Electric 3W sales hit highest level of 65,700 units in October, Mahindra and Bajaj Auto battle turns intense

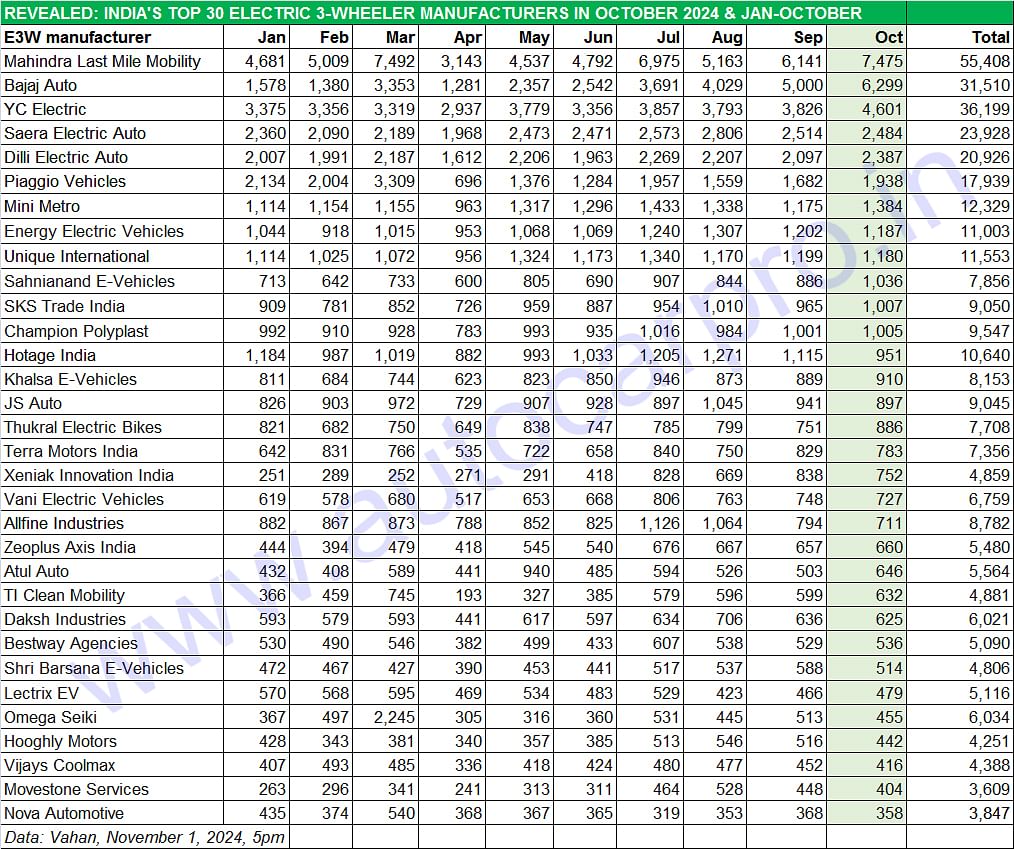

Electric three-wheelers registers their best monthly sales in festive October and are just 16,856 units away from surpassing CY2023's 583,597 units. While Mahindra Last Mile Mobility leads the market with 7,275 units and an 11% market share in October, Bajaj Auto sold 6,299 units, which gives it an e3W market share of 9.58% in October, up from the 3% in had in January 2024. We reveal India’s Top 30 OEMs from the 575 players in the field.

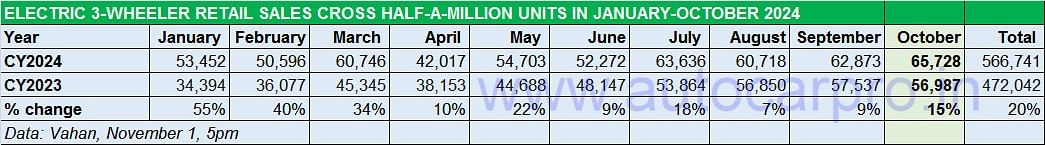

Along with the electric two-wheeler and passenger vehicle segments, which scored their second-best and best monthly retails in the festive month of October respectively, the e-three-wheeler segment added to the EV industry’s zero-emission fireworks with a new high of its own. At 65,728 units in October 2024, e-three-wheeler retail sales were 15% higher than year-ago sales of 56,987 units. This sets a new monthly high for the segment, improving upon July 2024’s 63,636 units.

Monthly sales have gone past the 60,000 mark now for four straight months – July 2024 (63,636), August (60,718), September (62,783) and October (65,728). In the process, cumulative sales for the first 10 months of this year (January-October 2024) at 566,741 units are up 20% YoY (January-October 2023: 472,042 units) and just 16,856 units away from bettering CY2023’s 583,597 units. This will be achieved in the first fortnight of November 2024 and will go on to set a new annual sales benchmark this year. Will CY2024 see the e-three-wheeler industry achieve a record 650,000 sales? It just might, if the current growth momentum is maintained.

With record monthly retails of 65,728 units in October and 566,741 units sold in January-October 2024, India e-3W Inc is just 16,856 units away from surpassing CY2023’s record sales of 583,597 units.

With record monthly retails of 65,728 units in October and 566,741 units sold in January-October 2024, India e-3W Inc is just 16,856 units away from surpassing CY2023’s record sales of 583,597 units.

The sustained growth in retails is a result of many factors including lower cost of ownership (compared to IC engine, CNG and LPG options), improved financing options, the FAME-EMPS and now the PM E-Drive purchase incentive scheme, increased product choice and as well as growing demand from fleet and last-mile logistics operators.

Demand for electric three-wheelers soared under the FAME II subsidy scheme, when it kept registering strong double-digit growth. Under the four-month EMPS, which ended on September 30, 2024 and had a reduced subsidy compared to FAME II, monthly sales growth has been more muted and in single digits. Now with the new PM E-Drive scheme – which offers the same subsidy as in the EMPS for the first year and half of that in the second – and effective for a two-year period, it remains to be seen if the same momentum is maintained in the second year.

The PM E-Drive scheme incentivises purchase of 316,000 e-three-wheelers. E-three-wheelers including e-rickshaws, get a subsidy of Rs 25,000 in the first year and Rs 12,500 in the second year. For the L5 category (cargo e-three-wheelers), the incentive is Rs 50,000 per unit in the first year and Rs 25,000 in the second.

Of all vehicle segments, it is the e-three-wheeler industry which is witnessing the fastest transition to electric mobility. Of the total 10,21,107 three-wheelers per se sold between January and October 2024, across petrol, diesel, CNG, LPG and electric powertrains, electric three-wheelers – 566,741 units – account for 56% of the sales, effectively translating into every second three-wheeler sold in India being an EV. CNG-powered three-wheelers, at 299,880 units, are the next highest and have a 29% share of the overall market, and are followed by diesel (1,13,829 units, 11% share), LPG (27,530 units, 2.69% share) and petrol (10,199 units, 1% share).

MAHINDRA LAST MILE MOBILITY HITS SECOND-BEST MONTHLY SALES IN OCTOBER: 7,475 UNITS

MAHINDRA LAST MILE MOBILITY HITS SECOND-BEST MONTHLY SALES IN OCTOBER: 7,475 UNITS

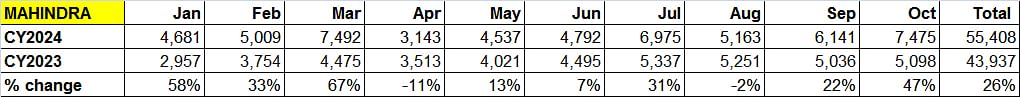

Market leader Mahindra Last Mile Mobility sold 7,475 units in October, up 47% YoY (October 2023: 5,098 units) which gives it an 11.37% market share.

Market leader Mahindra Last Mile Mobility sold 7,475 units in October, up 47% YoY (October 2023: 5,098 units) which gives it an 11.37% market share.

Like the e-two-wheeler industry, there’s fierce competition too in this segment, albeit amongst the Top 6 players – Mahindra Last Mile Mobility (MLMM), Bajaj Auto, YC Electric, Saera Electric Auto, Dilli Electric Auto and Piaggio Vehicles. They are part of an industry which, at last count as per Vahan, has all of 575 players!

In October as well as for January-October 2024, these Top 6 e3W OEMs have registered strong sales – their combined sales in October are 25,184 units (38% of total industry sales) and 185,910 units in January-October 2024 (33% of total industry sales). The real battle though is being fought at the podium level – between Mahindra Last Mile Mobility, Bajaj Auto and YC Electric.

E3W market leader Mahindra Last Mile Mobility sold 7,475 units in October, up 47% YoY (October 2023: 5,098 units) which gives it an 11.37% market share. This is the second highest monthly score for MLMM, narrowing missing out on the FAME II-ending month of March 2024 (7,492 units) by just 17 units. For the first 10 months of this year, MLMM’s cumulative sales of 55,408 units are a strong 26% YoY increase (January-October 2023: 43,937 units) and give it a market share of 9.77 percent. With this, MLMM has surpassed its CY2023 retails of 54,599 units, which means it is driving towards record sales in the region of 63,000 to 65,000 units in CY2024.

MLMM’s EV portfolio comprises the Treo, Treo Plus, Treo Zor, Treo Yaari, Zor Grand, e-Alfa Super and e-Alfa Cargo which cater to multiple mobility operations in the passenger and cargo domains. To ensure sustained supplies to meet growing demand, MLMM has tripled its production capacity, leveraging its manufacturing plants in Bengaluru, Haridwar, and Zaheerabad. In July, MLMM signed an MoU with Ecofy to offer ease of finance for 10,000 units through leasing and subscription schemes. This should give the company enhanced volumes in the months to come. MLMM has recently expanded into the electric commercial four-wheeler segment with the launch of the Mahindra Zeo e-SCV.

The Maxima XL Cargo E-Tec 12.0, which develops 5.5 kW power and 36 Nm, has a bigger battery and higher range of 183km per charge than the RE E-Tec 9.0 passenger model.

The Maxima XL Cargo E-Tec 12.0, which develops 5.5 kW power and 36 Nm, has a bigger battery and higher range of 183km per charge than the RE E-Tec 9.0 passenger model.

BAJAJ AUTO TURNS CHALLENGER: MARKET SHARE RISES FROM 3% IN JANUARY TO 9.58% IN OCTOBER

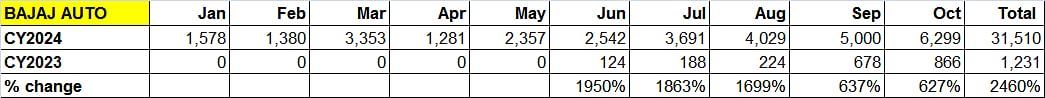

If there is a threat to MLMM’s longstanding supremacy in the e3W market, then it is coming from the Pune-based Bajaj Auto, which is India’s largest manufacturer of three-wheelers and a somewhat recent entrant into electric three-wheelers (June 2023). The company, which is currently hard on the heels of TVS Motor Co in the electric two-wheeler segment aiming for the No. 2 rank, seems to be doing the same in the e3W segment. Though the gap between market leader and Bajaj Auto is still a decent one, the fact is that Bajaj is witnessing strong month-on-month growth and continues to hit new sales highs. Between January (when the sales difference with MLMM was 3,103 units) and October 2024 (sales difference: 1,176 units), Bajaj Auto has now achieved its best-ever monthly sales of 6,299 units in October, with cumulative January-October 2024 retails at 31,510 units, up 2,460% on a low year-ago base of ,1231 units.

If there is a threat to MLMM’s longstanding supremacy in the e3W market, then it is coming from the Pune-based Bajaj Auto, which is India’s largest manufacturer of three-wheelers and a somewhat recent entrant into electric three-wheelers (June 2023). The company, which is currently hard on the heels of TVS Motor Co in the electric two-wheeler segment aiming for the No. 2 rank, seems to be doing the same in the e3W segment. Though the gap between market leader and Bajaj Auto is still a decent one, the fact is that Bajaj is witnessing strong month-on-month growth and continues to hit new sales highs. Between January (when the sales difference with MLMM was 3,103 units) and October 2024 (sales difference: 1,176 units), Bajaj Auto has now achieved its best-ever monthly sales of 6,299 units in October, with cumulative January-October 2024 retails at 31,510 units, up 2,460% on a low year-ago base of ,1231 units.

This stellar performance gives Bajaj Auto a market share of 9.58% for October, over six percentage points more than the 3% it had in January 2024 and pointing to the rapid progress the company is making. For the January-October 2024 period, the market share stands at 5.55% compared to MLMM’s 9.77 percent. Over the span of 16 months, Bajaj Auto has sold a total of 32,741 units. With growing demand for both its products, ramped-up production and an expanded EV sales network, expect the Pune-based auto major to achieve higher numbers in the coming months.

Bajaj Auto has two products – the RE E-Tec 9.0 passenger EV and Maxima XL Cargo E-Tec 12.0 in the fray. The Maxima XL Cargo E-Tec 12.0, which develops 5.5 kW power and 36 Nm, has a bigger battery and higher range of 183km per charge than the RE E-Tec 9.0 passenger model.

In CY2023 (six months since its market entry), Bajaj Auto was ranked 28th in the field with 2,428 units. In FY2024, in just 10 months after its EV rollout, Bajaj grabbed a 2% market share with 7,525 units and was ranked No. 13. Sixteen months later, it is hard on the heels of the market leader, Mahindra Last Mile Mobility.

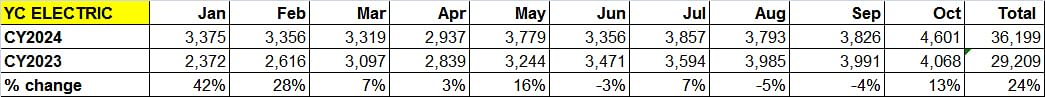

YC Electric, the longstanding No. 2 e-three-wheeler OEM, has been ranked No. 3 since August when Bajaj Auto went past it and continues to do so. In October 2024, YC Electric sold a best-ever 4,601 units, up 13% YoY and like most of the leading OEMs has benefited from the festive season sales. This performance gives the company, which has five products – the Yatri Super, Yatri Deluxe and Yatri for passenger duties and E-Loader and Yatri Cart for cargo operations – a market share of 7%, below MLMM’s 11% and Bajaj Auto’s 9.58 percent.

YC Electric, the longstanding No. 2 e-three-wheeler OEM, has been ranked No. 3 since August when Bajaj Auto went past it and continues to do so. In October 2024, YC Electric sold a best-ever 4,601 units, up 13% YoY and like most of the leading OEMs has benefited from the festive season sales. This performance gives the company, which has five products – the Yatri Super, Yatri Deluxe and Yatri for passenger duties and E-Loader and Yatri Cart for cargo operations – a market share of 7%, below MLMM’s 11% and Bajaj Auto’s 9.58 percent.

In No. 4 position is Saera Electric Auto, which manufactures the Mayuri brand of e-rickshaws and e-karts. Saera Electric sold 2,484 units in October, its second highest monthly score in the year to date after August’s 2,806 units. In end-October, the company announced a collaboration with Porter, an on-demand logistics platform to deliver L3 and L5 e-carts. The pilot project will be facilitated in Delhi and Bangalore with the initial projection of delivering 500 vehicles per month in respective cities. The strategic partnership should give a fillip to Saera Electric’s retails in the months ahead.

Dilli Electric Auto, with retails of 2,397 units in October and 20,926 units for the first 10 months of CY2024, is ranked fifth. Piaggio Vehicles, with 1,938 units last month and a cumulative 17,939 units in January-October 2024 is sixth. Other OEMs with four-figure sales in October are Mini Metro (1,384), Energy Electric Vehicles (1,187) and Unique International (1,180).

Meanwhile, Murugappa Group company TI Green Mobility (Montra Electric), another recent entrant into the e-three-wheeler market like Bajaj Auto, is slowly climbing up the ranks. On August 21, Montra Electric announced delivery of its 5,000th three-wheeler Passenger Auto (L5M category) within one year of launch and entry into the electric three-wheeler market. Over the past year, Montra Electric has delivered its Super Autos to customers across 74 markets spanning 17 states. The Chennai-based EV OEM continues to make month-on-month gains – August (596 units), September (599 units) and October (632 units). This gives it the No. 23 position, which is a creditable performance given that this sub-segment of the EV industry has the highest number of players – 575 companies – all vying for a slice of the zero-emission action on three wheels only.

ALSO READ: Electric cars and SUVs race to best-ever monthly sales of 10,500 units in festive October

EV sales in India scale new high: 217,000 units in October, up 55%

RELATED ARTICLES

Skoda Slavia and VW Virtus Sales Cross 150,000 Units, Virtus First to Cross 75,000 Units

Skoda Volkswagen India’s two MQB-A0-IN–based sedans have reached a new milestone, with the Slavia at 73,378 units and th...

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

03 Nov 2024

03 Nov 2024

24230 Views

24230 Views

Autocar Professional Bureau

Autocar Professional Bureau

Ajit Dalvi

Ajit Dalvi