CV sales down 16% in August

The CV sector, the worst impacted in Q1 FY2020, will continue to feel the pressure of a slowed-down economy, what with the GDP also crashing to its lowest yet.

The commercial vehicle industry, one of the worst affected segments in the Indian automotive industry, has released its sales numbers for August 2020 and the scenario still looks bleak.

This sector, which was the worst impacted in Q1 FY2020, will continue to feel the pressure of a slowed-down economy, what with the GDP also crashing to its lowest yet for the April-June 2020 period. If at all, then OEMs are pinning their hopes on the pent-up and replacement demand for some respite.

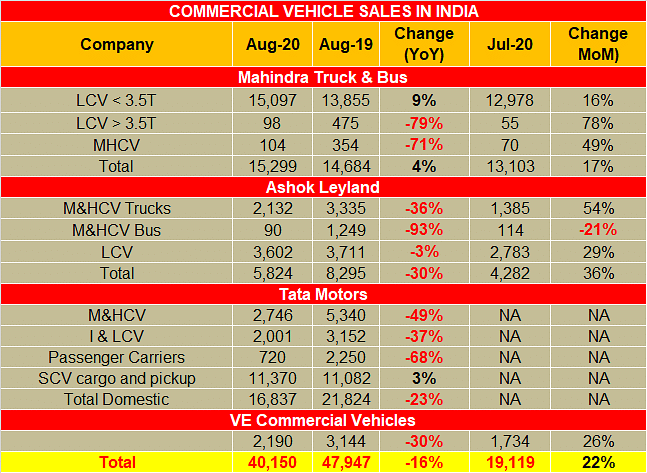

The combined sales of the three major OEMs – Ashok Leyland; Mahindra Trucks & Bus and VE Commercial Vehicles – in the month of August total 23,113 units, a growth of 22 percent over July 2020, but still 10.75 percent lower than last year.

Among the three, Mahindra Truck & Bus is the only company to have seen a growth both over the month of July 2020 as well as August 2019. The company sold 15,299 commercial vehicles (+4% YoY), majority driven by its LCV < 3.5-tonne offering.

Commenting on the performance, Veejay Nakra, CEO, Automotive Division, Mahindra & Mahindra said, “At Mahindra, we continue to see good recovery in demand both for SUVs and pick-ups in the small commercial vehicle segment. For the month of August, we have registered growth in both SUVs and pick-ups. We have been able to meet the uplift in demand by managing the supply chain challenges and going forward will continue to keep our focus on it.”

The country’s second-largest M&HCV player, Ashok Leyland too witnessed growth in its month-on-month sales. The company sold 5,824 CVs registering a growth of 36 percent over July, but a drop of 30 percent compared for the same period last year. The company saw demand for its buses and LCVs to be the primary drivers of growth.

On the other hand, VE Commercial Vehicles, which does not have any presence in the LCV segment, managed to sell 2,190 units in the domestic market, a decline of 30 percent YoY, but a smart uptick of 26 percent over July.

For the country's largest CV maker, Tata Motors the story was no different, while the company stopped sharing monthly data since the start of the year. The company's August sales were not so august, with a total of 16,837 CVs sold, the company reported a sales drop of 23 percent YoY. While the overall numbers were in red, the SCV segment for the company reported a growth of 3 percent YoY.

RELATED ARTICLES

Kia Carens Sells 277,000 Units in Four Years, Clavis And Clavis EVs Power 24% Growth in FY2026

The Carens MPV, which turns four years old today, accounts for a 27% share of Kia India’s sales of 10,43,126 utility veh...

TVS And Bajaj Auto Spar for E-2W Leadership, Ampere Outsells Ola

Powered by demand from the new and aggressively pricedChetak 2501 which takes on the popular TVS iQube2.2 kWh variant, B...

Mahindra Farm Equipment Posts 46% Domestic Growth, Sells 38,484 Tractors in January 2026

Mahindra Farm Equipment reports 46% January tractor sales surge driven by strong rural demand and record Rabi sowing, wi...

01 Sep 2020

01 Sep 2020

14822 Views

14822 Views

Ajit Dalvi

Ajit Dalvi

Shahkar Abidi

Shahkar Abidi