing, reflecting the growing competition in the form of new products from rival EV OEMs and increased choice for the buyer.

Nevertheless, there continues to be a big difference in numbers between Tata Motors and the rest of the competition. MG Motor India, registered sale of 5,886 EVs in H1 2024, with two products – the ZS EV and Comet EV – giving it a 14.48% market share.

In No. 3 position is Mahindra & Mahindra, with 3,620 units of the XUV400, and a 9% EV market share for the first-half 2024, up 128% YoY on a low year-ago base of 1,591 units. In mid-January 2024, the company launched the new XUV400 Pro range, with prices starting from Rs 15.49 lakh, going up to Rs 17.49 lakh for the new top-spec EL Pro variant.

BYD India, which sells the Atto 3 SUV, e6 MPV and launched the Seal sedan on March 5, is ranked fourth with H1 2024 retails of 887 units, albeit this is 16% down on year-ago sales of 1,049 units. BYD was behind Hyundai for the first three months of this year but has surged ahead of the Korean carmaker since April for three straight months. June sales (000 units) are BYD India’s best monthly numbers YTD.

Hyundai Motor India, with an H1 2024 total of 696 EVs, takes fifth rank both for June (61 units) and for the half-year period. The company, which had two EVs on sale (Kona and Ioniq 5) is understood to have discontinued the Kona in India, five years after launching it in July 2019. The Hyundai Kona Electric has been removed from the brand’s website – it is learnt that some dealers have unsold stocks, which are being offered at attractive discounts, depending on availability. In the 59 months that it has been on sale in India, Hyundai sold 2,329 units of the Kona Electric, or about 39 cars a month.

Citroen India (PCA Automobiles), which is gearing up to launch the Basant coupe-sedan later this year, has sold 269 electric cars and SUVs in H1 2024. The company’s sole product – the eC3 hatchback – is the third of the four Citroen cars and SUVs to be launched in India. The Citroen eC3, which has a 29.2kWh battery pack and an ARAI-claimed range of 320km, should see increased sales momentum later this year, given that the company has been contracted for bulk eC3 orders comprising over 7,000 units from EV fleet operators Blusmart, OHM E Logistics and Cab-E.

The electric luxury car and SUV segment continues to witness strong growth, which comes on the back of a sterling performance in CY2023 when estimated retail sales at 2,640 units were up 366% on CY2022’s 566 units. In the current calendar year, cumulative sales of 1,274 units in the first six months are already 00% of CY2023’s total retails.

As per Vahan data, luxury carmakers in India sold 1,274 units between January and June 2024, up 00% YoY (H1 2023: 997 units). This gives them a 3.13% share of the Indian EV market for the first six months of this year. BMW India tops the luxury EV sales chart with 479 units, followed by Mercedes-Benz India (393 units) and Volvo Auto India (269 units).

RELATED ARTICLES

Top 10 MPVs in First 10 Months of FY2026: Maruti Ertiga to Kia Carnival

Demand for multi-purpose vehicles remains strong, with their share of UV sales rising to 17% in FY2027 from 11% in FY202...

Skoda Slavia and VW Virtus Sales Cross 150,000 Units, Virtus First to Cross 75,000 Units

Skoda Volkswagen India’s two MQB-A0-IN–based sedans have reached a new milestone, with the Slavia at 73,378 units and th...

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

01 Jul 2024

01 Jul 2024

12745 Views

12745 Views

Ajit Dalvi

Ajit Dalvi

Autocar Professional Bureau

Autocar Professional Bureau